- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Priority Jewels IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Priority Jewels IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Priority Jewels Limited

Incorporated in 2007 by promoters Shailesh Sangani and Tushar Mehta, Priority Jewels is a Mumbai-based fine jewellery manufacturer known for lightweight, diamond-studded gold and platinum pieces. The company blends craftsmanship with innovation, serving major Indian retailers and exporting to 13 countries, including the USA and UAE. With facilities spanning over 25,000 sq. ft. in MIDC and SEEPZ, equipped with modern CAD/CAM and 3D printing, Priority Jewels delivers customised, precision-crafted jewellery across 21 Indian states and 3 union territories, offering diverse, contemporary designs.

Priority Jewels Limited IPO Overview

Priority Jewels is launching its IPO through a book-building process, offering 0.54 crore equity shares. This entire issue is a fresh offering of the same number of shares. The IPO dates, including the opening and closing dates, are yet to be announced. Likewise, the price band and the lot size are still to be declared. The allotment date is expected to be finalised soon, although it has not been officially confirmed yet.

The IPO will consist of 54,00,000 equity shares with a face value of ₹10 each, aggregating up to an undisclosed amount in crores. The shares will be listed on both the BSE and NSE. Prior to the IPO, the company’s total shareholding stands at 1.26 crore shares, which will increase to 1.80 crore shares post-issue.

According to the Draft Red Herring Prospectus (DRHP), which was filed with SEBI on Wednesday, April 30, 2025, the IPO is categorised as a book-building issue. The promoters of Priority Jewels include Shailesh Sangani, Manisha Shailesh Sangani, Tushar Mehta, Aditi Karan Motla, Aashna Sangani Parikh, and Priority Retail Ventures Pvt. Ltd. Before the issue, the promoters held 100% of the company’s shares. The post-issue shareholding will reflect changes due to equity dilution, the specifics of which will depend on the final allocation and shareholding structure.

Priority Jewels Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 0.54 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,26,00,000 shares |

| Shareholding post -issue | 1,80,00,000 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Priority Jewels Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Priority Jewels Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 5.67 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 7.54% |

| Net Asset Value (NAV) | 300.90 |

| Return on Equity | 7.35% |

| Return on Capital Employed (ROCE) | 17.47% |

| EBITDA Margin | 4.71% |

| PAT Margin | 1.74% |

| Debt to Equity Ratio | 1.32 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or part, of certain borrowings availed by the company | 750 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

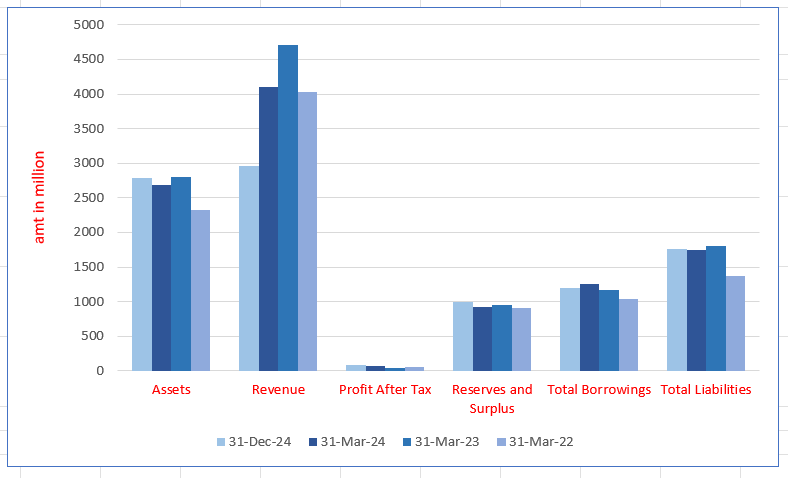

Priority Jewels Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2782.63 | 2689.89 | 2804.80 | 2319 |

| Revenue | 2954.19 | 4105.05 | 4708.52 | 4030.82 |

| Profit After Tax | 81.47 | 71.48 | 44.95 | 53.72 |

| Reserves and Surplus | 994.08 | 916.32 | 956.89 | 912.62 |

| Total Borrowings | 1195.64 | 1249.56 | 1170.76 | 1037.41 |

| Total Liabilities | 1758.05 | 1742.07 | 1806.41 | 1364.88 |

Financial Status of Priority Jewels Limited

SWOT Analysis of Priority Jewels IPO

Strength and Opportunities

- Established presence in 21 Indian states and 3 union territories, with exports to 13 countries including the USA, UAE, and Norway.

- Diverse product portfolio featuring lightweight, affordable diamond-studded gold and platinum jewellery.

- Strong relationships with major Indian retail jewellery players, enhancing market reach.

- Emphasis on innovation and craftsmanship, leading to unique collections like Meraki and Ada.

- Experienced leadership with over 35 years in the jewellery industry, providing strategic direction.

- Filing for IPO to raise capital for expansion, indicating growth ambitions.

- Commitment to quality control, including stringent testing for CVD diamonds.

- Participation in international jewellery shows, enhancing brand visibility.

- Focus on customer relationships, as evidenced by long-term partnerships and testimonials.

Risks and Threats

- Elongated operating cycle exceeding 170 days, indicating potential inefficiencies in inventory or receivables management.

- Exposure to fluctuations in gold and diamond prices, which can impact profit margins.

- High competition in the jewellery industry, both from organized and unorganized players.

- Dependence on a limited number of suppliers for raw materials, posing supply chain risks.

- Potential challenges in scaling operations while maintaining quality and craftsmanship.

- Regulatory risks associated with the jewellery sector, including hallmarking and import/export regulations.

- Vulnerability to economic downturns affecting consumer spending on luxury items.

- Risks associated with currency fluctuations impacting export revenues.

- Challenges in adapting to rapidly changing fashion trends and consumer preferences.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Priority Jewels Limited

Priority Jewels Limited IPO Strengths

Diversified Product Portfolio Supported by Design Capabilities and Customer-Centric Approach

Priority Jewels Limited offers an extensive range of affordable jewellery, blending traditional and contemporary styles for daily and special occasions. Backed by strong in-house and international design teams, they develop thousands of designs annually, catering to diverse customer preferences across regions, age groups, and markets through ongoing trend analysis and customised design solutions.

Integrated Manufacturing Facilities and Established Operational Systems

Priority Jewels Limited operates integrated manufacturing units in MIDC and SEEPZ, Mumbai, equipped with advanced CAD/CAM and 3D printing technology. These facilities enable cost control, efficient production, and high-quality output. Supported by over 480 personnel, centralised design, strong sourcing networks, and stringent quality checks, the company ensures timely, customised, and competitively priced jewellery manufacturing solutions for diverse markets.

Experienced Promoters and Leadership Team

Priority Jewels Limited benefits from the leadership of promoters Shailesh Sangani and Tushar Mehta, who bring 30+ years of industry experience. Supported by a skilled Board and executive team, including design head Aditi Karan Motla, the company leverages strategic insights, governance, and sectoral expertise to drive growth, respond to market trends, and maintain lasting customer relationships.

Longstanding Customer Relationships

Priority Jewels Limited has built enduring relationships with a diverse customer base, including leading Indian retailers and international partners. These longstanding ties ensure recurring revenues, strengthen customer loyalty, and offer market insights. Trusted by brands like CaratLane, Kalyan Jewellers, and Malabar Gold, these relationships enhance industry positioning and create competitive barriers through consistent service and tailored offerings.

Enduring Customer Loyalty and Partnerships

Priority Jewels Limited maintains strong, longstanding relationships with renowned domestic and international customers. These trusted partnerships ensure recurring revenue, offer market insights, and drive customer retention. Collaborations with leading brands like CaratLane, Reliance Retail, and Malabar Gold reinforce the company’s market position while creating significant competitive advantages through consistent value delivery and tailored jewellery solutions.

Strong Presence Across Domestic and International Markets

Priority Jewels Limited has established a robust footprint across Indian and key international markets. As of December 31, 2024, revenue from overseas operations contributed 35.96%, while domestic revenue comprised 64.04%. The company’s consistent global reach, combined with growing domestic sales, demonstrates market adaptability, reduces geographic risk, and supports sustainable, diversified revenue streams across varied customer segments.

More About Priority Jewels Limited

Priority Jewels Limited is engaged in the design, manufacture, and sale of a diverse range of light-weight, affordable diamond-studded gold and platinum fine jewellery. The company caters directly to independent jewellers and prominent jewellery chains in India and select global markets.

Key Clients and Partnerships

The company supplies jewellery to several reputed retail chains, including:

- CaratLane Trading Private Limited

- Kalyan Jewellers India Limited

- Reliance Retail Limited

- Malabar Gold & Diamonds FZCO

- Tribhovandas Bhimji Zaveri Limited

- Senco Gold Limited

Product Portfolio and Innovation

- The portfolio focuses on daily wear jewellery such as rings, earrings, pendants, neckwear, and bracelets, along with couture pieces for special occasions.

- Emphasis is placed on contemporary design and modern manufacturing techniques.

- Custom orders also include lab-grown diamond jewellery, with 1,588 such pieces manufactured during the nine months ending December 31, 2024.

Design Capabilities

The in-house design team of 27 professionals develops unique, trend-driven jewellery tailored to customer preferences. The number of designs produced were:

- 9M FY24: 4,572

- FY24: 5,231

- FY23: 8,084

- FY22: 5,366

Manufacturing Facilities

Priority Jewels operates two advanced manufacturing units in Mumbai:

- MIDC, Andheri (East) – 19,008.79 sq. ft.

- SEEPZ SEZ, Andheri East – 6,821.84 sq. ft.

These facilities support precision manufacturing through CAD/CAM and 3D printing technologies.

Operations and Reach

- Over 200 customers, including 159 independent jewellers and 35 jewellery chains

- Presence across 21 Indian states, 3 union territories, and 13 export markets

- Primary exports cater to Indian diaspora via overseas stores of Indian jewellery chains

Growth

- Profit after tax increased from ₹53.72 million in FY22 to ₹71.48 million in FY24 (CAGR: 15.35%)

- Quantity sold grew from 1,30,031 (FY22) to 1,72,108 (FY24)

Industry Outlook

India’s gems and jewellery industry is poised for robust growth, underpinned by rising disposable incomes, evolving consumer preferences, and expanding digital infrastructure. This sector, encompassing gold, diamond, and platinum jewellery, is projected to reach USD 128 billion by 2029, growing at a CAGR of 9.5% from USD 83 billion in 2024

Key Growth Drivers

- Rising Disposable Incomes: Economic growth and increasing urbanization have led to higher consumer spending on jewellery, especially among younger demographics.

- Cultural Significance: Jewellery remains integral to Indian traditions, with demand peaking during festivals and weddings.

- Digital Transformation: The surge in online jewellery sales, particularly among consumers aged 18–45, is reshaping purchasing behaviors.

- Government Initiatives: Policies promoting domestic manufacturing and export incentives are bolstering industry growth.

Segment-Specific Insights

Lightweight Diamond-Studded Jewellery

There’s a growing preference for lightweight, daily-wear diamond jewellery, especially among working women and younger consumers. This trend is driving demand for designs that balance elegance with practicality.

Lab-Grown Diamonds (LGDs)

The LGD segment, valued at USD 345 million in 2024, is expected to grow at a CAGR of 15%, reaching USD 1.2 billion by 2033. India contributes 15% to global LGD production, with exports increasing eightfold over the past four years.

Future Outlook

With a blend of traditional craftsmanship and modern innovation, India’s jewellery industry is set to capitalize on both domestic and international opportunities. The emphasis on lightweight, affordable designs and the rise of lab-grown diamonds position the sector for sustained growth in the coming years.

How Will Priority Jewels Limited Benefit

- Rising disposable incomes and urbanisation are boosting demand for affordable, daily-wear diamond jewellery, aligning with Priority Jewels’ product focus.

- The growing preference for lightweight jewellery, especially among working women and younger consumers, directly supports the company’s design philosophy.

- Expansion of digital infrastructure and rising online jewellery sales provide new channels for Priority Jewels’ growth and wider customer reach.

- Strong cultural demand for jewellery during festivals and weddings ensures consistent domestic demand for the company’s offerings.

- Government incentives for domestic manufacturing support Priority Jewels’ local production facilities in Mumbai.

- The lab-grown diamond segment, growing at 15% CAGR, aligns with the company’s custom offerings, strengthening its future-readiness.

- Established relationships with major retail chains like CaratLane, Kalyan Jewellers, and Reliance Retail enhance market penetration.

- Export potential is supported by increasing demand among the Indian diaspora and Priority Jewels’ presence in 13 international markets.

Peer Group Comparison

| Name of the Company | Total Revenue (₹ in million) | Face Value (₹) | P/E | EPS

(₹) |

RoNW (%) | NAV (₹) | Profit after Tax

(₹ in million) |

| Priority Jewels Limited | 4,105.05 | 10 | NA | 5.67 | 7.54% | 75.22 | 71.48 |

| Peer Groups | |||||||

| Khazanchi Jewellers Ltd | 8,207.83 | 10 | 50.09 | 11.04 | 14.55% | 75.87 | 273.19 |

| RBZ Jewellers Ltd. | 3,274.29 | 10 | 16.82 | 8.23 | 14.38% | 51.87 | 215.69 |

| Ashapuri Gold Ornament Ltd. | 1,650.70 | 1 | 17.83 | 0.40 | 11.65% | 3.60 | 74.30 |

| Shringar House of Mangalsutra Ltd. | 11,015.20 | 10 | NA | 4.39 | 25.65% | 154.34 | 311.04 |

Key Strategies for Priority Jewels Limited

Expanding Manufacturing Capabilities

Priority Jewels Limited is expanding its manufacturing infrastructure to increase production capacity, enhance operational efficiency, and meet market demand. This includes facility upgrades, lean manufacturing, skilled workforce development, and improved supply chain integration, enabling quicker market responsiveness and sustainable growth in production and profitability.

Strengthening Customer Relationships

Priority Jewels Limited is reinforcing customer relationships by growing recurring sales, expanding client engagement, and entering new markets. Through exhibitions, design innovation, and market intelligence, the company aims to diversify its clientele, increase retention, and establish a stronger foothold in both domestic and global markets.

Enhancing Product Portfolio and Margins

Priority Jewels Limited is innovating its product portfolio to serve a broader customer base and improve margins. By integrating lab-grown diamond jewellery, expanding into various price segments, and tracking design trends, the company aims to offer modern, affordable jewellery suited to evolving customer preferences.

Growth Through Strategic Partnerships

Priority Jewels Limited is pursuing strategic partnerships and joint ventures to grow its domestic reach, particularly in Tier 2 and 3 cities. Collaborating with regionally strong partners allows efficient market entry, enhances customer engagement, and aligns operations with evolving regional consumer preferences and retail expansion trends.

Capitalising on India’s Economic Growth

Priority Jewels Limited is aligning its strategy with India’s economic progress and changing consumer tastes. With rising disposable incomes and demand for contemporary designs, especially in Tier 2 and 3 cities, the company is enhancing distribution, marketing, and innovation to meet growing demand and boost market presence.

Optimising Debt Structure for Financial Health

Priority Jewels Limited is focused on improving financial health by repaying secured loans, reducing interest costs, and achieving a balanced debt-to-equity ratio. This strategic move supports future investments, enhances profitability, and reduces dependence on external financing, ensuring long-term operational and fiscal stability.

Leveraging Technology for Operational Excellence

Priority Jewels Limited is adopting advanced technologies like CAD/CAM, laser cutting, and 3D printing to improve design precision, reduce costs, and increase efficiency. Customised ERP systems and just-in-time inventory practices are also being implemented to streamline operations and better meet customer demand.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Priority Jewels Limited IPO

How can I apply for Priority Jewels Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of the Priority Jewels Limited IPO?

The Priority Jewels IPO will offer 0.54 crore equity shares as a fresh issue. The total value of the issue is yet to be disclosed by the company.

When will the Priority Jewels IPO open for subscription?

The IPO opening and closing dates are currently not announced. Investors should watch for official updates from SEBI or stock exchanges for the final bidding schedule.

What is the lot size and minimum investment for the Priority Jewels IPO?

As of now, the lot size and minimum investment amount have not been disclosed. These details will be available once the company announces its price band and final issue terms.

Where will Priority Jewels shares be listed post-IPO?

Post-IPO, shares of Priority Jewels Limited will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), offering wider market accessibility.

What is the promoter shareholding before and after the IPO?

Before the IPO, the promoters hold 100% of the company’s shares. After the IPO, total shares will increase to 1.80 crore, leading to a diluted promoter shareholding.