- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Prostarm Info Systems IPO

₹13/142 shares

Minimum Investment

IPO Details

27 May 25

29 May 25

₹13

142

₹95 to ₹105

NSE, BSE

₹168 Cr

03 Jun 25

Prostarm Info Systems IPO Timeline

Bidding Start

27 May 25

Bidding Ends

29 May 25

Allotment Finalisation

30 May 25

Refund Initiation

02 Jun 25

Demat Transfer

02 Jun 25

Listing

03 Jun 25

Prostarm Info Systems Limited

Prostarm Info Systems Limited specialises in designing, manufacturing, assembling, selling, and servicing energy storage and power conditioning equipment in India. The company offers a wide range of power solutions, including UPS systems, inverters, solar hybrid inverters, lithium-ion battery packs, and voltage stabilisers. It provides both standard and customized solutions through in-house facilities and third-party manufacturers. Additionally, it undertakes rooftop solar photovoltaic projects and offers after-sales services, rentals, and AMCs. With a strong presence across industries, Prostarm is a trusted partner in reliable power solutions nationwide.

Prostarm Info Systems Limited IPO Overview

Prostarm Info Systems is launching its IPO through a book-building process, aiming to raise ₹168.00 crores. The entire issue comprises a fresh offering of 1.60 crore equity shares. The subscription window for the IPO opens on May 27, 2025, and closes on May 29, 2025. The allotment of shares is expected to be finalised on Friday, May 30, 2025, and the shares are likely to be listed on both the BSE and NSE on Tuesday, June 3, 2025.

The IPO has a price band set between ₹95 and ₹105 per share. Retail investors must apply for a minimum of one lot, which includes 142 shares, requiring an investment of ₹13,490. However, investors are advised to bid at the cutoff price to avoid missing out due to oversubscription, which would amount to ₹14,910. For small non-institutional investors (sNII), the minimum application is 14 lots (1,988 shares), translating to an investment of ₹2,08,740. For big non-institutional investors (bNII), the minimum bid is 68 lots (9,656 shares), amounting to ₹10,13,880.

Choice Capital Advisors Pvt Ltd is serving as the book-running lead manager for the IPO, and Kfin Technologies Limited is the designated registrar for the issue.

Prostarm Info Systems Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹168 crores

Offer for Sale (OFS): NA |

| IPO Dates | 27 May 2025 to 29 May 2025 |

| Price Bands | ₹95 to ₹105 per share |

| Lot Size | 142 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,28,74,592 shares |

| Shareholding post -issue | 5,88,74,592 shares |

Prostarm Info Systems Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 142 | ₹14,910 |

| Retail (Max) | 13 | 1,846 | ₹1,93,830 |

| S-HNI (Min) | 14 | 1,988 | ₹2,08,740 |

| S-HNI (Max) | 67 | 9,514 | ₹9,98,970 |

| B-HNI (Min) | 68 | 9,656 | ₹10,13,880 |

Prostarm Info Systems Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB (Qualified Institutional Buyers) | Not more than 50% of the Offer |

| Retail Investors | Not less than 35% of the Offer |

| NII (HNI – Non-Institutional Investors) | Not less than 15% of the Offer |

Prostarm Info Systems Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 5.44 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 32.12% |

| Net Asset Value (NAV) | 19.67 |

| Return on Equity | 31.41% |

| Return on Capital Employed (ROCE) | 32.40% |

| EBITDA Margin | 14.20% |

| PAT Margin | 8.85% |

| Debt to Equity Ratio | 0.51 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding working capiital requirements | 7250 |

| Acquisition of further stake of our Subsidiary to make it a wholly owned subsidiary | 900 |

| Pre-payment/ re-payment, in part or full, of certain outstanding borrowings availed by the Company | 1800 |

| Achieving inorganic growth through unidentified acquisitions and other strategic initiatives and general corporate purposes | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

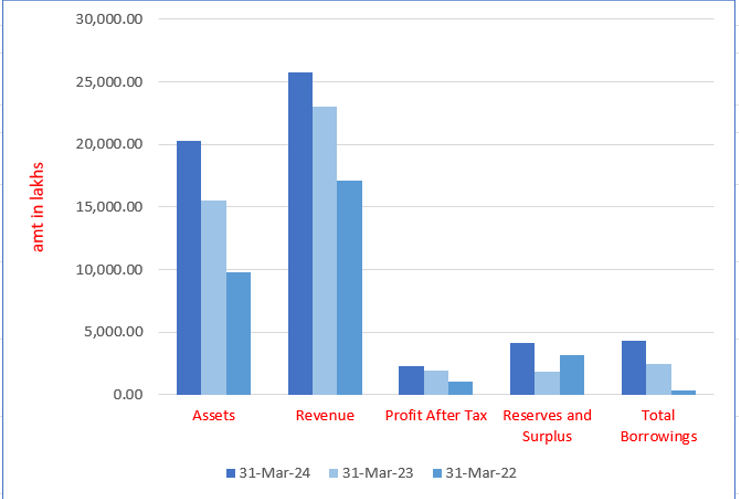

Prostarm Info Systems Limited Financials (in lakhs)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 20,304.50 | 15,538.67 | 9803.08 |

| Revenue | 25,787.04 | 23,036.32 | 17,130.73 |

| Profit After Tax | 2282.53 | 1934.55 | 1087.05 |

| Reserves and Surplus | 4145.53 | 1813.21 | 3187.41 |

| Total Borrowings | 4346.96 | 2485.15 | 320.94 |

| Total Liabilities | 11,707.68 | 9221.94 | 5427.34 |

Financial Status of Prostarm Info Systems Limited

SWOT Analysis of Prostarm Info Systems IPO

Strength and Opportunities

- Diverse product portfolio including UPS systems, inverters, and lithium-ion battery packs.

- In-house manufacturing ensures quality control and customization.

- Established presence across multiple industries such as healthcare, aviation, and BFSI.

- Empaneled vendor for several government agencies.

- Experience in executing rooftop solar PV projects totaling 7.35MW.

- Comprehensive after-sales services including AMCs and rentals.

- Strong pan-India sales and service network.

- Strategic shift towards in-house production enhancing innovation.

- Growing demand for renewable energy solutions like solar EPC projects.

- Government initiatives promoting clean energy and sustainability.

- Increasing industrial and commercial adoption of power backup solutions.

- Expansion opportunities in emerging markets and international territories.

- Rising demand for energy-efficient and eco-friendly power solutions.

- Scope for strategic partnerships and collaborations in the energy sector.

Risks and Threats

- Dependence on third-party contract manufacturers for some products.

- Potential challenges in scaling operations to meet increasing demand.

- Limited global presence compared to larger competitors.

- Vulnerability to fluctuations in raw material prices affecting production costs.

- Need for continuous investment in technology to stay competitive.

- Potential supply chain disruptions impacting manufacturing timelines.

- Reliance on key clients, with significant revenue from government contracts.

- Exposure to regulatory changes in the energy sector.

- Competition from well-established multinational corporations.

- Changing government policies and regulations affecting the energy sector.

- Economic downturns affecting customer purchasing power.

- Technological advancements requiring constant upgrades to remain competitive.

- Rising costs of raw materials and logistics.

- Cybersecurity risks affecting digital infrastructure in power solutions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Prostarm Info Systems Limited IPO

- Diversified and Continuously Expanding Product Portfolio

Prostarm Info Systems Limited offers a diverse and evolving product range, catering to industries such as healthcare, aviation, BFSI, defence, IT, and renewable energy. With standardized and customized solutions, it meets varied power storage and conditioning needs. Continuous product upgrades and cross-selling strategies strengthen customer retention, driving expansion across multiple industry segments.

- Strong Customer Relationships and Expanding Client Base

Prostarm Info Systems Limited has built lasting relationships with domestic clients across multiple industries. With over 15 years of experience, it serves PSU banks, Tata Power, L&T, and Bajaj Finance, among others. A significant portion of revenue comes from long-term customers, highlighting strong retention. A customer-centric approach and after-sales support drive continued growth.

- Extensive Geographical Reach and Strong Distribution Network

Prostarm Info Systems Limited operates across 17 states and one union territory in India, supported by 22 branch offices and two storage facilities. A robust distribution network of 478 dealers and distributors enhances product availability and after-sales services. In Fiscal 2024, dealer sales contributed ₹8,204.10 lakhs, accounting for 31.81% of total revenue. This widespread presence ensures rapid market expansion and a competitive edge.

- Strong Financial Performance and Robust Balance Sheet

Prostarm Info Systems Limited has demonstrated steady financial growth, driven by efficiency improvements and cost optimization. Revenue from operations grew at a CAGR of 22.69%, reaching ₹25,787.04 lakhs in Fiscal 2024. EBITDA rose to ₹3,662.35 lakhs, and profit after tax increased to ₹2,282.53 lakhs. The company outperformed peers in EBITDA, PAT margin, return on assets (11.2%), return on equity (26.6%), and return on capital employed (36.3%) in Fiscal 2024. A disciplined financial approach enables continued expansion and strengthens its position in the power solutions sector.

- Experienced Leadership and Committed Workforce

Prostarm Info Systems Limited thrives under experienced leadership, with Promoters boasting 16+ years in power solutions. A skilled senior management team drives strategy, client relations, and market expansion. Prioritizing workforce development, the company employs 222 permanent and 189 contractual staff, ensuring agility and expertise to sustain growth and capitalize on future opportunities.

More About Prostarm Info Systems Limited

Prostarm Info Systems Limited is engaged in designing, manufacturing, assembling, selling, servicing, and supplying Energy Storage Equipment and Power Conditioning Equipment in India. The company provides both customized and standard power solutions through in-house manufacturing and third-party contract manufacturers.

Product Offerings

Manufactured Power Solutions:

- UPS systems

- Inverter systems

- Lift inverter systems

- Solar hybrid inverter systems

- Lithium-ion battery packs

- Servo-controlled voltage stabilizers (SCVS)

- Isolation transformers

- Other power solution products

Additional Services:

- Sale and supply of third-party manufactured batteries

- Reverse logistics and end-of-life disposal for UPS systems and batteries

- Rooftop solar photovoltaic (PV) power plant projects on an EPC basis

- Installation, rental, and after-sales services

- Annual Maintenance Contracts (AMC) including warranty and post-warranty services

Industry Presence

Prostarm has built a reputation for providing reliable and affordable power electronics solutions to businesses across various sectors, ensuring continuous power availability in critical industries such as:

- Banking and Finance (BFSI)

- Healthcare

- Aviation

- Research and Education

- Railways and Defense

- Security and Information Technology

- Renewable Energy and Oil & Gas

Government Empanelment

Prostarm is an approved vendor for multiple government agencies, including:

- Airports Authority of India

- Central Public Works Department, Patna Bihar

- Public Works Department, New Delhi

- West Bengal Public Health Engineering Department

- Telangana State Technology Services Limited

- Railtel Corporation of India Limited

- NTPC Vidyut Vyapar Nigam Limited

Business Growth and Expansion

2008: Incorporated and began operations with the sale and installation of third-party power products.

Post-2008: Expanded into in-house manufacturing, ensuring high-quality standards and the ability to deliver customized solutions.

2018 Onwards: Entered the EPC segment to cater to the rising demand for renewable energy solutions, focusing on rooftop solar PV power systems. To date, Prostarm has successfully commissioned 7.35 MW of rooftop solar PV power plants across 100+ sites.

Market Reach

With a pan-India sales and service network, Prostarm serves a diverse clientele, including government agencies, private institutions, and corporate customers. The company’s strategic approach in power solutions and renewable energy positions it as a trusted industry leader

Industry Outlook

Rising Demand for Power Backup Systems

The power backup systems market in India is expanding rapidly due to frequent power shortages and technological advancements. The increasing gap between power demand and supply is driving the need for uninterrupted power solutions, particularly in industrial sectors.

Market Performance and Growth Trends

Indian UPS Market

- The Indian UPS market generated revenues of ₹96,432 million in FY24, up from ₹89,713 million in FY23.

- The market is projected to grow at a CAGR of 8.22% till FY30.

- Growth drivers include:

- Increasing reliance on electricity.

- Expanding commercial and industrial sectors.

- Frequent power outages, especially during peak hours.

Solar Hybrid Inverter Market

- The market was valued at ₹5,242 million in FY24, with a CAGR of 9.21% between FY19 and FY24.

- Expected to reach ₹13,938 million by FY30, growing at 18.60% CAGR.

- The surge in demand is driven by India’s transition towards renewable energy to improve energy security and reduce dependence on fossil fuels.

(Source: CARE Report)

India Lift Inverter Market

- Valued at ₹164,292.82 million in FY24.

- Projected to grow at a CAGR of 8.28%.

Servo Stabilizer Market

- Reached ₹13,455 million in FY24.

- Expected to reach ₹23,137 million by FY30, growing at a CAGR of 9.46%.

- Growth factors include:

- Rising demand from end-user industries.

- Increased R&D investments in new products and equipment.

Isolation Transformers Market (Non-Distribution Transformers)

- Valued at ₹15,843 million in FY24, up from ₹13,357 million in FY19.

- Expected to grow at a CAGR of 7.3% from FY25 to FY30.

Solar EPC Market

- Recorded at ₹135,464 million in FY24, with a CAGR of 4.97% between FY19 and FY24.

- Expected to reach ₹2,22,112 million by FY30.

- Key growth factors:

- Expansion of solar parks across various states.

- Increased demand for rooftop solar systems.

- Integration of energy storage solutions to enhance grid stability.

Indian Lithium-Ion Battery Market

- Valued at ₹5,58,078 million in FY24, with a CAGR of 7.66% between FY19 and FY24.

- Expected to grow at a CAGR of 19.67% till FY30, reaching ₹16,39,090 million.

- Market growth is driven by:

- Rising demand for energy storage in automotive, consumer electronics, and renewable energy sectors

How Will Prostarm Info Systems Limited Benefit

- Expanding UPS Market: Prostarm can capitalise on the growing ₹96,432 million UPS market by offering advanced solutions to industrial and commercial sectors experiencing frequent power outages.

- Solar Hybrid Inverter Demand: With the market projected to grow at 18.60% CAGR, Prostarm can leverage its solar hybrid inverters to support India’s renewable energy transition and increased solar adoption.

- Growing Lift Inverter Market: As the lift inverter market grows at 8.28% CAGR, Prostarm’sexpertise in lift inverters positions it to meet rising demand from high-rise buildings and commercial complexes.

- Rising Need for Servo Stabilizers: With demand expected to reach ₹23,137 million by FY30, Prostarm’s servo-controlled voltage stabilizers can serve industrial sectors requiring voltage regulation for operational efficiency.

- Isolation Transformer Expansion: The ₹15,843 million isolation transformer market offers Prostarm growth opportunities by providing critical power conditioning solutions to industries and commercial sectors.

- Solar EPC Market Growth: Prostarm can expand its EPC solar projects, benefiting from increased rooftop solar installations and grid stability solutions, projected to reach ₹2,22,112 million by FY30.

- Booming Lithium-Ion Battery Market: With an expected market size of ₹16,39,090 million, Prostarm’s lithium-ion battery packs can cater to energy storage needs in automotive, electronics, and renewable energy sectors.

Peer Group Comparison

| Name of the Company | Revenue (₹ in lakhs) | Face Value (₹) | P/E | EPS (Basic) (₹) | RoNW (%) | NAV (₹) |

| Prostarm Info Systems Limited | 25,787.04 | 10 | [●] | 5.44 | 32.12 | 19.67 |

| Peer Group | ||||||

| Servotech Power System Limited | 35,368.35 | 1 | 314.55 | 0.54 | 10.50 | 6.54 |

| Sungarner Energies Limited | 1,768.92 | 10 | 152.68 | 5.22 | 16.78 | 41.32 |

Key Insights

- Revenue: Prostarm Info Systems Limited reported revenue of ₹25,787.04 lakh, positioning it between its peers. Servotech Power System Limited leads with ₹35,368.35 lakh, indicating a stronger market presence, while Sungarner Energies Limited lags significantly at ₹1,768.92 lakh.

- Face Value of Equity Shares: Both Prostarm and Sungarner have a face value of ₹10 per share, offering uniformity in valuation. However, Servotech’s lower face value of ₹1 suggests a different capital structure, potentially influencing investor perception and trading liquidity.

- Price-to-Earnings (P/E) Ratio: Servotech has an extremely high P/E ratio of 314.55, indicating an overvaluation or high growth expectations. Sungarner’s P/E stands at 152.68, still considerably high. Prostarm’s P/E remains undisclosed, but its financials suggest a more balanced valuation compared to its peers.

- Earnings Per Share (EPS): Prostarm’s EPS of ₹5.44 is slightly higher than Sungarner’s ₹5.22, indicating better profitability per share. Servotech’s EPS is significantly lower at ₹0.54, suggesting lower earnings generation relative to its stock price.

- Return on Net Worth (RoNW): Prostarm leads with a strong RoNW of 32.12%, reflecting high profitability and efficient capital utilization. Sungarner follows with 16.78%, while Servotech lags at 10.50%, indicating weaker returns on shareholder equity.

- Net Asset Value (NAV): Sungarner has the highest NAV per share at ₹41.32, reflecting strong asset backing. Prostarm follows with ₹19.67, suggesting decent financial stability. Servotech’s NAV of ₹6.54 is the lowest, indicating a lower asset base per share.

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding working capiital requirements | 7250 |

| Acquisition of further stake of our Subsidiary to make it a wholly owned subsidiary | 900 |

| Pre-payment/ re-payment, in part or full, of certain outstanding borrowings availed by the Company | 1800 |

| Achieving inorganic growth through unidentified acquisitions and other strategic initiatives and general corporate purposes | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Prostarm Info Systems Limited Financials (in lakhs)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 20,304.50 | 15,538.67 | 9803.08 |

| Revenue | 25,787.04 | 23,036.32 | 17,130.73 |

| Profit After Tax | 2282.53 | 1934.55 | 1087.05 |

| Reserves and Surplus | 4145.53 | 1813.21 | 3187.41 |

| Total Borrowings | 4346.96 | 2485.15 | 320.94 |

| Total Liabilities | 11,707.68 | 9221.94 | 5427.34 |

Key Strategies for Prostarm Info Systems Limited

- Expansion Through Growth Strategies

Prostarm Info Systems Limited has expanded from third-party sales to in-house manufacturing, operating three units in Maharashtra. Through R&D, technology acquisitions, and increased production capabilities, it aims to enhance efficiency, reduce dependency, and strengthen its market position.

- Expanding Customer Base and Market Reach

Prostarm Info Systems Limited focuses on domestic growth through strategic acquisitions, product innovation, and service expansion. It aims to enter international markets, enhance after-sales services, and strengthen brand recognition through digital marketing, exhibitions, and distributor engagement.

- Optimizing Working Capital and Reducing Debt

Prostarm Info Systems Limited aims to shorten its working capital cycle through improved inventory management and faster client payments. It plans to rationalize borrowings by using proceeds to reduce debt, lower financing costs, and enhance the debt-to-equity ratio.

- Enhancing Operational Efficiency

Prostarm Info Systems Limited aims to optimize manufacturing processes, reduce costs, and drive innovation while maintaining product quality. It plans to acquire full ownership of its subsidiary and strengthen R&D capabilities to improve efficiency, product development, and long-term growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Prostarm Info Systems IPO

What is the size of the Prostarm Info Systems IPO?

The IPO comprises a fresh issue of up to 1.6 crore equity shares with a face value of ₹10 each.

When will the Prostarm Info Systems IPO open for subscription?

The IPO dates have not been announced yet.

How can investors apply for the Prostarm Info Systems IPO?

Investors can apply online via ASBA through their bank accounts or UPI through stockbroker platforms.

What is the allocation ratio for different investor categories in the IPO?

The allocation is 50% for Qualified Institutional Buyers (QIB), 15% for Non-Institutional Investors (NII), and 35% for Retail Investors.

Which exchanges will Prostarm Info Systems be listed on post-IPO?

The shares are proposed to be listed on both the BSE and NSE.