- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Prozeal Green Energy IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

₹700 Cr

TBA

Prozeal Green Energy IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Prozeal Green Energy IPO

Prozeal Green Energy Limited is a trusted name in delivering innovative green energy solutions. With a mission to accelerate the adoption of renewable energy across industries, the company champions a carbon-neutral future through cutting-edge solar EPC technology and strategic sustainability efforts. Guided by values of discipline, dedication, direction, and insightful decision-making, Prozeal excels in project execution. Its vision is to lead India’s clean energy transformation through wind-solar hybrid projects, EV charging infrastructure, and grid-scale storage.

Prozeal Green Energy has proposed an IPO through book building, aggregating ₹700 crores, comprising ₹350 crores as a fresh issue and ₹350 crores as an offer for sale. The IPO dates and price band are yet to be announced, with allotment expected soon. Nuvama Wealth Management and SBI Capital Markets are the lead managers, while Link Intime India serves as the registrar. Investors can refer to the DRHP, filed with SEBI on April 1, 2025, for complete details.

Prozeal Green Energy Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹350 crore

Offer for Sale (OFS): ₹350 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Prozeal Green Energy IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Prozeal Green Energy IPO Reservation:

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

Prozeal Green Energy Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 16.84 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 69.87% |

| Net Asset Value (NAV) | 43.66 |

| Return on Equity | 69.87% |

| Return on Capital Employed (ROCE) | 60.72% |

| EBITDA Margin | 13.15% |

| PAT Margin | 9.67% |

| Debt to Equity Ratio | 0.08 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the long-term working capital requirements | 2500 |

| Investment in our Subsidiary(ies), for repayment/pre-payment, in part or full of certain borrowings | 195.32 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

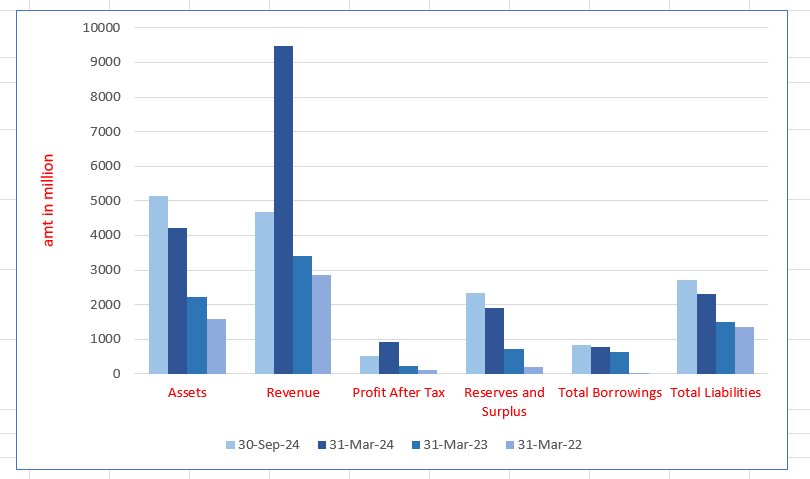

Prozeal Green Energy Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 5140.02 | 4229.41 | 2219.33 | 1572.50 |

| Revenue | 4685.40 | 9488.82 | 3409.96 | 2871.85 |

| Profit After Tax | 515.95 | 922.44 | 215.21 | 100.71 |

| Reserves and Surplus | 2343.38 | 1911.82 | 711.96 | 197.31 |

| Total Borrowings | 826 | 773.38 | 629.23 | 34.25 |

| Total Liabilities | 2701.61 | 2309.13 | 1499.17 | 1367.69 |

Financial Status of Prozeal Green Energy Limited

SWOT Analysis of Prozeal Green Energy IPO

Strength and Opportunities

- Over 750 MWp installed capacity as of 2024, showcasing strong execution capabilities.

- Robust order book exceeding 900 MWp, indicating strong market demand and client trust.

- Diverse service portfolio including Solar EPC, BESS, Green Hydrogen, and EV infrastructure.

- Strategic expansion into international markets like Nepal and plans for Europe.

- Successful execution of hybrid projects combining solar and wind energy solutions.

- Collaboration with government bodies for EV charging infrastructure development.

- Recognition through awards and participation in major industry events, enhancing brand reputation.

- Commitment to sustainability and corporate social responsibility initiatives.

- Experienced leadership team with a clear vision for achieving 10 GW capacity by 2030.

Risks and Threats

- High capital expenditure requirements for large-scale renewable projects.

- Dependence on government policies and subsidies, which may change over time.

- Intense competition from both domestic and international renewable energy companies.

- Regulatory challenges and compliance requirements in different geographical regions.

- Technological obsolescence risk due to rapid advancements in renewable technologies.

- Potential delays in project execution due to logistical or supply chain issues.

- Fluctuations in raw material prices affecting project costs and profitability.

- Environmental and land acquisition challenges for large-scale renewable projects.

- Currency exchange risks associated with international operations and procurements.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Prozeal Green Energy IPO

Prozeal Green Energy Limited IPO Strengths

- Pan-India “Plug-and-Play” Solar Park Model

Prozeal Green Energy Limited’s “plug-and-play” solar park model offers turnkey solar solutions with pre-approved infrastructure, reducing costs, delays, and regulatory hurdles. By September 2024, the company successfully commissioned 214.25 MWp capacity, enabling faster, efficient solar deployment across India for commercial and industrial clients.

- Proven Project Execution Capabilities

Prozeal Green Energy Limited has executed 182 solar projects totalling 783.98 MWp across 17 Indian states and Nepal. Backed by a skilled design, engineering, procurement, and onsite project team, the company ensures timely, high-quality delivery. Its performance guarantees have never been invoked since inception.

- Robust Asset Management Capabilities

Prozeal Green Energy Limited provides asset management services for IPP clients, facilitating customer acquisition, contract execution, and long-term PPAs. With 158 MWp capacity under management, Prozeal ensures optimal plant performance, enhancing project sustainability, strengthening client partnerships, and positioning itself as a trusted turnkey solar solutions provider.

- Strong Order Book

As of September 30, 2024, Prozeal Green Energy Limited had a robust Order Book worth ₹22,209.22 million across 929.08 MWp. Projects span ground-mounted and rooftop solar systems for commercial, industrial, and government clients, with additional EPC contracts and letters of intent received post-September 2024.

- Strong Financial Performance and Metrics

Prozeal Green Energy has demonstrated impressive financial growth, with revenue increasing from ₹2,871.85 million in Fiscal 2022 to ₹9,488.82 million in Fiscal 2024. Key metrics include substantial EBITDA and profit growth, alongside a significant increase in executed projects, new business orders, and O&M portfolio.

- Experienced Promoters and Key Management Personnel

Prozeal Green Energy benefits from the leadership of Shobit Baijnath Rai and Manan Hitendrakumar Thakkar, both with over 13 years of experience in renewable energy. Their expertise spans project management, client relations, and strategic growth, driving the company’s success. The management team also includes specialists in finance, operations, and procurement.

More About Prozeal Green Energy Limited

Prozeal Green Energy Limited, recognized as the fourth-largest solar EPC company in India by revenue for Fiscal 2024, has positioned itself as a leader in the renewable energy sector. The company delivers comprehensive end-to-end renewable energy solutions, specializing in the engineering, procurement, and construction (EPC) of solar power projects, with a strong focus on the commercial and industrial sectors.

Core Services

Prozeal Green Energy focuses on providing turnkey solutions for solar energy projects, primarily through its Plug-and-Play solar park model. This model simplifies the deployment of solar projects by managing the entire process, from conceptualization and land acquisition to project commissioning. Key services include:

- Project Deployment: Handling approvals, including for evacuation lines from the solar plant to the electricity grid.

- Customized Solutions: Offering options for Capex or Opex models, land purchase or lease, and selecting suitable technologies tailored to client needs.

Diversified Offerings

In addition to solar power projects, Prozeal Green Energy has expanded into the electric vehicle (EV) charging infrastructure sector. The company provides EPC services for setting up EV charging stations under the Charge Point Operator (CPO) model, with four operational stations and plans for 50 more across India. Furthermore, Prozeal is exploring hybrid (wind-solar) parks in Gujarat and has secured grid connectivity approval for a combined capacity of 54 MW.

Recent Achievements

- Public EV Charging Stations: Established four public charging stations and facilitated the installation of 50 stations across 25 locations.

- Expansion into Nepal: Commissioned a 9.20 MWp solar project in Nepal in October 2024.

- Group Captive Solar Projects: Engaged in three solar power projects with a combined capacity of 19.39 MWp in collaboration with commercial and industrial clients.

Awards and Recognitions

Prozeal Green Energy has garnered several awards, including the “EPC Company of the Year – Industrial Award” from Solar Quarter Magazine (2023) and the “Gujarat State Green Future Leadership Award” from World Sustainability (2023).

With a strategic vision for growth and a commitment to sustainability, Prozeal Green Energy continues to play a pivotal role in advancing India’s renewable energy landscape.

Industry Outlook

Solar Energy Market

India’s solar energy market is experiencing robust growth, driven by government initiatives and increasing adoption across sectors.

- Market Size and Growth: Valued at approximately USD 10.3 billion in 2024, the market is projected to reach USD 50.4 billion by 2031, growing at a CAGR of 21.9% .

- Government Initiatives: Programs like the National Solar Mission and financial incentives have bolstered solar adoption in residential, commercial, and industrial sectors.

- Capacity Expansion: India aims to add 35 GW of solar capacity by March 2025, contributing to the target of 500 GW of non-fossil fuel power by 2030 .

Power EPC Market

The Power Engineering, Procurement, and Construction (EPC) market is also witnessing significant growth, fueled by the increasing demand for energy infrastructure.

- Market Size and Growth: Estimated at USD 13.8 billion in 2022, the market is expected to grow at a CAGR of 21.94%, reaching USD 45.36 billion by 2029 .

- Growth Drivers: Factors such as rapid industrialization, urbanization, and technological advancements are driving the demand for power EPC services.

- Challenges: Despite growth, the sector faces challenges including project delays, regulatory hurdles, and financial constraints

How Will Prozeal Green Energy Limited Benefit

- Prozeal Green Energy Limited is well-positioned to leverage the growth of India’s solar energy market, capitalizing on the government’s renewable energy targets and initiatives.

- The company’s extensive track record of 182 projects and 783.98 MWp of capacity provides a strong foundation for future expansion.

- Prozeal’s turnkey solutions and Plug-and-Play solar park model streamline project deployment, offering clients a hassle-free experience.

- The company’s entry into electric vehicle (EV) charging infrastructure aligns with India’s push for sustainable mobility, providing additional growth opportunities.

- With an order book of ₹22,209.22 million, Prozeal is poised to benefit from the increasing demand for solar and EV infrastructure.

- Prozeal’s expertise in hybrid solar-wind parks opens new avenues in India’s renewable energy mix, enhancing its market competitiveness.

Peer Group Comparison

| Company Name | Revenue (₹ million) | Face Value (₹) | P/E Ratio | Basic EPS (₹) | RoNW (%) | NAV (₹) |

| Prozeal Green Energy Limited* | 9,488.82 | 2.00 | N.A. | 16.84# | 69.87% | 34.38 |

| Peer Groups | ||||||

| Sterling & Wilson Renewable Energy Ltd | 30,353.70 | 1.00 | Not measurable | (10.40) | (121.17%) | 33.09 |

| KPI Green Energy Ltd | 10,239.00 | 5.00 | 27.43 | 14.09 | 29.56% | 63.67 |

| Waaree Renewable Technologies Ltd | 8,765.03 | 2.00 | 59.75 | 13.95 | 87.66% | 23.64 |

| Gensol Engineering Ltd | 12,110.80 | 10.00 | 13.64 | 22.37 | 26.66% | 100.02 |

Key insights

- Revenue: Sterling & Wilson leads with the highest revenue at ₹30,353.70 million, followed by Gensol and KPI. Prozeal’s revenue is competitive, surpassing Waaree, indicating its growing position in the renewable energy space.

- Face Value: Face values vary across peers, with Gensol having the highest at ₹10, indicating larger nominal capital per share. Prozeal’s ₹2 face value aligns with Waaree’s, reflecting a standard equity base structure.

- Price-to-Earnings (P/E) Ratio: Prozeal’s P/E is not available, possibly due to its IPO stage. Among peers, Waaree shows the highest investor confidence with a P/E of 59.75, while Gensol remains more attractively valued at 13.64.

- Basic EPS: Gensol tops with ₹22.37, showcasing strong profitability. Prozeal follows with ₹16.84, reflecting sound earnings. Sterling & Wilson’s negative EPS indicates losses, highlighting Prozeal’s superior performance among emerging renewable energy players.

- Return on Net Worth: Waaree leads with 87.66%, reflecting high shareholder return. Prozeal’s 69.87% indicates robust profitability and efficient capital use. Sterling & Wilson’s negative RoNW highlights financial stress, in contrast to peers’ positive returns.

- Net Asset Value: Gensol’s NAV is the highest at ₹100.02, showing strong asset backing per share. Prozeal’s ₹34.38 is healthy and exceeds Waaree’s. KPI shows balanced strength with a NAV of ₹63.67, supporting investor confidence.

Key Strategies for Prozeal Green Energy Limited

- Capitalising on India’s Renewable Energy Growth

Prozeal Green Energy Limited is strategically positioned to capitalize on India’s growing renewable energy sector. With the increasing power demand and supportive government policies, Prozeal aims to expand its domestic operations. The company focuses on solar EPC projects and solar park development, leveraging local resources and expertise to enhance its market presence across India.

- Strategic Expansion of Renewable Park Business

Prozeal Green Energy Limited is expanding its portfolio of renewable energy parks across India. By adopting the solar park model, the company aims to streamline project execution and land acquisition processes, enhancing its service offerings to commercial and industrial clients. The company is actively pursuing solar park projects in key regions, focusing on efficiency and scalability.

- Diversification into Green Energy Solutions for Industrial Applications

Prozeal Green Energy Limited is diversifying into renewable solutions beyond solar energy, including green hydrogen and biomass systems. The company focuses on helping industrial clients transition to sustainable energy sources, providing EPC services for green energy projects. By leveraging its expertise in large-scale solar projects, Prozeal is well-positioned to lead in decarbonization efforts across industries.

- Diversification into Group Captive and Third-Party Power Plant Models

Prozeal Green Energy Limited is venturing into group captive and third-party solar power projects, leveraging its expertise in renewable energy project management. The company’s strategy involves long-term PPAs with industrial and commercial clients, offering cost-effective and sustainable energy solutions. By securing steady cash flows, Prozeal aims to enhance profitability and scalability in the renewable energy market.

- Strengthening Market Position through Strategic Partnerships

Prozeal Green Energy Limited is expanding its market reach by strengthening partnerships with stakeholders in the renewable energy sector. The company is focused on building long-term relationships with engineers, suppliers, and consultants to optimize project delivery. Through these collaborations, Prozeal aims to enhance its service offerings and provide clients with integrated renewable energy solutions.

- Expansion into Hybrid Wind-Solar Projects

Prozeal Green Energy Limited is advancing into hybrid wind-solar projects, with a focus on Gujarat, to diversify its energy portfolio. The company has secured grid connectivity approval for two wind-solar hybrid parks, each with a 54 MW contracted capacity. This strategic expansion aims to harness both wind and solar energy, creating efficient, sustainable power generation solutions.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On Prozeal Green Energy IPO

How can I apply for Prozeal Green Energy Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the Prozeal Green Energy IPO?

The IPO aims to raise ₹700 crore, comprising ₹350 crore fresh issue and ₹350 crore offer for sale.

What is the face value of the equity shares in this IPO?

Each equity share has a face value of ₹2.

On which stock exchanges will the shares be listed?

The equity shares are proposed to be listed on both the NSE and BSE.

Who are the lead managers for the Prozeal Green Energy IPO?

Nuvama Wealth Management Limited and SBI Capital Markets Limited are the book-running lead managers.

What is the primary purpose of the IPO proceeds?

Proceeds will be used for working capital needs and partial repayment of subsidiary borrowings.