- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Purple Style Labs IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Purple Style Labs Limited

Incorporated in 2015, Purple Style Labs Ltd. operates Pernia’s Pop-Up Shop (PPUS), a multi-brand luxury omni-channel fashion platform accessible via its website, mobile app, and Experience Centers. As of March 31, 2025, PPUS offered 211,727 SKUs from 1,312 designer brands, including Seema Gujral, Anushree Reddy, Amit Aggarwal, and Rohit Gandhi & Rahul Khanna, across womenswear, menswear, jewelry, accessories, and kidswear. Between FY23 and FY25, it served over 200,000 customers in 140 countries. Fiscal 2025 saw 18.57 million visitors, 70,651 customers, and 104,856 orders. The company has an international presence with a flagship London Experience Center and plans for New York, targeting markets in the US, UK, Middle East, and Canada. Abhishek Agarwal is the promoter.

Purple Style Labs Limited IPO Overview

Purple Style Labs Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 22, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a book-building issue of ₹660.00 crores, comprising solely a fresh issue of shares with no offer-for-sale component. The equity shares are proposed to be listed on NSE and BSE. Kfin Technologies Ltd. is the registrar for the issue, while the book running lead manager is yet to be announced. Key details such as IPO dates, price band, and lot size are pending. The IPO involves fresh capital with a face value of ₹10 per share, aggregating up to ₹660.00 crores. Pre-issue, the company has 6,82,35,000 shares, with promoter Abhishek Agarwal holding 27.36%.

Purple Style Labs Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹660 crore |

| Fresh Issue | ₹660 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,82,35,000 shares |

| Shareholding post-issue | TBA |

Purple Style Labs IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Purple Style Labs Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Purple Style Labs Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (₹29.03) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (158.85%) |

| Net Asset Value (NAV) | ₹18.27 |

| Return on Equity (RoE) | (158.85%) |

| Return on Capital Employed (RoCE) | (4.57%) |

| EBITDA Margin | 8.57% |

| PAT Margin | (38.49%) |

| Debt to Equity Ratio | 2.42 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in our wholly owned Subsidiary, PSL Retail for expenditure towards lease liabilities of Experience Centers, and back-end offices in India | 3632.93 |

| Funding towards sales and marketing expenses to be incurred by the Company | 1280 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

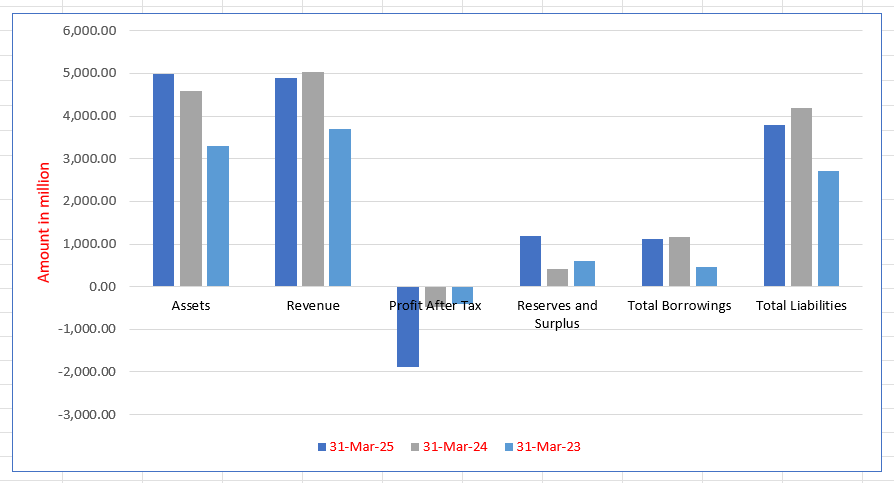

Purple Style Labs Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,982.51 | 4,597.52 | 3,297.45 |

| Revenue | 4,899.09 | 5,043.73 | 3,691.93 |

| Profit After Tax | (1,885.50) | (477.10) | (413.89) |

| Reserves and Surplus | 1,186.56 | 408.48 | 592.55 |

| Total Borrowings | 1,127.91 | 1,163.27 | 467.29 |

| Total Liabilities | 3,795.54 | 4,188.75 | 2,704.61 |

Financial Status of Purple Style Labs Limited

SWOT Analysis of Purple Style Labs IPO

Strength and Opportunities

- Strong omni-channel presence with both online and offline platforms.

- Established brand equity with a curated selection of premium Indian designers.

- Significant international reach, including markets in the US, UK, and Middle East.

- Robust financial backing with over ₹718 crore in total funding.

- Strategic acquisitions enhancing brand portfolio and market position.

- Expansion into global markets, including flagship stores in London and plans for New York.

- Diverse product offerings across womenswear, menswear, jewelry, accessories, and kidswear.

- Strong digital infrastructure supporting a seamless customer experience.

- Commitment to sustainability and ethical fashion practices.

Risks and Threats

- High dependency on the luxury fashion segment, which is sensitive to economic downturns.

- Intense competition from both domestic and international luxury fashion retailers.

- Operational challenges in scaling international operations effectively.

- Potential risks associated with currency fluctuations in global markets.

- Vulnerability to supply chain disruptions affecting product availability.

- Regulatory challenges in international markets impacting business operations.

- Brand dilution risk with rapid expansion and increased product range.

- Data privacy and cybersecurity concerns in handling customer information.

- Challenges in maintaining consistent quality across a growing number of brands.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Purple Style Labs Limited

Purple Style Labs Limited IPO Strengths

Multi-Brand Omni-Channel Luxury Platform

Purple Style Labs Limited operates one of India’s largest and fastest-growing multi-brand luxury fashion platforms. Its platform hosts 211,727 SKUs from 1,312 active designer brands, offering womenswear, menswear, jewelry, accessories, and kidswear. The wide-ranging portfolio ensures diverse customer choices, supports category expansion, and strengthens the company’s competitive advantage through deep, strategic designer relationships globally.

Omni-Channel Business Model and Operational Efficiency

The company integrates its online platform with physical Experience Centers, providing a seamless shopping journey. Customers benefit from personalized styling, in-store trials, and online convenience. Large-format centers in major cities enhance product visibility and assortment. This approach improves engagement, supports higher average order values, and drives operational efficiencies while maintaining a premium, consistent customer experience across channels.

Robust International Presence

Purple Style Labs Limited has established a strong international footprint, serving customers from over 100 countries. The UK Experience Center and upcoming US store complement the global online presence, providing curated Indian luxury fashion. By bridging accessibility gaps for international clientele, the company strengthens brand appeal, expands market reach, and addresses the global demand for high-quality Indian designer wear.

Powerful Network Effects and Customer Retention

The platform’s extensive designer network attracts both brands and customers, creating a self-reinforcing growth cycle. PPUS maintains high retention rates, increasing average order values and repeat purchases. By optimizing brand and product mix toward premium offerings, Purple Style Labs maximizes monetization per customer while fostering loyalty, engagement, and deepening long-term relationships with high-value clientele.

Experienced Management Team and Board

Led by Abhishek Agarwal, the company benefits from a senior management team with deep retail, marketing, and product expertise. Team members from premier institutions bring fresh perspectives, adaptability, and collaborative problem-solving. The diversified Board provides strategic vision and governance, combining operational experience in omni-channel luxury platforms with insights from consultancy, private equity, and consumer retail sectors.

More About Purple Style Labs Limited

Purple Style Labs Limited operates Pernia’s Pop-Up Shop (PPUS), one of India’s largest and fastest-growing multi-brand luxury fashion platforms, serving customers domestically and internationally. According to the 1Lattice Report, PPUS led revenue growth in FY 2024 through its omni-channel presence, which includes Experience Centers, its website, mobile applications (Android and iOS), telephonic and digital sales channels, as well as fashion events and exhibitions. In Fiscal 2025, the Average Order Value (PPUSAOV) reached ₹56,106.44.

Curated Luxury Offerings

PPUS features a curated selection of products from 1,312 active designer brands as of March 31, 2025. Prestigious designers include Seema Gujral, Anushree Reddy, Amit Aggarwal, and Rohit Gandhi & Rahul Khanna. Product categories cover womenswear, menswear, jewelry, accessories, and kidswear, with a particular focus on wedding and occasion wear.

Omni-Channel Expansion

Following the acquisition of Pernia’s Pop-Up Shop’s online assets in February 2018, Purple Style Labs transformed the platform into a true omni-channel experience. The first flagship Experience Center opened in Juhu, Mumbai in 2018. Currently, there are 14 global Experience Centers—13 in India and one in London, UK—with upcoming centers planned for Linking Road, Mumbai, and New York, USA. The recently opened Large Format Experience Centers in Fort, Mumbai, and South Extension, Delhi, range from 20,000 to 60,000 square feet, offering immersive luxury shopping experiences.

Customer and Market Reach

From FY23 to FY25, PPUS served over 200,000 unique customers globally, with 18.57 million unique visitors to its online platforms in Fiscal 2025 alone. Total orders reached 104,856, and GMV grew to ₹5,883.10 million in Fiscal 2025, a 12.35% CAGR from FY23. India remains the primary market, but international sales account for a significant share, particularly in the US, UK, Middle East, Canada, and Southeast Asia.

Value Proposition

For customers, PPUS combines discovery, curation, and immersive in-store experiences with personalized stylist support. For designer brands, the platform provides global visibility, premium retail access, and control over brand image and pricing, helping increase sales across channels.

Management Team

The company is led by Abhishek Agarwal, Promoter, Whole-Time Director, and CEO, supported by a senior management team with expertise in retail, marketing, and product management. The Board includes Abhinav Agarwal, Harminder Sahni, and Rahul Garg, bringing deep experience in luxury retail, consultancy, and investment sectors.

Industry Outlook

The Indian luxury fashion industry is experiencing significant growth, driven by increasing disposable incomes, evolving consumer preferences, and a burgeoning middle class. This sector encompasses high-end apparel, accessories, and designer wear, aligning with the offerings of Purple Style Labs Limited through its platform, Pernia’s Pop-Up Shop.

Market Size and Growth

- The Indian luxury fashion market was valued at approximately USD 9.37 billion in 2024 and is projected to reach USD 15.13 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.03%.

- The affordable luxury segment is anticipated to grow at a CAGR of 13–19% from 2024 to 2029, indicating a shift towards premium yet accessible fashion choices among consumers.

Growth Drivers

- Rising Disposable Incomes: An expanding affluent population is fueling demand for luxury fashion items.

- Urbanization: Increased urbanization leads to greater exposure to global fashion trends.

- Digital Transformation: The growth of e-commerce and digital platforms enhances accessibility to luxury fashion.

- Influencer Marketing: Social media influencers play a pivotal role in shaping consumer preferences.

- Global Brand Expansion: International luxury brands are increasing their presence in India, contributing to market growth.

Consumer Trends

- Sustainability: There is a growing preference for sustainable and ethically produced fashion.

- Personalization: Consumers seek personalized shopping experiences and products.

- Occasion-Based Purchases: Weddings and festivals drive significant sales in luxury fashion.

- Influence of Social Media: Platforms like Instagram and Pinterest influence fashion choices, especially among younger demographics.

Market Challenges

- High Price Sensitivity: Despite growing affluence, price sensitivity remains a factor for many consumers.

- Counterfeit Products: The prevalence of counterfeit goods poses a challenge to brand integrity.

- Logistical Hurdles: Distribution and supply chain complexities can affect product availability.

How Will Purple Style Labs Limited Benefit

- Purple Style Labs Limited can leverage the growing Indian luxury fashion market to expand its customer base, both domestically and internationally.

- The rising disposable incomes and increasing affinity for premium products will drive higher sales of curated designer collections on PPUS.

- Expansion of digital platforms and e-commerce trends enables the company to reach a wider audience efficiently.

- Personalized shopping experiences at Experience Centers align with the consumer demand for customization, enhancing customer loyalty.

- Global brand expansion and collaborations with international designers can increase the visibility and appeal of PPUS offerings.

- The emphasis on sustainable and ethically produced fashion provides an opportunity to attract environmentally conscious consumers.

- Occasion-based purchases, such as weddings and festivals, support consistent demand for PPUS luxury products.

- Social media influence can amplify marketing reach, driving brand awareness and engagement among younger demographics.

- Strategic positioning in key metro cities and planned international Experience Centers will strengthen market penetration.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Purple Style Labs Limited

Expand Footprint in Key Luxury Markets

Purple Style Labs Limited aims to expand its presence in key luxury markets by opening Large Format Experience Centers in high-traffic metropolitan areas. These centers enhance product visibility, attract higher footfall, and offer immersive shopping experiences, supporting growth in India and strategic expansion into international luxury markets.

Deepen Existing Customer Base

The company focuses on strengthening relationships with existing customers by curating personalized product offerings. Using data-driven insights into preferences and shopping behaviours, Purple Style Labs enhances customer satisfaction, encourages frequent purchases, and increases spending, thereby improving retention, loyalty, and long-term revenue contribution from its core customer base.

Increase and Optimize Product Categories and Designer Brand Mix

Purple Style Labs diversifies and refines its product and designer brand portfolio. By introducing high-value categories like real jewelry and expanding menswear, while optimizing top-selling designer brands, the company provides a curated shopping experience, drives profitability, and maintains a fresh, broad, and premium product assortment across channels.

Focus on Profitability and Cost Structure

The company prioritizes cost efficiency while maintaining brand-building initiatives. By optimising marketing spend, managing expenses, and focusing on high-impact campaigns and curated events, Purple Style Labs enhances financial performance, strengthens customer engagement, and ensures profitability, balancing operational efficiency with continued growth in luxury fashion retail.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Purple Style Labs Limited IPO

How can I apply for Purple Style Labs Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of Purple Style Labs Ltd. IPO?

The IPO is a fresh issue of ₹660.00 crores, with no offer-for-sale component, raising capital for business expansion.

Where will Purple Style Labs Ltd. shares be listed?

The equity shares are proposed to be listed on NSE and BSE, enabling trading on major Indian stock exchanges.

Who is the promoter of Purple Style Labs Ltd.?

Abhishek Agarwal is the company promoter, holding a pre-issue stake of 27.36% in Purple Style Labs Ltd.

What are the objects of the Purple Style Labs Ltd. IPO?

Funds will support lease obligations of Experience Centers, sales and marketing expenses, and general corporate purposes.

Has the company filed its IPO with SEBI?

Yes, the Draft Red Herring Prospectus (DRHP) was filed with SEBI on September 22, 2025.