- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Put Writing Strategy Explained: Process, Benefits, and Risks

By HDFC SKY | Published at: May 28, 2025 02:11 PM IST

One popular approach, particularly among experienced traders aiming to generate regular income or acquire stocks at potentially lower prices, involves selling options. Specifically, put writing, or selling put options, is a strategy where the trader takes on an obligation in exchange for receiving an upfront premium. While potentially rewarding, it carries significant risks that must be thoroughly understood.

This article explains what is put writing, the process involved, the obligations, benefits, and crucial risks associated with put writing in stock market activities in India.

What is Put Writing?

Put writing means selling or “writing” a put option contract on an underlying asset (like a specific stock or index). What is put writing in practice? When you write/sell a put option, you receive a payment (the option premium) from the buyer. In return, you undertake the obligation to buy the underlying asset at a specified price (the strike price) if the option buyer chooses to exercise their right to sell, which typically happens if the underlying asset’s price falls below the strike price by the expiry date.

The core idea or meaning of put writing from the seller’s perspective is often based on the expectation that the underlying asset’s price will remain above the strike price until the option expires. If this occurs, the put option expires worthless, and the writer keeps the entire premium received as profit. Alternatively, some use put writing with the intention of acquiring the underlying stock at an effective price lower than the current market price (Strike Price – Premium Received), should the option be exercised. This involves writing options with a specific outlook.

Process of Writing Put Options

Engaging in put writing involves several steps:

- Select Underlying & Outlook: Choose the specific stock or index you want to write put options on. You should have a neutral to bullish outlook, believing the price is unlikely to fall significantly below a certain level (the chosen strike price) before expiry. Familiarity with the underlying asset’s behaviour is important.

- Choose Strike Price & Expiry: Select an appropriate strike price (typically below the current market price – Out-of-The-Money or OTM) and an expiry date (e.g., near-month or next-month contracts on NSE). The further OTM the strike, the lower the premium received but the higher the probability of the option expiring worthless.

- Check Margin Requirements: Before selling, ensure you have sufficient funds or collateral in your trading account to meet the initial margin requirements mandated by SEBI and your broker for selling naked puts. Brokers in India (like HDFC Sky) provide margin calculators to estimate this.

- Sell the Put Option: Place an order through your trading platform to sell the chosen put option contract(s). Specify the quantity (in lots), strike price, expiry, and order type (limit or market).

- Receive Premium: Upon successful execution, the premium (Option Price x Lot Size x No. of Contracts) is credited to your trading account immediately.

- Monitor & Wait: Track the underlying asset’s price movement relative to the strike price as the expiry date approaches.

- Manage Outcome:

- If Price > Strike at Expiry: The put option expires worthless. You keep the full premium as profit. No further action needed.

- If Price < Strike at Expiry: The option is In-The-Money (ITM). The buyer will likely exercise their right, and you will be assigned – meaning you are obligated to buy the underlying shares at the strike price (even if the current market price is lower). The shares will be delivered to your Demat account, and the funds (Strike Price x Lot Size x No. Contracts) will be debited. Your effective purchase price is the strike price minus the premium you initially received.

- Close Early (Optional): You can exit the position before expiry by buying back the same put option contract (a ‘buy-to-close’ order). This can lock in a partial profit if the option premium has decreased significantly or cut losses if the underlying price falls sharply.

Obligations of Put Writers

Writing a put option means accepting certain obligations, like –

- Obligation to Buy: The primary obligation is to purchase the underlying asset at the agreed strike price if the option is exercised by the buyer (typically if it’s ITM at expiry). This applies even if the asset’s market price has fallen far below the strike price.

- Margin Maintenance: Put writers must deposit and maintain sufficient margin (SPAN + Exposure in India) with their broker for as long as the position is open. If market volatility increases or the underlying price falls sharply, the required margin can increase, potentially leading to margin calls demanding additional funds. Failure to meet margin calls can result in the broker forcibly closing the position at a loss. Indian brokers strictly enforce these margin rules for writing options.

Benefits Of Put Writing

Some of the primary benefits of put writing are as follows –

- Income Generation: The premium received upfront provides an immediate cash inflow and potential source of regular income if options consistently expire worthless.

- Acquiring Stock at Lower Effective Cost: If assigned, you buy the stock at the strike price, but your net cost is effectively lower (Strike Price – Premium Received). This can be a strategy for investors wanting to buy a stock but only at a price below the current market level.

- Potential for Higher Returns (vs Holding Cash): Selling puts can potentially generate better returns than holding cash if the market remains stable or rises, due to the premium income.

- Flexibility: Traders can choose strike prices and expiry dates to align with their risk tolerance and market outlook.

- Hedging Potential (Advanced): While less common for simple hedging than buying puts, certain strategies might involve selling puts as part of a broader hedging structure.

What are the Risks of Put Writing?

Though beneficial, put writing has some risks and drawbacks too. These include the following –

It is crucial to understand the significant risks involved before putting on writing puts:

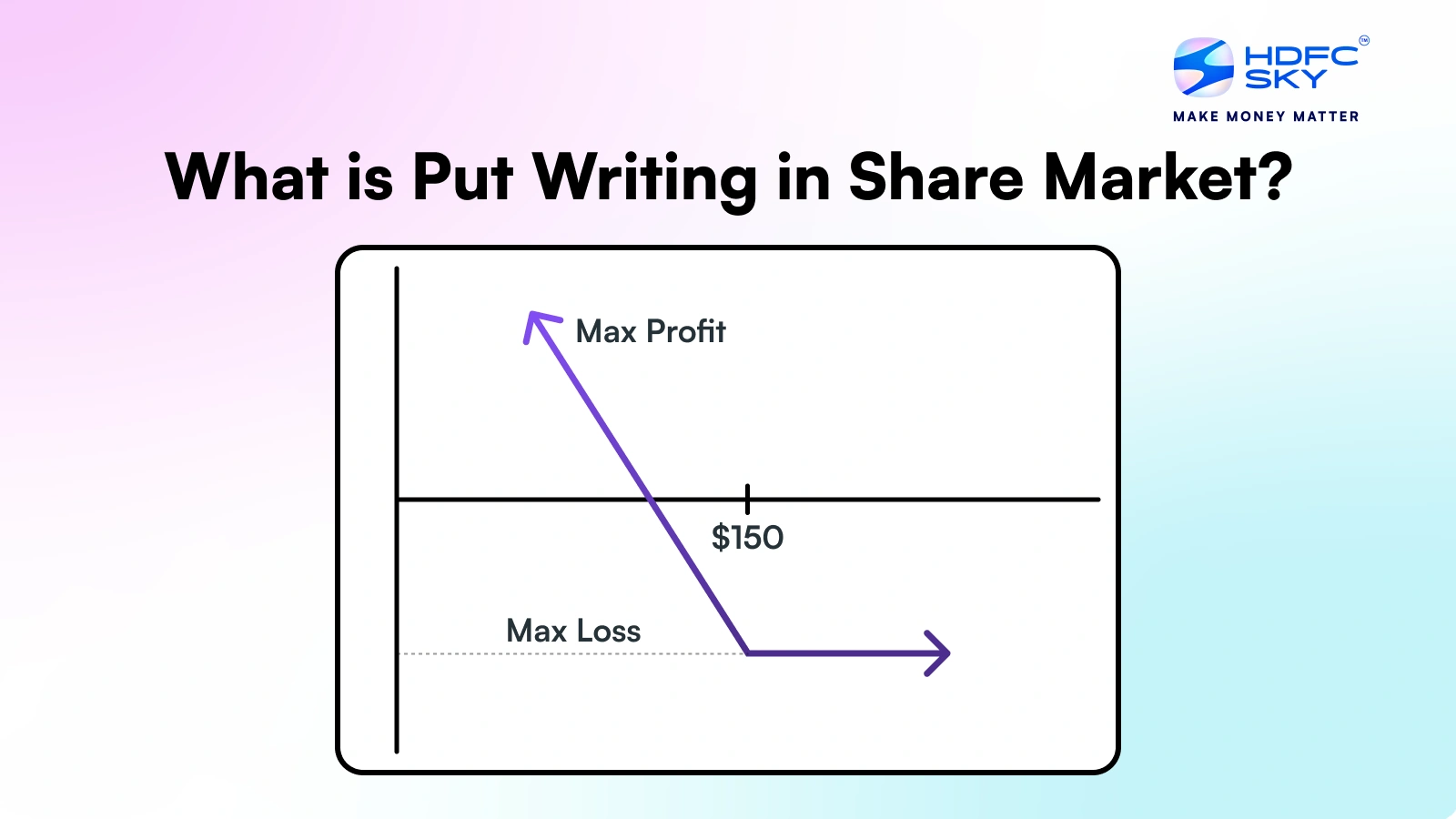

- Substantial Loss Potential: The biggest risk is a sharp fall in the underlying asset’s price well below the strike price. While the profit is limited to the premium, the loss can be substantial – equivalent to buying the stock at the strike price and seeing it fall further, potentially towards zero. Maximum Loss = (Strike Price – Premium Received) x Lot Size.

- Margin Calls: As mentioned, adverse price movements or increased volatility can trigger margin calls, requiring additional capital or forcing position closure at a loss.

- Opportunity Cost: If the stock price rises significantly, the put writer only keeps the premium and misses out on the potential gains from having owned the stock directly.

- Unfavourable Assignment: Being forced to buy a stock at the strike price when its market value is much lower results in an immediate paper loss on the newly acquired stock position.

- Complexity: Requires a good understanding of options pricing, volatility, margin rules, and risk management. It is generally not suitable for beginners.

Conclusion

Put writing is an options strategy that involves selling put options to earn premium income, often with the expectation that the underlying asset’s price will stay above the chosen strike price until expiry. It can be used to generate income or as a way to potentially acquire shares at a lower effective cost. However, the meaning of put writing must be understood in the context of its risk profile: limited profit potential (capped at the premium received) versus substantial, albeit not entirely unlimited, loss potential if the underlying asset price falls significantly.

Engaging in put writing in stock market requires adequate capital for margin, a solid understanding of options, disciplined risk management, and suitability for investors with a higher risk tolerance. Always analyse the risks thoroughly before writing a put option means committing capital to this strategy in the Indian share market.

Related Articles

FAQs on Put Writing Explained

How to write an example of a put option?

Suppose XYZ Ltd. is trading at ₹1000. However, you sell a put option at a strike price ₹950 and receive a premium of ₹50 per share. When the price is above ₹950, you get to keep the premium. If the price goes below ₹950, you will have to buy the shares at ₹950, but your actual outgo is ₹900 per share.

What occurs when selling a put option?

When you sell a put, you are committing to buying the stock at a set price if the buyer wishes to sell. You receive a premium for the protection. If the stock stays above the strike price, you keep the premium. If the stock goes below, you will have to purchase the stock at the strike price, despite it being cheaper on the market.

How to write a put option?

To sell a put, select the stock and strike, and sell a put option on the exchange. You are paid a premium by the buyer. You must have enough margin in your account. If the stock price falls below the strike, you must purchase the stock at that price. Otherwise, you get to keep the premium as profit.

How does buy-to-close support risk management?

Buy-to-close allows you to close a put option position prior to expiration by rebuying the same contract. It ties up profits or cuts losses should the market move against you. It spares you from losing larger amounts and provides you with more control over your transactions. It also releases margin for other opportunities and from being assigned unwanted shares.