- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Pyramiding Strategy: What it is and how to use it

By HDFC SKY | Updated at: Apr 24, 2025 04:36 PM IST

Summary

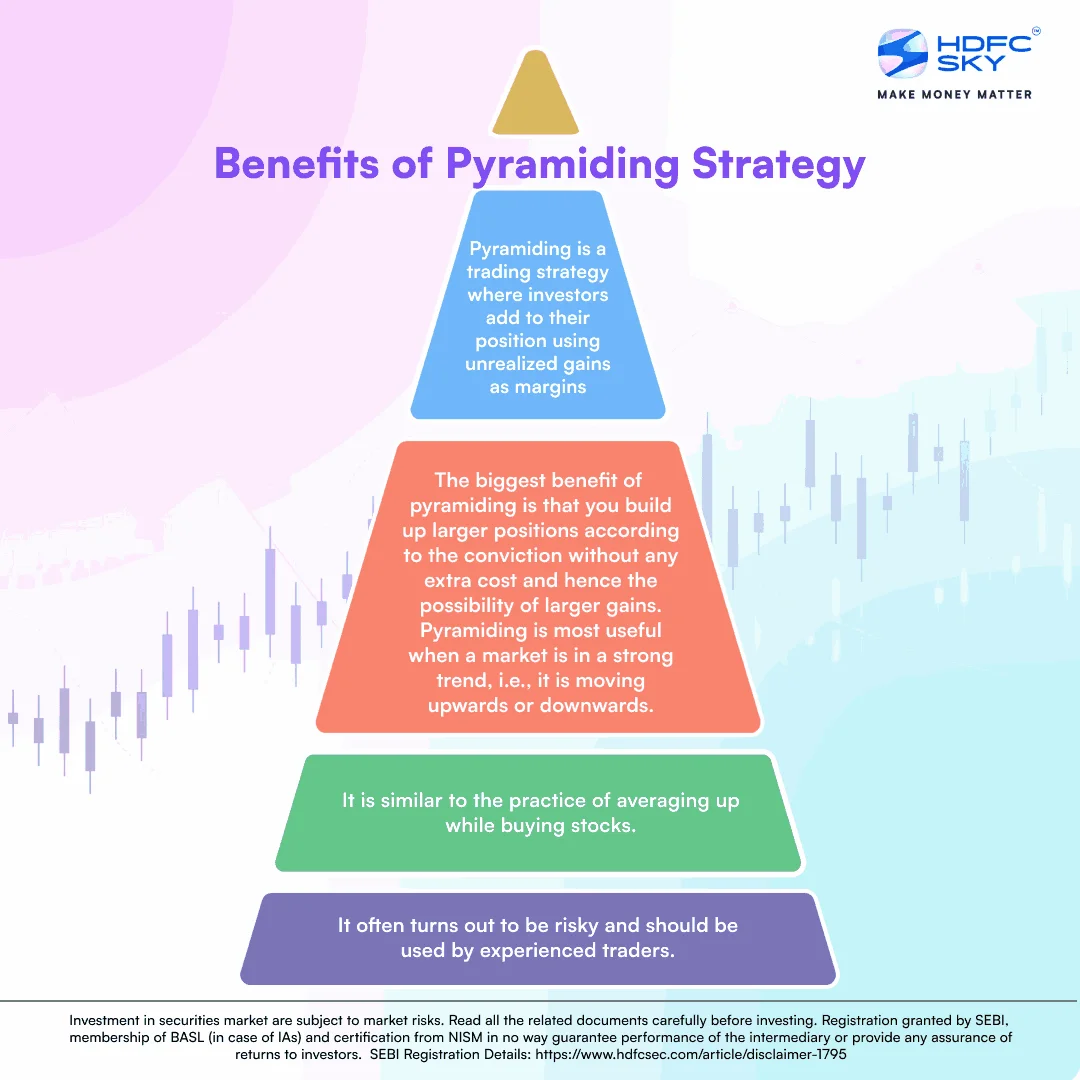

As we now know margin traders have to keep some margin or collateral to avail funding from brokers for taking more positions in the market. This collateral can be in the form of cash or securities. When the market is in a trend, margin traders use pyramiding strategy to amplify their gains.

Pyramiding strategy involves using the unrealised gains from trades as margin to add up new positions in the market. Thus, in a trending market, pyramiding can help you build a larger portfolio of stocks with margin trading.

Pyramiding is most useful when a market is in a strong trend, i.e., it is moving upwards or downwards. So, you would keep adding to your positions in a favourably trending market.

When the market continuously trends in a favourable direction, you can make huge profits with this strategy. But remember, if the trend reverses, you can also suffer huge losses.

How does pyramiding work?

As a trader, you can build long positions in an upward trending market, while you can create short positions in a downtrend.

For instance, let’s assume you are a margin trader and have taken a long position in a stock during an uptrend. Your initial margin is 50% and the balance is provided by the broker. When the share price rises, you make an unrealised profit. When there is a correction in the price, you buy more stocks in anticipation that the stock will again move in the broader uptrend. To purchase these additional shares, you can utilise the unrealised profit from previous shares as margin or collateral and get funds from the broker. This will increase your total position in the market without contributing additional funds.

In simple words, in the pyramiding strategy, the broker lends more funds to you to build additional positions, just by utilising the unrealised profit as the margin. Your leverage rises as you can take a higher position on the initially deposited amount.

During a bullish trend, this strategy works only when the market enters a small correction before resuming its upward journey. There are many such corrections which can be utilised for buying additional shares by margin traders on the back of unrealised profits. You will have to square off his positions once the trend peaks and reverses.

What are margin calls?

When the balance in the Margin Trading Facility (MTF) Account falls below the minimum level or the maintenance margin level, it triggers a margin call. If this minimum level is breached, the brokers will make a margin call and you will be required to deposit additional funds in the account or liquidate the position in part or full.