- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

R.K. Steel Manufacturing IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

R.K. Steel Manufacturing IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

R.K. Steel Manufacturing Co. Limited

Incorporated in 2006, R.K. Steel Manufacturing Co. Limited is a prominent manufacturer of welded structural steel tubes and pipes. The company boasts a diverse product portfolio, including Pre-Galvanised Pipes (GP), Hot Dip Galvanised Pipes (GI), Hot Rolled Pipes (HR), and Cold Rolled Pipes (CR), alongside value-added products like GP Coils and CRFH Coils. Its products cater to a wide array of industries such as construction, automotive, solar power, and engineering. Operating from a strategically located, integrated 18.49-acre facility in Perundurai, Tamil Nadu, the company is equipped with advanced machinery, including nine tube mills and a tandem cold rolling mill, serving a loyal base of over 470 customers.

R.K. Steel Manufacturing Co. Limited IPO Overview

R.K. Steel Manufacturing Co. Limited has filed a Draft Red Herring Prospectus (DRHP) with SEBI to raise funds through an initial public offering (IPO). This mainboard IPO is a book-built issue consisting entirely of a fresh issue of up to 2.00 crore equity shares. The proceeds are intended for strategic purposes, including repayment of certain borrowings and funding working capital requirements, which will strengthen the company’s balance sheet and support its growth trajectory. The equity shares are proposed to be listed on both the BSE and NSE, providing investors with a liquid avenue for participation in the company’s future.

R.K. Steel Manufacturing Co. Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO (Fresh Issue) |

| Total Issue Size | Up to 2,00,00,000 equity shares |

| Fresh Issue | Up to 2,00,00,000 equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,94,03,130 shares |

| Shareholding post-issue | 6,94,03,130 shares |

R.K. Steel Manufacturing IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

R.K. Steel Manufacturing Co. Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

R.K. Steel Manufacturing Co. Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 2.21 (Pre-IPO) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 9.04% |

| Net Asset Value (NAV) | ₹ 24.43 |

| Debt to Equity Ratio | 2.91 |

| EBITDA Margin | 4.21% |

| PAT Margin | 0.95% |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/prepayment of certain borrowings | Up to 432.302 |

| Funding of working capital requirements | Up to 760.000 |

| General corporate purposes* | [●] |

| *To be finalised upon determination of the Issue Price and updated in the Prospectus. |

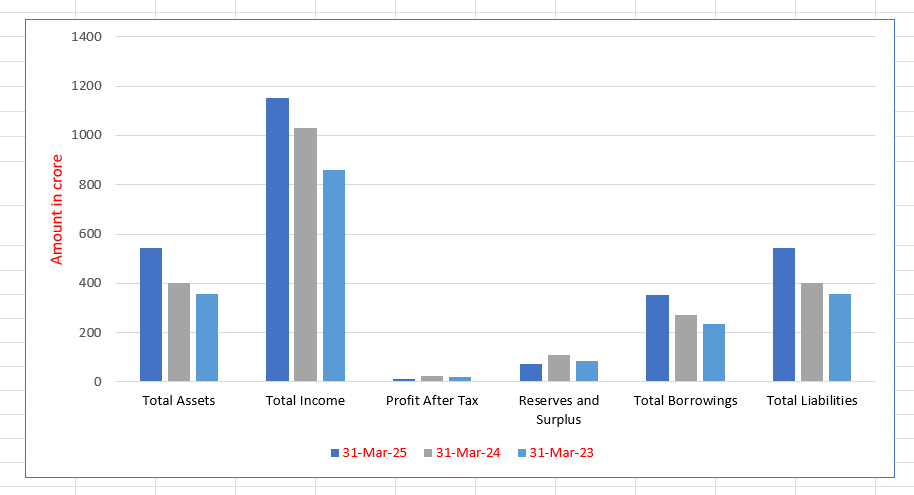

R.K. Steel Manufacturing Co. Limited Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Total Assets | 542.55 | 401.23 | 356.52 |

| Total Income | 1,153.73 | 1,028.52 | 858.80 |

| Profit After Tax | 10.91 | 22.70 | 19.88 |

| Reserves and Surplus | 71.28 | 107.45 | 84.68 |

| Total Borrowings | 351.09 | 273.16 | 233.30 |

| Total Liabilities | 542.55 | 401.23 | 356.52 |

Financial Status of R.K. Steel Manufacturing Co. Limited

SWOT Analysis of R.K. Steel Manufacturing IPO

Strength and Opportunities

- Established integrated manufacturing setup in a strategic location in Tamil Nadu.

- Diverse product portfolio catering to multiple high-growth industries.

- Positioned to capitalize on India's growing infrastructure and construction demand.

- Strong and established customer base with long-term relationships.

- Experienced management team with deep industry expertise.

- Backward integration capabilities with value-added coil production.

- Commitment to sustainability through solar power and cleaner fuels like CBG.

- Efficient logistics and supply chain due to proximity to transport hubs.

- Among the few players in South India with a tandem cold rolling mill.

- Government initiatives like 'Make in India' and NIP provide a favorable outlook.

Risks and Threats

- High dependency on the domestic market, with limited export presence.

- Significant reliance on a trader network for sales and distribution.

- Low capacity utilization rates across several production lines.

- High debt levels reflected in a Debt/Equity ratio of 2.91.

- Declining Profit After Tax (PAT) in the recent fiscal year.

- Intense competition within the fragmented steel pipes and tubes industry.

- Vulnerability to fluctuations in the prices of raw materials like HR coils.

- Regional revenue concentration in states like Karnataka, Kerala, and Tamil Nadu.

- Economic downturns or reduced government infrastructure spending could impact demand.

- Regulatory changes in environmental and safety norms could increase compliance costs.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About R.K. Steel Manufacturing Co. Limited

R.K. Steel Manufacturing Co. Limited IPO Strengths

Integrated Manufacturing Facility

R.K. Steel Manufacturing Co. Limited operates from an 18.49-acre integrated facility in Tamil Nadu, equipped with nine tube mills, a tandem cold rolling mill, and galvanizing lines. This strategic, well-connected location enables efficient raw material sourcing and product distribution, reducing logistics costs and ensuring a streamlined, cost-effective production process from raw material to finished goods. This vertical integration provides significant control over quality and production timelines.

Diverse and Applicable Product Portfolio

The company manufactures a wide range of welded steel pipes, tubes, and value-added coils in various shapes, sizes, and grades. This diverse portfolio, used in construction, automotive, and solar sectors, allows R.K. Steel to meet evolving market demands, reduce dependency on any single product, and de-risk its revenue streams while catering to a broad customer base and capturing cross-selling opportunities.

Established Market Position and Customer Relationships

With over 16 years of operational experience, R.K. Steel Manufacturing Co. Limited has cultivated a strong, loyal customer base. A significant portion of its revenue comes from long-standing clients, reflecting the company’s reliability and product quality. These established relationships provide revenue visibility, industry goodwill, and a solid foundation for future growth and market expansion, ensuring business stability.

Strategic Location with Logistics Advantages

The company’s manufacturing plant in Perundurai benefits from excellent connectivity to major cities like Erode and Coimbatore, national highways, railways, and ports. This proximity to multiple transport mediums facilitates efficient and cost-effective inbound and outbound logistics, reducing transportation expenses, improving delivery timelines, and optimizing the entire supply chain, thereby enhancing overall competitiveness.

Experienced Promoters and Management Team

The company is driven by its promoters, Pramod Kumar Bhalotia and Abhishek Bhalotia, who possess decades of combined experience in the steel industry. Supported by a seasoned senior management team with deep domain expertise, this leadership provides strategic direction, operational excellence, and industry insights, which are critical for navigating market cycles and capitalizing on growth opportunities.

Commitment to Sustainable Operations

R.K. Steel demonstrates a strong commitment to environmental responsibility by operating a 5.5 MW captive solar power plant and adopting Compressed Biogas (CBG) to replace conventional furnace oil. These initiatives reduce the carbon footprint, lower energy costs, and align with global sustainability trends, enhancing the company’s reputation as an environmentally conscious manufacturer.

More About R.K. Steel Manufacturing Co. Limited

R.K. Steel Manufacturing Co. Limited was established in 2006 and has since evolved from a manufacturer of basic welded steel pipes into a diversified producer of a wide range of tubes, pipes, and value-added steel coils. This journey has been marked by continuous investment in capacity expansion and technological upgrades, culminating in the establishment of its integrated facility in Perundurai, Tamil Nadu.

The Integrated Manufacturing Facility

The cornerstone of R.K. Steel’s operations is its 18.49-acre manufacturing facility. This plant is equipped with state-of-the-art machinery that enables a seamless production flow:

- Primary Processing: 9 Tube Mills and 4 Slitting Lines.

- Value Addition: 2 Continuous Galvanizing Lines (CGL), 1 Tandem Cold Rolling Mill (CRM), 1 Pickling Unit, and 1 Hot Dip Galvanizing (GI) Unit.

The presence of the tandem cold rolling mill is a key differentiator, making R.K. Steel one of the few companies in South India with this capability, which ensures consistency in production and quality control for cold-rolled products.

Product Portfolio and Applications

R.K. Steel’s product range is designed to meet diverse industrial needs:

- Welded Steel Pipes & Tubes: Available in round, square, and rectangular shapes, these include Pre-Galvanised (GP Pipes), Hot Dip Galvanised (GI Pipes), Hot Rolled (HR Pipes), and Cold Rolled (CR Pipes). They are widely used in structural applications, fencing, scaffolding, and fluid transportation.

- Steel Coils: The company also produces value-added coils like Galvanised Plain (GP) Coils, Cold Rolled Full Hard (CRFH) Coils, and Hot Rolled Pickled & Oiled (HRPO) Coils. These can be sold as independent products or used in-house for further manufacturing, providing revenue flexibility.

Customer Base and Market Reach

The company has demonstrated an ability to attract and retain customers. In the last three fiscal years, it served over 471, 476, and 424 customers respectively, with a significant number being long-term associates. While the primary market is domestic, with strong concentrations in Karnataka, Kerala, and Tamil Nadu, the company has also begun exporting to countries like the USA and Peru, indicating potential for international growth.

Operational and Sustainability Focus

Beyond production, R.K. Steel focuses on operational efficiency and sustainability. The company has invested in a captive solar power plant to meet a significant portion of its energy needs and has pioneered the use of CBG in its production processes, earning recognition from Indian Oil Corporation Limited (IOCL) for its sustainable practices.

Industry Outlook

The Indian steel pipes and tubes industry is poised for a period of robust growth, firmly anchored by the country’s massive infrastructure development ambitions. Government-led initiatives such as the National Infrastructure Pipeline (NIP), ‘Make in India’, and the push for affordable housing and renewable energy are creating unprecedented demand for steel products.

Market Size and Growth Projections

- The Indian mild steel pipes market is expected to maintain a steady growth trajectory.

- Consumption is projected to rise to 10.1 Million Tonnes Per Annum (MTPA) by FY28.

- In value terms, the market size is expected to expand to USD 32.1 billion, reflecting sustained growth driven by both structural and technological advancements.

Key Growth Drivers

- Infrastructure Development: Massive investments in roads, highways, bridges, urban metro projects, and irrigation systems are primary drivers of demand for structural steel tubes and pipes.

- Construction and Real Estate: The booming residential and commercial real estate sectors consistently consume large quantities of steel for structural frameworks, plumbing, and fencing.

- Industrial and Automotive Sectors: Growth in automobile manufacturing, engineering goods, and capital goods contributes to steady demand.

- Solar Power Expansion: The government’s focus on renewable energy has made the solar power sector a significant consumer of galvanized steel tubes and pipes, which are used for mounting structures in solar parks.

- Export Potential: The outlook for steel pipes and tubes in India includes a stronger growth trajectory for exports, as rising global demand positions Indian manufacturers to capture international market share.

This favorable industry outlook, coupled with the company’s integrated operations and diverse product mix, places R.K. Steel Manufacturing Co. Limited in a strategic position to capitalize on these emerging opportunities.

How Will R.K. Steel Manufacturing Co. Limited Benefit

- The primary benefit will be a strengthened balance sheet achieved through the repayment of high-cost borrowings, which will lead to a significant reduction in finance costs and interest burden.

- Enhanced capacity to undertake larger orders and support business growth with the funded working capital requirements, improving operational scalability.

- Increased brand visibility, corporate credibility, and transparency that comes with a public listing on premier stock exchanges like BSE and NSE.

- Improved financial flexibility to pursue future capital expenditure, technological upgrades, and strategic expansion opportunities without over-reliance on debt.

- A strengthened equity base which will improve debt-raising capabilities in the future for other strategic initiatives and growth projects.

Peer Group Comparison

| Companies (As on March 31, 2025) | CMP* (₹) | EPS (Basic in ₹) | PE Ratio | RONW (%) | NAV (Per Share) (₹) | Total Income (₹ Lakhs) |

| R K Steel Manufacturing Co. Limited | [=] | 2.21 | [=] | 9.04% | 24.43 | 1,15,373.05 |

| Peer Group | ||||||

| Surya Roshni Limited | 292.00 | 15.95 | 18.33 | 14.06% | 113.27 | 7,46,555.00 |

| Hariom Pipe Industries Ltd. | 550.15 | 20.25 | 27.60 | 10.78% | 184.93 | 1,35,994.35 |

| Hi-Tech Pipes Limited | 121.39 | 3.98 | 30.50 | 5.80% | 61.91 | 3,06,952.49 |

Key Strategies for R.K. Steel Manufacturing Co. Limited

Market Expansion and Customer Base Diversification

R.K. Steel Manufacturing Co. Limited aims to strengthen its domestic foothold while strategically expanding into international markets. The strategy focuses on increasing wallet share with existing customers by offering a wider product range and establishing relationships with new clients to drive sustainable, diversified growth.

Operational and Profitability Enhancement

The company is committed to enhancing operational efficiency through process optimization, technology upgrades, and supply chain management. By investing in automation and new machinery, R.K. Steel seeks to improve productivity, reduce costs, and achieve operational excellence for sustained profitability and financial growth.

Leveraging Integrated Manufacturing Capabilities

A core strategy involves fully utilizing its integrated plant to improve product quality and cost control. By maximizing the use of its cold rolling mill and galvanizing lines, the company aims to enhance value addition, ensure consistency in production, and increase the share of high-margin products in its overall sales mix.

Strengthening Financial Profile

Post-IPO, a key strategic focus will be on strengthening the company’s financial structure. The reduction of debt through IPO proceeds will lower leverage, decrease interest costs, and improve key financial ratios, thereby creating a more robust foundation for future growth and investment.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On R.K. Steel Manufacturing Co. Limited IPO

How can I apply for the R.K. Steel Manufacturing Co. Limited IPO?

You can apply via HDFC Sky or other broker platforms using UPI-based ASBA.

What is the lot size for the R.K. Steel IPO?

The lot size and application amount will be announced with the price band before the IPO opens.

What will the company use the IPO money for?

The net proceeds are earmarked for repayment of borrowings, funding working capital, and general corporate purposes.

Is this IPO an Offer for Sale (OFS)?

No, the IPO is a complete fresh issue of equity shares; no existing shares are being sold.

Where will R.K. Steel shares be listed?

The equity shares are proposed to be listed on both the BSE and NSE.