- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

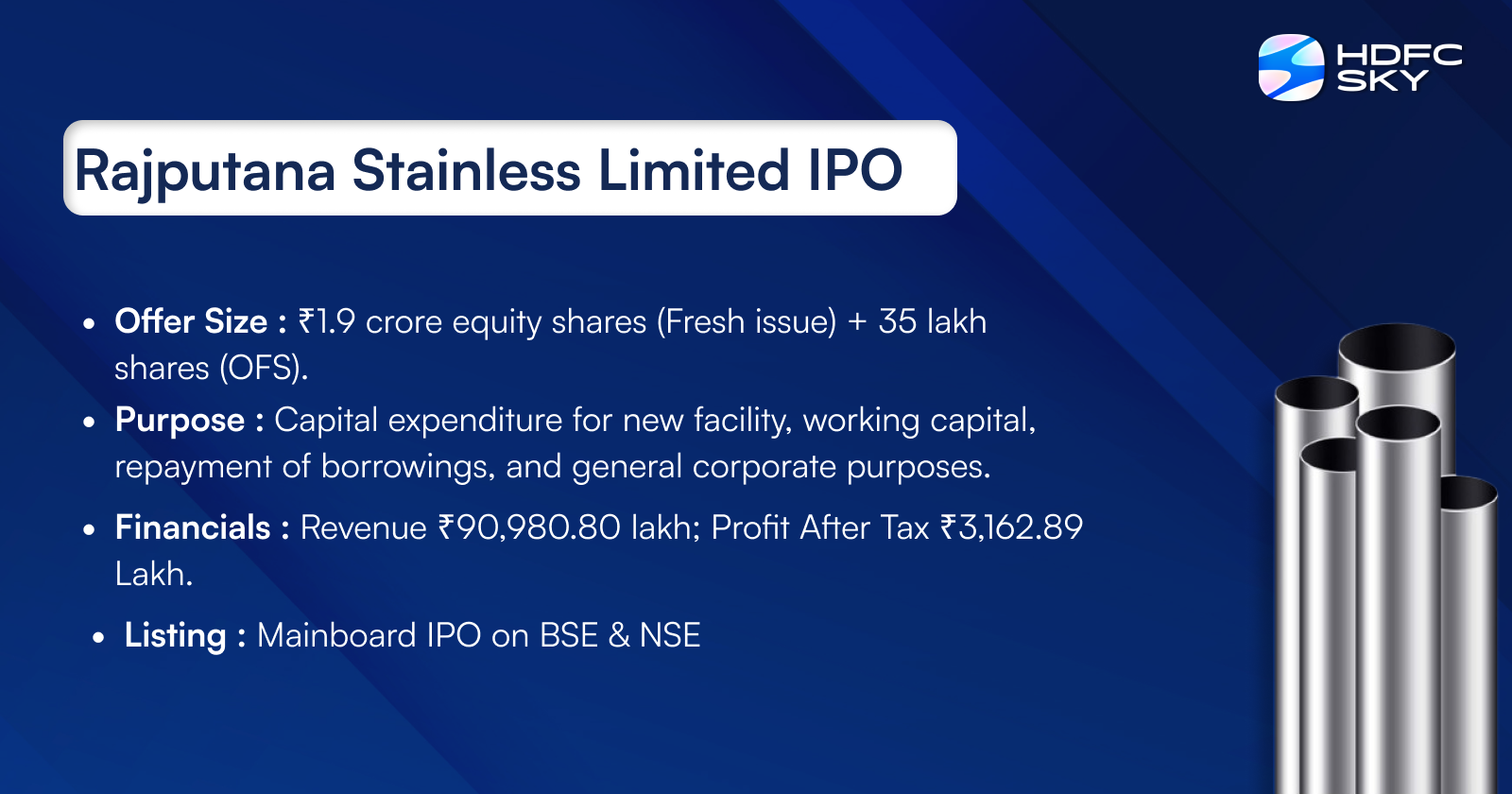

Rajputana Stainless IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Rajputana Stainless IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Rajputana Stainless Limited

Rajputana Stainless Limited is a leading manufacturer of special steel in India, with a rich legacy spanning over 30 years. The company’s unwavering commitment to quality is evident in its extensive range of stainless steel products. Located in Panchmahals, Gujarat, the facility on Halol-Kalol Road is equipped to produce a wide variety of products, including Billets, Forging Ingots, Round Bars (both black and bright), Square Bars, Hex Bars, Wire Rods, Flat Bars, and RCS.

Rajputana Stainless Limited IPO Overview

Rajputana Stainless IPO is a bookbuilding issue of 2.25 crore shares, comprising a fresh issue of 1.90 crore shares and an offer for sale of 0.35 crore shares. The IPO dates, allotment date, and price bands are yet to be announced. Nirbhay Capital Services Private Limited is the book-running lead manager, while KFin Technologies Limited is the registrar for the issue. The IPO will be listed on BSE and NSE, with a face value of ₹10 per share. As per the Draft Red Herring Prospectus (DRHP), the lot size, total issue value, and exact price band details are yet to be disclosed. The company’s pre-issue shareholding stands at 6,89,17,658 shares, with promoters Shankarlal Deepchand Mehta, Babulal D Mehta, Jayesh Natvarlal Pithva, and Yashkumar Shankarlal Mehta holding 78.21% before the issue. The DRHP was filed with SEBI on January 6, 2025, and the offer document was returned on April 11, 2025.

Rajputana Stainless Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.9 crore equity shares

Offer for Sale (OFS): 35 lakh shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 6,89,17,658 shares |

| Shareholding post -issue | TBA |

Rajputana Stainless IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Rajputana Stainless Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Rajputana Stainless Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.59 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.17% |

| Net Asset Value (NAV) | 17.88 |

| Return on Equity | 32.70% |

| Return on Capital Employed (ROCE) | 32.17% |

| EBITDA Margin | 9.42% |

| PAT Margin | 3.48% |

| Debt to Equity Ratio | 0.71 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ lakhs) |

| Funding capital expenditure requirements in relation to the setting up of the proposed facility | 1831.54 |

| Funding Working capital requirement for the Proposed Facility | 3768.05 |

| Full or part repayment and/or prepayment of certain outstanding secured borrowings availed by the company | 7650 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

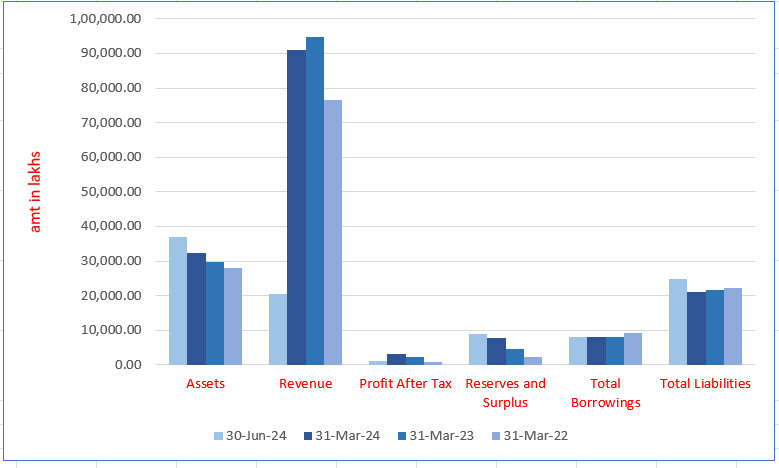

Rajputana Stainless Limited Financials (in lakhs)

| Particulars | 30 June 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 37,098.93 | 32,401.42 | 29,733.64 | 28,110.36 |

| Revenue | 20,528.03 | 90,980.80 | 94,767.44 | 76,641.70 |

| Profit After Tax | 1091.39 | 3162.89 | 2404.46 | 869.70 |

| Reserves and Surplus | 8875.84 | 7781.05 | 4670.73 | 2329.84 |

| Total Borrowings | 7969.12 | 7975.74 | 7982.54 | 9184.32 |

| Total Liabilities | 24,777.21 | 21,174.48 | 21,617.03 | 22,334.64 |

Financial Status of Rajputana Stainless Limited

SWOT Analysis of Rajputana Stainless IPO

Strength and Opportunities

- Strong brand reputation in the stainless steel manufacturing industry.

- Robust supply chain management ensuring timely delivery and cost-effective operations.

- Diversified product range catering to various industries such as construction, automotive, and household appliances.

- Continuous focus on research and development to improve product quality and innovation.

- Strategic partnerships with key players in the stainless steel industry to expand market reach.

- Expansion plans into emerging markets, offering significant growth potential in regions like Africa and Asia.

- Strong financial performance, ensuring consistent reinvestment into business development and infrastructure.

- Increased demand for stainless steel in infrastructure development and urbanization projects.

- Focus on sustainability and eco-friendly manufacturing practices, aligning with global environmental trends.

- Strong customer loyalty due to consistent product quality and customer service excellence.

Risks and Threats

- Intense competition in the stainless steel industry from both domestic and international players.

- Heavy dependence on raw material imports, making the company vulnerable to supply chain disruptions.

- Fluctuations in the prices of raw materials, such as nickel and chromium, can impact profitability.

- Limited geographical presence, with operations primarily focused on a few regions, hindering global expansion.

- Regulatory challenges related to environmental compliance and the impact of government policies on manufacturing.

- High fixed operational costs, including energy and maintenance expenses, affecting profit margins.

- Vulnerability to fluctuations in exchange rates, affecting the cost of importing raw materials and exports.

- Potential labor shortages and rising wage pressures could impact operational efficiency and cost structures.

- Rising raw material costs may affect overall pricing strategy, leading to reduced competitiveness.

- Limited diversification of product offerings could make the company more vulnerable to shifts in market demand.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Rajputana Stainless Limited IPO

Rajputana Stainless Limited (RSL) is a prominent manufacturer of long and flat stainless-steel products. These products include billets, forging ingots, rolled black and bright bars, flat and patti, and other ancillary items. With over 80 grades of stainless steel offered, RSL is committed to producing high-quality, value-added products with superior corrosion-resistant properties. Stainless steel, recognized for its high durability, corrosion resistance, and aesthetic finish, is used in a variety of industries and has become increasingly popular worldwide due to its high recyclability and low maintenance needs.

Domestic and International Reach

RSL’s products are primarily sold in the domestic market, benefiting from a broad network of direct sales and traders. In addition, the company exports to five international markets: UAE, USA, Turkey, Kuwait, and Poland. A breakdown of their revenue for the past few fiscal years illustrates a strong domestic market presence, contributing significantly to overall operations.

Diverse Industry Applications

RSL’s products serve as raw materials for a wide range of industries such as aerospace, automotive, defense, oil and gas, precision engineering, and more. With over 20 years of experience, RSL has established itself as a trusted supplier to over 200 customers globally. They have manufactured and delivered over 500,000 MT of stainless steel products between Fiscal 2006 and 2024, demonstrating their significant capability.

Manufacturing Facility and Technology

RSL operates a well-equipped manufacturing facility in Kalol, Gujarat. This facility spans 35,196.98 square meters and houses advanced machinery, including an induction furnace, continuous casting machine, heat treatment facilities, and rolling mills. The facility’s strategic location ensures efficient transportation of products, and it also utilizes third-party manufacturing units to meet increased demand.

Promoter Leadership and Expertise

RSL’s management is led by its promoters, who have more than five decades of collective experience in the steel industry. Their leadership, combined with a skilled team of senior management personnel, has driven RSL’s growth and innovation. The company maintains a strong focus on quality control and continuous improvement, ensuring high standards in both raw materials and finished products.

Through their extensive industry knowledge and strategic vision, RSL continues to position itself as a leader in the stainless-steel manufacturing sector

Industry Outlook

Current Overview of Indian Steel Industry

- Crude Steel Production: India, the second-largest crude steel producer, saw production capacity grow from 142.3 Mn tonnes in FY 2020 to 179.5 Mn tonnes in FY 2024, marking a 6% CAGR.

- Finished Steel Production: Finished steel production reached 139.4 Mn tonnes in FY 2024, a 12.7% increase from FY 2023. The private sector contributed 85%, with a 13.5% growth.

- Growth Drivers: Government initiatives like ‘Make in India’ and infrastructure development spurred demand from sectors such as construction, automobiles, and white goods.

- Technological Advancements: Investments in modernizing steel plants and sustainable practices like scrap steel and energy-efficient technologies enhanced production capacity.

Demand Scenario for Stainless Steel

- Macroeconomic Drivers:

- Industrial activity, urbanisation, and economic growth are major factors.

- Key sectors: Automotive, Railways, and heavy machinery.

- Demand from Key Sectors:

- Construction: Stainless steel demand driven by infrastructure development and real estate growth, contributing 9.1% to India’s GDP in FY 2024.

- Kitchenware: Stainless steel is a top choice for utensils, with robust market growth of 10-15% annually.

- Automotive & Transportation: Strong demand from growing vehicle production and sales, with a 12.5% y-o-y growth in FY 2024

Demand from Process Industries

- Role of Stainless Steel in India’s Process Industries

Stainless steel plays a crucial role in India’s process industries, particularly in sectors like chemicals and oil & gas. Its properties, such as corrosion resistance and durability, make it an essential material for tanks, pipes, pumps, and valves.

- Process Plant Equipment Market

The market for process plant equipment in India was valued at INR 209 billion in FY 2022, driven by industrial growth and government support. Economic reforms are expected to boost demand for stainless-steel equipment, leading to renewed investments in manufacturing.

Oil & Gas Sector

The oil & gas industry is one of the largest end users of steel pipes, including stainless steel (SS) pipes. Pipelines are the primary mode of transporting petroleum, oil, and lubricants. Stainless steel is preferred due to its ability to withstand high pressure and temperatures, making it ideal for use in refineries, pipelines, storage capacity, and gas terminals.

- Projections for Oil Consumption: According to the IEA, India’s oil consumption is projected to increase by 50% by 2030, outpacing global demand growth of just 7%. India’s consumption is expected to rise from 4.8 lakhs barrels per day (mbd) in 2019 to 7.2 mbd by 2030 and 9.2 mbd by 2050.

- Natural Gas Consumption: India’s natural gas consumption is expected to double to 133 billion cubic meters by 2030, from 64 billion cubic meters in 2019, surpassing the global demand growth rate of 12%.

- Refining Capacity: India ranks as the fourth-largest refiner globally, with a refining capacity of 257 lakhs metric tons per annum (MMTPA) as of 2024. The country is expected to add an additional 2 lakhs barrels per day in refining capacity by 2030 to support economic growth.

- Oil Import Dependency: India remains highly dependent on crude oil imports. In FY 2022, India’s crude oil imports increased by 8.9%, with the import bill rising significantly due to higher global oil prices. The government aims to reduce oil import dependence by 50% by 2030, which will support domestic oil exploration and production (E&P).

- Refining and Stainless Steel Demand:: Expanding the oil & gas sector is expected to drive demand for stainless steel, particularly in the construction of pipelines and refining facilities.

Demand Generation from Government Initiatives

- Government’s Budgetary Allocation to Infrastructure: Infrastructure spending is a key driver of economic growth in India. The government has allocated substantial funds for the development of roads, railways, airports, and urban infrastructure, creating demand for engineering, procurement, and construction (EPC) services.

- Impact of Large-Scale Projects: Major projects like highway expansions and smart city initiatives require the expertise of EPC companies, fostering innovation and efficiency in execution. These projects have a ripple effect on the economy by improving connectivity, logistics, and public facilities.

- Union Government’s Budget for Capital Expenditure: The government’s focus on capital expenditure (capex) has been rising steadily, with the allocation reaching INR 11.11 trillion for FY 2024-25. This growth in public spending has been instrumental in supporting the infrastructure sector.

National Infrastructure Pipeline (NIP)

To support India’s goal of becoming a USD 5 trillion economy, the National Infrastructure Pipeline (NIP) includes 9,736 projects across 56 diverse industries, valued at nearly USD 1.82 trillion. Of these, 2,014 projects are already under development.

The NIP will drive a flurry of infrastructure construction activity, creating numerous opportunities for the EPC sector. The pipeline spans FY 2019 to 2025, with a significant number of projects expected to be completed in the coming years.

PM Gati Shakti Plan

Launched in October 2021, the PM Gati Shakti plan is a national master plan for multi-modal connectivity. It aims to improve coordination among ministries and departments involved in infrastructure development. The program includes initiatives like Bharatmala, Sagarmala, port development, and dedicated freight corridors.

By streamlining the execution of infrastructure projects, the program will boost overall infrastructure development in India, leading to higher demand for construction materials like stainless steel.

India Infrastructure Project Development Fund (IIPDF)

The IIPDF scheme, introduced in 2022, encourages private sector participation in infrastructure development through Public-Private Partnerships (PPPs). This initiative is aimed at improving the quality and speed of infrastructure projects.

The scheme provides financial support to Project Sponsoring Authorities (PSAs) at both the Central and State levels, ensuring the development of viable and bankable PPP projects. The funding will also support the EPC sector, enhancing innovation and efficiency.

Flagship Government Programs: NIP and PM Gati Shakti

The ambitious goals outlined in the NIP and PM Gati Shakti programs will lead to unprecedented infrastructure development in India. The focus on improving coordination, reducing delays, and addressing project challenges will create a favourable environment for the consumption of stainless steel in construction projects

How Will Rajputana Stainless Limited Benefit?

- Increased Demand from Infrastructure Development

With India’s infrastructure sector expanding, driven by government initiatives like the National Infrastructure Pipeline (NIP) and PM Gati Shakti plan, Rajputana Stainless Limited (RSL) will see rising demand for stainless steel in construction. Projects requiring high-quality, durable materials will benefit from RSL’s extensive range of stainless-steel products, reinforcing its market position.

- Growth in Automotive and Transportation

As automotive production and sales grow, RSL’s high-quality stainless steel will be in demand for vehicle parts and components. The 12.5% year-on-year growth in automotive production provides an opportunity for RSL to tap into this expanding sector, leveraging its expertise in durable, corrosion-resistant materials.

- Robust Growth in Process Industries

The process industries, particularly chemicals and oil & gas, are major consumers of stainless steel. RSL, with its corrosion-resistant products, is well-positioned to meet the growing needs of these industries. Economic reforms, coupled with a growing industrial base, will drive further demand for RSL’s steel products in process plant equipment.

- Expansion in Oil & Gas Sector

As India’s oil consumption grows, RSL stands to benefit from the rising demand for stainless steel in pipelines and refining facilities. With its high-strength, high-temperature-resistant steel, RSL is well-placed to cater to the expanding oil and gas infrastructure, especially as refining capacity and pipeline projects increase.

- Government Initiatives and Budgetary Support

With the Indian government allocating substantial funds to infrastructure and capital expenditure (capex), RSL is set to benefit from increased stainless-steel demand in large-scale infrastructure projects. The government’s focus on construction and EPC services will create a steady market for RSL’s durable products, especially in key infrastructure projects.

- Expansion in International Markets

RSL has already established itself in international markets like the UAE, USA, Turkey, Kuwait, and Poland. As global demand for stainless steel rises, particularly in sectors like aerospace, automotive, and defense, RSL’s international presence will allow it to tap into these growing markets and further increase revenue.

- Technological Advancements and Production Capacity

With advancements in steel manufacturing technologies, RSL is positioned to enhance its production capacity and efficiency. By incorporating energy-efficient technologies and sustainable practices, RSL can meet the rising demand from industries like automotive, construction, and oil & gas, ensuring continued growth and competitive advantage in the stainless-steel sector.

- Strategic Leadership and Market Expertise

Led by promoters with over five decades of industry experience, RSL’s leadership has been key in its growth. Their expertise, coupled with a skilled management team, ensures the company is continuously improving quality standards. This focus on innovation and quality positions RSL as a trusted supplier in both domestic and international markets.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ Lakhs) |

EPS (₹) | P/E | RoNW (%) | NAV |

| Rajputana Stainless Limited | 10 | 90,980.80 | 4.59 | [●] | 28.17 | 16.29 |

| Manglam Worldwide Ltd | 10 | 81,810.80 | 8.89 | 19.05 | 12.74 | 69.38 |

| Mukand Ltd | 10 | 5,17,481 | 7.11 | 19.96 | 11.15 | 63.74 |

| Electrotherm Ltd | 10 | 4,27,150 | 249.08 | 4.74 | -40.63 | -612.99 |

| Panchmahal Steel Ltd | 10 | 42,762.00 | 1.56 | 151.57 | 1.89 | 82.14 |

Key Insights

- Revenue: Rajputana Stainless Limited has a revenue of ₹90,980.80 Lakhs, which places it significantly higher than Panchmahal Steel Ltd (₹42,762 Lakhs), but below Mukand Ltd (₹5,17,481 Lakhs) and Electrotherm Ltd (₹4,27,150 Lakhs). Manglam Worldwide Ltd (₹81,810.80 Lakhs) has a similar scale.

- Earnings Per Share (EPS): Rajputana Stainless Limited’s EPS stands at ₹4.59, which is moderate compared to Manglam Worldwide Ltd (₹8.89) and Mukand Ltd (₹7.11). Electrotherm Ltd shows a surprisingly high figure of ₹249.08, but it doesn’tindicate positive performance, while Panchmahal Steel Ltd shows a modest ₹1.56.

- Price-to-Earnings Ratio (P/E): Rajputana Stainless Limited’s P/E ratio is currently unavailable, making it difficult to gauge its market valuation relative to its earnings. However, Manglam Worldwide Ltd (19.05) and Mukand Ltd (19.96) suggest healthy market perceptions, whereasElectrothermLtd’s (4.74) P/E ratio reflects concerns over profitability.

- Return on Net Worth (RoNW): Rajputana Stainless Limited boasts a solid RoNW of 28.17%, indicating good profitability relative to shareholders’ equity. This outperforms Manglam Worldwide Ltd (12.74%) and Mukand Ltd (11.15%), while ElectrothermLtd’s negative RoNW (-40.63%) signals substantial losses, and Panchmahal Steel Ltd shows a lower 1.89%.

- Net Asset Value (NAV): Rajputana Stainless Limited’s NAV per share is ₹16.29, which is significantly lower than Manglam Worldwide Ltd’s ₹69.38 and Mukand Ltd’s ₹63.74, suggesting that their assets are valued higher in the market. However, ElectrothermLtd’s NAV (-612.99) and Panchmahal Steel Ltd’s NAV (82.14) show contrasting positions based on assets.

Rajputana Stainless Limited IPO Strengths

- High-Capacity Utilization

Rajputana Stainless Limited consistently maintains high capacityutilization across its key operations. As of June 2024, it achieved near-optimal utilization rates for melting, rolling, and heat treatment facilities, exceeding 99% in many areas. This efficient capacity management allows the company to maximize its output, meet increasing demand, and ensure a steady production flow, ultimately contributing to enhanced operational efficiency and profitability.

- Strategic Location and Logistic Benefits

The company’s manufacturing facility is strategically located in Gujarat, offering easy access to key transport routes like National Highway NH 148N. This proximity to transportation infrastructure, including ports, railway stations, and airports, helps reduce raw material transportation costs and enhances product distribution efficiency. The strategic location improves logistics management, reduces operating costs, and ensures timely delivery of products to customers, bolstering operational margins.

- Diverse and Expanding Product Portfolio

Rajputana Stainless Limited boasts a diversified product portfolio, including billets, ingots, rolled bars, and flat products in over 80 stainless steel grades. The company specializes in producing products in various sizes and grades, catering to industries with diverse requirements. This wide product range allows the company to meet evolving market demands, minimize dependence on any single product, and effectively compete in the stainless steel industry.

- Established Customer Relationships

With over two decades of operational experience, Rajputana Stainless Limited has developed strong, long-term relationships with a broad customer base. The company’s commitment to quality and customer-centric approach has fostered loyalty, with numerous customers being associated for over three years. The company’s reliable product offerings and services have helped sustain business growth, contributing significantly to its revenue generation, particularly in the domestic market, while also expanding its international presence.

- Forward Integration and Expansion Plans

The company is focused on forward integration to enhance operational efficiency and expand its product portfolio. By establishing a seamless pipe manufacturing plant within its existing facility, Rajputana Stainless Limited aims to produce stainless-steel seamless pipes using in-house materials. This initiative will reduce product costs, improve quality control, streamline delivery timelines, and increase operating margins. The expansion is expected to meet growing domestic demand and strengthen the company’s market position.

Key Insights from Financial Performance

- Assets: The assets have shown steady growth over the four periods, increasing from ₹28,110.36 lakhs in FY2022 to ₹37,098.93 lakhs in FY2024. This indicates an improvement in asset base, reflecting potential expansion or reinvestment strategies.

- Revenue: Revenue has fluctuated significantly, peaking at ₹94,767.44 lakhs in FY2023. However, there was a sharp decline to ₹20,528.03 lakhs in Q1 FY2024, indicating potential challenges in the business environment or a temporary downturn in operations.

- Profit After Tax (PAT): PAT has shown an overall positive trend, increasing from ₹869.70 lakhs in FY2022 to ₹1,091.39 lakhs in Q1 FY2024. This reflects a steady improvement in profitability, despite fluctuations in revenue, suggesting better cost control or operational efficiency.

- Reserves and Surplus: Reserves and Surplus have grown from ₹2,329.84 lakhs in FY2022 to ₹8,875.84 lakhs in FY2024. This growth indicates a healthy accumulation of retained earnings, suggesting a focus on strengthening financial stability and supporting future investments.

- Total Borrowings: Total borrowings have remained relatively stable, decreasing slightly from ₹9,184.32 lakhs in FY2022 to ₹7,969.12 lakhs in FY2024. This suggests that the company may be focusing on debt reduction or is managing borrowing levels to maintain financial stability.

- Total Liabilities: Total liabilities increased from ₹22,334.64 lakhs in FY2022 to ₹24,777.21 lakhs in FY2024, reflecting a rise in financial obligations. The increase may indicate expansion or higher short-term borrowings, but it needs careful management to avoid over-leverage.

Other Financial Details

- Cost of materials consumed: The cost of materials consumed in fiscal 2024 is the highest at ₹74,278.29 lakhs, indicating significant production activities. It decreased slightly in the latest period (June 2024), reflecting possible changes in raw material usage.

- Employee benefits expense: Employee expenses grew notably in fiscal 2024, driven by higher salaries and benefits, especially when compared to the period ending June 2024. This increase is in line with the company’s expanding workforce and wage inflation.

- Finance costs: Finance costs peaked in fiscal 2024, reflecting an increase in borrowings or interest rates. The costs decreased in June 2024, which could suggest debt reduction or renegotiated terms for loans or credit facilities.

- Depreciation and amortization expense: Depreciation and amortization remained relatively stable, with only slight changes. The relatively consistent figures indicate steady capital expenditures on assets, which are depreciated over time, in line with asset maintenance and asset management.

- Other expenses: Other expenses showed a sharp increase in fiscal 2024, with a substantial jump from June 2024 levels. These likely cover operational costs, such as rent, utilities, and administrative expenses, linked to company growth or inflationary pressures.

Key Strategies for Rajputana Stainless Limited

- Stainless-Steel Seamless Pipes Unit

Rajputana Stainless Limited aims to establish a seamless pipe manufacturing facility at its existing site. This forward integration will optimize operational efficiency, reduce costs, and improve supply control by using in-house produced raw materials. The facility will also expand its product portfolio, increase market reach, and mitigate offtake risks.

- Strengthening Domestic and Expanding International Markets

The company plans to increase market share by expanding its domestic customer base through direct sales and dealers. Additionally, Rajputana aims to boost export efforts, leveraging its established product portfolio and domestic market presence to enter new international markets and grow global sales.

- Operational and Profitability Enhancement

Rajputana Stainless Limited focuses on improving operational efficiency through quality initiatives, technology upgrades, and minor automation. The company continuously enhances manufacturing capabilities, optimizes supply-chain management, and emphasizes operational excellence to sustain long-term profitability and growth.

- Training and Development of Manpower

The company prioritizes employee growth through ongoing technical and functional training. Rajputana aims to foster internal progression by managing attrition, encouraging continuous learning, and offering career development opportunities for employees, ensuring a skilled and motivated workforce.

- Indebtedness Rationalization

Rajputana plans to reduce its borrowings to improve the debt-to-equity ratio and lower financing costs. By using proceeds to prepay loans, the company aims to achieve a more favorable financial structure, enabling future growth and expansion with improved access to capital at competitive rates

Competitor Analysis of Rajputana Stainless Limited

- Mangalam Worldwide Limited

Mangalam Worldwide Limited, established in 1995, is a prominent stainless steel manufacturer in India. In the fiscal year ending March 2024, the company reported revenues of ₹8,180 million and a net income of ₹218.27 million. In comparison, Rajputana Stainless Limited’s financials for the same period are not publicly disclosed. Mangalam’s established market presence and financial performance position it as a strong competitor in the stainless steel industry.

- Electrotherm Limited

Electrotherm Limited specializes in manufacturing induction furnaces and electric arc furnaces, catering to the steel industry. While it operates in the broader steel manufacturing sector, its focus on furnace technology differentiates it from Rajputana Stainless Limited, which specializes in stainless steel products. This specialization may provide Electrotherm with a competitive edge in furnace technology but does not directly compete with Rajputana’s product offerings.

- Panchmahal Steel Limited

Panchmahal Steel Limited is a leading manufacturer of stainless steel long products in India. With a strong market presence and a diverse product range, it competes directly with Rajputana Stainless Limited. However, specific financial data for Panchmahal Steel Limited is not readily available, making a detailed comparison challenging.

- Laxcon Steels Limited

Laxcon Steels Limited has been revolutionizing steelmaking for over 45 years, establishing itself as a leading stainless steel manufacturer in India. Its extensive experience and established market presence make it a formidable competitor to Rajputana Stainless Limited.

- Rajputana Group

The Rajputana Group is a diversified conglomerate with interests in various industries, including steel manufacturing. While it shares a name with Rajputana Stainless Limited, the group operates multiple businesses, and its steel manufacturing segment competes directly with Rajputana Stainless Limited.

- Ambica Steels Limited

Ambica Steels Limited is a leading stainless steel manufacturer in India, recognized for its high-quality products and strong market presence. The company has been honored for its outstanding contribution towards promoting Indo-German economic relations. This recognition underscores its commitment to quality and international business relations, positioning it as a strong competitor to Rajputana Stainless Limited.

- Synergy Steels Limited

Synergy Steels Limited is a steel manufacturing company in India. However, specific information regarding its financial performance and market position is limited, making it challenging to assess its competitive standing relative to Rajputana Stainless Limited.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the purpose of Rajputana Stainless Limited's IPO?

The IPO aims to fund capital expenditures for a new manufacturing facility, working capital requirements, repayment of outstanding borrowings, and general corporate purposes.

What is the size and structure of the IPO?

The IPO consists of a fresh issue of up to 1.9 crore equity shares and an offer for sale of up to 35 lakh equity shares by the promoter.

When is the Rajputana Stainless Limited IPO expected to open?

The exact dates for the IPO opening and closing have not been announced yet.

What is the price band for the IPO?

The price band for the IPO has not been disclosed at this time.

How can investors apply for the IPO?

Investors can apply for the IPO online through their brokers using UPI or ASBA payment methods.

What is the face value of the equity shares?

The face value of each equity share is ₹10.