- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Rays Power Infra IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Rays Power Infra IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Rays Power Infra Limited

Rays Power Infra Limited is a prominent player in providing utility-scale end-to-end renewable energy solutions, primarily focused on solar power. Established in 2011, the company operates through two key business models: Co-Development, involving land aggregation and securing grid connectivity for project transfer, and Engineering, Procurement, and Construction (EPC), offering comprehensive project execution. With a robust track record of commissioning 50 projects totaling 1,771.18 MWp and a strong order book of over ₹80,342 million as of July 2025, the company has a significant presence across India, serving both private and public sector clients.

Rays Power Infra Limited IPO Overview

Rays Power Infra Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offering (IPO). The company plans to raise ₹1,150.00 crores via a Book Building Issue, which includes a fresh issue of shares worth ₹900.00 crores and an Offer for Sale (OFS) aggregating ₹250.00 crores. The equity shares are proposed to be listed on both the NSE and BSE. While the book running lead manager has not yet been declared, Bigshare Services Pvt. Ltd. has been appointed as the registrar for the issue. Key details such as the IPO dates, price band, and lot size are yet to be announced.

The IPO will have a face value of ₹2 per share and is structured as a fresh capital-cum-offer for sale. The total issue size will aggregate up to ₹1,150.00 crores, with the fresh issue accounting for ₹900.00 crores and the OFS for ₹250.00 crores. The shares will be offered through the book building route and listed on both the NSE and BSE. Prior to the issue, Rays Power Infra Ltd. has a shareholding of 28,57,88,851 shares.

The promoters of the company include Ketan Mehta, Pawan Kumar Sharma, Sanjay Garudapally, Sweta Mehta, Richa Sharma, Shruthi Gupta Garudapally, Mehta Family Trustee Private Limited, Mehta Family Trust, Sharma Family Trust, and Garudapally Family Trust, who collectively hold 89.74% of the company pre-IPO.

Rays Power Infra Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1,150.00 Cr |

| Fresh Issue | [.] shares (aggregating up to ₹900.00 Cr) |

| Offer for Sale (OFS) | [.] shares (aggregating up to ₹250.00 Cr) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 89.74% |

| Shareholding post-issue | TBA |

Rays Power Infra IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Rays Power Infra Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

Rays Power Infra Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹4.96 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.89% |

| Net Asset Value (NAV) | ₹21.89 |

| Return on Equity (RoE) | 28.89% |

| Return on Capital Employed (RoCE) | 29.80% |

| EBITDA Margin | 15.91% |

| PAT Margin | 11.42% |

| Debt to Equity Ratio | 0.04 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in Rays Green Energy for a 1.5 GW solar cell manufacturing plant | 5,000.00 |

| Part funding of incremental working capital requirements | 2,000.00 |

| General corporate purposes* | [●] |

Note: The amount utilised for general corporate purposes shall not exceed 25% of the Gross Proceeds. To be determined upon finalisation of the Offer Price.

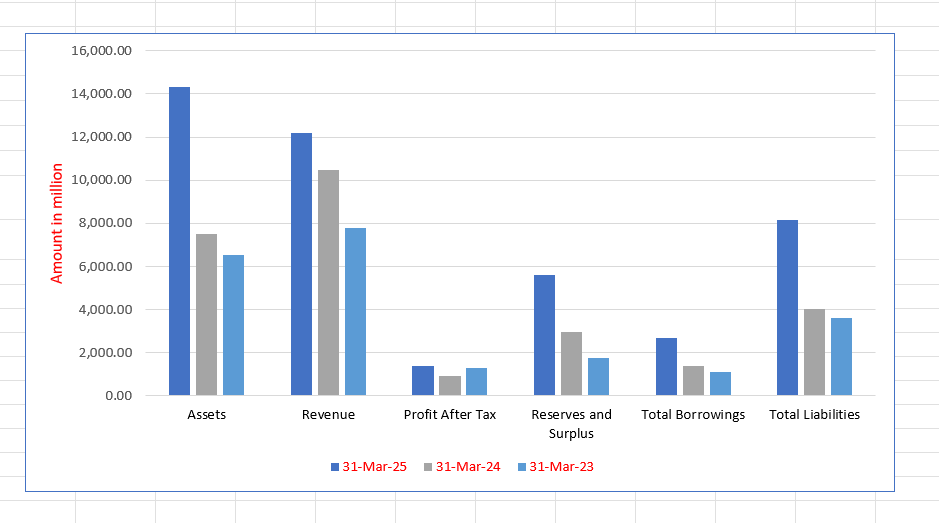

Rays Power Infra Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 14,327.05 | 7,506.63 | 6,525.42 |

| Revenue | 12,206.41 | 10,487.99 | 7,765.81 |

| Profit After Tax | 1,393.50 | 913.86 | 1,289.90 |

| Reserves and Surplus | 5,588.48 | 2,945.73 | 1,757.57 |

| Total Borrowings | 2,704.49 | 1,393.22 | 1,103.02 |

| Total Liabilities | 8,169.18 | 4,018.74 | 3,623.41 |

Financial Status of Rays Power Infra Limited

SWOT Analysis of Rays Power Infra IPO

Strength and Opportunities

- Established track record with 1,771.18 MWp commissioned capacity

- Robust and scalable asset-light business models (Co-Development & EPC)

- Strong order book visibility of ₹80,342.61 million providing revenue pipeline

- Expertise in critical land acquisition and securing grid connectivity approvals

- Experienced promoters and management team with deep industry knowledge

- Significant opportunity from backward integration into solar cell manufacturing

- Favorable industry tailwinds with massive government targets for renewable energy

- Diversification into high-growth areas like FDRE, BESS, and hybrid projects

- Strong financial performance with healthy profitability and return ratios

- Low debt profile and strong balance sheet providing financial flexibility

Risks and Threats

- Revenue and profitability can be susceptible to project timing and execution cycles

- High dependency on the Indian renewable energy sector and its regulatory policies

- Intense competition within the solar EPC and co-development space

- Risks associated with reliance on subcontractors for project execution

- Potential for cost overruns due to commodity price volatility and supply chain disruptions

- Execution risks related to scaling up operations and entering manufacturing

- Regulatory changes in customs duties and the ALMM policy could impact costs

- Dependence on a limited number of large customers for a significant portion of revenue

- Technological obsolescence risk in the rapidly evolving solar technology landscape

- Land acquisition delays and regulatory approvals can impact project schedules

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Rays Power Infra Limited

Rays Power Infra Limited IPO Strengths

Proven Execution Capabilities and Strong Track Record

Rays Power Infra Limited has established a formidable reputation by successfully executing and commissioning 50 renewable power projects with an aggregate capacity of 1,771.18 MWp. This demonstrated ability to deliver utility-scale projects on time reinforces its credibility and positions it as a trusted partner for both private and public sector clients, providing a significant competitive advantage in securing new contracts.

Robust and Scalable Asset-Light Business Model

The company operates primarily through asset-light models, including Co-Development and EPC services. This strategy allows Rays Power Infra Limited to minimize capital expenditure, enhance operational flexibility, and achieve rapid scalability without the burden of heavy asset ownership. This approach has contributed to its strong return ratios and a healthy balance sheet with low leverage.

Significant Revenue Visibility with a Strong Order Book

Rays Power Infra Limited boasts an exceptionally strong order book of ₹80,342.61 million as of July 2025, covering 30 contracted projects. This provides high revenue visibility for the coming years and reflects the market’s confidence in its execution capabilities. The order book has grown at a remarkable CAGR of 137.85% from FY2023 to FY2025.

Expertise in Land Acquisition and Grid Connectivity

The company possesses a critical competitive strength in its dedicated land acquisition team and proven expertise in securing contiguous, litigation-free land parcels. Furthermore, Rays Power Infra Limited has secured or is in the process of securing 2,300 MWp of grid connectivity approvals, a crucial and often challenging prerequisite for large-scale renewable energy projects.

Experienced Promoters and a Qualified Management Team

The company is led by promoters with strong educational backgrounds from premier institutions and over 13 years of domain experience. Their leadership, combined with a qualified and experienced management team, has been instrumental in navigating the complex renewable energy landscape and driving the company’s consistent growth and strategic direction.

Rays Power Infra Limited: More About the Company

Rays Power Infra Limited is a leading integrated player in the Indian renewable energy sector, specializing in providing end-to-end solutions with a primary focus on solar power. Incorporated in 2011, the company has cemented its position by executing projects across 13 states and 1 union territory. It operates through two synergistic business models that cater to the evolving needs of the market.

Core Business Models

- Co-Development Business: This model involves the initial development of solar power projects. Rays Power Infra undertakes critical activities such as land identification and aggregation, securing grid connectivity (from both State Transmission Utilities and Interstate Transmission Systems), and obtaining all necessary approvals. Once these milestones are achieved, the project is transferred to the developer through a Special Purpose Vehicle (SPV).

- Engineering, Procurement, and Construction (EPC) Business: Under this model, the company provides a comprehensive turnkey solution. This includes design, engineering, procurement of materials, construction, testing, and commissioning of the solar power project. This model contributes significantly to its revenue and leverages its project execution expertise.

Key Operational Strengths

- Land Acquisition Prowess: The company has a dedicated 40-member land acquisition team with deep knowledge of regional laws. It has a proven track record of acquiring over 20,000 acres of land for projects across India, which is a foundational enabler for timely project execution.

- Grid Connectivity Expertise: Securing grid connectivity is a major hurdle for renewable projects. As of July 31, 2025, the company has been granted or agreed to be granted 10 connectivity approvals totaling 2,300 MWp and has applied for an additional 3,565 MWp, providing a significant pipeline for future co-development and EPC projects.

- Diverse and Reputed Clientele: Rays Power Infra serves a mix of private sector developers like Serentica Renewables and Ampin Energy, as well as public sector undertakings like SJVN Green Energy and various municipal corporations.

Industry Outlook

The Indian renewable energy sector is poised for unprecedented growth, driven by the government’s ambitious target of achieving 500 GW of installed capacity from non-fossil fuels by 2030. Solar power is expected to be the cornerstone of this expansion.

- Massive Growth Potential: CRISIL Intelligence expects 170-180 GW of solar capacity to be added between fiscals 2026 and 2030, which is ~2.6 times the capacity added in the previous five-year period. The government plans to bid out 50 GW of renewable energy capacity annually until FY2028.

- Key Growth Drivers:

- Policy Support: Initiatives like the Production Linked Incentive (PLI) scheme and the Approved Models and Manufacturers List (ALMM) are boosting domestic manufacturing and creating a demand pipeline for locally sourced components.

- Rising Energy Demand: India’s growing electricity consumption, coupled with the cost-competitiveness of solar power, is a primary driver.

- Corporate Demand: Commercial and Industrial (C&I) consumers are increasingly adopting renewable energy to meet sustainability goals and reduce power costs, creating a robust market segment.

- New Avenues: Emerging areas like Wind-Solar Hybrid (WSH) projects, Firm and Dispatchable Renewable Energy (FDRE) coupled with storage, and the National Green Hydrogen Mission are opening new growth vectors, requiring significant solar capacity for integration.

This favorable outlook, supported by strong policy tailwinds and increasing investments, presents a multi-year growth opportunity for established and capable players like Rays Power Infra Limited.

How Will Rays Power Infra Limited Benefit

- Benefit from the massive ~2.6x increase in expected solar capacity additions (170-180 GW) between FY2026-2030, ensuring a sustained pipeline for its EPC and Co-Development services.

- Capitalize on the government’s annual bidding of 50 GW of RE capacity, providing consistent and large-scale project opportunities to leverage its execution capabilities.

- The implementation of ALMM norms will drive demand for domestically manufactured cells and modules, benefiting its strategic foray into 1.5 GW n-type TOPCon cell manufacturing.

- Tap into the growing C&I segment, which is adopting renewables at a rapid pace, and where the company already has a strong order book presence (64.39% from private customers).

- Leverage its expertise and early-mover advantage in emerging high-growth areas like FDRE, BESS, and hybrid projects, where it has already secured letters of award.

- Utilize its strong land bank and grid connectivity approvals (2,300 MWp granted/agreed and 3,565 MWp applied) to secure and expedite future co-development projects.

- The asset-light business model allows it to scale operations efficiently without significant capital lock-in, enabling it to undertake a larger number of projects.

- A strong and experienced management team positions the company to navigate industry complexities and secure large-ticket orders in a competitive market.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (₹ million) | EPS (₹) | NAV (₹) | P/E | RONW (%) |

| Rays Power Infra | 2 | 12,206.41 | 4.96 | 21.89 | NA | 28.89 |

| Sterling and Wilson Renewables Energy Limited | 124 | 63,018.60 | 3..49 | 42.57 | 69.56 | 8.78 |

| Waaree Renewables Technologies Limited | 21 | 15,977.48 | 22.00 | 43.57 | 45.94 | 65.29 |

| Oriana Power Limited | 102 | 9,871.66 | 79.52 | 259.61 | 30.17 | 47.59 |

| KPI Green Energy Limited | 5 | 17,354.54 | 16.23 | 132.44 | 27.58 | 18.77 |

Key Strategies for Rays Power Infra Limited

Backward Integration into Solar Cell Manufacturing

Rays Power Infra Limited is strategically foraying into manufacturing by establishing a 1.5 GW n-type TOPCon solar cell plant. This backward integration will reduce reliance on imports, provide better control over supply chain and quality, ensure compliance with ALMM norms for government projects, and create a new revenue stream by selling cells to third parties, thereby improving margins and competitiveness.

Expanding Order Book and Market Share

The company’s primary focus is to consistently grow its strong order book by capitalizing on India’s massive renewable energy capacity addition targets. It aims to scale up its Co-Development business focused on inter-state transmission system (ISTS) connected projects and leverage its existing connectivity approvals and applied capacities to secure more large-scale utility projects from both private and public sector clients.

Diversification into Hybrid and New Energy Segments

Rays Power Infra Limited plans to diversify its portfolio by leveraging its EPC expertise to enter high-growth adjacent segments. This includes actively pursuing projects in Wind-Solar Hybrid (WSH), Firm and Dispatchable Renewable Energy (FDRE) with storage, Battery Energy Storage Systems (BESS), and green hydrogen infrastructure. This strategy mitigates reliance on a single technology and captures emerging opportunities.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Rays Power Infra Limited IPO

How can I apply for Rays Power Infra Limited IPO?

You can apply via ASBA through your bank account or through your trading account using UPI, offered by most brokers.

What is the lot size and price band for the IPO?

The lot size and price band for the Rays Power Infra IPO are yet to be announced and will be finalized closer to the IPO date.

What is the core business of Rays Power Infra Ltd?

The company provides end-to-end renewable energy solutions, primarily focusing on solar power project co-development and EPC services.

How will the company use the IPO proceeds?

The net proceeds will be used to fund a solar cell manufacturing plant, meet working capital requirements, and for general corporate purposes.

Where will Rays Power Infra shares be listed?

The equity shares of Rays Power Infra Limited will be listed on both the BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange).