- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Rayzon Solar IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

TBA

TBA

TBA

Rayzon Solar IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Rayzon Solar Limited

Rayzon Solar Limited, based in India, is a prominent manufacturer of high-efficiency photovoltaic (PV) modules. The company focuses on monocrystalline and polycrystalline solar modules suitable for residential, commercial, and industrial projects. Its two Surat-based facilities, in Karanj and Sava, have a combined manufacturing capacity of 3.00 GW, expanded from 40 MW in 2018 to 6.00 GW by March 2025. Rayzon’s product portfolio includes bifacial (glass-to-glass), TOPCon, Mono PERC, monofacial, and black modules, offering high efficiency, power ratings up to 750 Wp, and warranties up to 30 years for diverse applications.

Rayzon Solar Limited IPO Overview

Rayzon Solar Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 2, 2025, to raise ₹1,500 crore through an Initial Public Offer (IPO) via a book-built fresh issue of shares, with no offer for sale. The equity shares are proposed to be listed on NSE and BSE. SBI Capital Markets Ltd. acts as the book running lead manager, and Kfin Technologies Ltd. is the registrar. Key details such as IPO dates, price band, and lot size are yet to be announced. The promoters—including Hardik Ashokbhai Kothiya, Chirag Devchandbhai Nakrani, Ashokbhai Manjibhai Kothiya, Devchandbhai Kalubhai Nakrani, Ramilaben Ashokbhai Kothiya, Induben Devchandbhai Nakrani, and the AMK, CDN, ADN, and DKN Family Trusts—hold 98.10% pre-issue.

Rayzon SolarLimited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1500 crore |

| Fresh Issue | ₹1500 crore |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 30,58,89,092 shares |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Rayzon Solar Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Rayzon Solar Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.03 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 69.79% |

| Net Asset Value (NAV) | ₹2.91 |

| Return on Equity (RoE) | 107.34% |

| Return on Capital Employed (RoCE) | 66.33% |

| EBITDA Margin | 7.95% |

| PAT Margin | 4.78% |

| Debt to Equity Ratio | 0.77 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in our wholly owned Subsidiary, Rayzon Energy Private Limited (“REPL”), for part financing the cost of establishing the manufacturing facility with 3.5 GW installed capacity, to produce solar cells using TOPCon technology (the “Project”), at RS No. 198, 197, 199/002, 196/002, Kathvada, Mangrol, Surat, 394 405, Gujarat, India | 12,650 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

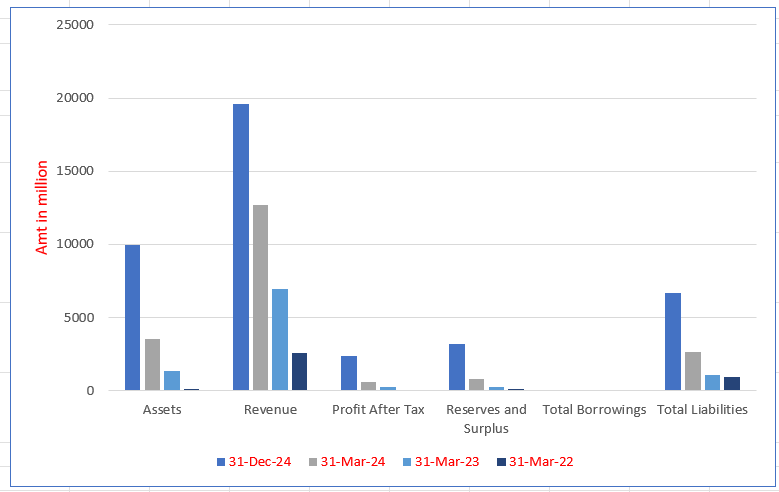

Rayzon Solar Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 9969.88 | 3527.95 | 1382 | 111.85 |

| Revenue | 19,570.01 | 12,728.47 | 6980.18 | 2616.48 |

| Profit After Tax | 2390.27 | 609.38 | 254.78 | 39.12 |

| Reserves and Surplus | 3230.80 | 841.98 | 233.40 | 144.47 |

| Total Borrowings | ||||

| Total Liabilities | 6709.03 | 2655.97 | 1118.60 | 967.28 |

Financial Status of Rayzon Solar Limited

SWOT Analysis of Rayzon Solar IPO

Strength and Opportunities

- Established as a leading solar panel manufacturer in India since 2017.

- Advanced manufacturing facilities in Surat, Gujarat, with a capacity of 6 GW.

- Diverse product portfolio including TOPCon, Mono PERC, bifacial, monofacial, and black modules.

- Strong presence in international markets such as the U.S., Europe, and Africa.

- Backed by a visionary leadership team committed to innovation and sustainability.

- Strategic partnerships with major sports franchises like Gujarat Titans and Chennai Super Kings, enhancing brand visibility.

- Recognition for high-efficiency modules with power ratings up to 750 Wp and warranties up to 30 years.

- Plans for expansion to 8 GW capacity by the end of 2025, indicating strong growth prospects.

- Focus on sustainability and renewable energy aligns with global trends towards clean energy adoption.

Risks and Threats

- Dependency on the Indian market may expose the company to regional economic fluctuations.

- Potential challenges in scaling operations to meet increasing global demand.

- Intense competition from both domestic and international solar panel manufacturers.

- Vulnerability to fluctuations in raw material prices and supply chain disruptions.

- Regulatory changes in key markets could impact business operations and profitability.

- Potential risks associated with geopolitical tensions affecting global trade and operations.

- Environmental factors and natural disasters could disrupt manufacturing and distribution.

- Challenges in maintaining consistent product quality across expanded production lines.

- Potential delays in meeting expansion targets due to unforeseen challenges.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Rayzon Solar Limited

Rayzon Solar Limited IPO Strengths

Advanced Manufacturing Facilities and R&D Capabilities with Focus on Quality

Rayzon Solar Limited operates two Gujarat-based facilities, Karanj and Sava, with a combined 6.00 GW PV module capacity. Equipped with advanced machinery, ISO certifications, and rigorous testing protocols, the company ensures high-quality, durable solar products. Its in-house R&D and academic collaborations drive innovation, reliability, and efficiency, supporting long-term warranties and meeting evolving market demands.

Diversified Customer Base with a Robust Order Book

Rayzon Solar Limited serves a diverse global clientele, including distributors, C&I clients, OEMs, IPPs, and EPCs, with marquee names like Panasonic Life Solutions and Mahindra Solarize. Its strategic capacity expansion, backward integration, and 3.60 GW order book enable reliable, competitively priced solar PV solutions, driving sustained growth, strong client relationships, and market leadership.

Expansive Distribution Network Supported by a Comprehensive Sales Framework

Rayzon Solar Limited operates a wide-reaching distribution network across 20 Indian states, supported by 68 channel partners and a 40-member in-house sales team. Direct and partner-led sales ensure efficient delivery to C&I clients, OEMs, and IPPs. Active participation in industry events and educational initiatives strengthens brand visibility, customer engagement, and market penetration.

Track Record of Delivering Consistent Financial and Operational Growth

Rayzon Solar Limited has demonstrated strong financial and operational performance, with revenue rising from ₹2,616.48 million in Fiscal 2022 to ₹12,728.47 million in Fiscal 2024. EBITDA, PAT, margins, and returns on capital and equity have grown substantially. Efficient working capital management, low debt levels, and robust operational metrics highlight the company’s sustainable growth trajectory.

Experienced Promoters and Senior Management Team

Rayzon Solar Limited is led by Promoters Chirag Devchandbhai Nakrani and Hardik Ashokbhai Kothiya, whose strategic vision drives growth. Supported by a professional management team with extensive expertise across solar, marketing, finance, operations, R&D, and procurement, the company leverages seasoned leadership to optimise resources, enhance operational efficiency, and ensure sustained success in the renewable energy sector

More About Rayzon Solar Limited

Rayzon Solar Limited is among the top 10 solar photovoltaic (“PV”) module manufacturers in India, with an installed capacity of 6.00 GW as of March 31, 2025. Certified under the Ministry of New and Renewable Energy’s Approved List of Module Manufacturers (ALMM), the company holds an enlisted capacity of 3.00 GW, representing 3.8% of the total ALMM capacity as of April 21, 2025.

The company operates two manufacturing facilities in Karanj and Sava, Surat, Gujarat, each with a 3.00 GW capacity. Expansion plans include adding 2.00 GW at the Sava facility, expected to be operational by October 2025. Through its subsidiary, Rayzon Energy Private Limited, the company is establishing a 3.50 GW solar cell manufacturing unit using TOPCon technology, scheduled for Fiscal 2027. Additionally, Rayzon Industries Private Limited is developing an aluminium extrusion and anodizing unit with 19,800 MT annual capacity for aluminium frames, expected to begin operations in July 2025.

Growth and Revenue

Rayzon Solar began in 2017 as M/s Rayzon Green Energies, focusing on affordable and quality solar solutions. Installed manufacturing capacity has expanded from 40 MW in 2018 to 6.00 GW by March 2025. Revenue has grown at a CAGR of 120.56%, from ₹2,616.48 million in Fiscal 2022 to ₹12,728.47 million in Fiscal 2024, reaching ₹19,570.01 million in the nine months ended December 31, 2024. The company has supplied 2.49 GW of high-efficiency modules and held an order book of 3.60 GW as of May 31, 2025.

Product Portfolio

Rayzon Solar offers:

- Bifacial modules (dual glass or glass-to-transparent backsheet) with TOPCon and Mono PERC cells

- Monofacial modules (glass-to-white/black backsheet) with Mono PERC cells

- Full black variants of bifacial and monofacial modules

Manufacturing utilizes advanced automation, including robotic lay-up, automated cell cutting, encapsulant loading, and TOPCon technology to optimize efficiency and reduce energy loss. Modules are designed for utility-scale, residential, commercial, and industrial installations.

Research, Certifications, and Customers

Rayzon Solar’s R&D lab in Karanj drives innovation and product reliability. Certifications include ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, and IEC standards for durability and safety. The company serves a diversified client base, including commercial, industrial, IPPs, EPCs, and OEMs, with over 1,930 customers in Fiscal 2022-2024.

Branding and Leadership

Brand-building initiatives include partnerships with the Indian Premier League, cricket teams Gujarat Titans and Chennai Super Kings, and a television entrepreneurship show. Led by Managing Director Chirag Devchandbhai Nakrani and Joint Managing Director and Chairman Hardik Ashokbhai Kothiya, the senior management team drives operations and strategic growth, supported by high-net-worth investors.

Rayzon Solar continues to expand its capacities, enhance efficiency, and strengthen its presence in India’s renewable energy sector.

Industry Outlook

Market Growth and Projections

- India’s solar energy market is projected to reach 284.14 GW by 2033, growing from 92 GW in 2024, reflecting a CAGR of 13.35% from 2025 to 2033.

- In Q1 2025, India added 7.8 GW of solar capacity, bringing the total installed capacity to 89.7 GW, indicating robust growth momentum.

Manufacturing Capacity Expansion

- India’s solar module manufacturing capacity has expanded dramatically from 2.3 GW in 2014 to over 100 GW as of August 2025.

- The Production Linked Incentive (PLI) scheme has driven the establishment of 18.5 GW of solar module capacity, 9.7 GW of solar cell capacity, and 2.2 GW of ingot-wafer capacity by June 2025.

Rooftop Solar Market Dynamics

- India’s rooftop solar sector has experienced rapid growth, with a 34% CAGR, reaching 18.4 GW by December 2024, driven by favorable policies and declining PV costs.

- The rooftop solar market is projected to reach 25–30 GW by FY27, up from 17 GW in FY25, with a CAGR of 33% from FY25 to FY27.

Technological Advancements

- India is expected to reach 160 GW of solar module capacity and 120 GW of cell capacity by 2030, up from 80 GW and 15 GW respectively in 2025.

- The adoption of advanced technologies like TOPCon cells is enhancing the efficiency and performance of solar modules, contributing to the sector’s growth.

Policy Support and Initiatives

- Government schemes such as the Pradhan Mantri Surya Ghar Muft Bijli Yojana and PM-KUSUM are accelerating the adoption of rooftop solar systems, especially in states like Gujarat, Maharashtra, and Tamil Nadu.

- Subsidies and incentives are making solar installations more accessible to residential and commercial consumers, further driving market expansion.

How Will Rayzon Solar Limited Benefit

- Rayzon Solar Limited can leverage India’s rapidly growing solar energy market, projected to reach 284 GW by 2033, expanding its customer base.

- The company stands to benefit from robust additions in installed capacity, with 7.8 GW added in Q1 2025, strengthening demand for high-efficiency PV modules.

- Expansion of domestic module manufacturing to over 100 GW and supportive PLI schemes create opportunities for scaling production and securing government-backed orders.

- Growing rooftop solar installations, expected to reach 25–30 GW by FY27, provide new markets for Rayzon’s residential and commercial module offerings.

- Adoption of advanced technologies like TOPCon and Mono PERC aligns with India’s focus on efficiency, allowing Rayzon to offer high-performance modules.

- Policy incentives and subsidies, such as PM-KUSUM and Surya Ghar programs, reduce adoption barriers, boosting sales potential across states like Gujarat, Maharashtra, and Tamil Nadu.

- Increasing demand for utility-scale, industrial, and C&I solar projects enables Rayzon to diversify its revenue streams.

- Expansion plans in solar cell and aluminium frame manufacturing position Rayzon to capitalize on upstream and downstream integration opportunities.

- Rising domestic and international recognition of certified, high-quality modules enhances brand credibility and long-term market positioning.

Peer Group Comparison

| Name of Company | Total Revenue (₹ million) | Face Value per Equity Share (₹) | P/E EPS (Basic and Diluted) (₹) | RoNW (%) | NAV (₹ per share) |

| Rayzon Solar Limited | 12,753.76 | 2.00 | Basic EPS: 2.03 Diluted EPS: 2.03 |

69.79% | 2.91 |

| Peer Groups | |||||

| Waaree Energies Limited | 116,327.63 | 10.00 | Basic EPS: 48.05 Diluted EPS: 47.86 |

30.72% | 157.76 |

| Premier Energies Limited | 31,713.11 | 1.00 | Basic EPS: 6.93 Diluted EPS: 5.48 |

35.06% | 25.05 |

Key Strategies for Rayzon Solar Limited

Continue to Expand Module Manufacturing Capacity

Rayzon Solar Limited plans to expand its solar PV module production from 6.00 GW to 8.00 GW by October 2025, leveraging a 3.60 GW order book. This expansion enhances market share, ensures competitively priced high-quality modules, and supports the transition to sustainable energy solutions for a diverse global customer base.

Focus on Backward Integration in Solar Cell and Aluminium Frame Manufacturing

Rayzon Solar Limited is establishing a 3.50 GW TOPCon solar cell unit and a 19,800 MT aluminium frame facility. Backward integration reduces reliance on external suppliers, lowers costs, supports domestic manufacturing initiatives, and positions the company to meet regulatory requirements under government schemes, enhancing competitiveness and operational efficiency.

Continuing to Develop and Reinforce the Latest Technologies to Manufacture Modules

Rayzon Solar Limited continually advances its module manufacturing through automation, R&D, and adoption of cutting-edge technologies like dual-glass modules with POE encapsulants. These initiatives ensure reliable, efficient, and high-performance products, maintaining a competitive edge while enhancing energy output and meeting the evolving technological demands of the solar industry.

Focusing on Customer Engagement Efforts

Rayzon Solar Limited prioritizes customer engagement through tailored solutions, superior service, and strategic branding initiatives, including IPL partnerships and digital campaigns. By fostering long-term relationships, educating consumers, and leveraging its extensive distribution network, the company strengthens brand recognition, drives sustainable growth, and reinforces its market leadership in solar PV modules.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Rayzon Solar Limited IPO

How can I apply for Rayzon Solar Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Rayzon Solar Limited IPO?

The IPO aims to raise ₹1,500 crore through a fresh issue of equity shares.

When will the Rayzon Solar IPO open for subscription?

The IPO opening and closing dates have not been officially announced yet.

How can I apply for the Rayzon Solar IPO?

Investors can apply via ASBA through banks or UPI through registered brokers and trading apps.

Who are the lead managers for the IPO?

The lead managers include Ambit Private Limited, IIFL Securities Limited, and SBI Capital Markets Limited.

How can I check the IPO allotment status?

Allotment status can be checked on the registrar’s website, Kfin Technologies Limited.