- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Regaal Resources IPO

₹13,824/144 shares

Minimum Investment

IPO Details

12 Aug 25

14 Aug 25

₹13,824

144

₹96 to ₹102

NSE, BSE

₹306 Cr

20 Aug 25

Regaal Resources IPO Timeline

Bidding Start

12 Aug 25

Bidding Ends

14 Aug 25

Allotment Finalisation

18 Aug 25

Refund Initiation

19 Aug 25

Demat Transfer

19 Aug 25

Listing

20 Aug 25

Regaal Resources Limited

Incorporated in 2012, Regaal Resources Limited is engaged in manufacturing maize specialty products in India, with a crushing capacity of 750 tonnes per day. Its product range includes maize starch, modified starch, gluten, germ, enriched fibre, maize flour, icing sugar, custard powder, and baking powder. The company operates a 54.03-acre zero liquid discharge facility in Kishanganj, Bihar. It exports to Nepal and Bangladesh and serves clients in food, paper, animal feed, and adhesive industries. Its customer segments include manufacturers, intermediaries, and wholesale distributors.

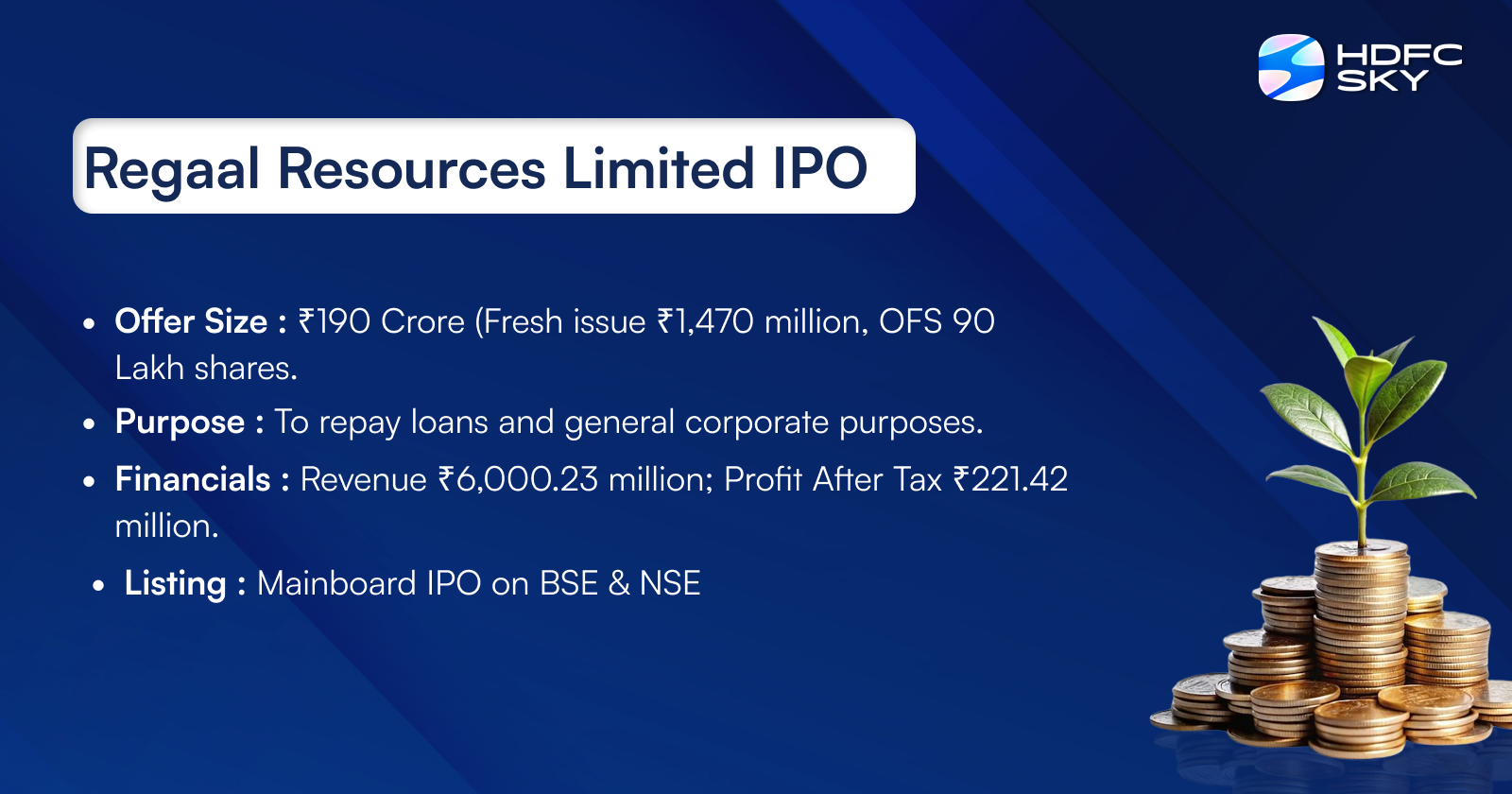

Regaal Resources Limited IPO Overview

Regaal Resources IPO is a book-built issue of ₹306.00 crores, comprising a fresh issue of 2.06 crore shares worth ₹210.00 crores and an offer for sale of 0.94 crore shares aggregating to ₹96.00 crores. The IPO opens for subscription on August 12, 2025, and closes on August 14, 2025. The allotment is expected to be finalised on August 18, 2025, with a tentative listing on BSE and NSE scheduled for August 20, 2025. The price band is fixed at ₹96 to ₹102 per share, with a lot size of 144 shares. Retail investors can invest with a minimum amount of ₹13,824 for one lot. For small HNIs, the minimum application is 14 lots (2,016 shares) amounting to ₹2,05,632, while large HNIs must invest in at least 69 lots (9,936 shares) worth ₹10,13,472. Pantomath Capital Advisors Pvt Ltd is the book-running lead manager, and MUFG Intime India Private Limited (Link Intime) is the registrar for the issue.

Regaal Resources Limited IPO Details

| Particulars | Details |

| IPO Date | 12 August 2025 to 14 August 2025 |

| Listing Date | 20 August 2025 |

| Face Value | ₹5 per share |

| Issue Price Band | ₹96 to ₹102 per share |

| Lot Size | 144 Shares |

| Total Issue Size | 3,00,00,235 shares (₹306.00 Cr) |

| Fresh Issue | 2,05,88,235 shares (₹210.00 Cr) |

| Offer for Sale | 94,12,000 shares (₹96.00 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 8,21,35,940 shares |

| Share Holding Post Issue | 10,27,24,175 shares |

Regaal Resources Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Offer |

| Retail | Not less than 35% of the Offer |

| NII (HNI) | Not more than 15% of the Offer |

Regaal Resources Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 144 | ₹14,688 |

| Retail (Max) | 13 | 1,872 | ₹1,90,944 |

| S-HNI (Min) | 14 | 2,016 | ₹2,05,632 |

| B-HNI (Min) | 69 | 9,936 | ₹10,13,472 |

Regaal Resources Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 99.56% |

| Post-Issue | TBD |

Regaal Resources Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹6.05 |

| Price/Earnings (P/E) Ratio | Pre: 17.58; Post: 21.98 |

| Return on Net Worth (RoNW) | 20.25% |

| Net Asset Value (NAV) | ₹28.66 |

| Return on Equity (ROE) | 20.25% |

| Return on Capital Employed | 14.17% |

| EBITDA Margin | 12.32% |

| PAT Margin | 5.19% |

| Debt to Equity Ratio | 2.08 |

Objectives of the Proceeds

- Repayment or pre-payment of certain outstanding borrowings – ₹159.00 Cr

- Funding general corporate purposes

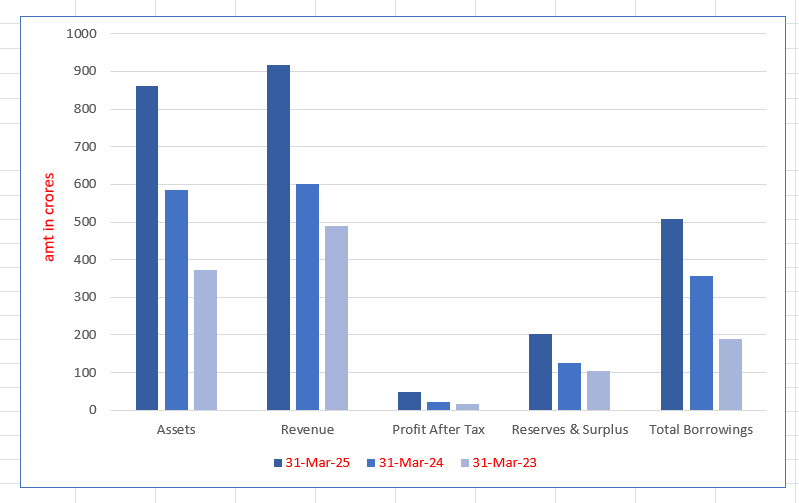

Key Financials (in ₹ Crores)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 860.27 | 585.97 | 371.52 |

| Revenue | 917.58 | 601.08 | 488.67 |

| Profit After Tax | 47.67 | 22.14 | 16.76 |

| Reserves & Surplus | 202.44 | 125.12 | 102.92 |

| Total Borrowings | 507.05 | 357.21 | 188.93 |

SWOT Analysis of Regaal Resources IPO

Strength and Opportunities

- Location advantage close to raw materials and demand hubs.

- Multi-source procurement ensures raw material availability.

- Diversified product range with applications across industries.

- Experienced management with sectoral expertise.

- Strong distribution network with widespread client base.

Risks and Threats

- High debt-to-equity ratio creates financial risk.

- Sector dependent on agro-climatic conditions.

- Export exposure poses currency fluctuation risks

- Regulatory and compliance changes can affect operations

- Stiff competition from domestic and global players.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Regaal Resources Limited IPO

Competitive Strengths

- Location close to maize-growing and consuming regions minimises logistics cost

- Multi-source procurement model ensures uninterrupted supply chain management

- Diversified starch-based product line meets cross-sector industrial demands

- Well-established distribution network serving domestic and international clients

- Promoters with extensive experience in agro-processing and supply chain

Peer Group Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Regaal Resources Ltd. | 6.05 | 6.03 | 28.66 | 21.98 | 20.25 | 6.18 |

| Sanstar Limited | 2.58 | 2.58 | 34.18 | 36.46 | 7.03 | 2.76 |

| Gujarat Ambuja Exports Ltd. | 5.44 | 5.44 | 65.46 | 20.22 | 8.30 | 1.69 |

| Gulshan Polyols Ltd. | 3.95 | 3.95 | 87.07 | 44.56 | 4.02 | 2.02 |

| Sukhjit Starch & Chemicals Ltd. | 12.79 | 12.79 | 173.82 | 13.51 | 7.36 | 0.99 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Regaal Resources Limited IPO

How can I apply for Regaal Resources Limited IPO?

You can apply via HDFC Sky using UPI through the ASBA process.

What is the lot size and minimum investment?

The minimum application is 1 lot comprising 144 shares, costing ₹14,688.

When will the shares of Regaal Resources IPO be listed?

The tentative listing date is 20 August 2025 on both BSE and NSE.

What is the price band of Regaal Resources IPO?

The price band is ₹96 to ₹102 per equity share.