- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Riddhi Display Equipments IPO

₹1,14,000/1200 shares

Minimum Investment

IPO Details

08 Dec 25

10 Dec 25

₹1,14,000

1200

₹95 to ₹100

BSE

₹24.68 Cr

15 Dec 25

Riddhi Display Equipments IPO Timeline

Bidding Start

08 Dec 25

Bidding Ends

10 Dec 25

Allotment Finalisation

11 Dec 25

Refund Initiation

12 Dec 25

Demat Transfer

12 Dec 25

Listing

15 Dec 25

Riddhi Display Equipments Limited

Riddhi Display Equipments Limited, incorporated in 2006, specialises in manufacturing and supplying high-quality display, kitchen, and commercial refrigeration equipment. The company serves diverse sectors such as retail, restaurants, hotels, supermarkets, exhibitions, and healthcare. With a modern manufacturing facility in Gondal, Gujarat, the company focuses on innovation, cost efficiency, and customised product solutions. Backed by skilled engineers and a strong marketing network, Riddhi Display continues to deliver durable and performance-driven equipment across India while maintaining a customer-centric approach.

Riddhi Display Equipments Limited IPO Overview

Riddhi Display Equipments Limited IPO is a book-built issue of ₹24.68 crore, fully comprising a fresh issue of 24,68,400 shares. The IPO opens on 8 December 2025 and closes on 10 December 2025, with allotment finalisation on 11 December 2025, refunds and demat credit on 12 December 2025, and listing on 15 December 2025 at BSE SME. The price band is ₹95–₹100 per share, and investors can apply with a lot size of 1,200 shares, while retail must apply for 2 lots (2,400 shares). Jawa Capital Services Pvt. Ltd. is the Lead Manager, Maashitla Securities Pvt. Ltd. acts as Registrar, and Aftertrade Broking Pvt. Ltd. is the Market Maker.

Riddhi Display Equipments Limited IPO Details

| Particulars | Details |

| IPO Date | 8 December 2025 to 10 December 2025 |

| Listing Date | 15 December 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹95 to ₹100 per share |

| Lot Size | 1,200 Shares |

| Total Issue Size | 24,68,400 shares (aggregating up to ₹24.68 Cr) |

| Fresh Issue | 24,68,400 shares (aggregating up to ₹24.68 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 61,71,589 shares |

| Share Holding Post Issue | 86,39,989 shares |

| Market Maker Portion | 1,23,600 shares |

Riddhi Display Equipments Limited IPO Reservation

| Investor Category | Shares Offered |

| Market Maker | 1,23,600 (5.01%) |

| QIB | 25,200 (1.02%) |

| NII (HNI) | 11,55,600 (46.82%) |

| Retail | 11,64,000 (47.16%) |

| Total | 24,68,400 (100%) |

Riddhi Display Equipments Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 2 | 2,400 | ₹2,40,000 |

| Retail (Max) | 2 | 2,400 | ₹2,40,000 |

| S-HNI (Min) | 3 | 3,600 | ₹3,60,000 |

| S-HNI (Max) | 8 | 9,600 | ₹9,60,000 |

| B-HNI (Min) | 9 | 10,800 | ₹10,80,000 |

Riddhi Display Equipments Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 99.99% |

| Post-Issue | 71.43% |

Riddhi Display Equipments Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | Pre IPO: ₹6.71, Post IPO: ₹6.95 |

| P/E Ratio | Pre IPO: 14.91x, Post IPO: 14.40x |

| Return on Net Worth (RoNW) | 39.94% |

| Net Asset Value (NAV) | ₹19.42 per share |

| ROE | 62.87% |

| ROCE | 58.40% |

| EBITDA Margin | 27.68% |

| PAT Margin | 16.53% |

| Debt to Equity Ratio | 1.04 |

Objectives of the Proceeds

- Setting up a new manufacturing and assembly unit in Lucknow – ₹49.65 million

- Upgrading existing manufacturing unit with new machinery – ₹37.91 million

- Establishing a new showroom at Gondal – ₹14.27 million

- Funding working capital requirements – ₹97.37 million

- Meeting general corporate purposes – balance amount

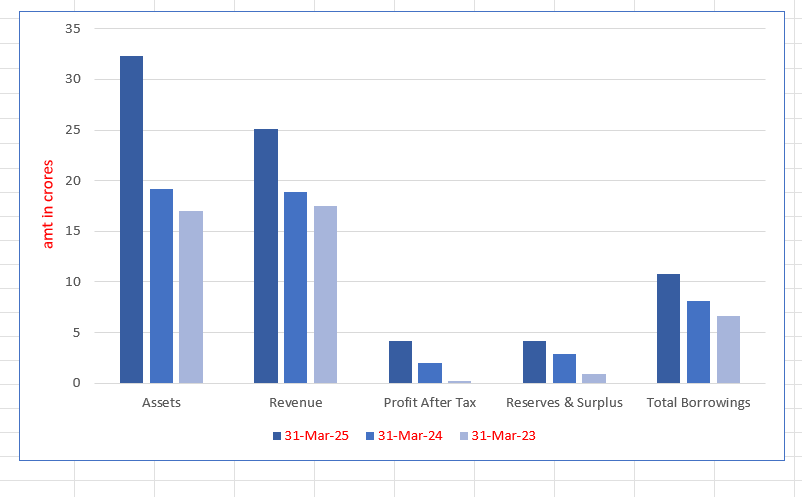

Key Financials (₹ crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 32.34 | 19.15 | 17.01 |

| Revenue | 25.09 | 18.90 | 17.54 |

| Profit After Tax | 4.14 | 2.02 | 0.21 |

| Reserves & Surplus | 4.19 | 2.93 | 0.91 |

| Total Borrowings | 10.79 | 8.10 | 6.65 |

SWOT Analysis of Riddhi Display Equipments IPO

Strength and Opportunities

- Experienced promoters and skilled technical team

- Strong demand across retail, hospitality, and commercial sectors

- Modern facility enabling customised, quality-driven production

- Wide product portfolio supporting long-term growth

Risks and Threats

- High dependency on manufacturing capacity

- Exposure to raw material price fluctuations

- Competition from established unlisted players

- Sector sensitive to economic slowdowns

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Riddhi Display Equipments Limited

Riddhi Display Equipments IPO Strengths

- Promoters highly experienced with a skilled and qualified technical team.

- Maintains consistent production and delivery of high-quality products always.

- Offers customised solutions prioritising efficient after-sales support and service.

- Possesses well-established, modern, and efficient manufacturing facilities nationwide.

- Strong marketing team drives brand growth and customer engagement effectively.

- Serves clients across multiple industries and diverse business sectors successfully.

Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (per share) (Rs) | P/E (x) | RoNW (%) |

| Riddhi Display Equipments Limited | 3.24 | 3.24 | 19.42 | – | 16.18 |

| Peer Groups | |||||

| Ice Make Refrigeration Limited | 14.72 | 14.72 | 81.36 | 52.21 | 18.09 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Riddhi Display Equipments IPO

How can I apply for the Riddhi Display Equipments IPO?

You can apply online through HDFC SKY using the UPI-based ASBA process for IPO applications.

What is the minimum investment required for retail investors?

Retail investors must apply for 2,400 shares, requiring a minimum investment of ₹2,40,000.

When will the shares be listed on the exchange?

The shares are scheduled to list on the BSE SME platform on 15 December 2025.

What type of issue is the Riddhi Display Equipments IPO?

It is a book-building IPO comprising a complete fresh issue of 24,68,400 equity shares.