- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Rite Water Solutions India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Rite Water Solutions India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Rite Water Solutions India Limited

Rite Water Solutions India Limited is India’s only Clean-tech company offering diverse solutions for rural transformation. The company specialises in water solutions, solar agriculture solutions, and IoT-driven innovations for energy, agriculture, and water management. Committed to improving living standards, it provides clean water access, sustainable sanitation, and reliable energy through cutting-edge technology. Its Clean-tech portfolio includes water treatment, solar irrigation, and digital monitoring solutions, ensuring efficiency and sustainability. By addressing climate challenges, it empowers communities and drives local development.

Rite Water Solutions India Limited IPO Overview

Rite Water Solution filed its Draft Red Herring Prospectus (DRHP) with SEBI on Thursday, February 13, 2025 to raise ₹745 crore through an initial public offering (IPO). The IPO consists of a fresh issue of ₹300 crore and an offer for sale (OFS) of ₹445 crore by promoters and investors. The company’s promoters are Vinayak S. Ganand and Abhijeet V. Gan. According to the DRHP, the promoters hold a pre-issue shareholding of 67.16%. Water Access Acceleration Fund SLP (W2AF), managed by Incofin Investment Management, Belgium, is an investor. Under the OFS, Vinayak Shankarrao Ganand will sell shares worth ₹85 crore, Abhijeet Vinayak Gan ₹90 crore, and W2AF ₹270 crore. The post-issue shareholding will be calculated based on equity dilution, which is determined by subtracting the post-issue holding from the pre-issue percentage.

Rite Water Solutions India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹300 crore

Offer for Sale (OFS): ₹445 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,53,62,720 shares |

| Shareholding post -issue | TBA |

Rite Water Solutions IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Rite Water Solutions Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Rite Water Solutions India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 7.43 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 21.04% |

| Net Asset Value (NAV) | 35.31 |

| Return on Equity | 21.04% |

| Return on Capital Employed (ROCE) | 27.22% |

| EBITDA Margin | 34.77% |

| PAT Margin | 24.31% |

| Debt to Equity Ratio | 008 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of the company | 2252.12 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

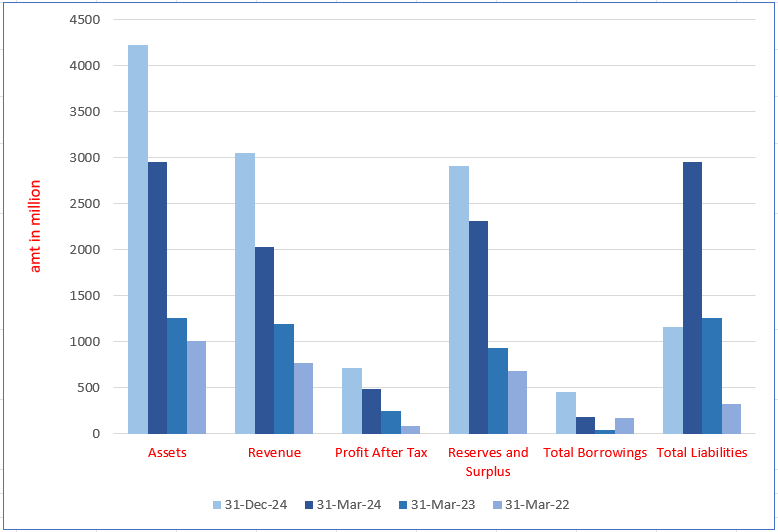

Rite Water Solutions India Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4221.80 | 2952.49 | 1261.33 | 1010.90 |

| Revenue | 3056.79 | 2027.49 | 1193.34 | 768.14 |

| Profit After Tax | 715.06 | 492.80 | 250.21 | 86.75 |

| Reserves and Surplus | 2909.37 | 2313.54 | 931.71 | 681. |

| Total Borrowings | 459.29 | 186.46 | 43.46 | 167.62 |

| Total Liabilities | 1164.73 | 2952.49 | 1261.33 | 329.05 |

Financial Status of Rite Water Solutions India Limited

SWOT Analysis of Rite Water Solutions India IPO

Strength and Opportunities

- Diverse clean-tech solutions in water, solar, and IoT sectors.

- ISO 9001:2015 certification ensures quality management.

- Focus on rural transformation enhances community development.

- Innovative water purification and supply systems.

- Solar-powered agriculture solutions support sustainable farming.

- IoT technologies improve efficiency in water and energy infrastructure.

- Recognition through awards enhances brand credibility.

- Growing demand for sustainable solutions presents market expansion opportunities.

- Potential for international expansion, especially in regions facing water scarcity.

Risks and Threats

- Dependence on government policies and subsidies for renewable energy projects.

- High competition from established players in the clean-tech industry.

- Rapid technological changes may require continuous investment in R&D.

- Challenges in scaling operations to meet increasing demand.

- Potential supply chain disruptions affecting project timelines.

- Financial constraints in expanding to new markets or regions.

- Dependence on skilled workforce; talent retention challenges.

- Economic downturns may impact funding and investment in clean-tech projects.

- Regulatory hurdles and compliance issues in different jurisdictions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Rite Water Solutions India Limited IPO

Rite Water Solutions India Limited IPO Strengths

- Driving Sustainable Rural Transformation

Rite Water Solutions leads India’s clean-tech sector with integrated water, solar agriculture, and IoT solutions. With over 9,000 installations purifying 627.42 million litres daily and 8,736 solar pumps under PM-KUSUM, it addresses rural challenges. Strategic positioning in high-growth sectors ensures sustainable impact and market expansion.

- Proven Track Record in Complex Infrastructure Projects

Rite Water Solutions India Limited has successfully executed large-scale infrastructure projects across India’s public sector, showcasing technical expertise and operational scalability. With over 9,131 water-related installations and 8,736 solar pumps deployed, its innovative solutions in water treatment, IoT, and solar energy drive sustainable development nationwide.

- Asset-Light Business Model Driving Agility and Scalability

Rite Water Solutions India Limited follows an asset-light business model, optimising strategic sourcing to enhance scalability and financial flexibility. By outsourcing non-core manufacturing while focusing on critical components, the company ensures cost efficiency, rapid market deployment, and adaptability to industry shifts, supporting consistent growth and profitability.

- Sustainability-Focused Business Model Aligned with ESG Principles

Rite Water Solutions India Limited integrates environmental, social, and governance (ESG) principles into its operations, aligning with global sustainability goals. Through renewable energy solutions, advanced water treatment, and IoT-based resource management, the company enhances efficiency while minimising environmental impact. This commitment strengthens its market position and attracts impact-driven investors and partners.

- Experienced Leadership and Strong Investor Backing

Led by Abhijeet V. Gan (Managing Director & CEO) and Vinayak S. Gan (Executive Chairman), Rite Water Solutions benefits from a leadership team with extensive experience in water, solar, and IoT sectors. Supported by marquee investors, including Incofin Investment Management, the company is strategically positioned for long-term growth and industry leadership.

- Proven Track Record of Profitability and Financial Stability

Rite Water Solutions India Limited has demonstrated consistent financial growth, with a 2-year CAGR of 62.46% in revenue from operations. Strong working capital management, minimal bad debt, and an asset-light business model contribute to its profitability. With EBITDA margins reaching 34.77% in Fiscal 2024 and a return on capital employed (ROCE) of 27.22%, the company operates with financial discipline and strategic debt management, maintaining a low debt-to-equity ratio of 0.08x in Fiscal 2024.

More About Rite Water Solutions India Limited

Rite Water Solutions India Limited is the only clean-tech company in India offering diverse solutions for rural transformation. The company operates across three key sectors:

- Water Solutions – Treatment, purification, and supply schemes

- Solar Agriculture Solutions – Solar irrigation pumps and cold storage

- IoT Solutions – Digital monitoring for energy, agriculture, and water management

Second Fastest-Growing Company in the Water Sector

Between Fiscal 2022 and Fiscal 2024, Rite Water Solutions became the second fastest-growing company in the Indian water sector based on revenue. The company’s EBITDA margin grew from 11.32% in Fiscal 2022 to 34.77% in Fiscal 2024, showcasing strong operational efficiency and growth potential. (Source: 1Lattice Report)

Expanding into Solar Agriculture and IoT

Leveraging its experience in rural solutions, the company entered the solar agriculture market, installing approximately 8,736 solar pumps by December 31, 2024, capturing a 2.85% market share. It is also an early player in IoT solutions, implementing large-scale energy and water management projects.

Commitment to Sustainability and Rural Development

Rite Water Solutions is dedicated to improving access to clean water, sanitation, and renewable energy in rural India. The company integrates innovation and technology to address energy shortages and water scarcity, supporting India’s infrastructure and social development goals.

- Operations in 21,807 villages across multiple states

- 9,131 water purification installations treating 627.42 million litres daily

- 8,736 solar pumps installed under the PM-KUSUM scheme

- IoT solutions in 2,639 villages and 1,837 energy sub-stations

Strategic Market Position and Asset-Light Model

Rite Water Solutions operates at the intersection of water treatment, solar pumps, and IoT, industries projected to grow at a CAGR of 12.0%, 32.1%, and 20.5%, respectively, by Fiscal 2030. Its asset-light business model enables scalable operations with minimal capital investment.

Strong Government and Private Sector Partnerships

The company works with central and state governments, executing projects under key programs such as:

- Jal Jeevan Mission (JJM)

- PM-KUSUM Scheme

- National Mission for Clean Ganga (NMCG)

Recognitions and ESG Commitment

Rite Water Solutions has received high ESG ratings and numerous awards, including:

- Future Ready Organization Award 2024-25 (Economic Times)

- Doing Good for Bharat Award 2024 (CSRBOX)

- Best Innovative Company in Water (ASSOCHAM, 2017)

Experienced Leadership and Promoters

Founded by Vinayak S. Gan (Executive Chairman) and Abhijeet V. Gan (Managing Director & CEO), the company benefits from a leadership team with extensive experience in water, solar, and IoT sectors.

With its innovative clean-tech solutions, strong financial performance, and strategic market positioning, Rite Water Solutions is well-equipped to drive sustainable development across India’s rural landscape

Industry Outlook

Water and Wastewater Treatment Industry

The Indian water and wastewater treatment market is expanding due to rapid urbanisation, industrialisation, and depletion of freshwater resources.

- Market Size and Growth: The market was valued at approximately USD 2.79 billion in 2022 and is projected to reach USD 5.60 billion by 2030, growing at a CAGR of 9.10%.

- Growth Drivers:

- Government Initiatives: Programs like the Jal Jeevan Mission drive demand for water treatment solutions.

- Industrial Regulations: Strict norms on industrial wastewater discharge are encouraging adoption of advanced treatment technologies.

Solar Energy Sector

India’s solar energy sector is growing rapidly, backed by favorable policies and increasing adoption of renewable energy.

- Market Size and Growth: The sector is expected to grow at a CAGR of 7.50% from 2025 to 2029.

- Growth Drivers:

- Government Policies: Initiatives like the PM-KUSUM scheme promote solar energy adoption in agriculture.

- Cost Reduction: Falling prices of solar panels make solar solutions more affordable.

Agrivoltaics Market

Agrivoltaics, which integrates solar energy production with farming, is an emerging sector in India.

- Market Size and Growth: The agrivoltaics market was valued at USD 102.01 million in 2022 and is expected to reach USD 204.58 million by 2029, growing at a CAGR of 12.30%.

- Growth Drivers:

- Land Utilisation: Enables dual use of land for solar energy and agriculture.

- Sustainability: Supports rural economies and promotes environmental benefits.

Solar Water Pump Market

Solar water pumps are gaining traction in India, especially in agriculture.

- Market Size and Growth: The Indian solar water pump market is projected to grow from USD 452.68 million in FY2023 to USD 2.12 billion by FY2031, at a CAGR of 23.2%.

- Growth Drivers:

- Energy Access: Provides reliable irrigation in areas with limited electricity.

- Government Incentives: Subsidies under PM-KUSUM are encouraging adoption.

How Will Rite Water Solutions India Limited Benefit

- Expanding Water Treatment Market: With the water treatment industry growing at 9.10% CAGR, Rite Water Solutions can scale its operations and secure more government projects.

- Increased Demand from Jal Jeevan Mission: The company can benefit from Jal Jeevan Mission’s push for safe drinking water by securing rural water purification projects.

- Industrial Compliance Driving Growth: Stricter wastewater regulations will increase demand for Rite Water’s advanced water treatment technologies in industrial sectors.

- Solar Agriculture Expansion: With the solar sector growing at 7.50% CAGR, Rite Water can expand its solar irrigation solutions, benefiting rural farmers.

- PM-KUSUM Scheme Opportunities: The company can capture a larger share of the solar pump market with government-backed subsidies and financing support.

- Growth in Agrivoltaics Sector: With agrivoltaics growing at 12.30% CAGR, Rite Water can integrate solar power with farming solutions to enhance rural sustainability.

- Rising Demand for IoT Monitoring: IoT-based energy and water management solutions will see higher adoption as India modernises its water and energy infrastructure.

- Strong Government Partnerships: Collaboration with central and state governments ensures a steady pipeline of projects across water, solar, and IoT sectors.

- Asset-Light Scalability: Rite Water’s asset-light model allows rapid expansion into high-growth markets with minimal capital expenditure.

- Sustainability and ESG Focus: Growing ESG investments will attract impact investors, further accelerating the company’s growth in clean-tech solutions.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Rite Water Solutions India Limited

- Strengthening Public-Private Partnerships

Rite Water Solutions has a long-standing history of over 16 years working with government bodies on large-scale projects. They aim to continue strengthening public-private partnerships to align with national priorities, ensuring a steady pipeline of projects and enabling future growth by participating in government schemes and tenders.

- Focus on Larger Projects

Rite Water Solutions focuses on large projects across water, solar, agriculture, and IoT sectors to ensure financial stability. By capitalising on government policy initiatives like PM Kusum and Jal Jeevan Mission, they aim to secure large-scale opportunities, leveraging these programs for long-term business growth.

- Diversifying Offerings and Expanding Geographic Presence

The company plans to diversify its solution portfolio and expand its geographic footprint in high-demand states and emerging international markets. They aim to address critical challenges like water scarcity and agricultural sustainability, particularly in Africa, leveraging their specialised knowledge and scalable solutions to improve health and living standards.

- Scaling Technological Innovation through Partnerships

Rite Water Solutions integrates advanced technologies like reverse osmosis, nanotechnology, solar energy, and IoT into their solutions. Through strategic collaborations with research institutions, they aim to scale their innovations and develop sustainable, high-impact solutions, addressing critical environmental challenges in underserved regions.

- Continuing Focus on Sustainability and ESG Principles

Rite Water Solutions is committed to sustainability by aligning their business practices with Environmental, Social, and Governance (ESG) principles. They focus on reducing environmental impact, promoting renewable energy, and improving resource efficiency. This commitment enhances their competitive advantage and strengthens their market reputation.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

How can I apply for Rite Water Solutions India Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Rite Water Solutions India Limited IPO?

The IPO aims to raise ₹745 crore, including a fresh issue of ₹300 crore and an offer-for-sale (OFS) of ₹445 crore.

Who are the promoters selling shares in the OFS?

Promoters Vinayak Shankarrao Gan and Abhijeet Vinayak Gan are selling shares worth ₹85 crore and ₹90 crore, respectively.

Which investor is participating in the OFS?

Water Access Acceleration Fund SLP plans to sell shares worth ₹270 crore in the OFS.

Who are the lead managers for the IPO?

JM Financial and Axis Capital are the book-running lead managers for the IPO.

What are the objectives of the IPO?

The IPO aims to fund working capital requirements and general corporate purposes.