- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

RKCPL IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

RKCPL IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

RKCPL Limited IPO

Incorporated in 2013, RKCPL Ltd. is a civil construction and infrastructure development company involved in executing large-scale structural projects across India, including elevated roads, flyovers, bridges, highways, expressways, drainage, and canal systems. Its core business operations are categorised into Engineering, Procurement and Construction (EPC) projects and Hybrid Annuity Model (HAM) projects. Focused on expanding its service portfolio and upholding high-quality standards, RKCPL aims to strengthen its market presence and contribute to India’s infrastructure growth. As of July 31, 2025, it employed 1,655 permanent staff.

RKCPL Limited IPO Overview

RKCPL Ltd. filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on September 24, 2025, to raise funds through an Initial Public Offering (IPO). The proposed IPO is a book-built issue worth ₹1,250 crore, comprising a fresh issue of shares valued at ₹700 crore and an offer for sale (OFS) of ₹550 crore. The company intends to list its equity shares on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Equirus Capital Pvt. Ltd. will act as the book-running lead manager, while MUFG Intime India Pvt. Ltd. has been appointed as the registrar of the issue. Specific details such as the IPO opening and closing dates, price band, and lot size are yet to be announced.

According to the DRHP, the issue will have a face value of ₹10 per share and follow a book-building process. The total issue size aggregates to ₹1,250 crore, including the fresh issue of ₹700 crore and the OFS component of ₹550 crore. The pre-issue shareholding of the company stands at 13.20 crore equity shares. The IPO will result in a dilution of promoter shareholding, which currently stands at 100%. The promoters of RKCPL Ltd. are Ram Kumar Goyal, Naresh Kumar, and Krishan Kumar Goyal. For complete information, investors can refer to the RKCPL IPO DRHP filed with SEBI.

RKCPL Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1250 crore |

| Fresh Issue | ₹700 crore |

| Offer for Sale (OFS) | ₹550 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 13,20,00,000 shares |

| Shareholding post-issue | TBA |

RKCPL IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

RKCPL Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

RKCPL Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹12.47 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.92% |

| Net Asset Value (NAV) | ₹43.11 |

| Return on Equity (RoE) | 28.92% |

| Return on Capital Employed (RoCE) | 25.13% |

| EBITDA Margin | 21.56% |

| PAT Margin | 12.95% |

| Debt to Equity Ratio | 0.89 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding the capital expenditure requirements of the Company towards purchase of construction equipment | 1300.2 |

| Funding working capital requirements of the Company | 2000 |

| Pre-payment and/or re-payment, in full or in part, of certain outstanding borrowings availed by the Company | 500 |

| Investment in the Subsidiaries namely Bathinda Ludhiana Highway Private Limited, Poanta Saheb Highway Private Limited and Ambala Ring Road Highway Private Limited for re- payment/pre-payment in full or in part, of certain borrowings availed by such Subsidiaries | 1380 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

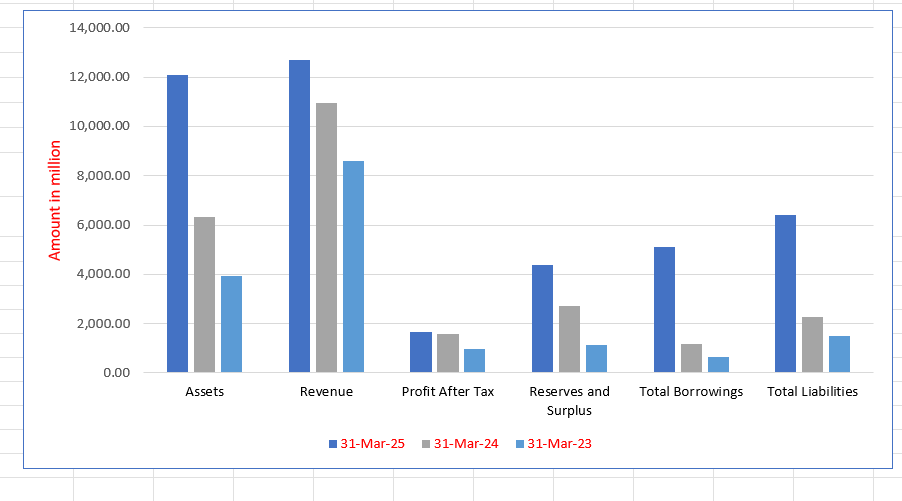

RKCPL Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 12,090.76 | 6,323.31 | 3,950.09 |

| Revenue | 12,706.61 | 10,933.27 | 8,617.23 |

| Profit After Tax | 1,645.81 | 1,569.48 | 965.22 |

| Reserves and Surplus | 4,370.51 | 2,724.69 | 1,138.72 |

| Total Borrowings | 5,092.57 | 1,162.10 | 625.54 |

| Total Liabilities | 6,400.25 | 2,278.55 | 1,491.38 |

Financial Status of RKCPL Limited

SWOT Analysis of RKCPL IPO

Strength and Opportunities

- Extensive experience in civil and structural construction projects across India.

- Strong and diversified order book ensuring revenue visibility.

- Healthy financial profile with low debt and strong return ratios.

- Class I (Super) certification enabling eligibility for high-value bids.

- Proven track record of completing projects within timelines and budgets.

- Pan-India presence reducing geographical dependency and project concentration.

- Expanding infrastructure development under government programmes like Bharatmala and Gati Shakti.

- Increasing opportunities in expressways, flyovers, and elevated road projects.

- Strong reputation for quality and reliability in project execution.

Risks and Threats

- Moderate scale of operations compared to larger EPC players.

- Intense competition in government tenders, pressuring margins.

- High financial commitments in HAM and SPV projects.

- Execution risks in complex structural and bridge projects.

- Fluctuating raw material and labour costs affecting profitability.

- Project delays due to land acquisition or regulatory approvals.

- Dependency on government contracts exposes the company to policy and funding changes.

- Slowdown in public spending or delays in fund disbursement can impact growth.

- Macroeconomic volatility and rising interest rates may affect infrastructure investment.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About RKCPL Limited

RKCPL Limited IPO Strengths

Established Roads & Railways EPC Expertise

RKCPL Limited is an established civil construction and infrastructure EPC player focusing on roads and railways across India. The company has successfully completed over 80 projects, leveraging its expertise in complex structural works like elevated roads, bridges, and railway structures. Its focused approach and ability to execute intricate projects on time solidify its strong market credentials and client relationships.

Diversified and Growing Order Book

The company maintains a significant and diversified Order Book (₹26,175.07 million as of July 31, 2025) across highway and railway verticals, mitigating sectoral risk and providing future revenue visibility. This order book is also geographically spread across multiple states and largely comprises contracts from major public sector clients, including NHAI and Indian Railways, ensuring stability.

Integrated Business Model for Comprehensive Services

RKCPL offers a comprehensive range of services from conceptualization to operation and maintenance through its integrated business model. This model features an in-house team of engineers and a large, owned fleet of construction equipment. This approach minimizes reliance on external vendors, enables high-quality oversight, reduces costs, and facilitates the timely completion of projects.

Experienced Promoters and Management

The company benefits from qualified and experienced promoters who possess over 44 years of experience in the construction business, providing vision and operational expertise. This leadership, combined with a supporting senior management team, is a competitive advantage. Their successful track record and industry knowledge position the company well to capitalize on future growth.

Healthy Financials and Strong Credit Profile

RKCPL demonstrates healthy profitability with consistent growth in financial metrics like Revenue, EBITDA, and PAT, driven by disciplined bidding and operational efficiencies. The company has also secured favorable credit ratings from CRISIL Ratings (e.g., ‘CRISIL A/Stable/CRISIL A1’ for bank facilities), reflecting its financial stability and balance sheet strength.

More About RKCPL Limited

RKCPL Limited is a prominent civil construction and infrastructure development company with extensive experience in executing specialised structural works across India. Its portfolio includes elevated roads, flyovers, bridges, highways, expressways, road over bridges, drainage, and canal systems.

The company’s operations are primarily divided into:

- EPC (Engineering, Procurement, and Construction) Projects

- HAM (Hybrid Annuity Model) Projects

Recognised for delivering technically demanding projects with precision and quality, RKCPL has been classified as Class I (Super) by the Director General, Central Public Works Department. This certification enables the company to bid for projects up to ₹6,500 million.

Operational Excellence and Financial Performance

RKCPL Limited ranked second highest in both ROE and ROCE among its peers in Fiscal 2025, reflecting strong financial efficiency.

- EBIDTA Margin: Increased from 15.46% (FY 2023) to 21.56% (FY 2025)

- PAT Margin: Rose from 11.20% (FY 2023) to 12.95% (FY 2025)

As of July 31, 2025, the company had successfully completed over 80 projects and had 17 ongoing projects—comprising 14 EPC and 3 HAM projects—with an order book value of ₹26,175.07 million.

Corporate Evolution

The foundation of RKCPL’s construction legacy dates back to the early 1980s, established by Mr. Ram Kumar Goyal. Over the years, the business transitioned from a sole proprietorship to a partnership firm and later, in 2013, to a corporate entity under the Companies Act, 1956.

In 2021, RKCPL Limited formally acquired M/s Ram Kumar Contractor, consolidating decades of expertise under a single corporate framework.

Key Clients and Projects

RKCPL’s clients include major public sector organisations such as:

- NHAI

- MoRTH

- Public Works Departments (PWDs)

- Northern Railways

- Faridabad Metropolitan Development Authority

Notable projects include the Haridwar Elevated Flyover, Bhatinda Rail Over Bridge, and Six-Laning of Dehradun–Ganeshpur Highway.

Commitment to Quality and Sustainability

RKCPL ensures timely project delivery through advanced project management, in-house equipment, and regular progress monitoring. The company integrates environmental, social, and governance (ESG) practices—adopting solar power systems, dust collectors, and other eco-friendly technologies—to ensure sustainable operations.

Industry Outlook

The Indian civil construction and infrastructure industry is witnessing robust expansion, supported by large-scale government investments, rising urbanisation, and rapid economic growth. The sector contributes nearly 8–9% of India’s GDP and remains one of the country’s largest employment generators.

The overall construction market in India is projected to grow from around USD 687 billion in 2024 to approximately USD 1.56 trillion by 2034, reflecting a CAGR of about 8–9%. Growth is being driven by massive infrastructure programmes such as Bharatmala Pariyojana, Gati Shakti, and Smart Cities Mission, which are aimed at improving connectivity and urban infrastructure across the nation.

Roads, Bridges, and Highway Segment

The roads and highways segment, where RKCPL Limited primarily operates, holds a central position in India’s infrastructure development strategy. The market is valued at over USD 140 billion in 2024 and is expected to reach around USD 340 billion by 2033, growing at a CAGR of about 10%. The bridge and flyover infrastructure segment is also forecast to expand steadily at 4–6% CAGR over the next decade, supported by government efforts to replace ageing bridges and improve intercity connectivity.

Key growth drivers include:

- Rising investments in expressways and economic corridors.

- Increasing demand for sustainable and technically advanced civil structures.

- Expanding network of highways and urban mobility projects.

How Will RKCPL Limited Benefit

- The company’s expertise in EPC and HAM projects aligns perfectly with the government’s increasing preference for these models in large-scale infrastructure development.

- Expansion of national highways, expressways, and bridges will create sustained demand for RKCPL’s specialised civil engineering capabilities.

- Being classified as Class I (Super) enables RKCPL to bid for high-value government projects, strengthening its competitive position.

- Continuous investment in urban mobility, smart cities, and inter-state connectivity will open new business opportunities across multiple regions.

- The company’s proven track record in timely project execution and high-quality structural work positions it favourably for repeat contracts and long-term partnerships.

- Emphasis on sustainable construction practices and ESG compliance enhances credibility and aligns with evolving government and investor expectations.

Peer Group Comparison

| Name of the Company | Face Value (₹/share) | Closing Price (₹) | Revenue (₹ million) | EPS (₹) | ROE (%) | P/E Ratio | RoNW (%) |

| RKCPL Limited* | 10 | N.A. | 12,706.61 | 12.47 | 28.92 | 43.11 | N.A. |

| Peer Group | |||||||

| Ceigall India Ltd | 5 | 280.55 | 34,367.32 | 17.04 | 15.57 | 105.69 | 16.46 |

| GR Infra Projects Ltd | 5 | 1,310.30 | 73,947.04 | 104.88 | 11.97 | 877.03 | 12.50 |

| HG Infra Engineering Ltd | 10 | 998.20 | 50,561.82 | 77.55 | 17.13 | 452.62 | 12.87 |

| KNR Constructions Ltd | 2 | 209.71 | 47,531.66 | 35.62 | 22.08 | 161.34 | 5.89 |

| PNC Infratech Ltd | 2 | 307.85 | 67,686.84 | 31.79 | 13.62 | 233.45 | 9.68 |

| J Kumar Infra Ltd | 5 | 640.25 | 56,934.88 | 51.70 | 12.98 | 397.42 | 12.38 |

| Ashoka Buildcon Ltd | 5 | 193.98 | 100,366.28 | 60.35 | 41.38 | 149.22 | 3.21 |

Key Strategies for RKCPL Limited

Strategic Expansion and Market Leverage

RKCPL aims to strategically expand its geographical footprint across India, moving beyond its existing markets. The company plans to maximize opportunities by undertaking larger, complex projects and may diversify into new infrastructure sectors like metros and airports, managing risk by initially limiting expansion to core competency areas.

Focus on EPC, HAM, and BOT Projects

The company will continue its core focus on EPC and HAM projects, leveraging its proven execution track record. RKCPL intends to increase its penetration in BOT (Build-Operate-Transfer) projects, capitalizing on its financial strength and recent favorable changes to the BOT model. This expansion will broaden its operational portfolio.

Concentrated Growth in Railway Projects

RKCPL is committed to expanding its market position in the high-growth railway sector, which is supported by increased government allocation. The company will leverage its existing road and railway expertise to bid for more projects, including complex structural work, to further diversify its capabilities and maintain financial discipline.

Venturing into Metro Projects

Recognizing India’s rapidly expanding urban transit network, RKCPL plans to venture into the metro rail sector. The focus will be on executing large-scale civil infrastructure works, such as viaducts, depots, and structural components. This move allows the company to capitalize on a growing market and leverage its technical expertise.

Targeting Airport Infrastructure Projects

To diversify its portfolio, RKCPL intends to enter the airport infrastructure business. It plans to apply its experience from roadways and bridges to bid for projects including runway construction and terminal building design. This move aligns with the government’s significant long-term capital expenditure plans for the aviation sector.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On RKCPL Limited IPO

How can I apply for RKCPL Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total issue size of the RKCPL Ltd. IPO?

The RKCPL IPO is a book-built issue of ₹1,250 crore, including ₹700 crore fresh issue and ₹550 crore OFS.

On which stock exchanges will the RKCPL IPO be listed?

The equity shares of RKCPL Ltd. are proposed to be listed on both NSE and BSE.

Who are the lead manager and registrar for the RKCPL IPO?

Equirus Capital Pvt. Ltd. is the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

What are the main objectives of the RKCPL IPO?

The IPO aims to fund equipment purchases, working capital, debt repayment, subsidiary investments, and general corporate purposes.

Who are the promoters of RKCPL Ltd.?

The company’s promoters are Ram Kumar Goyal, Naresh Kumar, and Krishan Kumar Goyal