- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Rotomag Enertec IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Rotomag Enertec IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Rotomag Enertec Limited

Rotomag Enertec Ltd. is a design-driven manufacturer and supplier of industrial drive solutions and solar products. Its solar portfolio features surface and submersible solar pumps, integrated pumping systems, inverters, and energy storage solutions for domestic, commercial, and industrial use. The company’s industrial drive offerings include DC, PMDC, BLDC, AC, and PMSM motors, along with gearboxes and gearmotors, marketed under the brands “Rotomag,” “Rotomotive,” “Rotodrive,” and “Cyclo.” Serving industries like plastics, textiles, wind energy, construction, and railways, Rotomag exports to over 35 countries and operates six manufacturing facilities across Gujarat, Maharashtra, Haryana, and Uttar Pradesh.

Rotomag Enertec Limited IPO Overview

Rotomag Enertec Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 26, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a book building issue, comprising a fresh issue of ₹500 crore and an offer for sale (OFS) of up to 2.40 crore equity shares. The company’s shares are proposed to be listed on both NSE and BSE, with MUFG Intime India Pvt. Ltd. appointed as the registrar, while the book running lead manager is yet to be declared. Key details such as IPO dates, price bands, and lot size are still to be announced. The promoters of the company include Umesh Mohan Balani, Neelam Umesh Balani, Priya Mohan Balani, Umesh Balani Family Private Trust, and Neelam Balani Family Private Trust, holding 91.71% pre-IPO. The face value of each share is ₹1, and the IPO will combine fresh issuance with an offer for sale, increasing the total shareholding from 8,32,58,379 pre-IPO to 10,10,13,260 post-IPO.

Rotomag Enertec Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹500 crore |

| Offer for Sale (OFS) | 2.40 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,32,58,379 shares |

| Shareholding post-issue | 10,10,13,260 shares |

Rotomag Enertec IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Rotomag Enertec Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Rotomag Enertec Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹16.85 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.98% |

| Net Asset Value (NAV) | ₹233.50 |

| Return on Equity (RoE) | 27.98% |

| Return on Capital Employed (RoCE) | 28.20% |

| EBITDA Margin | 19.29% |

| PAT Margin | 13.11% |

| Debt to Equity Ratio | 0.14 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Redemption of Non-Convertible Debentures issued by the Company | 1000 |

| Funding the working capital requirements | 2750 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

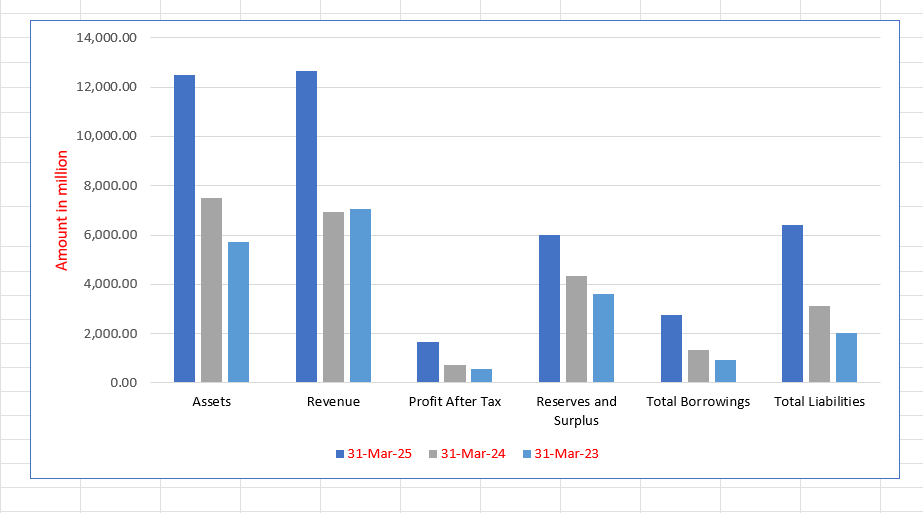

Rotomag Enertec Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 12,492.12 | 7,520.88 | 5,734.86 |

| Revenue | 12,649.97 | 6,941.83 | 7,042.19 |

| Profit After Tax | 1,675.20 | 713.76 | 554.49 |

| Reserves and Surplus | 5,996.16 | 4,322.73 | 3,610.99 |

| Total Borrowings | 2,769.80 | 1,327.24 | 936.14 |

| Total Liabilities | 6,412.64 | 3,116.59 | 2,043.99 |

Financial Status of Rotomag Enertec Limited

SWOT Analysis of Rotomag Enertec IPO

Strength and Opportunities

- Strong product development capability in motors and drives.

- Diversified portfolio including DC, BLDC, PMDC motors, and solar pumps.

- Established manufacturing base with decades of experience since 1993.

- Growing presence in renewable energy with strategic investments in power-electronics firms.

- Wide distribution network and geographically diversified clientele.

- Opportunity to expand in solar energy storage and inverter solutions.

- Rising demand for energy-efficient industrial motors and automation solutions.

- Low leverage and strong debt-coverage indicators ensuring financial stability.

- Upcoming IPO providing capital for growth and technological advancement.

Risks and Threats

- High working-capital intensity in solar pumping business.

- Margin pressure due to low-margin government solar pump orders.

- Heavy reliance on fluctuating raw-material and foreign-exchange markets.

- Intense competition in AC motors, solar pumps, and drive solutions.

- Large exposure to changes in government policy or subsidies in solar pumping.

- Order-book concentration risk in specific verticals such as solar pumping.

- Cyclical industrial demand leading to revenue volatility.

- Execution risk and schedule delays in large-scale projects.

- Vulnerability to rapid technological disruptions affecting competitiveness.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Rotomag Enertec Limited

Rotomag Enertec Limited IPO Strengths

Key Player in Solar Products Market

Rotomag Enertec Limited is an early participant in the solar products industry since 1999, specializing in solar pumps. The company’s in-house motor expertise, long experience, and participation on the Pumps Sectional Committee have enabled it to supply approximately 16.72% of PM Kusum solar pump installations by volume between Fiscal 2023 and 2025.

Diversified Product Portfolio

The company maintains a diverse portfolio encompassing both industrial drive solutions (AC/DC motors, gearboxes, railway products) and solar products (pumps, inverters, energy storage). Recent acquisitions of Su-Vastika and Statcon have further expanded its reach into power inverters and energy storage, effectively de-risking the business from single-product market fluctuations.

Strong Design and Development Expertise

Rotomag is a design-focused manufacturer supported by a dedicated 36-member team. The company leverages this expertise to develop and deliver customized motors and drive solutions (e.g., BLDC solar pumps, drivetrains for EVs). A proven track record of product innovation, such as redesigning the solar controller enclosure for better performance and cost-effectiveness, provides a competitive edge.

Extensive Customer Base and Service Network

The company serves a marquee customer base in India and internationally, including government solar projects under the PM Kusum Scheme. It backs its sales with a robust, two-tier network of 12 installation partners and 378 agents for solar products, alongside over 65 service centers for industrial drives and over 440 centers for solar pumps across India.

Deep In-House Manufacturing Know-How

The company possesses deep know-how in critical processes, including specialized manufacturing techniques like heat shrinking of rotors and automated testing. Operating six manufacturing facilities with captive consumption of in-house motors and gearboxes improves quality control, reduces costs, and enhances operational efficiency and speed of delivery.

Robust Financial Health and Performance

Rotomag has demonstrated strong financial growth, with revenue from operations growing at a CAGR of $34.03\%$ and EBITDA at a CAGR of $108.26\%$ between Fiscal 2023 and 2025. This robust financial position, coupled with a growing order book for solar pumping systems, ensures stability and facilitates future investment in innovation and market expansion.

More About Rotomag Enertec Limited

Rotomag Enertec Limited is a design-driven manufacturer and supplier of industrial drive solutions—including motors, gearboxes, drivetrains, and railway products—and solar products such as solar pumps, pumping systems, inverters, and energy storage systems. Established in 1993, the company has evolved into a key player in India’s industrial electric motors and solar products markets, combining innovation, efficiency, and sustainability.

Journey of Growth and Innovation

Rotomag Enertec entered the solar products industry in 1999, becoming one of the early contributors to India’s renewable energy transition. Its participation in government-led programmes such as the National Solar Pumping Programme (2014–15) and PM-KUSUM Scheme (2019) strengthened its presence in the irrigation sector. Between FY 2023 and FY 2025, the company supplied over 113,000 solar pumps—representing nearly 17% of total installations in India.

Product Portfolio

Industrial Drive Solutions:

- Wide range of DC, PMDC, BLDC, AC, and PMSM motors.

- Gearboxes, including worm, bevel, helical, cycloidal, and planetary types.

- Products marketed under brands such as Rotomag, Rotomotive, Rotodrive, and Cyclo.

- Strong demand across industries including textiles, wind energy, railways, and construction equipment.

Solar Products:

- AC and DC solar pumps (1–10 hp), solar pumping systems, inverters, and energy storage units.

- Integration of IoT and smart technologies to enhance efficiency.

- Rapid revenue growth, with solar products contributing over 80% of operational revenue in FY 2025.

Manufacturing and Operations

The company operates six manufacturing facilities across India, with a design-centric, asset-light model ensuring operational efficiency. Its products are exported to over 35 countries, supported by a network of more than 320 dealers and 500 service centres nationwide.

Strategic Expansion and Leadership

In FY 2026, Rotomag acquired Su-Vastika Systems Pvt. Ltd. and Statcon Energiaa Pvt. Ltd., expanding into the power inverter and energy storage markets. Led by Promoter Umesh Mohan Balani and a seasoned leadership team averaging 19 years of experience, Rotomag Enertec continues to combine design innovation with strategic growth, positioning itself as a leader in India’s energy and industrial solutions sector.

Industry Outlook

The Indian industrial motors and drive systems industry is witnessing steady growth, fuelled by automation, energy efficiency regulations, and infrastructure expansion. The industrial motor market in India was valued at around USD 796 million in 2024 and is projected to reach approximately USD 1.63 billion by 2033, reflecting a CAGR of about 7.9%. Similarly, the energy-efficient motors segment is estimated to grow from USD 1.48 billion in 2024 to around USD 2.76 billion by 2033, registering a CAGR of roughly 7.2%.

Key Growth Drivers:

- Growing industrial automation and adoption of IoT-enabled drive systems.

- Strong government initiatives such as “Make in India” and energy-efficiency programmes.

- Rising replacement demand for older motors with high-efficiency, smart models.

Segment Specific: Solar Pumps and Solar Products

The solar pump and energy storage sector is expanding rapidly due to renewable energy adoption and agricultural electrification. The Indian solar water pump market was valued at around USD 145 million in 2024 and is expected to reach approximately USD 221 million by 2030, growing at a CAGR of about 7%. Another estimate places the market at INR 51.8 billion in FY24, projected to reach INR 218 billion by FY29, indicating a CAGR of nearly 33%.

Growth Drivers:

- Subsidy-led government schemes like the National Solar Pumping Programme and PM-KUSUM.

- Falling solar module prices and wider affordability of integrated pumping systems.

- Rising focus on rural energy access and sustainable irrigation.

- Expansion in inverter and energy storage technologies.

Outlook for Rotomag’s Product Mix

Rotomag Enertec operates in both high-potential sectors—industrial motors and solar energy systems. The industrial drives and gearbox market is projected to maintain a moderate growth rate of 7–8% through 2033, while the solar pumps and renewable energy products segment could grow at a faster pace of 10–33% annually during the late 2020s. With continued policy support, advances in IoT-based solutions, and increased renewable energy integration, Rotomag’s diversified portfolio is well positioned to capitalise on India’s industrial and clean energy growth trajectory.

How Will Rotomag Enertec Limited Benefit

- RotomagEnertec Limited is well positioned to benefit from India’s growing demand for industrial motors, gearboxes, and energy-efficient drive systems driven by automation and infrastructure expansion.

- The company’s focus on IoT-enabled and smart motor technologies aligns with the increasing industrial shift toward connected and intelligent machinery.

- Its early presence in the solar products segment enables it to capitalise on the accelerating adoption of solar irrigation systems and government-backed schemes such as PM-KUSUM.

- Expanding operations in inverters and energy storage systems strengthen its foothold in the renewable energy value chain.

- Rotomag’sstrong design capabilities, diversified manufacturing base, and pan-India network enhance scalability to meet rising domestic and export demand.

- With steady growth expected across industrial and solar markets, the company stands to achieve sustained revenue expansion and long-term competitive advantage in India’s evolving clean-energy ecosystem.

Peer Group Comparison

| Name of the Company | Face Value (₹ per share) | Revenue from Operations (₹ in million) | Basic EPS 2025 (₹) | Diluted EPS 2025 (₹) | P/E Ratio | RoNW (%) | NAV (₹) |

| Rotomag Enertec Limited | 1.00 | 12,649.96 | 20.10 | 16.85 | – | 27.98% | 233.50 |

| Peer Group | |||||||

| Kirloskar Brothers Limited | 2.00 | 44,922.43 | 52.29 | 52.29 | 37.81 | 19.84% | 263.55 |

| KSB Limited | 2.00 | 25,330.86 | 14.22 | 14.22 | 58.37 | 16.66% | 85.35 |

| Oswal Pumps Limited | 1.00 | 14,303.07 | 28.21 | 28.18 | 28.76 | 60.69% | 40.57 |

| Shakti Pumps (India) Limited | 10.00 | 25,162.40 | 33.97 | 33.97 | 25.27 | 35.17% | 96.59 |

| WPIL Limited | 1.00 | 18,068.87 | 13.52 | 13.52 | 31.82 | 9.62% | 140.46 |

| CG Power & Industrial Solutions Limited | 2.00 | 99,086.60 | 6.38 | 6.37 | 123.24 | 25.35% | 25.14 |

| Sona BLW Precision Forgings Limited | 10.00 | 35,460.21 | 9.92 | 9.92 | 43.20 | 10.94% | 88.38 |

| Elecon Engineering Company Limited | 1.00 | 22,269.60 | 18.50 | 18.50 | 32.46 | 20.77% | 89.07 |

| Shanthi Gears Limited | 1.00 | 6,046.20 | 12.52 | 12.52 | 44.64 | 23.83% | 52.53 |

| Igarashi Motors India Limited | 10.00 | 8,384.21 | 7.68 | 7.68 | 64.43 | 5.19% | 147.91 |

Key Strategies for Rotomag Enertec Limited

Capitalize on Industry Growth

The company intends to leverage its manufacturing strength in industrial drive and solar products to gain market share. For solar pumps, it will expand its installation network and develop digital project management tools for real-time tracking, aiming to accelerate installations and improve the receivables cycle significantly.

Enhance Product Innovation and Design

Rotomag is committed to strengthening its design-focused approach by enhancing in-house testing facilities and attracting engineering talent. The strategy involves leveraging new product development to meet diverse industrial needs, focusing on high-efficiency motors, expanding the Magnus gearbox series, and developing advanced drivetrain for EVs.

Pursue Strategic Inorganic Growth

The company plans to seek inorganic growth opportunities through strategic acquisitions and collaborations. By integrating complementary products, like those from recent inverter acquisitions, Rotomag aims to capture a larger share of customer spending, deepen technical expertise, and leverage the existing distribution network for cross-selling.

Increase Geographical and Market Penetration

The company will deepen its presence in existing markets and enter new states by adding qualified installation partners and agents for solar products. For industrial drives, Rotomag will increase its distributor network in key industrial cities and set up new service centers to enhance customer reach and responsiveness.

Focus on Digitization and Automation

Rotomag plans to prioritize the integration of digital technologies and automation across its entire value chain, from manufacturing to after-sales support. Key measures include developing project management software, remote monitoring of installed pumps, and implementing an advanced complaint management system to streamline operations.

De-leveraging and Liquidity Optimization

The company intends to repay or prepay a portion of its borrowings using the net proceeds, aiming to reduce gross debt and improve the net debt-to-equity ratio. Furthermore, utilizing funds for working capital will reduce dependence on short-term borrowings, preserve sanctioned limits, and enhance its credit profile.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Rotomag Enertec Limited IPO

How can I apply for Rotomag Enertec Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of RotomagEnertec Limited’s IPO?

The IPO comprises a fresh issue of ₹500 crore and an offer for sale of up to 2.40 crore equity shares.

Where will RotomagEnertec Limited’s shares be listed?

The equity shares are proposed to be listed on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

What type of IPO is RotomagEnertec Limited launching?

It is a Book Building Issue, combining a fresh issue of shares and an offer for sale (OFS).

What are the key objectives of the Rotomag Enertec IPO?

The proceeds will fund debenture redemption, working capital needs, and general corporate purposes.

Who are the promoters of Rotomag Enertec Limited?

The promoters include Umesh Mohan Balani, Neelam Umesh Balani, Priya Mohan Balani, and family trusts.