- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

RSB Retail India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

RSB Retail India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

RSB Retail India Limited

RSB Retail is a prominent multi-format retail company catering to various income groups, including premium, mid-premium, and value segments. Its diverse store formats feature multi-brand outlets for men, women, and children, exclusive ethnic wear stores, and large hypermarkets. The company offers a wide range of ethnic, casual, and formal wear, making it a leading retailer in Telangana and Andhra Pradesh. As of March 31, 2025, RSB Retail operates 73 stores across 22 cities in three South Indian states, including formats like R.S. Brothers and South India Shopping Mall.

RSB Retail India Limited IPO Overview

RSB Retail India Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on August 14, 2025, aiming to raise funds through an Initial Public Offer (IPO). The IPO is a Book Build Issue, consisting of a fresh issue worth ₹500 crore and an offer for sale (OFS) of up to 2.99 crore equity shares. The company plans to list its equity shares on both NSE and BSE. Motilal Oswal Investment Advisors Ltd. is the book running lead manager, while Kfin Technologies Ltd. will act as the registrar. The IPO details, including dates, price band, and lot size, are yet to be announced. The promoters of the company include Potti Venkateswarlu, Seerna Rajamouli, Tiruveedhula Prasada Rao, and others, with the promoter holding pre-issue standing at 100%.

RSB Retail India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹500 crore |

| Offer for Sale (OFS) | 2.99 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 28,38,50,000 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

RSB Retail India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

RSB Retail India Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.68 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 22.85% |

| Net Asset Value (NAV) | ₹16.10 |

| Return on Equity (RoE) | 25.83% |

| Return on Capital Employed (RoCE) | 28.95% |

| EBITDA Margin | 13.88% |

| PAT Margin | 3.84% |

| Debt to Equity Ratio | 2.35 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in part or full, of certain loan facilities availed by our Company | 2750 |

| Setting up of new stores under the formats of “R. S. Brothers” and “South India Shopping MallSetting up of new stores under the formats of “R. S. Brothers” and “South India Shopping Mall | 1181.81 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

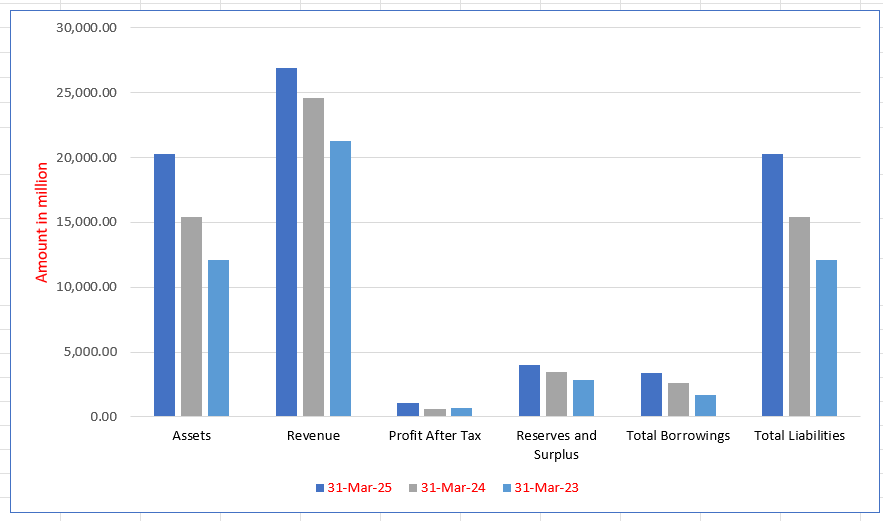

RSB Retail India Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 20,233.33 | 15,376.68 | 12,067.84 |

| Revenue | 26,939.44 | 24,579.91 | 21,267.19 |

| Profit After Tax | 1,044.21 | 616.74 | 678.21 |

| Reserves and Surplus | 4,001.23 | 3,435.97 | 2,811.52 |

| Total Borrowings | 3,350.32 | 2,601.09 | 1,666.81 |

| Total Liabilities | 20,233.33 | 15,376.68 | 12,067.84 |

Financial Status of RSB Retail India Limited

SWOT Analysis of RSB Retail India IPO

Strength and Opportunities

- Strong multi-format retail presence across South India

- Diverse product range including ethnic, casual, and formal wear

- Established brand with a loyal customer base

- Leading player in Telangana and Andhra Pradesh

- Wide range of exclusive store formats

- Robust financial growth with increasing revenue

- Strong online and offline sales channels

- Expanding store network across multiple cities

- Strategic partnerships with top retail brands

- Ability to cater to diverse income segments

Risks and Threats

- Limited presence outside South India

- Intense competition in the retail sector

- Reliance on regional markets

- Vulnerability to changes in consumer preferences

- Fluctuations in raw material prices

- Potential supply chain disruptions

- High operational costs

- Economic slowdown affecting retail consumption

- Risk of inventory mismanagement

- Vulnerability to inflation and rising costs

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About RSB Retail India Limited

RSB Retail India Limited IPO Strengths

Diverse Multi-Format Presence

RSB Retail India Limited has a strong customer proposition supported by a diversified presence across multiple store formats. The company operates multi-brand outlets, such as R.S. Brothers and South India Shopping Mall, which serve as one-stop destinations for the entire family. It also has exclusive stores like Kanchipuram Narayani Silks and Dè Royal for premium, traditional ethnic wear.

Strategic Store Locations and In-House Sourcing

The company operates 73 stores across 22 cities in Andhra Pradesh, Telangana, and Karnataka, with locations chosen based on customer demographics. Its in-house sourcing team and central warehouse in Hyderabad help ensure consistent product quality and efficient inventory management, while a fleet of 36 vehicles supports the seamless transportation of apparel to stores.

Market Leadership in Southern India

RSB Retail is a leading multi-format retailer in Telangana and Andhra Pradesh. With a comprehensive footprint of 73 stores as of March 31, 2025, the company is well-positioned to capitalize on the industry’s shift from unorganized to organized retail. It is one of the few regional players with a presence across value, large-format, and dedicated ethnic wear stores.

Consistent Financial Growth

The company’s business model has delivered consistent financial growth, with revenue from operations increasing at a compound annual growth rate (CAGR) of 12.55% from Fiscal 2023 to Fiscal 2025, reaching ₹26,939.44 million. This growth is driven by increasing customer numbers, higher sales, and an expanding store network, attracting new customers and retaining existing ones.

Experienced Leadership and Management

RSB Retail’s operations are led by its promoters, who have been instrumental in expanding the company’s footprint to 73 stores. The promoters are supported by an experienced senior management team with diverse expertise in commercial strategy, sales, finance, and human resources. This leadership ensures effective operational oversight, long-term strategic direction, and a strong foundation for future business growth.

More About RSB Retail India Limited

RSB Retail India Limited is a prominent multi-format retailer catering to diverse customer segments, including premium, mid-premium, and value shoppers. The company operates through various store formats, such as multi-brand outlets for men, women, and children, exclusive ethnic wear stores, and hypermarkets. The product portfolio includes ethnic wear, casual wear, and formal wear, designed to meet the evolving preferences of a wide range of customers.

History and Expansion

Founded in 2008, RSB Retail traces its roots to 1999, when its promoters opened the first R.S. Brothers store in Koti, Hyderabad. Initially offering ethnic and casual clothing, the company’s growth led to the launch of South India Shopping Mall in 2010, providing a one-stop shopping solution for middle and upper-middle-class customers. Today, RSB Retail operates a robust portfolio of stores designed to cater to family shopping needs, offering a variety of products across all price points.

Store Formats and Geographic Reach

RSB Retail focuses on a cluster approach, establishing stores in specific regions to achieve operational efficiency and increase brand recognition. As of March 31, 2025, the company operates 73 stores across 22 cities in three South Indian states, with plans for further expansion. The store formats include:

- R.S. Brothers: Serving mid-premium customers.

- South India Shopping Mall: Targeting premium customers.

- Value Zone Hyper Mart: Providing value-for-money products.

- Dè Royal: Catering to exclusive customers.

- Ethnic Destination and Status Exclusive Men’s Wear: Acquired in 2024.

The company has expanded its geographical footprint beyond Telangana and Andhra Pradesh into Karnataka, with one Dè Royal store launched in Bengaluru in 2024.

Product Portfolio and Revenue Generation

RSB Retail’s revenue from operations spans across its diverse store formats, with significant contributions from South India Shopping Mall (68%) and R.S. Brothers (21%). The company’s in-house brands, which include 13 exclusive labels, support its strategy of offering differentiated products across various categories. As of March 31, 2025, the company has partnered with 107 job-workers and 3,888 suppliers, ensuring a wide selection of apparel and minimizing dependency on any single supplier.

Industry Outlook

The Indian retail industry is one of the fastest-growing sectors, driven by rapid urbanization, increasing disposable incomes, and changing consumer preferences. With a projected compound annual growth rate (CAGR) of 9-10% from 2023 to 2028, the sector is expected to reach ₹77 trillion by 2028. The retail market is evolving, with a shift toward organized retail formats, including multi-brand outlets, hypermarkets, and exclusive brand stores, which are well-positioned to cater to diverse consumer segments.

Key Growth Drivers:

- Urbanization & Growing Middle-Class: The rise in urban populations and a burgeoning middle class is expanding the consumer base, driving demand for diverse product offerings in fashion, lifestyle, and daily essentials.

- Technological Integration: E-commerce growth, mobile shopping, and the integration of technology in brick-and-mortar stores are enhancing the retail experience, broadening the customer reach.

- Changing Consumer Preferences: A growing preference for branded, quality products, especially ethnic, casual, and formal wear, is pushing retailers to expand their offerings.

- Government Initiatives: Policies like ‘Make in India’ and ‘Atmanirbhar Bharat’ are boosting domestic manufacturing, fostering a supportive environment for retailers.

Outlook for Apparel Retail:

Apparel, a key component of the retail sector, is expected to continue its growth trajectory. The Indian apparel market, valued at ₹6 trillion in 2023, is forecasted to grow at a CAGR of 10-12% over the next five years. Ethnic wear, casual, and formal wear categories are expected to see the highest demand due to rising fashion consciousness, especially in regions like South India, where brands like RSB Retail have a strong presence.

With increased consumer spending on clothing, retailers offering a mix of affordable, trendy, and quality products are poised for continued success.

How Will RSB Retail India Limited Benefit

- As the retail sector expands, RSB Retail will benefit from the increasing demand for diverse fashion products across various income segments.

- With the growth of urbanization and the middle class, RSB Retail’s presence in South India positions it well to tap into a broader consumer base.

- Technological advancements in e-commerce and in-store experiences will allow RSB Retail to enhance its customer reach and convenience, boosting both offline and online sales.

- The growing preference for branded ethnic, casual, and formal wear aligns with RSB Retail’s product offerings, providing opportunities for increased market share.

- The continued rise in consumer spending on clothing, particularly in South India, presents a favorable environment for RSB Retail’s growth.

- Government initiatives like “Make in India” could further support RSB Retail’s expansion by facilitating local sourcing and reducing dependency on imports.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (in ₹ million) | EPS (₹) | NAV (₹) | P/E | RONW (%) |

| RSB Retail India Limited | 2 | 26,939.44 | 3.68 | 16.10 | NA | 22.85% |

| V2 Retail Limited | 10 | 18,844.95 | 20.83 | 100.11 | 82.91 | 20.80% |

| V-Mart Retail Limited | 10 | 32,538.60 | 5.78 | 102.08 | 132.03 | 5.65% |

| Baazar Style Limited | 5 | 13,437.13 | 2.02 | 54.12 | 153.09 | 3.63% |

| Sai Silks (Kalamandir) Limited | 2 | 14,620.10 | 5.80 | 76.81 | 29.22 | 7.54% |

| Shoppers Stop Limited | 5 | 46,276.40 | 0.99 | 29.18 | 527.53 | 3.39% |

| Aditya Birla Fashion and Retail Ltd. | 10 | 73,547.30 | (3.53) | 55.83 | NA | (9.16%) |

| Trent Limited | 15 | 171,346.10 | 43.51 | 157.06 | 125.12 | 27.48% |

| Vishal Mega Mart Limited | 10 | 107,163.45 | 1.40 | 13.92 | 104.45 | 9.87% |

| Avenue Supermarts Limited | 10 | 593,580.50 | 41.61 | 329.27 | 100.83 | 12.64% |

Key Strategies for RSB Retail India Limited

Expanding Market Share and Network

RSB Retail India Limited plans to enhance brand presence and expand its reach in Tier I and II cities across Telangana and Andhra Pradesh. By reducing dependence on Hyderabad, the company aims to diversify revenue streams and increase market share, with potential expansion into Tamil Nadu and Maharashtra. The company is set to open 14 new stores in the next three years, which will drive growth and facilitate revenue diversification through new formats.

Improving Operational Efficiencies

RSB Retail focuses on optimizing its operations by strengthening relationships with suppliers and job workers, improving commercial terms, and using technology for automation. Incorporating AI and machine learning for better demand forecasting will enhance inventory planning and customer trends analysis. The company also plans to diversify its product offerings, improving margins through economies of scale, reducing costs, and boosting sales volume.

Growing Private Label Brands

RSB Retail aims to further grow its private label brands, which already contribute a significant portion to revenue. With 13 private label apparel brands, including Adam Parker and Republican, the company will continue to introduce new products and increase the sales contribution. Private label revenue has increased consistently and is expected to further grow through expanded SKU offerings and exclusive store formats for these brands.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On RSB Retail India Limited IPO

How can I apply for RSB Retail India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of RSB Retail India Limited's IPO?

RSB Retail India Ltd. is raising funds through a fresh issue of ₹500 crores and an offer for sale (OFS) of up to 2.99 crore equity shares.

What will the IPO proceeds be used for?

The IPO proceeds will be used for repayment of loan facilities, setting up new stores, and general corporate purposes.

When is RSB Retail India Ltd.'s IPO expected to list?

The IPO is proposed to be listed on BSE and NSE, but exact listing dates are yet to be announced.

What is the face value of RSB Retail India Ltd. shares?

The face value of the shares is ₹2 per share.

What are the key details about RSB Retail India’s IPO reservation?

The IPO reserves up to 50% for Qualified Institutional Buyers (QIBs), 35% for Retail Investors, and 15% for Non-Institutional Investors (NIIs).