- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Runwal Developers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Runwal Developers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Runwal Developers Limited

Incorporated in 1988, Runwal Developers Ltd. is a real estate company engaged in residential, commercial, organized retail, and hospitality projects. With a strong presence in the Mumbai Metropolitan Region (MMR) and Pune, Maharashtra, the company focuses on lifestyle-oriented, product-driven developments. It ranks among the top 10 developers in MMR for residential units supplied between January 2022 and March 2025. As of June 30, 2025, Runwal Developers had 35 completed, 17 ongoing, and 24 upcoming projects, covering ultra-luxury to mid-income housing segments.

Runwal Developers Limited IPO Overview

Runwal Developers Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building Issue of ₹2,000.00 crore, comprising a fresh issue of shares worth ₹1,700.00 crore and an Offer for Sale (OFS) of ₹300.00 crore. The equity shares are proposed to be listed on the NSE and BSE. While MUFG Intime India Pvt. Ltd. has been appointed as the registrar of the issue, the book running lead manager is yet to be declared. Key details, including IPO dates, price band, and lot size, are also yet to be announced. For further information, refer to the Runwal Developers IPO DRHP.

The IPO will have a face value of ₹1 per share, and the sale type is a combination of fresh capital and offer for sale. The issue is structured as a bookbuilding IPO with the total issue size aggregating up to ₹2,000.00 crore, which includes a fresh issue aggregating up to ₹1,700.00 crore and an OFS of ₹300.00 crore. The shares will be listed on both BSE and NSE.

Sandeep Subhash Runwal is the promoter of the company, holding 99.15% of shares pre-IPO. Details regarding the post-issue promoter holding, IPO date, listing date, issue price band, and lot size are yet to be disclosed. The DRHP filing with SEBI was completed on September 30, 2025.

Runwal Developers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹2000 crore |

| Fresh Issue | ₹1700 crore |

| Offer for Sale (OFS) | ₹300 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 44,20,27,600 shares |

| Shareholding post-issue | TBA |

Runwal Developers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Runwal Developers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Runwal Developers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.13 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 5.32% |

| Net Asset Value (NAV) | ₹58.94 |

| Return on Equity (RoE) | 4.27% |

| Return on Capital Employed (RoCE) | 2.44% |

| EBITDA Margin | 39.80% |

| PAT Margin | 55.10% |

| Debt to Equity Ratio | 0.98 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Prepayment/repayment of certain outstanding borrowings availed by our Company and our Subsidiaries, namely (i) Runwal Construction Private Limited, (ii) Aethon Developers Private Limited, (iii) R Retail Ventures Private Limited, (iv) R Mall Developers Private Limited, and (v) Histyle Retail Private Limited, in part or full | 13000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

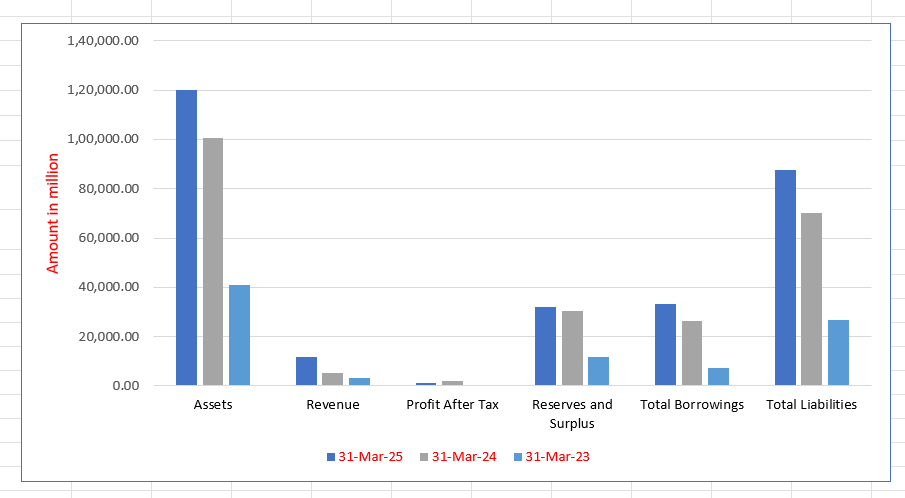

Runwal Developers Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,19,926.63 | 1,00,753.59 | 41,052.27 |

| Revenue | 11,632.34 | 5,394.38 | 3,019.54 |

| Profit After Tax | 1,373.68 | 2,036.30 | 179.28 |

| Reserves and Surplus | 31,921.38 | 30,535.70 | 11,560.66 |

| Total Borrowings | 33,114.91 | 26,207.78 | 7,356.49 |

| Total Liabilities | 87,772.95 | 69,974.81 | 26,625.96 |

Financial Status of Runwal Developers Limited

SWOT Analysis of Runwal Developers IPO

Strength and Opportunities

- Strong brand legacy and recognition in the MMR region.

- Diversified portfolio: residential, commercial, organised retail and hospitality.

- Strong project pipeline with completed, ongoing and upcoming projects.

- Ability to command pricing premium in select micromarkets.

- Growing demand for midincome and luxury housing in key markets.

- Regulatory tailwinds like improved housing affordability and policy support.

- Potential to expand into new assetlight/jointventure models leveraging land partnerships.

- Fresh listings and realestate consolidation favour organised developers.

- Scope for technology, sustainability and lifestyle driven developments to differentiate.

Risks and Threats

- Relatively small market share in the broader Mumbai Metropolitan Region despite top10 ranking.

- Heavy concentration in Maharashtra (MMR and Pune) leading to geographic concentration risk.

- High dependence on launch and execution timelines—any delay can hurt cash flows.

- Rising construction, regulatory and funding costs could squeeze margins.

- Competitive pressure from larger listed developers with deeper resources.

- Inventory risk: large current assets and workinprogress may tie up capital.

- Macroeconomic risks: realestate demand sensitive to interest rates and economic slowdown.

- Project approvals, regulatory delays or litigation in Maharashtra realestate can increase risk.

- Currency or input cost inflation (steel, cement) may increase cost base beyond control.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Runwal Developers Limited

Runwal Developers Limited IPO Strengths

Diversified Portfolio for Market Resilience

Runwal Developers Limited has a hybrid ownership model spanning retail, commercial, and scalable residential segments in MMR. This diversified portfolio provides a vital hedge against cyclical market downturns. Leased assets offer stable annuity income, while residential sales generate strong cash flows and margins, enhancing the company’s financial resilience and capacity for sustained growth.

Creating Unique Commercial and Retail Assets

The company demonstrates an ability to create marquee, experience-led assets in commercial and organized retail, such as the prominent R City Mall and R Square. These projects provide substantial and recurring rental income, which amounted to ₹ 2,673.62 million in Fiscal 2025. This stable annuity income stream helps to counterbalance the inherent cyclicality of the residential real estate market.

Robust Pipeline and Strategic Market Presence

Runwal Developers Limited maintains a robust project pipeline across residential, commercial, and retail segments in key MMR and Pune micro-markets. This extensive pipeline, coupled with a focus on urban infill and high-growth locations, provides strong future cash flow visibility. Their expertise in identifying potential land parcels also acts as a natural hedge against inflation.

Established Brand and Design-Led Premium Pricing

With a legacy of over 45 years, the “Runwal” brand is recognized for quality, customer-centricity, and design innovation. This established reputation enables the company to command premium pricing in multiple micro-markets. Furthermore, the brand’s trust allows for the effective selling of units throughout the construction phase, ensuring steady cash flows.

Proven End-to-End Project Execution Capabilities

The company has demonstrated end-to-end project execution capabilities, supported by a centralized operations system and integrated real estate development model. This robust framework, along with specialized in-house teams, ensures quality control and the timely delivery of projects. For instance, certain projects achieved completion ahead of their RERA deadlines.

Expertise in Land Acquisition and Asset-Light Models

Runwal Developers Limited possesses consistent land acquisition expertise across key MMR micro-markets. The company utilizes a hybrid acquisition model, combining outright purchases with asset-light redevelopment and Joint Development Agreements (JDAs). This strategy unlocks value, balances capital efficiency, and positions them well to scale their capital-efficient redevelopment vertical.

Seasoned Leadership and Institutional Partnerships

The company is led by a seasoned Promoter and Managing Director, Sandeep Subhash Runwal, with over three decades of industry experience, and a professional senior management team. This strong leadership is complemented by a history of successful partnerships with marquee institutional investors on major projects, reflecting the company’s strong governance and financial transparency.

More About Runwal Developers Limited

Runwal Developers Limited is a leading real estate development company with a strong focus on lifestyle-oriented projects and a diversified portfolio spanning residential, commercial, organized retail, and hospitality segments across the Mumbai Metropolitan Region (MMR) and Pune, Maharashtra. The company is recognised for delivering quality, product-driven solutions within committed timelines, and it ranks among the top 10 developers in MMR in terms of residential units supplied between January 2022 and March 2025. Additionally, it is the second largest developer in Thane during the same period.

Project Portfolio

As of June 30, 2025, Runwal Developers has:

- 35 Completed Projects

- 17 Ongoing Projects

- 24 Upcoming Projects

These projects include ultra-luxury, luxury, high-income, and mid-income residential housing, along with commercial, organized retail, and hospitality developments. The company has delivered 11.22 million square feet of real estate across its portfolio, transforming its project locations into vibrant, high-value destinations.

Residential highlights include The Residence at Nepean Sea Road, Nirvana in Parel, Elegante at Andheri, and The Reserve in Worli. Multi-tower projects include 25 Hour Life and Runwal Lands End in Thane. The commercial and retail portfolio features 2.89 million square feet of leased space, including premier developments such as R City Mall, Ghatkopar (1.23 million sq. ft.) and R Square, Andheri (1.18 million sq. ft.). Upcoming hospitality projects are planned in Worli, Thane, and Pune.

Business Model and Strategy

Runwal Developers operates a hybrid business model that includes land acquisition, redevelopment of ageing societies, and joint development agreements (JDAs) with landowners. The company also leverages asset-light strategies for redevelopment projects under the Slum Rehabilitation Authority (SRA), JDAs, and joint ventures. In-house capabilities cover the entire project lifecycle from land acquisition and approvals to design, construction, marketing, and post-possession services, ensuring quality control and timely delivery.

Leadership and Sustainability

Founded in 1978 by Subhash Runwal, the company is led by Promoter and Managing Director Sandeep Subhash Runwal, who brings over three decades of industry experience. The senior management team comprises seasoned professionals across design, finance, marketing, and legal functions.

Runwal Developers integrates sustainability across its operations, including solar power plants, rainwater harvesting, sewage treatment, LED lighting, and smart infrastructure. The company has received awards for environment-friendly and luxury developments, reflecting its commitment to innovation, customer-centricity, and long-term value creation.

Industry Outlook

The Indian real estate sector is expected to reach a market size of around US$ 1 trillion by 2030, up from approximately US$ 200 billion in 2021. The industry is projected to grow at a compound annual growth rate of about 10.5% from 2025 to 2033, driven by urbanisation, rising incomes, and infrastructure development.

Segment Outlook – Residential, Commercial & Retail

The residential real estate segment is estimated at around US$ 399 billion in 2025 and is expected to expand to roughly US$ 639 billion by 2030, with a CAGR of approximately 9.9%. The commercial real estate market, valued at about US$ 49.8 billion in 2024, is forecast to grow to around US$ 253.3 billion by 2033, reflecting a CAGR of nearly 19.8%. Organised retail and mixeduse developments are also gaining momentum due to rising urban consumption and lifestyle-oriented demand.

Growth Drivers & Key Figures

- Rapid urbanisation and rising household incomes driving residential demand

- Regulatory clarity under RERA and growing institutional investment enhancing investor confidence

- Expansion of IT/ITeS, global capability centres, and flexible workspace models boosting commercial demand

- Infrastructure projects and urban development supporting overall growth

- Residential launches in major cities projected at several hundred million square feet

- Commercial leasing absorption in top metros crossing tens of million square feet

Outlook for Developers & Products

Developers engaged in residential (ultra-luxury to mid-income), commercial offices, and organised retail assets have strong growth opportunities. Residential demand is expected across income segments, while commercial and retail projects will attract institutional investment and lifestyle-focused demand. Developers with diversified portfolios, strong execution capabilities, and presence in key growth corridors are well positioned to benefit from the robust industry outlook.

How Will Runwal Developers Limited Benefit

- Runwal Developers Limited is well positioned to capitalise on the growing residential demand across ultra-luxury, luxury, high-income, and mid-income segments in key urban corridors.

- Expansion in commercial and organised retail sectors allows the company to generate recurring rental income from premium office spaces and high-footfall retail destinations.

- A diversified portfolio across residential, commercial, retail, and upcoming hospitality projects mitigates risks associated with cyclical downturns in any single segment.

- Strong presence in Mumbai Metropolitan Region and Pune gives access to high-growth urban markets with increasing housing and office space requirements.

- Expertise in mixed-use developments and joint development agreements enhances capital efficiency and long-term value creation.

- Sustainable and technology-driven project execution strengthens brand reputation and appeals to environmentally conscious buyers and investors.

- Established relationships with institutional investors and banks provide financial flexibility for large-scale project development and timely execution.

- Proven track record in delivering quality projects within committed timelines reinforces customer trust and supports repeat business.

- Expansion into upcoming hospitality projects aligns with rising demand for lifestyle-focused and integrated real estate offerings.

Peer Group Comparison

| Name of the Company | Revenue (₹ million) | Face Value (₹) | EPS Basic (₹) | EPS Diluted (₹) | Return on Net Worth (%) | NAV per Share (₹) | P/E (x) |

| Runwal Developers Limited | 11,632.34 | 13.13 | 3.13 | 3.13 | 5.32% | 58.94 | N.A |

| Peer Group | |||||||

| Kalpataru Limited | 22,216.20 | 10 | 1.54 | 1.54 | 1.02% | 126.79 | 247.40 |

| Oberoi Realty Limited | 52,862.75 | 10 | 61.21 | 61.21 | 14.32% | 427.28 | 26.12 |

| Macrotech Developers Limited | 1,37,795.00 | 10 | 27.76 | 27.67 | 13.95% | 198.57 | 41.54 |

| Godrej Properties Limited | 49,228.40 | 5 | 49.02 | 49.0 | 8.17% | 569.17 | 40.15 |

| Sunteck Realty Limited | 8,531.34 | 10 | 10.26 | 10.26 | 6.18% | 166.16 | 41.17 |

| Keystone Realtors Limited | 20,041.00 | 10 | 13.85 | 13.71 | 6.23% | 219.05 | 44.27 |

| Prestige Estates Projects Limited | 73,494.00 | 10 | 11.19 | 11.19 | 3.03% | 357.67 | 136.68 |

Key Strategies for Runwal Developers Limited

Investing in Sustainability and Technology

The company is committed to integrating sustainability and technology to future-proof its business and enhance customer experience. This includes commissioning two solar power plants (12.00 MW total capacity) by Fiscal 2026 to power commercial projects and leveraging digital platforms like Salesforce CRM with SAP integration for seamless operations and customer support.

Scaling Footprint through Strategic Acquisitions

Runwal Developers Limited plans to pursue inorganic growth by selectively acquiring land and properties, utilizing methods like joint ventures, stake purchases, and NCLT-approved schemes. The strategy targets pre-developed or high-potential assets to accelerate revenue, shorten time-to-market, and strengthen their presence across residential, commercial, organized retail, and hospitality segments.

Expansion of Redevelopment Vertical

Runwal Developers Limited plans to scale its asset-light redevelopment vertical across the MMR. This strategy focuses on unlocking value from aging housing societies by transforming them into modern, high-density developments. By focusing on redevelopment, the company eliminates land acquisition costs, leading to improved project economics and faster scaling in land-scarce Mumbai.

Focus on Mixed-Use and Lifestyle Developments

The company intends to enhance its project portfolio by focusing on mixed-use and lifestyle-oriented developments. This approach complements their existing residential, commercial, and retail verticals. The goal is to maximize project value through better annuity income and asset appreciation by creating integrated spaces that cater to evolving consumer preferences for community-centric living.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Runwal Developers Limited IPO

How can I apply for Runwal Developers Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Runwal Developers Limited IPO?

Runwal Developers IPO is a book-built public offering to raise ₹2,000 crore through fresh issue and OFS.

When will the Runwal Developers IPO open and list?

The IPO and listing dates are yet to be announced by the company and SEBI.

What is the size and structure of the IPO?

The IPO includes a fresh issue of ₹1,700 crore and an offer for sale of ₹300 crore.

Where will Runwal Developers shares be listed?

The equity shares are proposed to be listed on NSE and BSE.

What will the IPO proceeds be used for?

Proceeds will repay borrowings and fund general corporate purposes of the company and subsidiaries.