- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Runwal Enterprises IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Runwal Enterprises IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Runwal Enterprises Limited

Runwal Enterprises, part of the renowned Runwal Group founded in 1978 by Mr. Subhash Runwal, is a prominent real estate developer with a strong presence in Mumbai. The company operates across the full spectrum of real estate, including affordable, mid-income, and luxury residential projects, as well as commercial spaces, malls, and educational buildings. Their operations span land acquisition, planning, execution, marketing, and sales. As of September 30, 2024, they are developing a total of 28.53 million sq. ft. across various Mumbai suburbs, aiming to build inclusive communities with diverse amenities.

Runwal Enterprises Limited IPO Overview

Runwal Enterprises is set to launch its IPO through a bookbuilding process, with a total issue size aggregating up to ₹1,000.00 crores, entirely comprising a fresh issue of shares. The IPO dates, price band, lot size, and listing date are yet to be announced. ICICI Securities Limited and Jefferies India Private Limited are acting as the book running lead managers, while Link Intime India Private Ltd serves as the registrar. The IPO will be listed on both BSE and NSE. As per the DRHP filed with SEBI on April 3, 2025, the face value of each share is ₹2. Prior to the issue, the company’s shareholding stands at 14,34,52,930 shares, with promoter Subodh Subhash Runwal holding 87.16%. Post-issue shareholding details will reflect equity dilution based on allotment.

Runwal Enterprises Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹1000 crores

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹2 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 14,34,52,930 shares |

| Shareholding post -issue | TBA |

Runwal Enterprises Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Runwal Enterprises Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Runwal Enterprises Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 8.69 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 26.69% |

| Net Asset Value (NAV) | 32.55 |

| Return on Equity | – |

| Return on Capital Employed (ROCE) | – |

| EBITDA Margin | 28.25% |

| PAT Margin | 1.68% |

| Debt to Equity Ratio | 1.68 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment or prepayment, in full or part, of certain outstanding borrowings availed by our Company | 2000 |

| Investment in our Material Subsidiaries namely Susneh Infrapark Private Limited and Runwal Residency Private Limited and our Subsidiary namely Evie Real Estate Private Limited, for repayment/pre-payment, in full or in part, of all or a portion of certain of their outstanding borrowings | 4500 |

| Funding acquisition of future real estate projects and general corporate purposes | [●] |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

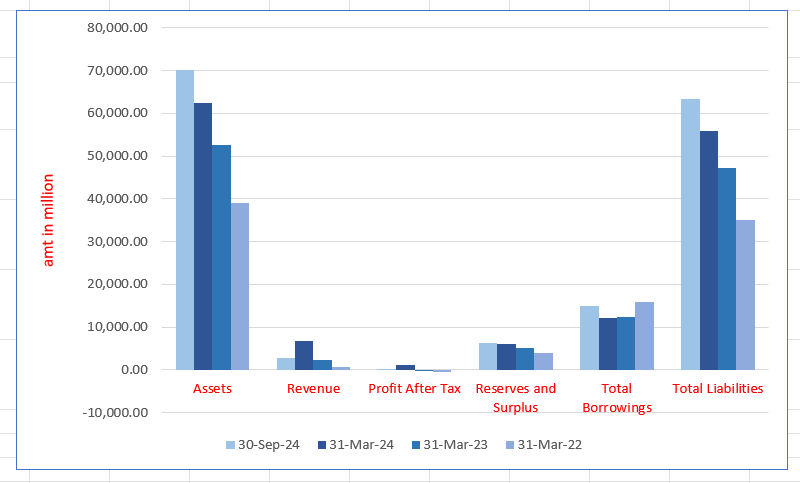

Runwal Enterprises Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 70,028.11 | 62,404.84 | 52,507.42 | 38,980.76 |

| Revenue | 2705.17 | 6621.93 | 2294.86 | 613.60 |

| Profit After Tax | 255.26 | 1072.80 | (67.39) | (509.92) |

| Reserves and Surplus | 6340.95 | 6062.11 | 4983.58 | 4019.55 |

| Total Borrowings | 14,978.27 | 12,056.27 | 12,282.28 | 15,745.09 |

| Total Liabilities | 63,302.69 | 55,935.14 | 47,102.55 | 35,046.20 |

Financial Status of Runwal Enterprises Limited

SWOT Analysis of Runwal Enterprises IPO

Strength and Opportunities

- Established brand presence in Mumbai.

- Strong pipeline of ongoing and upcoming projects.

- Expertise in developing large townships.

- Ability to sell at premium pricing.

- Focus on sustainable development.

- Experienced leadership and financial partners.

- Diverse portfolio including residential, commercial, and retail spaces.

- Strategic partnerships for project execution.

- Consistent ranking among top developers in Mumbai.

- Strong visibility of future cash flows.

Risks and Threats

- High dependency on Mumbai market.

- Risks from economic and regulatory changes.

- Delays in project completion affecting reputation.

- Cost overruns impacting financial stability.

- Unsold inventory affecting cash flow.

- Losses incurred in previous fiscal years.

- Competition from other real estate developers.

- Market fluctuations impacting demand.

- Uncertainty in IPO performance and investor confidence.

- Vulnerability to natural disasters affecting Mumbai real estate.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Runwal Enterprises Limited IPO Strengths

A Trusted Name in Mumbai’s Residential Real Estate

Runwal Enterprises Limited, a leading real estate developer in Mumbai, ranks second in new launches and sales (5.69% and 5.25%) from January 2019 to September 2024. With 10 completed, 15 ongoing, and 18 upcoming residential projects, the company has launched over 20,700 units and sold approximately 15,679, strengthening its legacy of trust, quality, and innovation.

Robust Pipeline of Projects Ensures Strong Future Cash Flows

Runwal Enterprises Limited has a strong pipeline with ongoing projects covering 17.39 million sq. ft. and upcoming projects spanning 28.92 million sq. ft. across Mumbai’s key suburbs. Expanding from affordable and mid-income to luxury segments, the company benefits from major infrastructure upgrades like metro lines and coastal roads, enhancing connectivity and boosting demand near developments such as Runwal Gardens and Runwal Bliss.

Ability to Command Premium Pricing and Maintain Sales Throughout Construction

Runwal Enterprises Limited leverages its strong brand reputation to command premium pricing in key Mumbai micro markets like Kanjurmarg and Mulund, reflecting shifting buyer preferences toward trusted developers post-pandemic. The company consistently sells a significant portion of its projects’ saleable area during construction, with some projects achieving up to 90% sales before occupancy certificates, underscoring robust demand and lender confidence.

Core Competency in Large-Scale Integrated Township Development

Runwal Enterprises Limited excels in developing expansive townships that seamlessly integrate residential, educational, commercial, and recreational facilities. With landmark projects like Runwal Bliss and Runwal Avenue in Mumbai, and the 250-acre Runwal Gardens township, the company delivers comprehensive, self-contained living environments. Supported by strong in-house expertise and strategic partnerships, Runwal consistently executes projects efficiently, enhancing lifestyle convenience and community living.

Strong Focus on Sustainable Development

Runwal Enterprises Limited is deeply committed to sustainable development, integrating economic, social, and environmental principles across its projects. Their eco-friendly initiatives include renewable energy, water conservation, and extensive greenery like Miyawaki forests. Projects such as Runwal Gardens and Runwal Bliss exemplify this commitment, earning prestigious safety and sustainability awards while promoting long-term growth and stakeholder trust.

Experienced Promoter, Qualified Senior Management, and Credible Financial Partners

Runwal Enterprises Limited is led by Managing Director Subodh Subhash Runwal, with over 29 years in real estate and strong industry involvement. The professional senior management team brings extensive expertise, supported by reputed banks like ICICI and Kotak Mahindra, and financial partners such as Piramal Capital. Strategic investments and loans ensure smooth project execution and sustained growth.

More About Runwal Enterprises Limited

Runwal Enterprises Limited is a prominent real estate developer with a diversified portfolio spanning the entire real estate spectrum. The company specialises in residential developments—ranging from affordable and mid-income to luxury housing—as well as commercial complexes, retail malls, and educational institutions. With a strong brand presence and deep-rooted operations in Mumbai, the company is widely recognised in the industry.

Market Position and Performance

According to a JLL Report, as of September 30, 2024:

- Runwal ranks second in Mumbai for both new project launches and sales from January 2019 to September 2024, with respective market shares of 5.69% and 5.25%.

- Mumbai led among India’s top seven real estate markets, contributing:

- 26% of overall sales

- 30% of new launches

- 34% of residential sales value

Dominance in Key Submarkets

- Eastern Suburbs (Mulund, Vikhroli, Ghatkopar, etc.):

- 1st in new launches and sales

- Market share: 9.84% (launches), 11.40% (sales)

- Kalyan-Dombivli Region:

- Top-ranked developer

- Market share: 17.63% (sales), 20.84% (launches)

Project Portfolio

As of September 30, 2024:

- 15 Completed Projects

- 25 Ongoing Projects

- 32 Upcoming Projects

- Total Developable Area: 57.44 million sq. ft.

- Residential: 48.71 million sq. ft.

- Affordable: 30.39 million sq. ft.

- Mid-income: 15.49 million sq. ft.

- Luxury: 2.84 million sq. ft.

- Non-residential: 8.73 million sq. ft.

Strategic Approach and Legacy

Established in 1978 under the Runwal Group by Subhash Runwal, the current entity was formed in 2016 under Subodh Subhash Runwal. The company follows a comprehensive five-step development model—from land acquisition and approvals to execution, marketing, and sales—leveraging both in-house and external expertise.

Additionally, Runwal is exploring asset-light models through joint ventures and JDAs, exemplified by the 7 Mahalaxmi luxury residential project with a 50% profit share.

Industry Outlook

India’s real estate sector is poised for significant expansion in 2025, driven by urbanization, rising incomes, and supportive government policies.

- Market Size: Projected to reach USD 332.85 billion in 2025, with expectations to grow to USD 985.80 billion by 2030.

- CAGR: Estimated at 24.25% from 2025 to 2030.

- GDP Contribution: Anticipated to increase from 7.3% to 15.5% by 2047.

Residential Real Estate Outlook

- Market Size: Expected to reach USD 283.55 billion in 2025 and grow to USD 857.40 billion by 2030.

- CAGR: Projected at 24.77% during 2025–2030.

Growth Drivers:

- Increasing urbanization and a burgeoning middle class.

- Government initiatives like Pradhan Mantri Awas Yojana (PMAY) promoting affordable housing.

- Rising demand for luxury housing among high-net-worth individuals and NRIs.

Commercial Real Estate Outlook

- Market Size: Projected to reach USD 106.05 billion by 2029.

- CAGR: Estimated at 21.10% from 2025 to 2029.

Growth Drivers:

- Expansion of office spaces, retail, and warehousing segments.

- Hybrid work models increasing demand for flexible office solutions.

- Growth of e-commerce boosting warehousing and logistics real estate.

Key Growth Drivers

- Urbanization: Rapid urban migration increasing demand for housing and commercial spaces.

- Government Policies: Tax reliefs and incentives enhancing disposable income and promoting homeownership.

- Foreign Direct Investment (FDI): Increased FDI inflows supporting sector growth.

- Infrastructure Development: Improved connectivity and infrastructure projects boosting real estate demand

How Will Runwal Enterprises Limited Benefit

- Positioned to capitalise on India’s booming real estate sector, with a projected CAGR of 24.25% through 2030.

- Strong presence in Mumbai, the leading real estate market contributing 34% of residential sales value.

- Diversified portfolio across residential, commercial, and retail sectors aligns with rising demand in all categories.

- Dominant market share in high-growth submarkets like Eastern Suburbs and Kalyan-Dombivli enhances revenue potential.

- Affordable and mid-income housing projects align with rising urbanisation and government-led housing schemes like PMAY.

- Luxury segment expansion supports increasing interest from HNIs and NRIs.

- Commercial and retail projects benefit from hybrid work trends and retail sector revival.

- Joint development models reduce capital burden while expanding footprint strategically.

- Backed by a legacy of over four decades and efficient development processes, ensuring timely project delivery.

- Large pipeline of 32 upcoming projects across 57.44 million sq. ft. to leverage future sectoral growth.

Peer Group Comparison

| Name of the Company | Revenue

(₹ million) |

Face Value per (₹) | P/E (x) | EPS (₹) | RoNW (%) | NAV (₹) |

| Runwal Enterprises Limited* | 6,621.93 | 2 | N.A. | 8.69 | 26.69 | 32.55 |

| Peer Groups | ||||||

| Oberoi Realty Limited | 44,957.90 | 10 | 30.78 | 52.99 | 13.92 | 380.76 |

| Macrotech Developers Limited | 1,03,161.00 | 10 | 75.66 | 16.03 | 8.87 | 175.67 |

| Godrej Properties Limited | 30,356.20 | 52 | 81.99 | 26.09 | 7.26 | 359.39 |

| Sunteck Realty Limited | 5,648.47 | 1 | 80.00 | 4.99 | 2.27 | 213.28 |

| Keystone Realtors Limited | 22,222.50 | 10 | 56.33 | 9.85 | 6.24 | 157.85 |

| Prestige Estates Projects Limited | 78,771.00 | 10 | 35.67 | 34.28 | 12.17 | 281.61 |

Key Strategies for Runwal Enterprises Limited

Continued Focus on Mumbai

Runwal Enterprises Limited concentrates its real estate development in Mumbai, leveraging high entry barriers like limited land and capital access. With completed projects in central suburbs, it is expanding into South Mumbai and western suburbs, supported by infrastructure projects such as the Mumbai Metro and Navi Mumbai Airport, enhancing connectivity and real estate demand in the region.

Asset-Light Growth through Redevelopment and Joint Ventures

Faced with scarce land and rising prices, Runwal pursues asset-light growth via redevelopment, joint ventures, and joint development agreements. Redevelopment maximizes land use and reduces upfront costs by compensating homeowners. Current projects, like the Mahalaxmi JDA, exemplify this approach, enhancing financial flexibility and enabling expansion while leveraging its execution and marketing strengths.

Balanced Residential Focus with Selective Mixed-Use Development

Runwal continues to target affordable and mid-income residential sectors while expanding into luxury markets reflecting evolving customer needs. It selectively develops retail and commercial spaces within mixed-use projects, fostering integrated communities. Additionally, the company grows its annuity income through commercial leasing and hospitality, while exploring suburban plotted developments supported by improving infrastructure connectivity.

Expansion of IT-Driven Processes

Runwal is building a digital ecosystem for customers, partners, employees, and management. It is upgrading customer applications and portals, streamlining vendor interactions, and implementing centralized dashboards for leadership. Utilizing Salesforce and SAP, the company enhances data management and analytics, improving operational efficiency and predictive capabilities across its operations.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Runwal Enterprises Limited IPO

How can I apply for Runwal Enterprises Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size and structure of the Runwal Enterprises IPO?

The IPO comprises a fresh issue of ₹1,000 crore with no offer-for-sale component.

How will the IPO proceeds be utilized?

Funds will be used for debt repayment, investments in subsidiaries, project acquisitions, and general corporate purposes.

Is there a pre-IPO placement option?

Yes, a pre-IPO placement of up to ₹200 crore may reduce the fresh issue size accordingly.

What is the allocation structure for different investor categories?

Allocation: at least 75% to QIBs, up to 15% to NIIs, and at least 10% to retail investors.

Who are the lead managers and where will the shares be listed?

ICICI Securities andJefferies India are lead managers; shares will list on BSE and NSE.