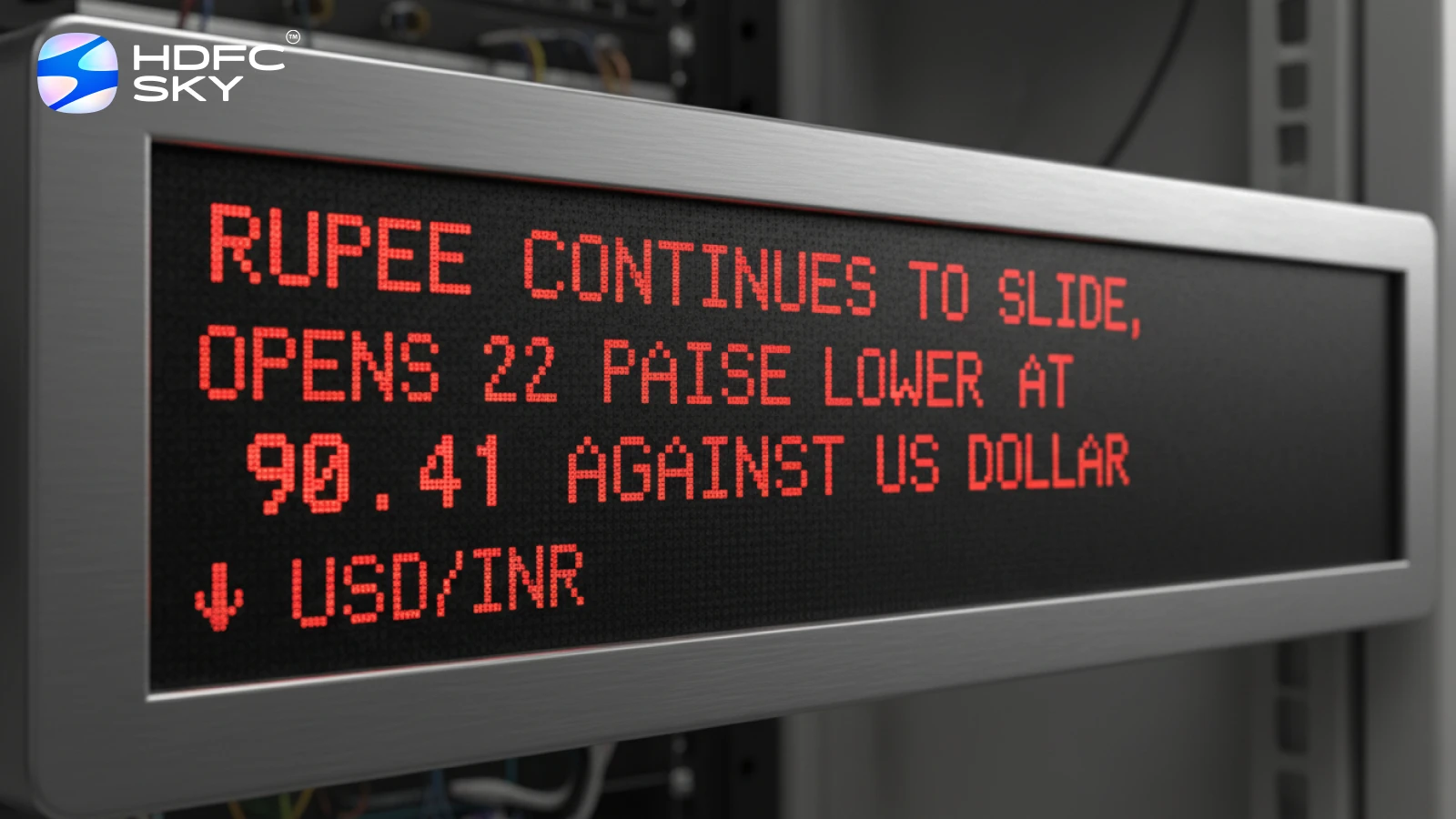

Rupee Continues to Slide, opens 22 Paise Lower At 90.41 Against the US Dollar

By Shishta Dutta | Updated at: Dec 4, 2025 05:12 PM IST

Thursday, December 4, 2025: The Indian rupee maintained the same downward trend today and opened 22 paise down or 90.41 against the US dollar. This is after breaching the 90 mark in the last session and closing at 90.19 for the first time. The continuous weak signalling is an indication that there is continued pressures on the domestic currency against the external uncertainty and historically sustained equity outflows.

Constant Outflows and Trade Deal Uncertainty Pile Pressure

The market players observed that the renewed weakness of the rupee is attributed to the constant outflow of foreign equity and also the uncertainty about the India US trade deal. The two factors took a heavy toll on the sentiment of investors hampering demand of the rupee currency pushing it to unknown territories. As the risk appetite in the global market persistently remains weak, the rupee will experience even more head winds in the near future.

Low RBI Intervention Increases Policy Expectations

The RBI has also played a limited role which has made the currency slide. The central bank is acting in the foreign exchange market only in limited measures, thereby not creating any massive impact in the money flow. The low profile stance has led to speculation that the RBI might be about to make a major pronouncement in its next monetary policy review on December 5. Market watchers believe that the central bank will admit the rapid depreciation of the rupee but avoid giving specific currency level directions.

Short Term Forecasts Continue to Impact the Rupee Value

Currency analysts feel that the rate might continue to have a bias towards the 90.70 to 91 zone since international issues and internal forces will keep shaping the market forces. The changing geopolitical scenario and the trend in global interest rates is likely to be important in dictating the way the rupee will move in the next few weeks.

Disclaimer: At HDFC SKY, we take utmost care and due diligence in curating and presenting news and market-related content. However, inadvertent errors or omissions may occasionally occur.

If you have any concerns, questions, or wish to point out any discrepancies in our content, please feel free to write to us at content@hdfcsec.com.

Please note that the information shared is intended solely for informational purposes and does not make any investment recommendations