- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sael Industries IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sael Industries IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sael Industries Limited IPO

Sael Industries Limited is a prominent integrated renewable energy independent power producer (IPP) in India. With a robust portfolio spanning solar power projects and agri waste-to-energy (AgWTE) plants, the company boasts a total contracted and awarded capacity of 5,765.70 MW. It possesses in-house Engineering, Procurement & Construction (EPC) and Operations & Maintenance (O&M) capabilities, ensuring end-to-end project control. A pioneer in the AgWTE sector, Sael effectively addresses the critical issue of stubble burning while generating clean, reliable power, showcasing a strong commitment to environmental sustainability and a diversified energy portfolio.

Sael Industries Limited IPO Overview

Sael Industries Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on 3 November 2025, marking the first step toward launching its Initial Public Offer (IPO). The company plans to raise ₹4,575 crore through a Book Build Issue, which includes a fresh issue of ₹3,750 crore and an offer for sale (OFS) worth ₹825 crore. The equity shares are proposed to be listed on both the NSE and BSE. ICICI Securities Ltd. has been appointed as the book-running lead manager, while Kfin Technologies Ltd. will serve as the registrar for the issue. Important information such as IPO dates, price band and lot size is still awaited. For more detailed disclosures, investors can refer to the Sael Industries IPO DRHP.

According to the DRHP, the IPO will have a face value of ₹5 per share, and the issue type will follow the bookbuilding route. The total issue size will aggregate up to ₹4,575 crore, comprising both the fresh issue and OFS components. Details regarding the exact number of shares in each segment are yet to be announced. The sale type is categorised as Fresh Capital-cum-Offer for Sale, and the shares will be listed on the BSE and NSE once the issue is finalised. Before the IPO, the company’s shareholding stands at 1,28,32,11,722 shares.

The DRHP also indicates that the filing with SEBI was completed on 3 November 2025. Sael Industries Ltd.’s promoters include Jasbir Singh, Sukhbir Singh and Laxit Awla. The promoter holding before the issue stands at 99.16%, while the post-issue holding will be updated once final details are disclosed.

Sael Industries Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Shares aggregating up to ₹4,575.00 Cr |

| Fresh Issue | Shares aggregating up to ₹3,750.00 Cr |

| Offer for Sale (OFS) | Shares aggregating up to ₹825.00 Cr |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,28,32,11,722 shares |

| Shareholding post-issue | TBA |

Sael Industries IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sael Industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Sael Industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ (2.31) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | Not Calculable (Negative Net Worth) |

| Net Asset Value (NAV) | ₹ (2.32) |

| Return on Equity (RoE) | 92.98%* |

| Return on Capital Employed (RoCE) | -1.35% |

| EBITDA Margin | 19.43% |

| PAT Margin | -42.26% |

| Debt to Equity Ratio | 6.27 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are proposed to be utilized as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Investment in our Subsidiaries namely SAEL Solar P5 Private Limited and SAEL Solar P4 Private Limited for repayment/prepayment, in full or in part, of certain of their outstanding borrowings, interest accrued and prepayment penalties, as applicable. | 28,125.00 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC.

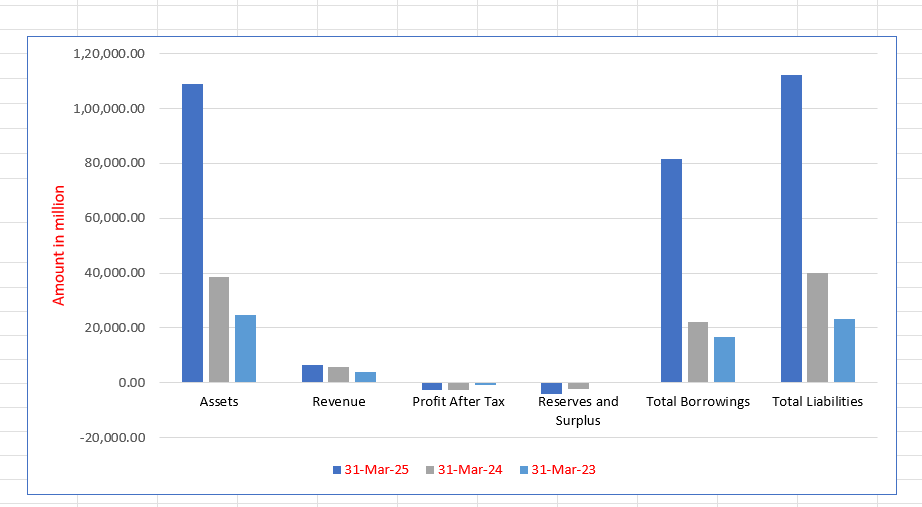

Sael Industries Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 109,172.73 | 38,526.22 | 24,711.71 |

| Revenue | 6,647.69 | 5,584.66 | 3,889.33 |

| Profit After Tax | (2,809.48) | (2,671.41) | (710.70) |

| Reserves and Surplus | (4,008.79) | (2,277.44) | 381.29 |

| Total Borrowings | 81,620.31 | 22,148.66 | 16,557.52 |

| Total Liabilities | 112,194.44 | 39,881.08 | 23,407.84 |

Financial Status of Sael Industries Limited

SWOT Analysis of Sael Industries IPO

Strength and Opportunities

- Vertically integrated business model with in-house EPC and O&M capabilities.

- Pioneer and largest operator in the Agri Waste-to-Energy sector in India.

- Diversified renewable portfolio with a strong contracted capacity base.

- Strong, creditworthy off-taker base with long-term PPAs.

- Proven track record of executing large-scale and complex projects.

- Robust capital management and access to diversified funding sources.

- Advanced technology deployment in O&M for high plant efficiency.

- Attracted equity investments from reputed global institutions like Norfund and US DFC.

- Favorable industry tailwinds driven by strong government support and India's energy needs.

- Strategic expansion plans into Round-the-Clock energy and solar cell manufacturing.

Risks and Threats

- History of net losses as visible in the financial statements.

- High leverage and a negative net worth position.

- Significant dependence on government policies and subsidies.

- Intense competition in the renewable energy IPP and manufacturing space.

- Exposure to project execution risks including land acquisition and cost overruns.

- Vulnerability to fluctuations in foreign currency exchange rates.

- Dependence on the seasonal and variable supply of agricultural residue for AgWTE.

- Regulatory changes in tariffs, ALMM, and renewable purchase obligations.

- Potential operational challenges in maintaining high plant load factors.

- Risks associated with the integration of new business verticals and technologies.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sael Industries Limited

Sael Industries Limited IPO Strengths

Vertically Integrated Renewable Energy Platform

Sael Industries Limited benefits from a highly integrated business model that encompasses in-house solar module manufacturing, EPC, and O&M services. This vertical integration allows the company to exercise control over the entire project lifecycle, from conception to commissioning and long-term maintenance. This structure is instrumental in optimizing costs, ensuring quality, improving execution timelines, and capturing margins across the value chain, thereby creating a significant competitive advantage in the market.

Leadership in the Agri Waste-to-Energy Sector

The company is a pioneer and the largest operator in India’s AgWTE sector based on operational capacity. Sael’s plants utilize paddy straw and other crop residues to generate clean, round-the-clock electricity, directly addressing the critical environmental issue of stubble burning in North India. This pioneering position is backed by over 16 years of operational experience, robust plant performance with high PLFs, and a business model that delivers tangible social and environmental impact.

Diversified Portfolio with High-Quality Off-Takers

Sael Industries Limited has built a strong and diversified portfolio of renewable energy assets, with a total contracted and awarded capacity of 5,765.70 MW spread across solar and AgWTE projects. A significant strength is its off-taker profile, with over 81% of its capacity contracted with entities having credit ratings of ‘AA’ and above. These projects are backed by long-term Power Purchase Agreements with government entities and reputable private companies, ensuring stable and predictable cash flows with reduced collection uncertainty.

Proven Execution Capabilities for Complex Projects

The company has demonstrated a proven ability to execute large-scale and complex projects efficiently. This is evidenced by the completion of a 1,000 MWp solar IPP in Khavda, Gujarat, in just 16 months. Sael’s execution prowess extends to unique projects such as India’s largest metro rooftop solar installation, canal-top projects, and the first large-scale solar IPP in North-East India. This capability is supported by a dedicated in-house team of over 1,400 EPC and O&M personnel.

Robust Capital Management and Institutional Investor Confidence

Sael Industries Limited has exhibited robust capital management, securing funding from a diversified pool of domestic and international lenders, including multilateral banks. A key endorsement of its credibility and governance is the equity investment from prestigious institutions like Norfund and the US International Development Finance Corporation (DFC), which have collectively invested US$145 million. This reflects strong institutional confidence in the company’s business model and its long-term impact on renewable energy and climate change mitigation.

More About Sael Industries Limited

Sael Industries Limited is one of India’s top five renewable energy independent power producers (IPPs), distinguished by its fully integrated model that combines project development, in-house solar module manufacturing, EPC, and O&M services. Incorporated in 2022, the company has rapidly built a significant footprint in the Indian renewable sector.

Business Verticals

- Solar Power Business: The company entered the solar power sector in 2011 and has seen exponential growth since 2016. As of September 30, 2025, its solar portfolio stands at 5,600.80 MW (8,299.51 MWp), comprising 29 utility-scale and 25 rooftop projects. Its projects are backed by long-term PPAs, with a weighted average life of 24.64 years.

- Agri Waste-to-Energy (AgWTE): Sael is the pioneer and largest operator in India’s AgWTE segment. It operates 10 plants (150 MW) with one more under construction. These plants use agricultural residue to generate reliable, round-the-clock power, helping to reduce air pollution from stubble burning. The AgWTE plants boast a high Plant Load Factor (PLF) of over 90% and have in-built tariff escalation provisions.

- Solar Module Manufacturing: The company is among India’s leading TopCon solar module manufacturers with an annual installed capacity of 3,625 MW across facilities in Punjab and Rajasthan. It has plans to further expand its manufacturing prowess by setting up a new integrated 5 GW solar cell and 5 GW module manufacturing facility in Greater Noida, Uttar Pradesh.

Operational Excellence

Sael employs advanced technology across its operations. Its O&M function utilizes a Centralized Monitoring System (CMS), a Remote Operation Monitoring Automation Center (ROMA-Center), drone-based thermography, and automated robotic cleaning systems to ensure high efficiency and plant availability. The company’s strong focus on corporate governance and ESG standards is driven by an experienced, Promoter-led management team and board.

Industry Outlook

The Indian renewable energy sector is poised for transformative growth, driven by the country’s escalating energy demands, rapid urbanization, and strong governmental impetus towards decarbonization.

Market Size and Growth

India is the world’s third-largest consumer of primary energy. The country’s total installed power capacity has increased from 302 GW in FY16 to 475 GW in FY25 and is projected to reach 705-710 GW by FY30. Within this, renewable energy, particularly solar, has been a major contributor. Solar capacity has increased by 63 GW between FY16 and FY25 and is projected to grow by an additional 160-170 GW by FY30. The module manufacturing capacity in India, which stood at approximately 82 GW in FY25, is expected to increase by about 175-185 GW per year until FY30.

Agri Waste-to-Energy Potential

The AgWTE sector holds significant untapped potential in India. The country has an estimated biomass power potential of approximately 28 GW, derived from a surplus availability of around 230 million tonnes of agricultural residue per annum. The current installed capacity under the Biomass Program is 11.58 GW as of March 2025, which is estimated to grow to around 15.50 GW by 2032. The AgWTE sub-segment specifically is expected to grow at a CAGR of 3.4%, reaching 2.42 GW by 2032.

Key Growth Drivers

- Government Policies: Initiatives like the Renewable Purchase Obligation (RPO), “24×7 Power For All,” the Green Energy Corridor, and the Production Linked Incentive (PLI) scheme are key drivers.

- Domestic Manufacturing Push: Policies like the Approved List of Module Manufacturers (ALMM) and the upcoming ALMM for solar cells are designed to boost domestic manufacturing and ensure quality.

- Payment Security: The introduction of the Electricity (Late Payment Surcharge) Rules, 2022, has significantly improved the payment security mechanism for generators.

- Emerging Segments: There is a growing shift towards Round-the-Clock (RTC) and firm, dispatchable renewable energy solutions, supported by government tenders and the integration of energy storage systems (ESS).

How Will Sael Industries Limited Benefit

- Benefit from the massive projected growth in India’s solar energy capacity (160-170 GW by 2030), leveraging its large IPP portfolio and project execution expertise to secure and commission new projects.

- Capitalize on its leadership position in the AgWTE sector to expand capacity in a high-potential market (28 GW potential), utilizing its operational experience and established supply chain for agricultural residue.

- Leverage government policies like ALMM and the PLI scheme through its in-house solar module manufacturing capacity, with the planned 5 GW cell and module facility positioning it to meet domestic content requirements and reduce import dependency.

- Seize the opportunity in the emerging Round-the-Clock (RTC) energy segment by integrating energy storage with its solar projects, aligning with government tenders and improving grid stability.

- Utilize its strong, creditworthy off-taker base and the improved payment security mechanism under the LPS Rules to ensure stable and timely cash flows, reducing receivable days and financial volatility.

- Enhance its competitive edge and margins through its vertically integrated model, which provides cost control, supply chain security, and the ability to capture value across the entire renewable energy chain.

Peer Group Comparison

There are no directly comparable listed companies in India that engage in a business model identical to Sael Industries Limited, which is a vertically integrated player with a significant combined focus on both solar IPP and AgWTE projects, alongside in-house module manufacturing. Accordingly, a standard industry comparison table is not provided.

Key Strategies for Sael Industries Limited

Expanding the Renewable Energy Portfolio

Sael Industries Limited intends to aggressively expand its portfolio to maintain its position as a leading integrated player. The company will actively participate in project bids, leveraging its high historical success rate and proven execution capabilities in land acquisition and grid connectivity. With a strong pipeline and a total contracted capacity of 5,765.70 MW, Sael is well-positioned to capitalize on the massive growth tailwinds in the Indian solar and AgWTE sectors, aiming to significantly scale its operational capacity in the coming years.

Strategic Vertical Integration into Manufacturing

The company plans to implement further strategic vertical integration to enhance its business model and improve profitability. A key initiative is the establishment of a new integrated 5 GW solar cell and 5 GW module manufacturing facility in Greater Noida. This move will reduce dependence on imported and third-party cells, capture more value from the supply chain, and ensure compliance with the ALMM regulations, thereby securing a competitive advantage in the domestic market.

Diversification into New Renewable Technologies

Sael Industries Limited aims to diversify organically into adjacent renewable energy technologies. It plans to enter the Round-the-Clock (RTC) energy sector by integrating energy storage solutions with its existing solar power expertise. With awarded projects already in hand that include ESS components, the company is poised to address the intermittency of solar power and capitalize on the government’s push for firm, dispatchable renewable energy, which is a key growth segment in the evolving energy landscape.

Technology-Driven Operational Excellence

The company is focused on integrating advanced technology and driving process excellence to improve the efficiency and longevity of its projects. This includes implementing predictive maintenance systems like CMMS, deploying bifacial modules, using AI-based forecasting to reduce charges, and optimizing AgWTE plant parameters for lower fuel consumption. These initiatives are designed to reduce operational costs, minimize downtime, extend equipment life, and maintain high plant performance, thereby enhancing overall profitability.

Optimizing Capital Structure and Risk Management

Sael Industries Limited will continue to optimize its capital structure by diversifying its financing sources, reducing financing costs through project refinancing, and tapping into global pools of low-cost capital. Concurrently, the company will strengthen its corporate governance and risk management framework, maintaining strict adherence to its hedging policy for foreign exchange and interest rate risks and integrating ESG considerations into its core strategy to ensure sustainable and resilient long-term growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sael Industries Limited IPO

How can I apply for Sael Industries Limited IPO?

You can apply via ASBA through your bank account or use the UPI-based ASBA facility provided by your stockbroker’s platform.

What is the lot size and price band for the IPO?

The lot size and price band for the Sael Industries Limited IPO are yet to be announced and will be finalized closer to the IPO date.

What is the core business of Sael Industries Limited?

The company is an integrated renewable energy independent power producer focused on solar power projects and agri waste-to-energy plants.

Will the company receive any money from the IPO?

Yes, the company will receive proceeds from the fresh issue of ₹3,750 crores, primarily for debt repayment and general corporate purposes.

Where will the equity shares of Sael Industries be listed

The equity shares are proposed to be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).