- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Safex Chemical India IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Safex Chemical India IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Safex Chemical India Limited

Safex Chemicals (India) Ltd is a speciality chemicals company focused on agrochemicals, operating across the entire agrochemical value chain. It functions through three verticals: branded formulation, specialty chemicals, and CDMO, serving farmers and global agrochemical firms. As of March 31, 2025, the company’s operations span 22 countries across six continents, offering a portfolio of 140 products, including insecticides, herbicides, fungicides, fertilizers, and plant growth regulators. With six manufacturing units in India, a network of over 14,950 dealers, 37 quality control staff, and 1,555 full-time employees, Safex boasts one of the largest product portfolios in the Indian agrochemical sector

Safex Chemical India Limited IPO Overview

Safex Chemicals India Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 4, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a Book Building Issue, comprising a fresh issue of ₹450.00 crores and an Offer for Sale (OFS) of up to 3.57 crore equity shares. The company plans to list its shares on both NSE and BSE. Axis Capital Ltd. is appointed as the book running lead manager, while Kfin Technologies Ltd. will act as the registrar. Key details such as IPO dates, price bands, and lot size are yet to be announced. Promoters include Surinder Kumar Chaudhary, Rajesh Kumar Jindal, Neeraj Kumar Jindal, and Piyush Jindal

Safex Chemical India Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹450 crore |

| Offer for Sale (OFS) | 3.57 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 16,05,85,503 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Safex Chemical India Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Safex Chemical India Limited IPO Valuation Overview

| KPI | Values |

| Earnings Per Share (EPS) | ₹(0.89) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (2.34%) |

| Net Asset Value (NAV) | ₹41.88 |

| Return on Equity (RoE) | (2.12%) |

| Return on Capital Employed (RoCE) | 10.65% |

| EBITDA Margin | 14.70% |

| PAT Margin | (0.90%) |

| Debt to Equity Ratio | 0.95 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/prepayment, in part or full, of certain of or all of borrowings availed by the Company | 2555.9 |

| Repayment/prepayment, in part or full, of certain of or all of borrowings availed by Subsidiary, namely, Shogun Organics, through investments in such Subsidiary | 1100 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

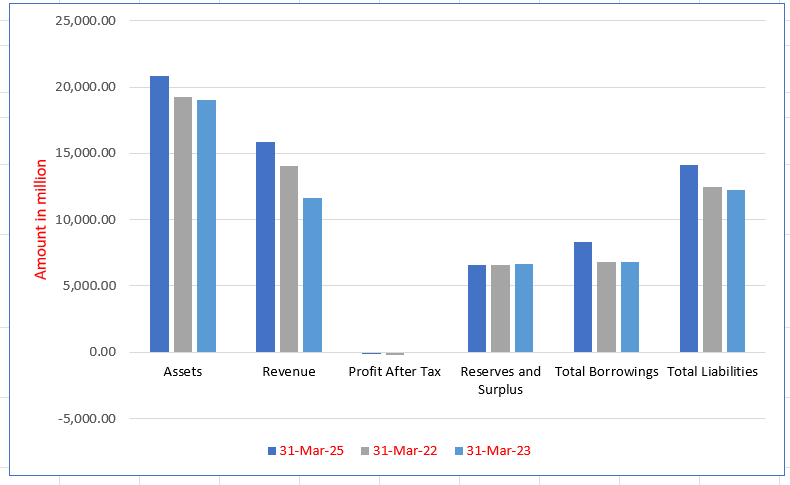

Safex Chemical India Limited Financials (in million)

| Particulars | 31 March 2025 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 20,843.55 | 19,234.26 | 19,051.72 |

| Revenue | 15,847.80 | 14,045.91 | 11,610.18 |

| Profit After Tax | (142.86) | (227.88) | (10.17) |

| Reserves and Surplus | 6,564.71 | 6,578.35 | 6,648.46 |

| Total Borrowings | 8,303.94 | 6,770.90 | 6,802.18 |

| Total Liabilities | 14,118.25 | 12,495.32 | 12,242.67 |

Financial Status of Safex Chemical India Limited

SWOT Analysis of Safex Chemical India IPO

Strength and Opportunities

- Over three decades of industry experience.

- Strong brand presence in the agrochemical sector.

- Extensive distribution network across India and abroad.

- Robust manufacturing and R&D infrastructure.

- Successful international expansion, including acquisition of Briar Chemicals in the UK.

- Diverse product portfolio encompassing pesticides, insecticides, and herbicides.

- Commitment to environmentally sustainable chemicals.

- Increased turnover and operating profit over the last decade.

- Backed by Balaji Amines Limited, lending credibility and operational experience.

Risks and Threats

- High dependency on a limited product range.

- Profit margins sensitive to raw material price fluctuations.

- Exposure to environmental and chemical safety compliance risks.

- Requires substantial funding for raw material stocking and customer credit cycles.

- Working capital-intensive operations due to seasonal nature of business.

- Susceptibility to fluctuations in raw material prices.

- Intense competition from local and multinational agrochemical companies.

- Exposure to climatic conditions affecting operations.

- Exposure to risks inherent in the agrochemicals market.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Safex Chemical India Limited

Safex Chemical India Limited IPO Strengths

Diversified Business Model and Global Presence

Safex Chemical India Limited has a diversified business model spanning the agrochemical value chain, including active ingredients, intermediates, and formulations. The company operates in branded formulations, specialty chemicals, and contract development and manufacturing (CDMO), with a global presence in 22 countries. This structure allows the company to capitalize on various business opportunities, mitigate risks, and leverage synergies between its business verticals.

Multi-Brand Strategy and Wide Distribution

The company employs a unique multi-brand strategy in its branded formulation business, selling products under three umbrella brands: “Safex,” “Indo Swiss,” and “Smith n Smith.” This approach, supported by a pan-India direct distribution network of over 14,950 active dealers, ensures deeper market penetration and wider brand visibility, positioning the company as a comprehensive solutions provider for farmers.

Robust Specialty Chemicals Portfolio

Safex Chemical India Limited has a robust product portfolio within its specialty chemicals business, which includes agrochemical active ingredients and household insecticides. Through its subsidiary, Shogun Organics, the company manufactures products like the patented molecule “Renofluthrin” and serves global customers. This backward integration enhances its supply chain control and improves profit margins.

Established Global CDMO Business

The company’s CDMO business, operated through its UK-based subsidiary Briar Chemicals, provides contract development and manufacturing services to global agrochemical companies. This segment benefits from high entry barriers, long-term customer relationships, and advanced manufacturing capabilities, allowing Safex Chemical India Limited to access key international markets and serve prominent clients.

Efficient Working Capital Management

Safex Chemical India Limited maintains an efficient working capital cycle, which is crucial for its operations. By diversifying its business across less working-capital-intensive segments like specialty chemicals and CDMO, the company mitigates the impact of its more intensive branded formulation business. This strategy ensures high cash conversion and sufficient liquidity to sustain operations effectively.

Experienced Leadership and Management

The company is led by experienced promoters and a senior management team with extensive industry expertise. Their ability to successfully expand operations, integrate acquisitions, and foster a distinct entrepreneurial structure has been instrumental in the company’s evolution. This leadership provides a significant competitive advantage and drives strategic growth initiatives.

More About Safex Chemical India Limited

Safex Chemical India Limited is a specialty chemicals company focused on agrochemicals, with a presence across the agrochemical value chain. Established in 1991 by the late Surinder Kumar Jindal and Surinder Kumar Chaudhary, the Company has served farmers for over three decades, providing a wide range of crop protection products to enhance crop productivity. Safex Chemical has grown significantly, both organically and inorganically, evolving from a branded agrochemical formulation company to a specialty chemicals firm with strong internal synergies across its business verticals.

The Company operates in three main verticals: branded formulation, specialty chemicals, and contract development and manufacturing (CDMO), catering to the needs of farmers and global agrochemical companies. Through strategic acquisitions, including Shogun Lifesciences (July 2021), Shogun Organics (September 2021), and Briar Chemicals in the UK (October 2022), Safex Chemical has expanded its revenue streams, customer base, geographic footprint, and optimized its supply chain. As of March 31, 2025, its operations span 22 countries across six continents. According to the F&S Report, Safex Chemical was among the fastest-growing agrochemical companies in India in terms of revenue between FY2023 and FY2025.

Business Verticals

Branded Formulation

- Offers 140 products across insecticides, herbicides, fungicides, fertilizers, and plant growth regulators.

- Operates under three umbrella brands: Safex, Indo Swiss, and Smith n Smith, enabling deeper market penetration.

- Pan-India direct distribution network with over 14,950 active dealers.

- Six strategically located manufacturing units in India.

- Acquisition of Shogun Lifesciences enhanced product offerings in aluminium phosphide and zinc phosphide.

Specialty Chemicals

- Manufactures agrochemical active ingredients and household insecticides through Shogun Organics.

- Backward integration supports branded formulation business and flexible manufacturing.

- Exports to over ten countries including Vietnam, Indonesia, Mexico, Bangladesh, Belgium, and Brazil.

- Developed India’s first indigenous mosquito repellent molecule, Renofluthrin.

- Supplies Renofluthrin to Godrej Consumer Products Limited for household insecticides.

CDMO Services

- Briar Chemicals in the UK provides contract development, synthesis, formulation, and packaging services.

- Among the largest CDMO players in the UK by manufacturing capacity.

- Serves global agrochemical companies including Bayer AG under contract manufacturing agreements.

Leadership and Recognition

Safex Chemical is led by an experienced promoter and management team, including Surinder Kumar Chaudhary, Rajesh Kumar Jindal, Neeraj Kumar Jindal, and Piyush Jindal. ChrysCapital holds a 44.80% stake. The Company has received multiple awards, including PMFAI-SML’s ‘Outstanding Innovation: Chemical Synthesis’ (2025) and ET Edge’s ‘Best Brands of 2024’. Senior leaders have earned recognitions for visionary and emerging leadership in the chemical sector.

Industry Outlook

The Indian agrochemical industry is poised for significant growth, driven by the need to enhance agricultural productivity and ensure food security for a growing population. The market size is projected to reach USD 9 billion by 2025, with expectations to grow at a CAGR of 7.10%, reaching USD 12.70 billion by 2030 .

Growth Drivers

- Government Initiatives: Policies promoting sustainable agriculture and subsidies for agrochemical inputs are bolstering industry growth.

- Technological Advancements: Innovations in crop protection chemicals and formulation technologies are enhancing product efficacy and farmer adoption.

- Export Opportunities: India’s strong manufacturing base and cost competitiveness are expanding export markets for agrochemical products.

Market Segmentation

- Crop Protection Chemicals: The crop protection segment, encompassing insecticides, herbicides, and fungicides, is estimated at USD 2.59 billion in 2025, with a projected CAGR of 4.35% through 2030.

- Biopesticides: With increasing demand for eco-friendly solutions, the biopesticides market is anticipated to grow from USD 217.97 million in 2024 to USD 347.53 million by 2029, reflecting a CAGR of 9.78% .

Industry Outlook for Safex Chemical India Limited

Safex Chemical, operating across branded formulations, specialty chemicals, and contract development and manufacturing (CDMO), is well-positioned to capitalize on these industry trends. The company’s focus on innovation, sustainable practices, and strategic acquisitions aligns with the sector’s growth trajectory, offering opportunities for expanded market share and enhanced product offerings.

How Will Safex Chemical India Limited Benefit

- Safex Chemical can leverage the projected 7.1% industry CAGR to expand its branded formulation and specialty chemicals sales in India.

- Increasing demand for eco-friendly and biopesticide solutions provides opportunities to promote products like Renofluthrin and other patented molecules.

- Government policies supporting sustainable agriculture can reduce costs and incentivize adoption of the Company’s crop protection products.

- Export opportunities across Asia, Europe, and Latin America allow Safex Chemical to diversify revenue streams and strengthen its global presence.

- Technological advancements in formulation and manufacturing can enhance product efficacy and operational efficiency, improving margins.

- The growing crop protection chemicals market ensures consistent demand for insecticides, herbicides, and fungicides, reinforcing Safex Chemical’s market leadership.

- Strategic acquisitions and CDMO capabilities position the Company to capture new contracts with global agrochemical players, expanding its customer base.

- Enhanced distribution networks and multi-brand strategy enable deeper penetration into rural markets, supporting sustainable long-term growth.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue

(₹ million) |

EPS (₹) | P/E | NAV (₹) | RoNW (%) |

| Safex Chemicals Limited | 1.00 | 15,847.80 | (0.89) | [●] | 41.88 | (2.34)% |

| Peer Groups | ||||||

| Bayer Cropscience Ltd | 10.00 | 54,734.00 | 126.38 | 50.33 | 634.24 | 19.93% |

| Sumitomo Chemical India Ltd | 10.00 | 31,485.00 | 10.13 | 51.13 | 358.20 | 17.43% |

| Rallis India Ltd | 1.00 | 26,629.40 | 6.43 | 50.77 | 97.92 | 6.57% |

| Dhanuka Agritech Ltd | 2.00 | 20,351.50 | 65.55 | 26.38 | 311.17 | 21.17% |

| Navin Fluorine International Ltd | 2.00 | 23,493.80 | 58.20 | 84.07 | 529.59 | 10.99% |

| Vinati Organics Ltd | 1.00 | 22,481.70 | 39.09 | 50.03 | 269.45 | 14.51% |

| PI Industries Ltd | 1.00 | 79,778.00 | 109.44 | 37.97 | 669.47 | 16.35% |

| Anupam Rasayan India Ltd | 10.00 | 14,369.74 | 8.50 | 134.42 | 259.28 | 5.61% |

Key Strategies for Safex Chemical India Limited

Branded Formulation Expansion

Safex Chemical India Limited aims to increase product penetration in existing regions and enter new markets by appointing additional dealers. The company plans to launch new products, leveraging its multi-brand strategy, extensive distribution network, and R&D efforts to differentiate offerings and grow its branded formulation business.

Ag-Tech Platform “Golden Farms”

Safex Chemical India Limited launched “Golden Farms” to connect farmers, dealers, and agricultural experts digitally. The platform provides product catalogues, market rates, weather updates, and transactional capabilities. It empowers farmers, strengthens dealer relationships, and supports agile decision-making while enhancing operational reach and customer engagement.

Specialty Chemicals Growth

Safex Chemical India Limited focuses on manufacturing and selling agrochemical active ingredients and household insecticides. By introducing new products and leveraging partnerships like Godrej for Renofluthrin, the company seeks to expand its specialty chemicals business across domestic and international markets, supporting both branded formulations and external customers.

CDMO Business Development

Safex Chemical India Limited leverages its manufacturing infrastructure to provide contract development and manufacturing services globally. With plants in the UK and India, it aims to attract new customers, strengthen existing relationships, and generate cost synergies by integrating specialty chemicals with CDMO operations and flexible manufacturing capabilities.

Inorganic Growth Initiatives

Safex Chemical India Limited evaluates mergers, acquisitions, and brand or plant acquisitions to expand market share, diversify its product portfolio, and enhance distribution. Past acquisitions, including Shogun Organics and Briar Chemicals, have strengthened supply chains, entered new markets, and increased revenues through backward integration and operational efficiencies.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Safex Chemical India Limited IPO

How can I apply for Safex Chemical India Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When did Safex Chemical India Limited file its IPO DRHP?

The company filed its Draft Red Herring Prospectus with SEBI on July 4, 2025, to raise funds through IPO.

What is the size of the Safex Chemical IPO?

The IPO consists of a fresh issue of ₹450 crore and an offer for sale of 3.57 crore equity shares.

Where will the shares be listed?

The equity shares are proposed to be listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

What is the face value and type of the IPO?

The face value of each share is ₹1, and the IPO is a book building issue comprising fresh issue and OFS.

What will the IPO proceeds be used for?

Proceeds will be used for repayment of borrowings, subsidiary investments, and general corporate purposes.