- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sahajanand Medical Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sahajanand Medical Technologies IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sahajanand Medical Technologies Limited

Founded in 2001 by Mr. Dhirajlal Kotadia, Sahajanand Medical Technologies Ltd. is a medical device company specialising in Class III and Class C/D devices, mainly for vascular and structural heart interventions. It was the first globally to receive CE certification for a drug-eluting stent with a biodegradable polymer, Infinnium. Its portfolio includes coronary stents and balloons, TAVI devices, occluders, renal stents, peripheral DCBs, and selected trading products. With R&D centres in India and Thailand, a team of 102 professionals, and 102 granted patents, the company’s key products, backed by 72 clinical studies, are used in over 76 countries. Sahajanand markets its brands globally via direct operations, hybrid models, and distributors, leveraging endorsements, government tenders, and GPO partnerships.

Sahajanand Medical Technologies Limited IPO Overview

Sahajanand Medical Technologies Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 25, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is structured as a Book Building Issue and comprises entirely an offer for sale of up to 2.76 crore shares. The equity shares are proposed to be listed on both NSE and BSE. While the registrar for the issue is MUFG Intime India Pvt. Ltd., the book running lead manager has not been declared. Key details such as IPO dates, price band, and lot size are yet to be announced. The pre- and post-issue shareholding remains at 10.14 crore shares, with promoters holding 40.92%. The face value of each share is ₹1, and the total issue size aggregates to ₹[.] crore. For full details, refer to the Sahajanand Medical Technologies IPO DRHP.

Sahajanand Medical Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 2.76 crore equity shares |

| Fresh Issue | NA |

| Offer for Sale (OFS) | 2.76 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹1 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,14,03,232 shares |

| Shareholding post-issue | 10,14,03,232 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sahajanand Medical Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sahajanand Medical Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.09 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 3.73% |

| Net Asset Value (NAV) | ₹55.86 |

| Return on Equity (RoE) | 3.68% |

| Return on Capital Employed (RoCE) | 10.37% |

| EBITDA Margin | 12.49% |

| PAT Margin | 2.45% |

| Debt to Equity Ratio | 0.91 |

Objectives of the IPO Proceeds

- Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

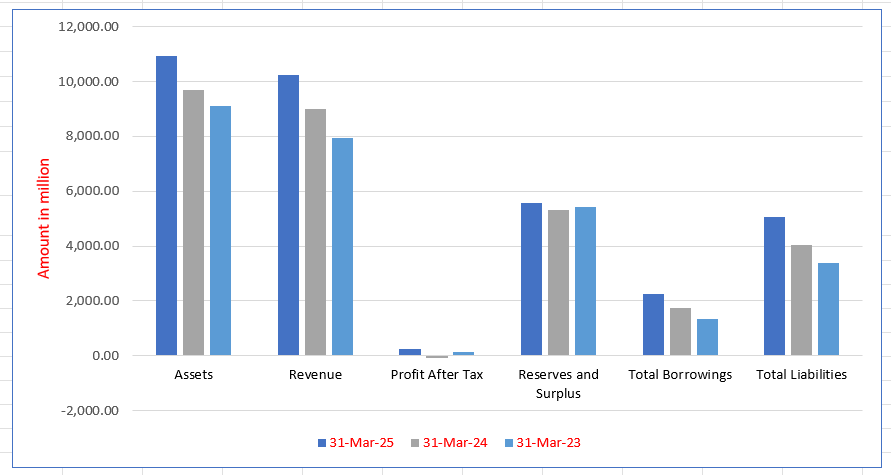

Sahajanand Medical Technologies Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 10,948.99 | 9,705.77 | 9,116.34 |

| Revenue | 10,248.79 | 9,016.04 | 7,955.49 |

| Profit After Tax | 251.52 | (73.54) | 119.34 |

| Reserves and Surplus | 5,559.66 | 5,303.40 | 5,435.77 |

| Total Borrowings | 2,250.17 | 1,752.69 | 1,321.81 |

| Total Liabilities | 5,044.31 | 4,042.58 | 3,385.36 |

Financial Status of Sahajanand Medical Technologies Limited

SWOT Analysis of Sahajanand Medical Technologies IPO

Strength and Opportunities

- Market leader in India's interventional cardiology sector with a 31% market share in FY21.

- Operates in over 76 countries, including direct presence in 10, enhancing global reach and market penetration.

- Pioneered biodegradable polymer coating technology in coronary stents, positioning itself as an innovator in the field.

- Strong R&D capabilities leading to continuous product innovation and portfolio expansion.

- Recognition from the Government of India for significant contributions to cardiovascular healthcare.

- Established partnerships with leading healthcare institutions and professionals worldwide.

- Commitment to sustainability and eco-friendly manufacturing processes.

- Expanding portfolio to include structural heart devices and peripheral intervention products, tapping into new market segments.

- Robust financial performance with consistent revenue growth over the years.

Risks and Threats

- Faces intense competition from global medical device giants like Medtronic and Boston Scientific.

- High dependency on regulatory approvals across diverse markets, which can delay product launches.

- Vulnerability to currency fluctuations due to significant international operations.

- Potential challenges in scaling operations to meet increasing global demand.

- Exposure to geopolitical risks affecting international trade and operations.

- Regulatory hurdles in emerging markets may impede swift market entry.

- Rising raw material costs could impact profit margins.

- Potential intellectual property challenges and patent disputes in a competitive industry.

- Dependence on a limited number of suppliers for critical components.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sahajanand Medical Technologies Limited

Sahajanand Medical Technologies Limited IPO Strengths

Leading Innovation in High-Barrier Medical Segments

Sahajanand Medical Technologies Limited (SMT) is a Class III and Class C/D medical device company operating in a sector with high barriers to entry. SMT is among the few global players with a comprehensive portfolio of advanced cardiovascular implants and devices, including Drug-Eluting Stents (DES), Transcatheter Aortic Valve Implantation (TAVI) systems, and occluders. The company’s products are supported by robust clinical evidence and meet stringent international regulatory standards.

Strong Research and Development Capabilities

SMT has two R&D facilities in India and Thailand, staffed by 102 professionals with extensive expertise in biomedical engineering and clinical research. The company has a strong intellectual property portfolio with over 102 global patents and 71 applications pending. SMT’s R&D initiatives have led to groundbreaking products like the ‘Supraflex Cruz,’ the world’s first biodegradable polymer DES, and the ‘Hydra’ TAVI system with its patented AVDC system.

Global Market Leadership and Presence

SMT is a key player in the Indian DES market, holding a nearly 25% market share by volume. The company also ranks among the top five DES companies by sales volume in Germany, Spain, Poland, and Brazil, demonstrating its strong international presence. SMT has also successfully leveraged its leadership in the DES market to expand its presence in the structural heart (SH) products segment, particularly with TAVI and occluders.

Diversified, Integrated, and Efficient Manufacturing

SMT operates three integrated manufacturing facilities in India and Thailand, benefiting from lower labor and manufacturing costs. The company’s facilities are accredited by multiple global regulatory bodies like CE, ANVISA, and TGA. With over 24 years of experience, SMT has in-house capabilities to design and manufacture advanced machinery, ensuring stringent quality control and cost efficiency. The Hyderabad facility has significant room for expansion, allowing for future scaling of operations.

Proven M&A and Strategic Collaboration Success

SMT has a strong track record of successful mergers, acquisitions, and strategic alliances. The company’s acquisitions of Vascular Concepts and Vascular Innovations enabled it to add structural heart products to its portfolio, driving significant revenue growth. Similarly, the acquisitions of Imex and Zarek strengthened its presence in Spain and Brazil. Additionally, SMT collaborates with leading companies like Philips India Limited and Insight Lifetech Co. to enrich its product offerings.

Experienced Leadership and Institutional Investor Support

SMT is led by a team of qualified senior executives with an average tenure of eight years, bringing global experience in R&D, manufacturing, and business development. Their expertise and robust governance framework have been crucial to the company’s success. The leadership team is backed by reputable institutional investors, including Samara Capital Markets Holding Limited, Kotak Pre-IPO Opportunities Fund, Plutus Wealth Management LLP, and Ashish Kacholia, who provide a strong foundation for future growth.

More About Sahajanand Medical Technologies Limited

Sahajanand Medical Technologies Limited, founded in 2001 by Mr. Dhirajlal Kotadia, is a leading developer and manufacturer of Class III and Class C/D medical devices, specialising in vascular and structural heart interventions. The company was the first globally to receive CE certification for an in-house developed drug-eluting stent (DES) with a biodegradable polymer, Infinnium, reflecting its commitment to innovation and clinical excellence.

Product Portfolio

Sahajanand’s diverse offerings are categorised as follows:

- Vascular Intervention (VI): Coronary stents and balloons for minimally invasive blood vessel treatments.

- Structural Heart (SH): Transcatheter Aortic Valve Implantation (TAVI) devices and Occluders.

- Other Products: Renal stents, peripheral drug-coated balloons (DCBs), and selected trading products.

In Fiscal 2025, VI devices contributed ₹6,749.70 million (65.86% of revenue), SH devices ₹1,573.17 million (15.35%), and other products ₹1,925.92 million (18.79%).

Research and Development

Sahajanand operates two R&D centres in India and Thailand with a team of 102 professionals. Its focus includes:

- Expanding indications for existing products

- Product and process enhancements

- Development of new devices and technologies

- Conducting clinical trials for new market entry

The company has secured 102 patents globally, with 71 pending applications and five design registrations in India. Flagship products such as Supraflex Cruz (DES), Hydra (TAVI), Pipit, and Cocoon (Occluders) are supported by 72 clinical studies across multiple geographies.

Manufacturing and Global Presence

Sahajanand operates three manufacturing facilities, two in India and one in Thailand, enabling high control over production, faster prototyping, and reduced costs. Products are marketed in 76 countries through direct, hybrid, and distributor-led models, with significant presence in Europe, India, and other regions. Key endorsements, government tender wins, and partnerships with Group Purchasing Organizations (GPOs) enhance global acceptance.

Strategic Initiatives

The company follows a “House of Brand” strategy, with internationally recognised brands Supraflex Cruz, Hydra, and Cocoon. It has successfully executed acquisitions and partnerships to expand product offerings, enter new markets, and strengthen its competitive position.

Leadership

Sahajanand’s leadership team, comprising 11 senior members with an average of 25 years’ industry experience, drives innovation, strategic growth, and operational excellence. Strong investor backing further supports its long-term vision.

Industry Outlook

India’s medical device industry is experiencing robust growth, valued at approximately ₹1,02,660 crore (US$12 billion) in FY24. The sector is projected to reach ₹4,27,750 crore (US$50 billion) by 2025, reflecting a compound annual growth rate (CAGR) of 15%. This expansion positions India as the fourth-largest medical device market globally, trailing only Japan, China, and South Korea in Asia.

Growth Drivers

- Rising Healthcare Demand: An increasing burden of chronic diseases and an aging population are driving the need for advanced medical technologies.

- Government Initiatives: Programs like the National Health Mission aim to enhance healthcare infrastructure, facilitating broader access to medical devices.

- Technological Advancements: Innovations in medical technology, including minimally invasive procedures and advanced imaging, are enhancing treatment efficacy and safety.

Cardiovascular Devices Segment

The cardiovascular devices market in India is experiencing significant growth. Valued at USD 2.2 billion in 2024, it is projected to reach USD 4.1 billion by 2033, with a CAGR of 6.8%. This growth is driven by the increasing prevalence of cardiovascular diseases, such as coronary artery disease and heart failure.

How Will Sahajanand Medical Technologies Limited Benefit

- Sahajanand Medical Technologies Limited stands to gain from the overall expansion of India’s medical device industry, projected to reach ₹4,27,750 crore by 2025, ensuring a larger domestic market for its products.

- The growing prevalence of cardiovascular diseases directly increases demand for its vascular intervention devices, including coronary stents and balloons.

- Government initiatives like the National Health Mission enhance healthcare infrastructure, providing broader access to hospitals and clinics that can adopt Sahajanand’s Class III and Class C/D devices.

- Technological advancements and rising adoption of minimally invasive procedures align with the company’s focus on TAVI, Occluders, and advanced balloon catheters, enhancing market acceptance.

- Increasing global recognition of Indian medical device quality supports Sahajanand’s international expansion across 76 countries.

- The rising preference for innovative, clinically validated products boosts uptake of flagship brands such as Supraflex Cruz, Hydra, and Cocoon.

- Expansion of cardiovascular device spending in India and other emerging markets strengthens the company’s revenue growth potential

Peer Group Comparison

| Name of the Company | Total Revenue

(₹ million) |

Face Value | P/E | EPS (₹) | RoNW

(%) |

NAV (₹) |

| Sahajanand Medical Technologies Limited* | 10,248.79 | 1 | NA | 2.09 | 2.01 | 3.73% |

| Peer Groups | ||||||

| Poly Medicure Limited | 16,698.32 | 5 | 61.21 | 34.13 | 34.11 | 12.24% |

| Laxmi Dental Limited | 2,391.07 | 2 | 78.32 | 6.07 | 6.05 | 15.24% |

Key Strategies for Sahajanand Medical Technologies Limited

Expand Market Penetration and Product Launches

Sahajanand Medical Technologies Limited aims to drive revenue growth by deepening penetration of existing products and introducing its comprehensive portfolio in both current and new markets. Leveraging KOL connections, scientific engagements, and market insights, the company seeks higher adoption, stronger brand presence, and value creation.

Target Tier 2 and Tier 3 Markets for DES

The company plans to expand its DES footprint across Tier 2 and Tier 3 cities in India, tapping new catheterization labs and government-supported programs. It will strengthen its presence in North and South India while maintaining leadership in West and East India.

Expand TAVI Adoption

Sahajanand intends to grow its TAVI market share by participating in government tenders, building relationships with private hospitals, conducting scientific engagements, and expanding proctorship programs to train physicians, thereby increasing awareness, product adoption, and clinical proficiency in India.

Increase Occluder Market Share

The company aims to deepen Occluder penetration globally by leveraging its existing presence, expanding account networks, participating in tenders, and engaging KOLs and physicians, while also exploring new markets to capture incremental revenue and reinforce clinical adoption internationally.

Asset-Light Expansion in New Markets

Sahajanand plans to enter high-growth markets through a distributor-led, asset-light model. This approach allows scalable revenue growth with limited overheads. Recent approvals in Australia, Taiwan, and Mexico exemplify its strategy for DES, TAVI, and Occluders, focusing on rapid expansion and cost-efficient market entry.

Portfolio Expansion Across Geographies

The company continuously evaluates existing markets to introduce additional products, such as DES, TAVI, and Occluders, in untapped countries. It focuses on complex PCI segments, clinical trials, and KOL engagement to broaden its international presence, enhance penetration, and capture higher-value opportunities.

Develop Clinically Proven High-Value Products

Sahajanand invests in innovative VI and SH devices, including DCBs and next-generation HydraTAVI. Through clinical trials and real-world evidence, the company strengthens product efficacy, safety, and regulatory approval, ensuring it addresses unmet medical needs and expands its patient reach globally.

Strategic Mergers and Acquisitions

The company evaluates M&A opportunities to acquire fast-growing product segments, technological capabilities, and geographic access. Prior acquisitions of Vascular Concepts, Vascular Innovations, Imex, and Zarek demonstrate successful integration, expanding portfolios, sales channels, and market penetration efficiently.

Operational Efficiency and Cost Optimization

Sahajanand aims to improve material margins and reduce manufacturing costs through vertical integration, automation, and process optimization. By refining production workflows, enhancing supply chain management, and increasing sales productivity, the company drives revenue growth while controlling overheads and maintaining operational agility.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sahajanand Medical Technologies Limited IPO

How can I apply for Sahajanand Medical Technologies Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Sahajanand Medical Technologies Limited?

Founded in 2001, the company develops advanced Class III and C/D medical devices for vascular and structural heart interventions.

What is the size and type of the IPO?

The IPO is a Book Building Offer For Sale comprising up to 2.76 crore shares.

Will the company receive any proceeds from the IPO?

No, the proceeds from the IPO will go entirely to selling shareholders; the company will not use any funds.

Where will the shares be listed?

The equity shares are proposed to be listed on the BSE and NSE mainboards post-IPO