- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sai Infinium Limited IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sai Infinium Limited IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sai Infinium Limited

Sai Infinium Limited, incorporated in 2004, operates in three core business segments: manufacturing of Mild Steel (MS) Billets and Thermo Mechanically Treated (TMT) Bars, ship breaking, and real estate investment and sales within Gujarat. The company’s manufacturing plant, situated in Charmardi Village, Bhavnagar, spans 53,781 sq. metres and has an installed production capacity of 300 MT per eight-hour shift. Sai Infinium manufactures MS Billets using various scrap materials and produces TMT Bars in Fe 500 and Fe 500 D grades. Its ship breaking yard is located at Sosiya, Bhavnagar, Gujarat.

Sai Infinium Limited IPO Overview

Sai Infinium Limited has proposed an IPO comprising a book-built issue of 1.96 crore equity shares, all of which are fresh issue shares. The IPO dates and price band are yet to be announced, and the allotment date will be confirmed in due course. The offering will be listed on both BSE and NSE. The issue is being managed by Sarthi Capital Advisors Private Limited, with Kfin Technologies Limited acting as the registrar.

As per the Draft Red Herring Prospectus (DRHP), the face value of each share is ₹10, and the total post-issue shareholding will increase from 5.85 crore shares to 7.81 crore shares. The company’s promoters are Ishu Bansal, Shivnarayan Bansal, and Devansh Infinium Private Limited, with pre-issue promoter holding at 85.43%. The DRHP was filed with SEBI on April 3, 2025.

Sai Infinium Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.96 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,85,34,000 shares |

| Shareholding post -issue | 7,81,34,000 shares |

Sai Infinium Limited IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sai Infinium Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Sai Infinium Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.22 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 7.39% |

| Net Asset Value (NAV) | 54.67 |

| Return on Equity | 5.89% |

| Return on Capital Employed (ROCE) | 9.24% |

| EBITDA Margin | 8.32% |

| PAT Margin | 1.90% |

| Debt to Equity Ratio | 0.59 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements towards setting up of the 17.4 MW Hybrid Power Plant — Gangiyavadar, Wankaner, Gujarat | 1300 |

| Funding of capital expenditure requirements towards setting up of the Mild Steel (“MS”) Structures Rolling Mill – Bhavnagar, Gujarat | 650 |

| Purchase of Cargo Vessel (“Ship – Corsica”) for Ship Breaking Plant – Alang, Bhavnagar, Gujarat | 190 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

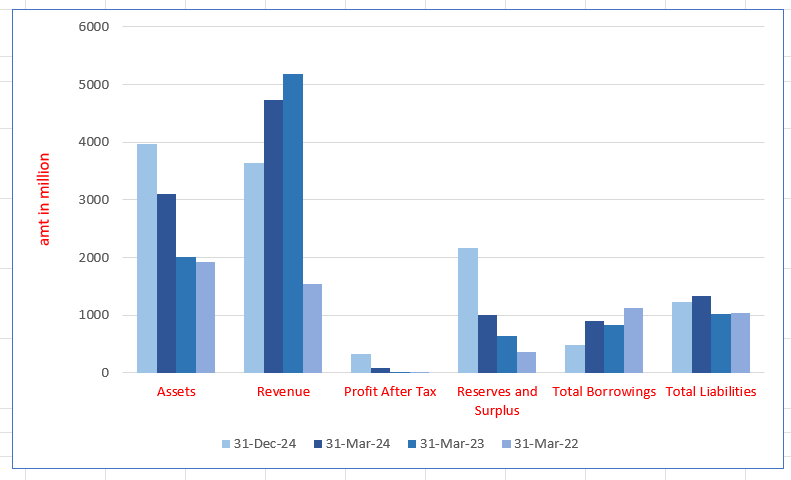

Sai Infinium Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 3971.50 | 3101.29 | 2012.27 | 1923.04 |

| Revenue | 3647.27 | 4727.43 | 5184.26 | 1543.00 |

| Profit After Tax | 328.42 | 90.54 | 10.74 | 23.40 |

| Reserves and Surplus | 2161.31 | 1011.22 | 631.82 | 362.98 |

| Total Borrowings | 492.00 | 906.78 | 823.47 | 1131.95 |

| Total Liabilities | 1224.82 | 1332.33 | 1018.61 | 1034.60 |

Financial Status of Sai Infinium Limited

SWOT Analysis of Sai Infinium Limited IPO

Strength and Opportunities

- Experienced promoters with a strong network of suppliers and customers.

- Semi-integrated operations allowing flexibility in product offerings between billets and TMT bars.

- Healthy growth in scale of operations with increasing total operating income.

- Plans to utilize IPO proceeds for setting up a 17.4 MW Hybrid Power Plant, enhancing energy efficiency.

- Merger with Fidelis International, expanding operational capabilities and market reach.

- Advanced manufacturing processes, including LRF and block mill technologies, ensuring product quality.

- Diverse product portfolio catering to various industries such as construction and infrastructure.

- Strong brand reputation with a focus on quality assurance and customer satisfaction.

- Commitment to innovation and continuous improvement through R&D initiatives.

Risks and Threats

- Exposure to volatility in raw material prices, impacting cost structures.

- Intense competition in the steel industry, affecting market share and pricing.

- Cyclicality in the steel industry, leading to fluctuating demand and revenues.

- Project implementation risks associated with large-scale expansions and new ventures.

- High debt levels due to large debt-funded projects, impacting financial stability.

- Dependence on external suppliers for raw materials like scrap and sponge iron.

- Regulatory and environmental compliance challenges in the steel and ship recycling industries.

- Potential delays in project timelines due to unforeseen circumstances, affecting revenue projections.

- Economic downturns and market fluctuations posing threats to profitability and growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sai Infinium Limited IPO

Relationship with Our Customers

Sai Infinium Limited has established long-term relationships with customers in steel and ship recycling industries. This success is built on delivering consistent product quality, ensuring on-time delivery, offering competitive pricing, and benefiting from a strategic location. These factors have helped the company build strong trust and a solid reputation among its clientele over the years.

Raw Material Sourcing

Sai Infinium sources scrap iron and steel from multiple channels, including local Alang shipyards, its own recycling unit, imports, and the Gujarat market. This diversified approach secures a steady supply of raw materials at competitive prices, reduces logistics costs due to proximity, and ensures smooth billet production, giving the company a cost advantage over competitors in the market.

Ability to Mitigate Operational Risk

Sai Infinium’s revenue streams span steel manufacturing, ship recycling, and real estate, effectively spreading operational risks. This diversification allows the company to navigate market cycles and raw material shortages better than single-industry competitors. Multiple income sources ensure consistent cash flow, helping maintain financial stability and operational continuity even during industry fluctuations or economic downturns.

Plant Location

Sai Infinium’s manufacturing facility is strategically located just 60 km from the Alang shipyard. This proximity offers a clear logistical advantage, ensuring easy access to key raw materials like scrap steel. Reduced transportation distance lowers costs and shortens supply lead times, enabling more efficient production and contributing to the company’s competitive positioning in the steel industry.

Certified as Green Products by the CII

Sai Infinium’s TMT bars carry the prestigious green certification from the CII Green Products and Services Council. This recognition highlights the company’s adherence to sustainable and eco-friendly manufacturing practices. It enhances the company’s eligibility for government tenders and supports broader efforts to reduce the carbon footprint in construction and infrastructure sectors.

Experienced Directors and Key Managerial Persons

The company is led by an experienced Board of Directors and skilled senior management who actively guide its strategic direction. Their expertise enables Sai Infinium to anticipate market trends, diversify its product offerings, optimize operations, strengthen customer relationships, and adapt swiftly to changes in industry dynamics and consumer preferences, driving sustained business growth.

Consistent Track Record of Financial Performance

Sai Infinium has demonstrated steady financial performance, overcoming pandemic challenges in 2022. Revenue has shown consistent growth over recent years, reflecting improved balance sheets and cash flows. This resilience underscores the company’s effective financial management and operational strength, positioning it well for future growth opportunities within the steel and related sectors.

More About Sai Infinium Limited

Sai Infinium Limited began its TMT manufacturing operations in December 2022. From April to December 2024, the company reported a production volume of 67,868 MT, with 56,373 MT of TMT bars sold. The capacity utilisation for this period stood at 83.79%, compared to 53.34% in Fiscal 2024 and 28.62% in Fiscal 2023. The annual plant capacity is 108,000 MT, assuming one shift (eight hours) for 360 working days.

Production Performance (Per One Shift)

- Capacity: 300 MT

- Production (FY24): 241.90 MT

- Utilisation: 80.63%

TMT Bar Manufacturing Process

In-House Rolling Mill Operations

Sai Infinium uses in-house manufactured hot billets for TMT bar production, employing advanced Tempco quenching technology for strength.

Key Processes:

- Billet Rolling: Red-hot MS billets pass through roughing stands for reduction, followed by shaping and ribbing in successive stands.

- Shearing: Automatic hot billet shearing machines are used; gas cutting is kept as a backup.

- Cooling and Strapping: Bars cool at room temperature before bundling via automatic strapping machines.

Stages in TMT Production

- Rolling Mill Stands: Segregated into roughing, intermediate, and finishing stages for accurate sizing.

- Quenching: Thermex system hardens the outer layer while retaining core softness.

- Self-Tempering: Heat transfer from the core tempers the outer shell.

- Atmospheric Cooling: Achieves ductility through slow cooling on a cooling bed.

- Cutting and Quality Check: Final bars undergo strength and composition tests.

Raw Material Sourcing

For MS Billets

Sai Infinium sources scrap iron and steel mainly from:

- Own ship recycling unit (0.53% of total scrap in Apr–Dec 2024)

- Local Alang ship recyclers (18.28%)

- Imports (37.30% from UAE, UK, Singapore)

- Gujarat market (43.89%)

For TMT Bars

- Raw Material: MS Billets

- Source: Entirely from in-house production

Utilities Infrastructure

- Power: Supplied by PGVCL, with a connected load of 33,700 KVA

- Water: Sourced from Gujarat Water Infrastructure Ltd., used extensively in various cooling processes

Industry Outlook

India’s steel industry is poised for significant expansion, driven by infrastructure development and urbanization. In 2023, the market was valued at USD 119.5 billion, with projections indicating a rise to USD 154.7 billion by 2030, reflecting a CAGR of 3.8% .

Key Drivers:

- Infrastructure Initiatives: Government programs like PM Gati Shakti and Smart Cities Mission are accelerating steel demand.

- Urbanization: Rapid urban growth necessitates increased steel usage in construction.

- Industrialization: Expansion in sectors such as automotive and manufacturing boosts steel consumption.

TMT Bar Segment: Strengthening Foundations

Thermo-Mechanically Treated (TMT) bars, essential for reinforced concrete structures, are experiencing heightened demand. The Indian TMT bar market is projected to grow at a CAGR of 9.1% from 2025 to 2032, reaching nearly USD 22.55 billion .

Growth Catalysts:

- Construction Boom: Surge in residential and commercial projects increases TMT bar usage.

- Infrastructure Projects: Roads, bridges, and metro systems require substantial TMT bar inputs.

- Quality Standards: Preference for high-strength, corrosion-resistant materials favors TMT bars.

How Will Sai Infinium Limited Benefit

- Sai Infinium Limited benefits from strong industry growth with the Indian TMT bar market expected to grow at a 9.1% CAGR, aligning well with its production capacity.

- High capacityutilization (83.79%) demonstrates efficient use of resources and operational excellence, boosting profitability potential.

- In-house billet manufacturing ensures consistent raw material quality and reduces dependence on external suppliers, enhancing supply chain stability.

- Advanced Tempco quenching technology improves product strength and durability, meeting rising quality standards and customer demand.

- A production capacity of 108,000 MT with one shift allows room for scaling output as market demand increases.

- Strategic raw material sourcing from own ship recycling, local, and imported scrap secures steady inputs at competitive costs.

- Reliable utilities infrastructure (power and water) supports uninterrupted manufacturing processes, critical for meeting deadlines and quality benchmarks.

- Growing infrastructure and urbanization trends in India provide a robust demand base for Sai Infinium’s TMT bars, driving future sales growth

Peer Group Comparison

| Companies | Face Value (₹) | Sales (₹ in Lakhs) | PAT (₹ in Lakhs) | EPS (₹) | P/E Ratio | RoNW (%) |

| Sai Infinium Limited | 10.00 | 47,578.70 | 905.41 | 3.22 | – | -7.31% |

| Peer Groups | ||||||

| Kamdhenu Limited | 1.00 | 73,829.48 | 5,013.35 | 18.61 | 1.60 | 23.52% |

| Vraj Iron & Steel Limited | 10.00 | 42,427.00 | 1,849.90 | 23.22 | 6.44 | 9.23% |

| VMS Industries | 10.00 | 27,084.31 | 631.53 | 3.83 | 7.66 | 9.88% |

Key Strategies for Sai Infinium Limited

Continuous Focus on Capability Building

Sai Infinium Limited plans to expand its product portfolio with more value-added products to improve profit margins and cash flow. Leveraging management and engineering expertise, the company will adopt latest technologies to optimize manufacturing efficiency, reduce costs, and boost productivity and financial performance.

Commitment to Environment-Friendly Energy

The company is committed to sustainable energy by proposing a 66.20 MW hybrid solar and wind power plant. This initiative aims to provide uninterrupted, eco-friendly power to the manufacturing facility, reducing dependence on conventional energy and supporting the company’s environmental responsibility goals.

Setting Up 17.4 MW Hybrid Power Plant in Gujarat

Sai Infinium is establishing a 17.4 MW hybrid solar-wind power plant in Gangiyavadar, Gujarat. The generated electricity will feed into the local grid, with credits offsetting the company’s manufacturing plant electricity consumption, thereby lowering operational energy costs and enhancing cost efficiency.

Expansion with Mild Steel Structures Rolling Mill

The company proposes to add a Mild Steel Structures plant in Bhavnagar, Gujarat, with 43,200 MT annual capacity. This expansion will produce various steel shapes widely used in construction, infrastructure, and power projects, broadening Sai Infinium’s manufacturing capabilities and product offerings.

Acquisition of Cargo Vessel “CORSICA”

To boost its ship breaking operations, Sai Infinium plans to acquire the cargo vessel “CORSICA” for USD 2.19 million. The purchase, formalized through a Memorandum of Agreement, will strengthen raw material sourcing by improving operational capacity at its Alang, Bhavnagar ship breaking facility.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sai Infinium Limited IPO

How can I apply for Sai Infinium Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size and structure of Sai Infinium Limited’s IPO?

The IPO comprises a fresh issue of 1.96 crore equity shares, with no offer-for-sale component.

What are the primary uses of the IPO proceeds?

Funds will be allocated to a 17.4 MW hybrid power plant (₹130 crore), an MS structures rolling mill (₹65 crore), a cargo vessel purchase (₹19 crore), and general corporate purposes.

Who is managing the Sai Infinium IPO?

Sarthi Capital Advisors is the book-running lead manager for the IPO.

Where will Sai Infinium Limited’s shares be listed?

The company’s shares are proposed to be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

What is the retail investor quota in the IPO?

The retail investor quota is set at 10%, with 75% allocated to Qualified Institutional Buyers (QIBs) and 15% to High Net-Worth Individuals (HNIs).