- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sai Parenterals IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sai Parenterals IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sai Parenteral’s Limited

Sai Parenteral’s Ltd., established in 2001, is a diversified pharmaceutical company specializing in research, development, and manufacturing. It operates in two key segments: Branded Generic Formulations and Contract Development and Manufacturing Organisation (CDMO) services for both domestic and international markets. The company offers products across various therapeutic areas, including cardiovascular, neuropsychiatry, anti-diabetic, and respiratory health, in forms like injectables, tablets, and ointments. With five manufacturing facilities in India, Sai Parenteral’s expanded into exports in FY 2023, serving regulated markets in regions like Australia, Southeast Asia, and the Middle East.

Sai Parenteral’s Limited IPO Overview

Sai Parenteral’s Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 30, 2025, to raise funds through an Initial Public Offering (IPO). The IPO will be a Book Build Issue, consisting of a fresh issue of ₹285.00 crores and an Offer for Sale (OFS) of up to 0.35 crore equity shares. The equity shares will be listed on the NSE and BSE. Although the book running lead manager has not been declared yet, Bigshare Services Pvt. Ltd. has been appointed as the registrar for the issue. Key details such as the IPO dates, price bands, and lot sizes are yet to be announced.

The IPO includes a fresh capital issue aggregating up to ₹285.00 crores and an offer for sale of 35,00,000 shares, amounting to ₹[X] crore. The face value of each share is ₹5. The issue will be a bookbuilding IPO and is expected to be listed on both BSE and NSE. Pre-issue, the promoters hold 61.23% of the company’s shares, and the post-issue promoter holding is yet to be disclosed.

Sai Parenteral’s Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹285 crore |

| Offer for Sale (OFS) | 0.35 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 3,69,08,823 shares |

| Shareholding post-issue | TBA |

Sai Parenteral’s IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sai Parenteral’s Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sai Parenteral’s Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.43 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 15.09% |

| Net Asset Value (NAV) | ₹35.98 |

| Return on Equity (RoE) | 17.70% |

| Return on Capital Employed (RoCE) | 28.90% |

| EBITDA Margin | 24.18% |

| PAT Margin | 8.90% |

| Debt to Equity Ratio | 1.17 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Objects of the Issue | Amount

(₹ in million) |

| Capacity expansion and upgradation of manufacturing facilities | 1108 |

| Establishment of a new R&D Centre | 180.2 |

| Repayment / prepayment of certain outstanding borrowings | 200 |

| Working capital requirements | 330 |

| Investment in wholly owned subsidiary, Sai Parenterals Pte Limited (Singapore), in relation to the proposed acquisition of Noumed Pharmaceuticals Pty Limited (Australia) | 360 |

| General corporate purposes* |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

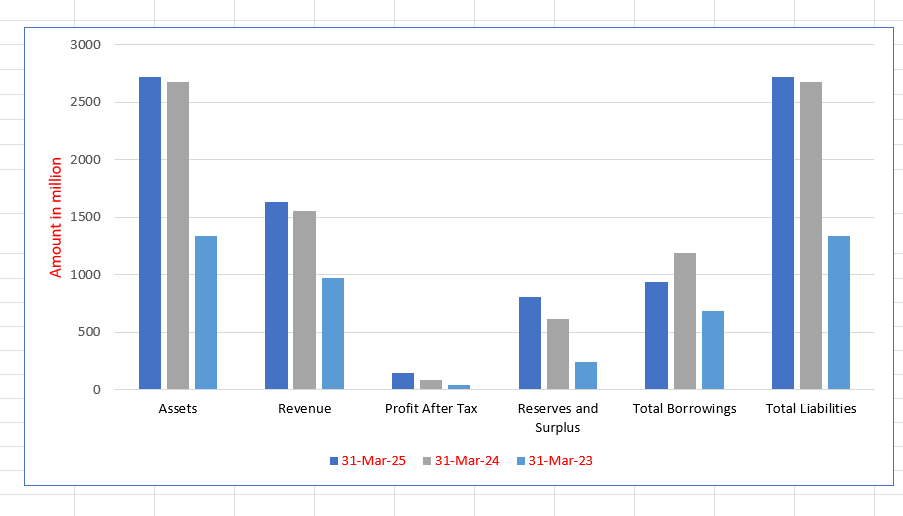

Sai Parenteral’s Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2723.87 | 2680.98 | 1339.63 |

| Revenue | 1637.43 | 1551.80 | 970.28 |

| Profit After Tax | 144.54 | 84.15 | 43.76 |

| Reserves and Surplus | 803.60 | 612.97 | 243.35 |

| Total Borrowings | 937.54 | 1187.85 | 685.47 |

| Total Liabilities | 2723.87 | 2680.98 | 1339.63 |

Financial Status of Sai Parenteral’s Limited

SWOT Analysis of Sai Parenterals IPO

Strength and Opportunities

- Strong reputation in the pharmaceutical industry

- Extensive product portfolio in injectable medicines

- Established presence in international markets

- Robust research and development capabilities

- High-quality manufacturing standards and certifications

- Increasing demand for parenteral products globally

- Strategic focus on expanding distribution networks

- Long-term partnerships with key suppliers and distributors

- Growing focus on innovation and technological advancements

Risks and Threats

- High dependence on raw material imports

- Intense competition in the pharmaceutical sector

- Fluctuating regulatory policies in key markets

- Vulnerability to currency exchange rate fluctuations

- Potential disruptions in the supply chain

- Pressure on profit margins due to cost fluctuations

- Regulatory challenges in different regions

- Risks associated with changing healthcare policies

- Increased operational costs due to inflation

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sai Parenteral’s Limited

Sai Parenteral’s Limited IPO Strengths

Robust Diversification and Revenue Trajectory

Sai Parenteral’s Limited has transformed from a parenteral-focused manufacturer (2001) into a highly diversified generic formulations player offering injectables, tablets, capsules, and more across various therapeutic segments. Driven by operational efficiency and strategic expansion, the Company’s revenue surged from ₹8.6 million (2016) to ₹1,631.05 million in Fiscal 2025, demonstrating an established track record of strong financial growth and market reach.

Strategic Focus on CDMO and Exports

The Company strategically expanded its presence in Regulated and Semi-Regulated Markets by leveraging accredited facilities (Unit III and IV) to grow its exports of Branded Generic Formulations and CDMO products. This focus on long-term CDMO engagements with multinational companies diversifies the revenue mix, significantly reduces segment-specific risks, and adds essential stability and long-term visibility to its future revenue streams.

Accredited and Optimized Manufacturing Base

Sai Parenterals owns and operates five strategically located manufacturing facilities, four in Hyderabad and one in Ongole, with a collective installed capacity of 1,160 million units per year. These facilities hold key accreditations, including TGA-Australia and PIC/S certifications, enabling efficient exports to Regulated Markets. Automation and proximity to major ports ensure logistics optimization and cost-efficient operations.

Extensive Domestic and Global Network

The Company possesses a well-established distribution network, securing a strong presence in Indian institutional markets by participating in government tenders and supplying to PMBJP centers. Internationally, the Company is growing its footprint in Australia, SE Asia, and Africa. This dual strategy leverages a super stockist network domestically and regional distributors abroad, ensuring a broad and reliable market reach.

Seasoned Management and Domain Expertise

Sai Parenterals is led by experienced promoters and a technically skilled senior management team with extensive domain knowledge in pharmaceutical manufacturing, commercial operations, and regulatory compliance. The Managing Director, Anil Kumar Karusala, brings over 31 years of experience, providing strategic direction that has been crucial in driving business expansion, entry into regulated markets, and establishing long-term customer loyalty.

More About Sai Parenteral’s Limited

Sai Parenteral’s Limited is a diversified pharmaceutical company involved in branded generic formulations and Contract Development and Manufacturing Organisation (CDMO) services. The company manufactures and develops pharmaceutical products across various therapeutic areas, such as cardiovascular, neuropsychiatry, anti-diabetic, respiratory health, and dermatology. Sai Parenteral’s portfolio includes injectables, tablets, capsules, oral liquids, and ointments, catering to both domestic and international markets.

Business Operations and Product Offerings

The company’s branded generic formulations are sold to a diverse customer base, including government agencies, hospitals, and pharmaceutical companies in India. Since its export expansion in Fiscal 2023, Sai Parenteral has been exporting products to regulated and semi-regulated markets, including Australia, New Zealand, Southeast Asia, and the Middle East. The company also offers CDMO services, focusing on product development, regulatory filings, and commercial manufacturing. This, combined with their robust R&D capabilities, positions them as a preferred partner in the global pharmaceutical market.

Strategic Acquisitions and Growth

To expand its footprint, Sai Parenteral’s Limited has acquired multiple facilities and made strategic investments. For example, in 2023, the company acquired two internationally accredited manufacturing units in Hyderabad, enhancing its capacity for sterile injectable formulations. Additionally, the proposed acquisition of Noumed Pharmaceuticals in Australia will further strengthen Sai Parenteral’s global presence and CDMO capabilities.

Manufacturing Facilities

Sai Parenteral operates five manufacturing units in India, with a combined installed capacity of 1,160 million units annually. The company is in the process of expanding and upgrading its facilities, with plans to increase capacity and achieve new certifications to meet growing demand for specialized products.

Research & Development

The company’s R&D focus includes developing complex formulations and drug delivery systems, catering to both internal needs and CDMO clients. Equipped with advanced quality control laboratories and skilled personnel, Sai Parenteral ensures its products meet the highest regulatory standards

Industry Outlook

The Indian pharmaceutical industry is one of the fastest-growing sectors in the country and is poised to continue its growth trajectory over the next few years. The sector’s overall outlook remainshighly optimistic, driven by increasing demand both domestically and globally.

Growth Prospects and CAGR

- The Indian pharmaceutical market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 11-12% from 2023 to 2030.

- By 2030, the market size is projected to reach over USD 65 billion, making India one of the leading pharmaceutical markets globally.

Growth Drivers

- Increasing healthcare access: Rising government initiatives, growing middle-class income, and improved healthcare access are key drivers.

- R&D and innovation: Companies are focusing on complex formulations and generic drugs, including injectables and biosimilars.

- Regulatory Support: The government’s push for ‘Make in India’ initiatives and favorable regulatory policies further boost the industry’s prospects.

- Global export potential: Indian pharma exports have surged, especially in regulated markets like the US and Europe, and semi-regulated markets in Africa and Asia.

Key Figures and Values

- India accounts for 20% of global generic exports by volume and is the largest supplier of generic drugs globally.

- The Indian pharma sector exports products to more than 200 countries, contributing significantly to the country’s economy.

Product-Specific Outlook

For companies like Sai Parenteral’s Limited, which focus on injectables, branded generic formulations, and CDMO services, the demand for these products is expected to rise, particularly in:

- Injectables: Increased healthcare needs and higher demand for critical care and sterile therapies.

- Branded Generics: As healthcare systems worldwide focus on affordable medicines, India’s branded generics are becoming increasingly popular.

- CDMO services: The rise of global pharmaceutical outsourcing to India will continue to fuel growth in this segment.

How Will Sai Parenteral’s Limited Benefit

- Sai Parenteral’s focus on injectables aligns with the growing demand for critical care and sterile therapies, positioning the company for increased market share in both domestic and international markets.

- The rise in global demand for affordable branded generics offers significant growth opportunities for the company’s product offerings.

- Sai Parenteral’s established expertise in CDMO services is well-timed as more global pharmaceutical companies outsource manufacturing to India.

- The company’s expansion into regulated markets, such as Australia, New Zealand, and Europe, will benefit from India’s surge in pharma exports and its recognition as a global leader in generics.

- The push for R&D and innovation will enhance the company’s ability to introduce new, complex formulations, keeping it competitive and aligned with industry trends.

- Government support for ‘Make in India’ initiatives further strengthens Sai Parenteral’s growth prospects, especially in manufacturing and export expansion.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (₹ million) | EPS Basic (₹) | EPS Diluted (₹) | P/E (Times) | RoNW (%) | NAV (₹) |

| Sai Parenteral’s Limited | 5 | 1,631.06 | 5.43 | 5.43 | [●] | 15.09% | 35.98 |

| Peer Group | |||||||

| Sai Life Sciences Limited | 1 | 16,945.70 | 8.83 | 8.61 | 107.99 | 7.99% | 102.12 |

| Innova Captab Limited | 10 | 12,436.76 | 22.41 | 22.41 | 37.47 | 13.37% | 167.66 |

| Senores Pharmaceuticals Limited | 10 | 3,982.50 | 16.12 | 16.12 | 55.08 | 7.18% | 176.37 |

| Gland Pharma Limited | 1 | 56,165.04 | 42.40 | 42.40 | 46.53 | 7.63% | 555.41 |

Key Strategies for Sai Parenteral’s Limited

Global Injectable Formulations Expansion

Sai Parenteral’s Limited is expanding its presence in Regulated and Semi-Regulated markets for injectables, allocating1107.95$ million for unit upgrades by Fiscal 2027. This investment aims to achieve EU-GMP and PIC/S certifications, enhance capacity to 117 million units, and introduce high-value lyophilised vial and cartridge manufacturing capabilities.

Capitalising on CDMO Opportunities

The company’s strategy is to leverage its manufacturing capabilities and enhanced R&D competences to capitalise on the growing global CDMO market. This involves targeting Regulated and Semi-Regulated markets for injectables and oral solid dosages, supported by facility upgrades, capacity expansion, and the development of a dedicated R&D Centre.

Strengthening Presence via Noumed Acquisition

Sai Parenteral’s is strengthening its CDMO and market reach through the proposed acquisition of a majority stake in Australia’s Noumed Pharmaceuticals. This move grants access to Noumed’s long-term supply agreements, 451 approved dossiers, and an upcoming Australian manufacturing facility, enhancing the company’s competitive edge in regulated markets.

Focus on New Product Development

Sai Parenteral’s plans to drive future growth by dedicating 180.23 million to establish an advanced R&D Centre operated by its subsidiary, SP Analytics. This centre will focus on novel formulations, regulatory dossier submissions, and developing cost-effective generics for patents expiring soon, supporting both in-house and CDMO business needs.

Grow Branded Generic Formulations Business

The company aims to expand its Branded Generic Formulations business across Semi-Regulated Markets like Latin America, Asia, the Middle East, and Africa. Leveraging upcoming certifications (PIC/S, EU-GMP, TGA) and Noumed’s approved dossiers, Sai Parenteral’s will significantly strengthen its export portfolio and grow its market share in the institutional segment

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sai Parenteral’s Limited IPO

How can I apply for Sai Parenteral’s Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Sai Parenteral’s Limited IPO?

Sai Parenteral’s IPO is a Book Building Issue comprising fresh issue of ₹285 crore and an offer for sale.

When will Sai Parenteral’s shares be listed?

The equity shares are proposed to be listed on NSE and BSE; exact listing date is yet to be announced.

What is the face value of Sai Parenteral’s IPO shares?

Each share has a face value of ₹5, with the issue price band to be declared later.

How will the IPO proceeds be utilised?

Proceeds will fund capacity expansion, new R&D centre, repayment of borrowings, working capital, and overseas acquisition.

Who are the promoters of Sai Parenteral’s Limited?

The company promoters are Anil Kumar Karusala, Vijitha Gorrepati, and Karusala Aruna, holding 61.23% pre-IPO.