- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sambhv Steel Tubes IPO

₹14/182 shares

Minimum Investment

IPO Details

25 Jun 25

27 Jun 25

₹14

182

₹77 to ₹82

NSE, BSE

₹540 Cr

02 Jul 25

Sambhv Steel Tubes Limited

Sambhv Steel Tubes Limited is a leading name in the Indian steel industry, specialising in electric resistance welded (ERW) steel pipes and structural tubes. As of March 31, 2024, it ranks among the top manufacturers by installed capacity. Sambhv Steel stands out as India’s only single-location backward-integrated facility for ERW steel pipes, managing the entire value chain from raw materials to finished products. The company produces sponge iron, steel blooms, hot-rolled (HR) coils, ERW black pipes, hollow sections, and galvanised iron (GI) pipes entirely in-house, ensuring quality, cost-efficiency, and consistency. It is also one of two Indian manufacturers using narrow-width HR coils for ERW pipes and the only one producing these coils internally.

Sambhv Steel Tubes Limited IPO Overview

Sambhv Steel Tubes IPO is a bookbuilding issue of ₹540.00 crore, comprising a fresh issue of ₹440.00 crore and an offer for sale of ₹100.00 crore. The IPO dates and price band are yet to be announced, and the allotment is expected to be finalized on [.]. Nuvama Wealth Management Limited and Motilal Oswal Investment Advisors Limited are the book-running lead managers for the Sambhv Steel Tubes IPO, while Kfin Technologies Limited is the registrar. The shares, with a face value of ₹10 each, will be listed on BSE and NSE.

Specific details such as the lot size, total number of shares offered, and issue price band are awaited. Before the IPO, the company’s shareholding stands at 2,41,00,200 shares, with promoters Brijlal Goyal, Suresh Kumar Goyal, Vikas Kumar Goyal, Sheetal Goyal, Shashank Goyal, and Rohit Goyal collectively holding 71.8% of the equity. The DRHP was filed with SEBI on Thursday, October 3, 2024, and SEBI approval was received on Tuesday, January 21, 2025. The post-issue shareholding will be updated once the equity dilution is determined.

Sambhv Steel Tubes LimitedUpcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹440 crore |

| Offer for Sale: ₹100 crore | |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,41,00,200 shares |

| Shareholding post -issue | TBA |

Sambhv Steel Tubes IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sambhv Steel Tubes Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sambhv Steel Tubes Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 3.79 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.42% |

| Net Asset Value (NAV) | 18.19 |

| Return on Equity | 25.42% |

| Return on Capital Employed (ROCE) | 17.66% |

| EBITDA Margin | 12.43% |

| PAT Margin | 6.41% |

| Debt to Equity Ratio | 0.80 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Prepayment or scheduled repayment of a portion of certain outstanding borrowings availed | 3,900 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

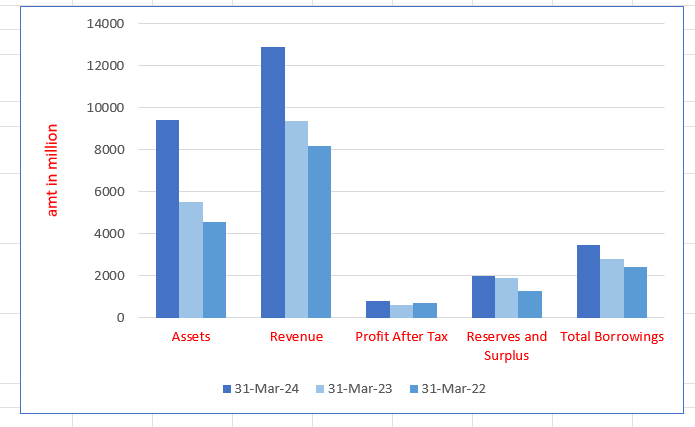

Sambhv Steel Tubes Limited Financials (in millions)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 9401.34 | 5521.36 | 4585.09 |

| Revenue | 12,893.75 | 9390.04 | 8207.53 |

| Profit After Tax | 824.39 | 603.83 | 721.08 |

| Reserves and Surplus | 1972.80 | 1903.07 | 1292.07 |

| Total Borrowings | 3468.76 | 2827.72 | 2412.88 |

| Total Liabilities | 5018.52 | 3417.39 | 3092.12 |

Financial Status of Sambhv Steel Tubes Limited

SWOT Analysis of Sambhv Steel Tubes IPO

Strength and Opportunities

- An integrated manufacturing facility enhances operational efficiency, cost-effectiveness, and control over the entire value chain.

- The strategic location in Raipur provides seamless access to quality raw materials and efficient logistics for product distribution.

- A diverse product portfolio caters to a broad customer base across domestic and international markets.

- Consistent growth in operating income reflects strong market demand and effective business strategies tailored for the steel sector.

- Recent equity infusion has bolstered financial stability, supporting expansions and technological advancements in manufacturing.

- Expansion into value-added products like stainless steel blooms and HR coils opens up new market opportunities.

- Plans to commission a second facility to enhance production capacity and expand the product range.

- Backward integration ensures better quality control, cost efficiency, and streamlined supply chain management for all operations.

- Ability to produce narrow-width HR coils provides a competitive edge in addressing niche market demands.

- Strong domestic presence positions the company to capitalise on growing infrastructure and industrialisation projects in India.

- Ongoing investments in advanced technologies strengthen production capabilities and ensure future readiness for evolving market trends.

Risks and Threats

- Exposure to raw material price volatility may significantly impact the company’s profit margins and financial stability.

- The cyclical nature of the steel industry often leads to demand fluctuations, affecting overall revenue growth and operational planning.

- High competition from well-established players in the steel manufacturing industry presents challenges for market share expansion.

- Working capital-intensive operations require robust management to ensure liquidity and financial stability during market slowdowns.

- Project completion risks and delays in stabilising operations at new facilities can disrupt production timelines and revenues.

- Dependence on external power sources increases operational costs, affecting overall competitiveness and profitability.

- Regulatory changes, especially in environmental policies, may necessitate additional investments, affecting cost structures.

- Fluctuations in foreign exchange rates can influence the cost of imported raw materials, impacting overall production expenses.

- Economic downturns or geopolitical uncertainties may adversely affect both domestic and international market demand for steel products.

- Over-reliance on domestic demand may limit diversification opportunities and expose the business to market-specific risks.

- Potential delays in procuring machinery or raw materials for expansions could hinder timely project execution and market competitiveness.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Sambhv Steel Tubes Limited IPO

More About Sambhv Steel Tubes Limited

Sambhv Steel Tubes Limited stands out as a leading manufacturer of electric resistance welded (ERW) steel pipes and structural tubes in India. As of March 31, 2024, the company achieved an installed capacity of 1,122,400 metric tons per annum (MTPA), which increased to 1,540,000 MTPA by September 20, 2024 (Source: CRISIL Report). Notably, Sambhv Steel is the only Indian company with a single-location, backward-integrated manufacturing setup for ERW pipes and tubes, enabling complete value chain control.

Strategic Location and Raw Material Advantage

The company’s manufacturing facility is strategically located in Sarora (Tilda), Raipur, Chhattisgarh, a mineral-rich region.

- Iron Ore: Sourced from a “Navratna” PSU with India’s highest-grade ore.

- Coal: Procured from a “Maharatna” PSU operating Asia’s largest coal mines, located just 250 km from the facility.

This proximity optimises logistics, ensures steady raw material supply, and reduces costs.

Advanced Technology and Manufacturing Processes

Sambhv Steel employs cutting-edge technology, including an advanced hot rolling mill with hydraulic automatic gauge control (HAGC). This system enhances precision, enabling the production of narrow-width hot-rolled (HR) coils that are on par with primary manufacturers.

Key Product Configurations:

- Square Sections: From 15.00 mm x 15.00 mm to 150.00 mm x 150.00 mm.

- Rectangular Sections: From 40.00 mm x 20.00 mm to 200.00 mm x 100.00 mm.

- Round Pipes: From 15 NB to 150 NB.

Diverse Product Applications

The company’s products cater to various sectors, including:

- Housing and infrastructure

- Water transportation and agriculture

- Solar energy, oil and gas, and telecommunications

Focus on Quality and Innovation

Sambhv Steel’s commitment to excellence is evident through certifications like ISO 9001:2015 and EN 10219-1:2006. Gross margins improved consistently, from 24.35% in FY22 to 28.43% in FY24. Future plans include expanding the product range to pre-galvanised pipes and stainless steel offerings.

Wide Distribution Network

With operations spanning 15 states and one union territory, Sambhv Steel is well-positioned to meet India’s growing demand for high-quality steel pipes and tubes.

Expansion and Efficiency Enhancements

Expanded Production Capacity

- Sarora (Tilda) Facility: Recently expanded to handle higher production volumes, boosting operational efficiency.

- Upcoming Kuthrel Facility: Located in Raipur, Chhattisgarh, the facility will manufacture value-added products, including:

- GP Coils and Pipes

- SS HRAP and CR Coils

- Proximity Advantage: The closeness of both facilities enhances backward integration.

Focus on Sustainability

Captive Power Generation

- Current Capacity: Increased from 15 MW (March 2024) to 25 MW (September 2024).

- Components:

- 16 MW Waste Heat Recovery Boiler (WHRB)

- 9 MW Atmospheric Fluidized Bed Combustion (AFBC) system

- Efficiency Gains:

- Captive plant now meets up to 56.40% of Sarora Facility’s power needs (up from 43.70%).

- Significant cost savings and reduced environmental impact.

Robust Distribution Network

Strategic Reach

- 33 distributors and 600+ dealers across 15 states and 1 union territory.

- Strong presence in states like Maharashtra, Gujarat, Haryana, and Telangana.

- Efficient logistics aided by abundant heavy vehicle availability in Chhattisgarh.

Marketing and Brand Building

Multi-Faceted Approach

- Direct engagement through visits and group meetings with fabricators and retailers.

- Participation in trade fairs and exhibitions to expand market intelligence.

- Integrated campaigns across social media and offline channels for visibility.

Experienced Leadership

The company thrives under the guidance of:

- Promoters: Brijlal Goyal, Suresh Kumar Goyal, and Vikas Kumar Goyal, with over 20 years of sector expertise.

- Key Board Member: Bhavesh Khetan, Executive Director and COO, with relevant industry experience.

Industry Outlook

Indian Steel Industry Overview

- Global Position: India produced 140 MT of crude steel in 2023, contributing 7.4% to global production.

- Growth: India’s steel demand rose by 13-14% in FY2024, driven by construction and infrastructure.

- Per Capita Consumption: India’s consumption of 98 kg is less than half the global average (219 kg), indicating growth potential.

- Key Steel Types:

- Long products (used in construction)

- Flat products (essential for automotive and manufacturing)

- Alloy and non-alloy steel (used in various sectors, including defence)

- Future Prospects: Projected rise in per capita consumption from 2024-2030, supporting long-term growth.

- Government Support:

- National Steel Policy targets 300 MT production by FY2030.

- PLI Scheme offers ₹1.03 lakh crore investment for manufacturing expansion.

- Focus on boosting domestic production and exports.

Indian Steel Pipes and Tubes: Demand Review and Outlook

- Demand Growth (2019-2025): Domestic steel pipe and tube demand is expected to grow at a CAGR of 5-6%, increasing from 8.8 MTPA in Fiscal 2019 to 12.50-13.50 MTPA in Fiscal 2025.

- Impact of Government Initiatives: Growth driven by infrastructure development and investments in the oil and gas sector.

- Covid-19 Impact: A 7% demand dip in Fiscal 2021 due to the pandemic.

- Types of Pipes:

- HSAW Pipes: Made with spirally submerged arc welding, used in oil, gas, and water transportation.

- LSAW Pipes: Made using longitudinally submerged arc welding; used in high-pressure applications like oil and gas exploration.

- ERW Pipes: Made with electric resistance welding, used for water transportation, automobile, and construction.

- Seamless Pipes: Made from steel billets, used in high-pressure oil and gas applications.

- Future Outlook (2025-2029): Demand is projected to reach 18.50-20.50 MTPA by Fiscal 2029, growing at 8-9% CAGR.

- Key Drivers: Structural infrastructure, irrigation, and substitution of traditional construction materials like concrete and steel.

- Government Schemes: The “Amrit Bharat Station Scheme” could create sales opportunities of 500-3,000 tons of steel pipes per railway station.

- Emerging Applications: Demand will grow for construction projects like new airports, high-rises, warehouses, and hospitals

Domestic Demand Outlook for Steel Pipes and Tubes (2019-2029)

- ERW Pipes Demand: Expected to grow at 6-7% CAGR, reaching 9.10-9.30 MTPA in fiscal 2025.

- SAW Pipes Demand: Expected to grow at a slower rate of 1.5-2.5% CAGR, reaching 2.40-2.60 MTPA in fiscal 2025.

- Impact of Pandemic: Demand for both ERW and SAW pipes dropped in fiscal 2021 but surged in subsequent years due to pent-up demand and government-led infrastructure projects.

- Future Outlook (2025-2029): ERW and SAW pipes are projected to grow at 7-9% and 6-7% CAGR, driven by infrastructure, oil, gas, and irrigation projects.

- Seamless Pipes Demand: Expected to grow at 7.5-9.5% CAGR until 2025, with strong growth in fiscal 2022, and projected at 5-6% CAGR from 2025-2029.

Demand Drivers and Challenges for Steel Pipes in India

Government Initiatives

Government schemes like Jal Jeevan Mission and AMRUT are key drivers for steel pipe demand in India, particularly in water supply and irrigation. Annual investments in these sectors are expected to reach ₹4,150-4,200 billion by FY2029, supporting continued growth.

Sector Investment

With states like Gujarat and Telangana achieving 100% Jal Jeevan Mission coverage, the focus on water infrastructure continues to drive steel pipe demand.

Steel Pipe Industry Capacity and Utilisation Outlook

- Domestic Steel Pipe Capacity Growth: From 17.9 MTPA in FY19 to an estimated 21.5-22.0 MTPA in FY24.

- Key Players: APL Apollo Tubes (1 MTPA) and Surya Roshni (0.36 MTPA) expanded capacity in FY23.

- ERW Pipes: Production capacity grew from 9.3 MTPA in FY19 to 12.7-13.2 MTPA in FY24, with utilisation increasing to 71-72%.

- SAW Pipes: Capacity grew to 7.2-7.3 MTPA in FY24, but with a 35-37% utilisation rate, boosted by government focus on infrastructure.

- Future Growth: The capacity is expected to reach 28-29 MTPA by FY29 with a 65-67% utilisation rate, driven by demand from sectors like oil and gas, infrastructure, and irrigation.

How Will Sambhv Steel Tubes Limited Benefit?

- Strategic Location and Raw Material Advantage

Sambhv Steel Tubes Limited benefits from its strategically located manufacturing facility in Sarora, Raipur, surrounded by abundant raw materials like high-grade iron ore and coal. This proximity ensures steady raw material supply, cost efficiency, and optimised logistics, strengthening its competitive edge in the market.

- Advanced Technology and Manufacturing Processes

The company’s investment in cutting-edge technology, such as the advanced hot rolling mill with hydraulic automatic gauge control, enhances precision and allows for the production of high-quality narrow-width hot-rolled coils. This innovation sets Sambhv Steel apart, meeting the demands of diverse industrial applications.

- Diverse Product Applications

Sambhv Steel’s versatile product range, including square, rectangular, and round pipes, caters to key sectors like infrastructure, agriculture, solar energy, and oil and gas. This broad application base allows the company to tap into multiple high-growth industries, ensuring consistent demand for its products.

- Focus on Quality and Innovation

The company’s commitment to quality, certified with ISO 9001:2015 and EN 10219-1:2006, ensures high standards across its product range. Consistent gross margin growth further underscores Sambhv Steel’s focus on innovation, enabling the company to meet evolving industry requirements with excellence.

- Wide Distribution Network

With a robust network of 33 distributors and over 600 dealers across 15 states and one union territory, Sambhv Steel is well-positioned to meet India’s growing steel demand. Its extensive reach in key states ensures market penetration and facilitates efficient product delivery to customers nationwide.

- Expansion and Efficiency Enhancements

Sambhv Steel’s ongoing expansion at its Sarora facility and the upcoming Kuthrel facility will increase production capacity and efficiency. The new facilities will also allow the company to manufacture value-added products, further enhancing its product portfolio and strengthening its market presence.

- Focus on Sustainability

Sambhv Steel’s commitment to sustainability is reflected in its captive power generation capabilities. By increasing its waste heat recovery and fluidised bed combustion systems, the company reduces costs and environmental impact while meeting a significant portion of its energy needs, supporting long-term operational sustainability.

- Robust Distribution Network and Strategic Reach

The company’s strategic distribution network, spanning 15 states and one union territory, ensures timely delivery and strengthens its market presence. The logistical advantage of abundant heavy vehicle availability in Chhattisgarh aids efficient transportation, helping Sambhv Steel meet the growing demand for quality steel products.

- Marketing and Brand Building

Sambhv Steel engages in direct outreach through meetings with fabricators and retailers, ensuring strong customer relationships. Participation in trade fairs and integrated marketing campaigns across multiple channels enhances brand visibility, positioning the company as a key player in the steel industry.

Peer Group Comparison

| Name of Company | Revenue

(₹ million) |

Face Value (₹ per share) | P/E | EPS (₹) | RoNW (%) | NAV (per share) (₹) |

| Sambhv Steel Tubes Limited | 12,857.57 | 10 | N.A. | 3.79 | 25.42 | 18.19 |

| APL Apollo Tubes Limited | 1,81,188.00 | 2 | 58.05 | 26.40 | 22.21 | 129.6 |

| Hariom Pipes Industries Ltd | 11,531.88 | 10 | 39.41 | 20.34 | 13.56 | 160.50 |

| Hi-Tech Pipes Limited | 26,992.93 | 1 | 73.00 | 3.25 | 8.90 | 38.20 |

| JTL Industries Limited | 20,402.29 | 2 | 35.17 | 6.63 | 19.15 | 43.72 |

| Rama Steel Tubes Limited | 10,465.10 | 1 | 30.41 | 0.50 | 10.40 | 2.14 |

| Surya Roshni Limited | 78,092.70 | 5 | 24.07 | 30.51 | 17.41 | 187.63 |

Key Insights

- Revenue: APL Apollo Tubes Limited leads with the highest revenue of ₹1,81,188 million, reflecting its large-scale operations in the industry. In contrast, Rama Steel Tubes Limited generates the lowest revenue of ₹10,465 million, positioning it as a smaller player in comparison to its peers.

- Face Value: The face value per share varies across the companies, with Sambhv Steel Tubes Limited, Hariom Pipes Industries Ltd, Hi-Tech Pipes Limited, and Rama Steel Tubes Limited having a face value of ₹10, suggesting a more conservative stock price. Hi-Tech Pipes Limited has a lower face value of ₹1, potentially offering greater liquidity.

- P/E Ratio: Hi-Tech Pipes Limited holds the highest P/E ratio of 73.00, reflecting optimistic market expectations for its future growth. Sambhv Steel Tubes Limited, which lacks a P/E ratio, might be in its IPO phase or struggling with negative earnings. Rama Steel Tubes Limited has the lowest P/E ratio at 30.41.

- EPS: Surya Roshni Limited stands out with the highest EPS of ₹30.51, indicating its strong profitability. Rama Steel Tubes Limited, on the other hand, shows the lowest EPS of ₹0.50, which could suggest profitability challenges or operational inefficiencies within the company.

- RoNW: Sambhv Steel Tubes Limited boasts a strong RoNW of 25.42%, showing good returns on equity. Conversely, Hi-Tech Pipes Limited has the lowest RoNW at 8.90%, which could indicate suboptimal use of equity capital or challenges in generating shareholder value.

- NAV: Surya Roshni Limited tops the list with the highest NAV per share at ₹187.63, signalling its strong asset base and market value. In comparison, Rama Steel Tubes Limited has the lowest NAV per share of ₹2.14, indicating either lower asset value or market perception.

Sambhv Steel Tubes Limited IPO Strengths

- Single Location Backward Integrated Facility

This company is the only one in India with a backward integrated manufacturing facility for ERW steel pipes and tubes, producing a wide range of products from raw materials sourced and processed in-house. Their vertically integrated operations result in operational efficiency, reduced costs, and competitive advantages in product quality and pricing.

- Fully Integrated Manufacturing Operations

The company’s operations span the entire manufacturing value chain, from producing intermediate products like sponge iron and mild steel blooms/slabs to final products such as ERW pipes, GI pipes, and steel door frames. This integration reduces dependence on external suppliers, ensuring cost control and product quality while offering a significant edge in production efficiency.

- Captive Power Plant for Energy Efficiency

With a 25 MW captive power plant, the company efficiently meets a significant portion of its energy requirements using renewable sources. This energy-efficient setup reduces greenhouse gas emissions, conserves power through waste heat recovery, and lowers energy costs, underscoring the company’s commitment to sustainability and operational savings.

- Strategic Location for Raw Material Supply

The Sarora (Tilda) Facility is strategically located in Chhattisgarh, near abundant coal and iron ore resources. This geographic advantage optimises logistics, ensuring a reliable supply of raw materials at competitive costs and facilitatingtimely distribution. The facility’s location reduces transportation expenses and strengthens the company’s supply chain, enhancing operational efficiency.

- Strong Process Innovation and Execution Capabilities

The company’s continuous innovation allows it to produce value-added products, such as narrow-width HR coils and stainless steel, through cost-effective processes. By employing advanced techniques like the AOD process for stainless steel and WHRB for energy recovery, the company maintains product quality, reduces raw material costs, and strengthens its competitive position in the market.

- Wide-Spread Distribution Network Across India

With a robust network of distributors and dealers in over 15 states, the company has established an efficient distribution system that ensures its products reach a wide customer base. This expansive network, combined with direct sales to OEMs, infrastructure companies, and government projects, helps the company maintain market leadership and customer reach.

- Commitment to Recycling and Sustainability

The company incorporates a sustainable approach by recycling scrap generated across its production units, including the pipe mill, steel melt, and hot rolling mill. This not only reduces waste but also lowers production costs and improves margins. Through effective recycling, the company contributes to environmental sustainability while boosting operational efficiency.

Key Insights from Financial Performance

- Assets: The company’s assets have shown remarkable growth, increasing from 4585.09 in 2022 to 9401.34 in 2024. This represents a significant rise, particularly in 2024, where assets grew by 69.5% from 2023, suggesting robust business expansion or strategic investments.

- Revenue: Revenue has experienced a consistent upward trend over the past three years, growing from 8207.53 in 2022 to 12,893.75 in 2024. The sharp increase of 37.8% in 2024 from 2023 indicates business growth, possibly driven by higher sales or new market opportunities.

- Profit After Tax (PAT): Although the company’s PAT has grown from 603.83 in 2023 to 824.39 in 2024, there was a decline from 721.08 in 2022. The 14.5% drop from 2022 to 2024 may point to rising costs or lower profit margins in recent periods.

- Reserves and Surplus: Reserves and surplus have steadily increased, rising from 1292.07 in 2022 to 1972.80 in 2024. This consistent growth, particularly a 3.7% increase in 2024, reflects the company’s ability to retain earnings and strengthen its financial position for future development.

- Total Borrowings: The company’s borrowings have grown substantially from 2412.88 in 2022 to 3468.76 in 2024. The 22.7% increase in 2024 may indicate that the company is leveraging debt to fund expansion plans, although it introduces higher financial obligations and potential risks.

- Total Liabilities: Liabilities have risen sharply over the three years, with a 47% increase from 2023 to 2024, totalling 5018.52. This suggests that the company is taking on more obligations, possibly due to borrowings or increased operational liabilities, which will need effective management moving forward.

Other Financial Details

- Cost of Materials Consumed: The cost of materials consumed has increased significantly by 23.7%, from ₹6,700.23 million in 2023 to ₹8,287.16 million in 2024. This indicates higher material consumption due to increased production or expansion.

- Employee Benefits Expense: Employee benefits expense increased by 37.8%, from ₹414.61 million in 2023 to ₹571.33 million in 2024. This reflects higher wages, employee benefits, or potentially a greater workforce to support business expansion.

- Finance Costs: Finance costs grew by 46%, rising from ₹218.16 million in 2023 to ₹318.15 million in 2024. This increase may be due to higher borrowings or increased interest expenses linked to expansion.

- Depreciation and Amortisation Expense: Depreciation and amortisation expenses rose by 29.5%, from ₹161.51 million in 2023 to ₹209.10 million in 2024. This is likely due to new asset acquisitions or business expansion, requiring more depreciation.

Key Strategies for Denta Water and Infra Solutions Limited

- Expansion of Production Capacity Focused on Value-Added Products

The company has consistently increased its production capacity at the Sarora (Tilda) Facility, with a current total of 1,122,400 MTPA. Expansion plans are focused on value-added products, including the introduction of stainless steel blooms and coils. Future expansions include the Kuthrel manufacturing plant, which will further augment production capacity and ensure growth to meet increasing demand.

- Expanding Distributor Network and Enhancing Market Share

The company plans to expand its distributor network across India and internationally. This includes increasing the number of distributors and enhancing relationships with existing ones. Expansion will focus on coastal states and other regions where the company currently has a limited presence. The aim is to increase product availability and strengthen market reach.

- Focus on Value-Added Products and Customisation

The company remains committed to developing new value-added products and customising offerings to meet evolving market demands. The introduction of SS HRAP coils, SS CR coils, GP pipes, and other products is expected to diversify its product range and target industries such as construction, telecommunications, and firefighting, thereby driving growth and customer satisfaction.

- Operational and Cost Optimisation

Operational efficiency and cost optimisation are core to the company’s strategy. By automating processes, optimising power consumption through captive energy agreements, and reducing costs with advanced technologies, the company aims to strengthen its competitive position. Its focus on cost-effective production and economies of scale ensures sustainable long-term growth.

- Brand-Building Initiatives

The company continues to invest in branding initiatives, including advertising across multiple platforms and direct engagement with fabricators and distributors. Efforts like personalised visits, interactive sessions, and participation in industry events help to foster loyalty and build strong relationships. These initiatives aim to increase visibility, market presence, and customer engagement, supporting long-term success.

Competitor Analysis of Sambhv Steel Tubes Limited

- APL Apollo Tubes Limited

APL Apollo Tubes Limited is a dominant player in the steel pipes industry, offering a broad product range with a focus on innovation and market reach. While Sambhv Steel Tubes Limited is known for its quality, APL Apollo’s larger scale, advanced technologies, and extensive distribution network give it a competitive edge in terms of market presence and product diversity.

- Hariom Pipes Industries Limited

Hariom Pipes Industries Limited specialises in manufacturing a variety of pipes, excelling in quality and reliability. Sambhv Steel Tubes Limited, however, competes strongly in the market with a focus on efficient production processes and product innovation, although Hariom’s specialisation in pipes could give it an edge in niche markets.

- Hi-Tech Pipes Limited

Hi-Tech Pipes Limited stands out for its diverse product offerings and advanced manufacturing processes, focusing on both domestic and international markets. While Sambhv Steel Tubes Limited is strong in quality and customer service, Hi-Tech’s superior technological advancements and higher production capacity position it as a stronger competitor in the global market.

- JTL Industries Limited

JTL Industries Limited is known for its modern manufacturing units and a wide range of steel tubes. Sambhv Steel Tubes Limited, while competing in similar segments, focuses more on niche market segments and quality control. JTL’s greater emphasis on technological upgrades gives it a higher production capacity and broader market presence.

- Rama Steel Tubes Limited

Rama Steel Tubes Limited has a solid reputation for producing high-quality steel tubes and pipes, catering to various industrial needs. Sambhv Steel Tubes Limited holds its own in terms of product excellence but faces challenges in scale compared to Rama, which has a well-established reputation and larger production capacity.

- Surya Roshni Limited

Surya Roshni Limited is a market leader in the manufacturing of steel pipes, with a robust presence in both domestic and international markets. Sambhv Steel Tubes Limited competes by focusing on high-quality production and customer relations, but Surya Roshni’s advanced technology, larger manufacturing scale, and established brand presence put it ahead of the competition.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the size of the Sambhv Steel Tubes Limited IPO?

The IPO aims to raise ₹540 crore, comprising a fresh issue of ₹440 crore and an offer-for-sale (OFS) of ₹100 crore by promoters.

Who are the promoters participating in the offer-for-sale (OFS)?

Promoters Shashank Goyal and Rohit Goyal will each sell shares worth ₹10 crore; Kaushlya Goyal and Harsheet Goyal will each offer shares worth ₹10 crore; and Rinku Goyal will offer shares totaling ₹60 crore.

How will the proceeds from the fresh issue be utilized?

The company plans to use ₹390 crore from the fresh issue to repay debt and for general corporate purposes.

Who are the lead managers for the IPO?

Nuvama Wealth Management and Motilal Oswal Investment Advisors are the book-running lead managers for this IPO.

What is the timeline for the Sambhv Steel Tubes Limited IPO?

The IPO date and price band have not yet been announced, and the company is awaiting approval from SEBI.