- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Scoda Tubes IPO

₹13,000/100 shares

Minimum Investment

IPO Details

28 May 25

30 May 25

₹13,000

100

₹130 to ₹140

NSE, BSE

₹220 Cr

04 Jun 25

Scoda Tubes IPO Timeline

Bidding Start

28 May 25

Bidding Ends

30 May 25

Allotment Finalisation

02 Jun 25

Refund Initiation

03 Jun 25

Demat Transfer

03 Jun 25

Listing

04 Jun 25

Scoda Tubes Limited

Incorporated in 2008, Scoda Tubes Limited manufactures stainless steel tubes and pipes, offering seamless and welded variants under its brand. Its product range includes seamless pipes, tubes, “U” tubes, instrumentation tubes, and welded “U” tubes. The company serves sectors like oil and gas, power, pharma, and automotive. With a facility in Mehsana, Gujarat, it exports to 16 countries and has 49 stockists. Domestic sales are managed from Maharashtra, while global distribution spans the US and Europe. As of August 2024, the company employs 496 individuals, including 149 permanent staff.

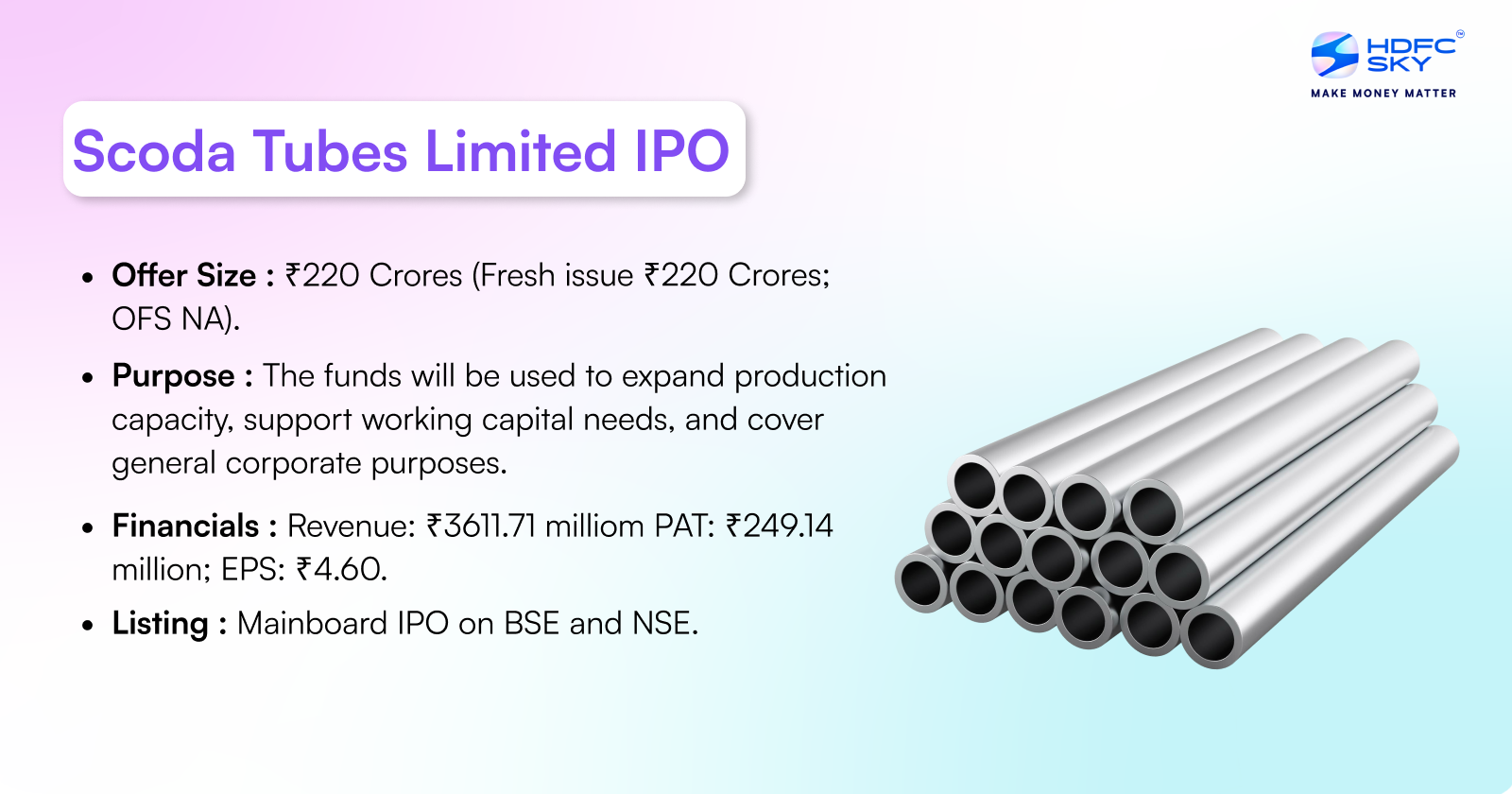

Scoda Tubes Limited IPO Overview

Scoda Tubes IPO is a book-built issue worth ₹220.00 crores, comprising a fresh issue of 1.57 crore shares. The IPO opens for subscription on May 28, 2025, and closes on May 30, 2025. Allotment is expected to be finalised on June 2, 2025, and the shares are likely to be listed on both BSE and NSE on June 4, 2025. The price band is set between ₹130 and ₹140 per share. Retail investors can apply for a minimum of one lot (100 shares) requiring an investment of ₹13,000, though bidding at the cutoff price is recommended, raising the amount to ₹14,000. For sNII, the minimum application is 15 lots (1,500 shares) costing ₹2,10,000, while for bNII it is 72 lots (7,200 shares) amounting to ₹10,08,000. Monarch Networth Capital Ltd serves as the book-running lead manager, and MUFG Intime India Private Limited (Link Intime) is the registrar for the issue.

Scoda Tubes Limited IPO Details

| Particulars | Details |

| IPO Date | 28 May 2025 to 30 May 2025 |

| Listing Date | 4 June 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹130 to ₹140 per share |

| Lot Size | 100 Shares |

| Total Issue Size | 1,57,14,286 shares (aggregating up to ₹220.00 Cr) |

| Fresh Issue | 1,57,14,286 shares (aggregating up to ₹220.00 Cr) |

| Offer for Sale | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | NSE SME |

| Share Holding Pre Issue | 4,41,94,700 shares |

| Share Holding Post Issue | TBD |

Scoda Tubes Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Scoda Tubes Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 100 | ₹14,000 |

| Retail (Max) | 14 | 1,400 | ₹1,96,000 |

| S-HNI (Min) | 15 | 1,500 | ₹2,10,000 |

| S-HNI (Max) | 71 | 7,100 | ₹9,94,000 |

| B-HNI (Min) | 72 | 7,200 | ₹10,08,000 |

Scoda Tubes Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue |

Scoda Tubes Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.60 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 28.77% |

| Net Asset Value (NAV) | 15.99 |

| Return on Equity | 28.77% |

| Return on Capital Employed (ROCE) | 15.92% |

| EBITDA Margin | 14.70% |

| PAT Margin | 4.58% |

| Debt to Equity Ratio | 3.19 |

Objectives of the Proceeds

- Capital expenditure for expanding production capacity of seamless and welded tubes and pipes – ₹769.90 million

- Funding part of the incremental working capital requirements of the company – ₹1,100.00 million

- General corporate purposes

Key Financials (in ₹ million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4284.90 | 3304.24 | 2382.62 | 1560.64 |

| Revenue | 3611.71 | 3998.61 | 3051.28 | 1940.28 |

| Profit After Tax | 249.14 | 183 | 103.36 | 16.36 |

| Reserves and Surplus | 993.51 | 623.28 | 440.27 | 336.94 |

| Total Borrowings | 2021.64 | 2026.63 | 1393.08 | 1098.95 |

SWOT Analysis of Scoda Tubes IPO

Strength and Opportunities

- Specializes in stainless steel seamless and welded tubes and pipes with a broad product range.

- Holds global certifications like ISO 9001:2015, PED 2014/68/EU, and AD 2000-Merkblatt W0.

- Serves diverse sectors including oil & gas, power, automotive, and pharmaceuticals.

- Strategically located manufacturing facility near key ports, enhancing export capabilities.

- Demonstrates consistent financial growth with ongoing capacity expansion initiatives.

Risks and Threats

- Operates in a highly fragmented and competitive steel industry.

- Faces susceptibility to raw material price volatility and forex fluctuations.

- Relies on a limited stockist network for sales and distribution.

- Exposed to risks from unsecured loans and potential cash flow strains.

- Dependent on third-party logistics, making it vulnerable to transportation disruptions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Scoda Tubes Limited IPO

IPO Strengths

- The company specialises exclusively in stainless-steel tubes and pipes, offering tailored solutions backed by deep segment expertise.

- It holds multiple international certifications, enabling global-standard production and enhancing credibility across markets.

- A diverse customer base across industries and geographies ensures revenue stability and reduced market risk.

- Rigorous quality control systems with low rejection rates uphold product consistency and brand reputation.

- The strategically located, fully integrated facility with backward integration enables cost efficiency and production flexibility.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue

(₹ mn) |

EPS | P/E Ratio | RoNW (%) | NAV per Share (₹) |

| Scoda Tubes Limited | 10.00 | 3,998.61 | 4.60 | – | 28.77% | 15.99 |

| Peer Groups | ||||||

| Ratnamani Metals & Tubes Ltd | 2.00 | 50,590.90 | 89.18 | 31.93 | 19.90% | 448.07 |

| Venus Pipes & Tubes Ltd | 10.00 | 8,021.98 | 42.36 | 30.77 | 21.17% | 200.05 |

| Welspun Specialty Solutions Ltd | 10.00 | 6,966.70 | 1.18 | 27.15 | 67.11% | 1.76 |

| Suraj Limited | 10.00 | 3,306.65 | 11.72 | 34.79 | 17.57% | 66.74 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Scoda Tubes Limited IPO

How can I apply for Scoda Tubes Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What are the IPO dates for Scoda Tubes Limited?

The IPO opens on 28 May 2025 and closes on 30 May 2025.

What is the minimum investment required for retail investors?

Retail investors must invest at least ₹14,000 for one lot of 100 shares.

When will Scoda Tubes Limited IPO shares be listed?

Shares are expected to be listed on BSE and NSE on 4 June 2025.

What is the price band set for the Scoda Tubes IPO?

The price band is between ₹130 and ₹140 per equity share.