- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

SEDEMAC Mechatronics IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

SEDEMAC Mechatronics IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

SEDEMAC Mechatronics Limited

SEDEMAC Mechatronics Limited is a Pune-based technology leader specializing in advanced control electronics and mechatronic systems. Founded in 2007, the company designs and manufactures critical components like powertrain controllers, motor control units, and integrated starter-generator solutions for automotive and industrial applications. Its core strength lies in patented sensor-less motor control technology, which enhances reliability and performance. SEDEMAC collaborates closely with major OEMs globally, providing innovative, efficient, and scalable electronic solutions for two-wheelers, three-wheelers, generator sets, and emerging electric vehicle segments, establishing itself as a key player in the control technology landscape.

SEDEMAC Mechatronics Limited IPO Overview

SEDEMAC Mechatronics Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on 10 November 2025 as it plans to raise funds through an Initial Public Offer (IPO). The IPO will be a Book Built Issue and consists entirely of an Offer for Sale of up to 0.80 crore shares. The company aims to list its equity shares on both NSE and BSE. ICICI Securities Ltd. will act as the book-running lead manager, while MUFG Intime India Pvt. Ltd. will serve as the registrar. Key details such as the IPO dates, price band, and lot size are yet to be announced. As per the DRHP, the issue size is 80,43,300 shares, aggregating up to ₹[.] crore, with a face value of ₹10 per share. Since this is a pure Offer for Sale, the pre-issue and post-issue shareholding remains the same at 4,37,37,000 shares. The DRHP was officially filed on 10 November 2025. The company’s promoters include Prof. Shashikanth Suryanarayanan, Amit Arun Dixit, Manish Sharma, and Anaykumar Avinash Joshi, who collectively held 26.43% of the shares before the issue.

SEDEMAC Mechatronics Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO (Entirely an Offer for Sale) |

| Total Issue Size | 80,43,300 shares (aggregating up to ₹[.] Cr) |

| Fresh Issue | ₹ 0 |

| Offer for Sale (OFS) | ₹ [.] |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,37,37,000 shares |

| Shareholding post-issue | 4,37,37,000 shares |

SEDEMAC Mechatronics IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

SEDEMAC Mechatronics Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

SEDEMAC Mechatronics Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 10.93 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 15.48% |

| Net Asset Value (NAV) | ₹ 71.57 |

| Return on Equity (RoE) | 22.01% |

| Return on Capital Employed (RoCE) | 33.79% |

| EBITDA Margin | 19.00% |

| PAT Margin | 7.15% |

| Debt to Equity Ratio | 0.21 |

Objectives of the IPO Proceeds

Being entirely an OFS issue, the IPO proceeds will entirely go to the selling shareholders, and the company will not use the proceeds for corporate purposes.

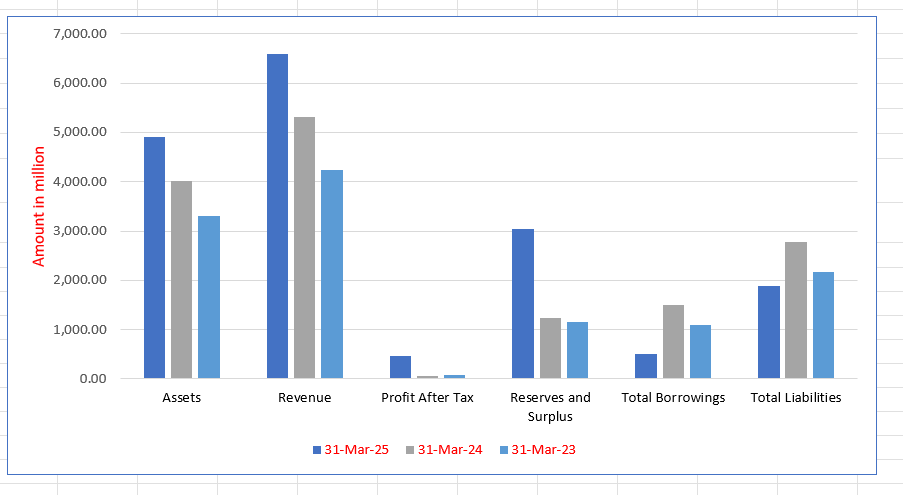

SEDEMAC Mechatronics Limited Financials (in ₹ million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 4,911.59 | 4,022.41 | 3,312.75 |

| Revenue | 6,583.63 | 5,306.53 | 4,230.28 |

| Profit After Tax | 470.45 | 58.78 | 85.73 |

| Reserves and Surplus | 3,033.53 | 1,240.26 | 1,149.29 |

| Total Borrowings | 496.18 | 1,506.18 | 1,096.07 |

| Total Liabilities | 1,877.78 | 2,781.19 | 2,162.50 |

Financial Status of SEDEMAC Mechatronics Limited

SWOT Analysis of SEDEMAC Mechatronics IPO

Strength and Opportunities

- First-mover advantage with patented sensor-less motor control technology.

- Complete in-house ownership of product design and technology.

- Strong, entrenched partnerships with leading global OEMs.

- Agility in R&D and rapid response to market changes.

- Significant market leadership in genset controllers in India.

- Successful cross-market synergy of core technologies.

- Highly qualified engineering team from premier institutions.

- Robust financial performance with high growth in revenue and profitability.

- Expanding product portfolio into high-growth areas like EVs and power tools.

- Favorable industry outlook driven by electrification and emission control norms.

Risks and Threats

- Dependence on the automotive and generator sectors for majority of revenue.

- Limited public market track record post-IPO.

- Intense competition from large, established global Tier-I suppliers.

- Vulnerability to global semiconductor supply chain disruptions.

- High reliance on a technically skilled workforce, leading to talent retention challenges.

- Potential pressure on margins from OEM cost-reduction demands.

- Rapid technological shifts in the automotive industry, especially towards electrification.

- Regulatory changes in emission norms across different countries.

- Economic cycles affecting discretionary spending on vehicles and industrial equipment.

- Risks associated with international expansion and global operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About SEDEMAC Mechatronics Limited

SEDEMAC Mechatronics Limited IPO Strengths

First-to-Market Advantage Driving Market Leadership

SEDEMAC Mechatronics Limited has consistently been a first-mover in several key control-intensive propositions, such as its sensor-less ISG systems and genset controllers with integrated eGov functionality. This pioneering approach allows the company to establish high entry barriers, influence industry standards, and secure dominant market positions. Early adoption by OEMs leads to deep integration, making it challenging for customers to switch and enabling SEDEMAC to continuously refine its products, thereby sustaining its competitive advantage and leadership across its target markets.

Agility At Scale Through Integrated Operations

SEDEMAC Mechatronics Limited possesses remarkable agility derived from its complete in-house control over design, engineering, and manufacturing. This integrated structure allows the company to rapidly innovate, validate, and scale customized solutions without reliance on third-party licensors. This capability was notably demonstrated during the global semiconductor shortage, where SEDEMAC quickly redesigned products to ensure uninterrupted customer supply. This agility, powered by a strong team of engineers, enables swift responses to customer needs, regulatory shifts, and supply chain challenges, providing a significant competitive edge.

Synergies Across Markets and Products

SEDEMAC Mechatronics Limited effectively leverages synergies by deploying its core technology platforms across diverse markets. For instance, its motor control architecture, developed for ISG applications in engine-powered vehicles, has been successfully adapted for electric vehicles and is being explored in power tools. This cross-pollination enhances product robustness, reduces development time, and provides procurement advantages through aggregated volumes, particularly for semiconductors. This strategy strengthens the company’s supply chain, reduces costs, and deepens its relationships with both customers and suppliers.

Continued Ability to Build Fresh Propositions

SEDEMAC Mechatronics Limited demonstrates a sustained capability for innovation, consistently launching and scaling differentiated technologies. The company’s culture, driven by a high-quality technical nucleus and strong leadership, ensures a continuous pipeline of fresh, value-added propositions. This is evident in its successful track record of introducing products like ISG ECUs, EFI ECUs, and MCUs across different mobility segments. This ongoing innovation embeds the company’s platforms deeper into customer operations, raising barriers to competition and supporting long-term, profitable growth.

Quality, Traceability, and Reliable Delivery

SEDEMAC Mechatronics Limited is committed to high-quality manufacturing and reliable delivery, which is critical for its control-intensive products. The company employs rigorous validation protocols and maintains complete traceability from raw materials to finished goods. This focus on quality results in consistently low part failure rates, as evidenced by minimal warranty expenses. Its proven ability to ensure uninterrupted supply, even during global disruptions, has established SEDEMAC as a dependable and trusted partner for OEMs, reinforcing its market position.

More About SEDEMAC Mechatronics Limited

SEDEMAC Mechatronics Limited is a technology-driven company that designs, develops, and manufactures sophisticated control electronics and mechatronic systems. Its solutions are critical to the operation of equipment in the mobility and industrial sectors.

Core Technology and Product Portfolio

The company’s expertise spans four core design aspects: hardware, base software, application software, and mechanical integration. It holds significant intellectual property, particularly in proprietary base and application software.

- Flagship Products Include:

- Integrated Starter-Generator (ISG) ECUs: Enable a vehicle’s magneto to function as both a starter and generator, enhancing efficiency.

- Electronic Fuel Injection (EFI) ECUs: Ensure precise fuel delivery for compliance with stringent emission norms.

- Motor Control Units (MCUs): For electric two-wheelers, three-wheelers, and bicycles.

- Genset Controllers (GCs): Supervisory controllers for automatic mains failure and load transfer in generators.

Market Leadership and Global Reach

SEDEMAC has established a formidable market position:

- Genset Controllers: Largest supplier in India with a 75% market share by volume in FY 2025. A key global player with a 14% global market share.

- ISG Systems: A top global player by sales for ICE-powered two-wheelers and three-wheelers, with over 7.5 million sensorless ISG units installed globally.

Innovation and R&D Engine

The company’s R&D is its lifeblood, driven by a team of 217 engineers, over 62% of whom are from premier institutions like IITs, NITs, and BITS. This focus has led to patented technologies like sensor-less motor control, which eliminates the need for external hall-effect sensors, boosting reliability and reducing cost.

Financial Trajectory

SEDEMAC has shown impressive financial growth, with revenue increasing from ₹4,230 million in FY 2023 to ₹6,584 million in FY 2025. More significantly, its Profit After Tax surged to ₹470 million in FY 2025 from ₹59 million in FY 2024, underscoring improved operational efficiency and scalability.

Industry Outlook

The Indian automotive components and industrial electronics industry is poised for robust growth, driven by multiple structural factors.

Overall Industry Growth

The Indian auto component industry is a key pillar of the economy. According to the CRISIL Report, the industry is expected to see a healthy CAGR, supported by strong domestic vehicle demand, increasing exports, and the government’s Production Linked Incentive (PLI) schemes. The transition to stricter emission norms (BS-VI) and the push for electrification are creating significant opportunities for advanced electronic component suppliers.

Growth Drivers

- Electrification of Vehicles: The Indian electric vehicle (EV) market, particularly for two-wheelers and three-wheelers, is expanding at an exponential rate, driving demand for MCUs and associated powertrain electronics.

- Stringent Emission Norms: The implementation of BS-VI standards for all vehicle categories, including commercial vehicles, mandates advanced electronic controls for fuel injection and aftertreatment systems.

- Industrialization and Power Demand: Growth in infrastructure, real estate, and the need for reliable backup power sustains the demand for generator sets and their electronic controllers.

- Global Sourcing Shift: India is increasingly becoming a preferred manufacturing hub for auto components, benefiting from the “China-plus-one” strategy of global OEMs.

Specific Product Segments

- Genset Controllers: The market is stable with a replacement demand and growth linked to commercial and industrial activity. The trend towards more efficient and digitally controlled generators benefits advanced controller suppliers.

- Automotive Controllers (ISG, EFI, MCU): This segment is in a high-growth phase. The penetration of EFI systems in two-wheelers is increasing, and the adoption of start-stop systems (enabled by ISG) is rising for fuel efficiency. The EV controller market is nascent but offers a massive growth potential.

- Emerging Areas (Power Tools, Commercial Vehicles): The global power tool market, with sales of 334.7 million units in 2024, presents a substantial opportunity for advanced motor controls. Similarly, the commercial vehicle segment in India offers a new frontier for aftertreatment and engine control units.

How Will SEDEMAC Mechatronics Limited Benefit

- Benefit from the rapid electrification of two-wheelers and three-wheelers in India through increased demand for its Motor Control Units (MCUs), which are architecturally similar to its proven ISG ECUs, allowing for rapid and scalable deployment.

- Capitalize on its market leadership in genset controllers to capture consistent demand from the industrial sector, which requires reliable backup power solutions for infrastructure and commercial growth.

- Leverage its first-mover advantage and patented sensor-less technology to secure design wins with OEMs looking for differentiated and reliable solutions for emission control and fuel efficiency.

- Expand its addressable market by successfully adapting its core SLC motor control technology for high-volume adjacent sectors like power tools and outdoor equipment, leveraging demonstrated proof-of-concepts.

- Deepen relationships with existing OEM customers by offering a suite of control-intensive products (e.g., ISG, EFI, ISG+EFI ECUs), thereby increasing the value share per customer and creating entrenched partnerships.

- Utilize its strong R&D capabilities and agile design process to quickly develop solutions for new regulatory mandates, positioning itself as a go-to partner for OEMs navigating compliance challenges.

- Gain from the global supply chain diversification trend, as international OEMs seek reliable Indian suppliers for critical electronic components, benefiting a proven player like SEDEMAC.

Peer Group Comparison

| Name of Company | Face Value (₹) | Revenue (₹ million) | EPS – Basic (₹) | EPS – Diluted (₹) | NAV (₹) | P/E | RONW FY 2025 |

| SEDEMAC Mechatronics Limited | 10 | 6,583.63 | 10.93 | 10.82 | 71.57 | NA | 15.48 |

| Peer Groups | |||||||

| Bosch Limited | 10 | 180,874.00 | 683.25 | 683.25 | 4,682.43 | 53.89 | 14.59 |

| ZF Commercial Vehicle Control Systems India Ltd. | 5 | 38,309.63 | 242.90 | 242.90 | 1,697.00 | 52.19 | 14.31 |

| Sona BLW Precision Forgings Limited | 10 | 35,460.21 | 9.92 | 9.92 | 88.39 | 49.49 | 10.94 |

| Schaeffler India Limited | 2 | 82,323.80 | 60.10 | 60.10 | 341.57 | 68.06 | 17.59 |

Key Strategies for SEDEMAC Mechatronics Limited

Expand Technologies Across Multiple Large Markets

SEDEMAC Mechatronics Limited intends to systematically develop and deploy its technologies across large mobility and industrial markets, avoiding niche sectors. The strategy involves leveraging its comprehensive portfolio, from ISG ECUs for vehicles to genset controllers, and expanding into high-potential areas like power tools and commercial vehicles. By targeting large, global end-markets, the company aims to ensure its product platforms achieve significant scale, foster global relevance, and drive sustained business growth while mitigating dependence on any single sector.

Drive Technology and Product Differentiation

SEDEMAC Mechatronics Limited is committed to continuous investment in differentiated, innovative technologies that provide tangible value to OEMs. The company focuses on developing control-intensive offerings that deliver critical functionality, such as improved performance, enhanced user experience, and regulatory compliance. It consciously avoids commoditized products, instead focusing on value-added, complex technologies like its sensorless motor control. This approach secures its reputation as an innovative leader, supports premium positioning, and maintains healthy profitability to fuel further R&D efforts.

Offer A Suite of Control-Intensive Products

SEDEMAC Mechatronics Limited aims to establish a deep presence in each key market by offering a diverse array of critical, control-intensive solutions. Rather than limiting itself to one product per sector, it provides a suite, such as ISG, EFI, and ISG+EFI ECUs for the automotive market. This multi-product strategy deepens customer relationships, increases the value delivered per equipment, and enhances capital efficiency by generating multiple revenue streams from a single market, thereby strengthening its overall value proposition and customer stickiness.

Build and Sustain Partnerships with Market Leaders

SEDEMAC Mechatronics Limited prioritizes long-term, entrenched partnerships with leading OEMs. For new technology launches, it prefers to collaborate with established, technically capable customers who can commit to rigorous validation and early adoption. This focus on market leaders increases the success rate of integration and lends credibility to its solutions. These strategic relationships, combined with its engineering strength, have been instrumental in successfully introducing new technologies into series production and reinforcing its position as a respected Tier-I supplier.

Leverage Synergies Across Markets and Supply Chains

SEDEMAC Mechatronics Limited proactively seeks efficiencies by deploying shared technology platforms and streamlining supply chains across its portfolio. The company encourages cross-functional collaboration to design products with common core architectures, which delivers benefits in product robustness, cost, scalability, and speed-to-market. By concentrating procurement, particularly for semiconductors, it achieves economies of scale and builds strong supplier relationships. This synergistic approach drives profitability, improves capital efficiency, and reinforces the widespread adoption of its technologies.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On SEDEMAC Mechatronics Limited IPO

How can I apply for SEDEMAC Mechatronics Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size and price band for the IPO?

The lot size and price band for the SEDEMAC Mechatronics IPO are yet to be announced and will be updated post SEBI approval.

Will the company receive any funds from this IPO?

No, this IPO is entirely an Offer for Sale (OFS), so all proceeds will go to the selling shareholders, not the company.

What are the company's main products?

SEDEMAC manufactures critical control units like ISG ECUs, EFI ECUs, Motor Control Units for EVs, and Genset Controllers.

Where will SEDEMAC Mechatronics shares be listed?

The equity shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).