- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Seshaasai Technologies IPO

₹14,070/35 shares

Minimum Investment

IPO Details

23 Sep 25

25 Sep 25

₹14,070

35

₹402 to ₹423

NSE, BSE

₹813.07 Cr

30 Sep 25

Seshaasai Technologies IPO Timeline

Bidding Start

23 Sep 25

Bidding Ends

25 Sep 25

Allotment Finalisation

26 Sep 25

Refund Initiation

29 Sep 25

Demat Transfer

29 Sep 25

Listing

30 Sep 25

About Seshaasai Technologies Limited

Seshaasai Technologies Limited is a technology-driven solutions provider specialising in payments, communication, and IoT. The company manages information across its lifecycle—from creation to dissemination—ensuring its effective use to drive business success. Scalable and compliance-focused, Seshaasai’s solutions address operational challenges, enhance customer experiences, and support strategic business goals.

Since its inception, Seshaasai’s journey has evolved significantly. Starting as a print stationery supplier for private banks in the 1990s, the company transitioned into a trusted custodian of government data in the early 2000s. Today, it drives digital transformation across industries with advanced technologies.

Seshaasai Technologies Limited IPO Overview

Seshaasai Technologies IPO is a book-built issue worth ₹813.07 crores, comprising a fresh issue of 1.13 crore shares aggregating to ₹480.00 crores and an offer for sale of 0.79 crore shares aggregating to ₹333.07 crores. The IPO opens for subscription on September 23, 2025, and closes on September 25, 2025, with the allotment expected to be finalized by September 26, 2025. The shares are planned to list on BSE and NSE, with a tentative listing date of September 30, 2025.

The IPO price band is set between ₹402.00 and ₹423.00 per share, with a lot size of 35 shares. Retail investors need a minimum investment of ₹14,805 based on the upper price band. For small non-institutional investors (sNII), the lot size is 14 lots (490 shares), amounting to ₹2,07,270, while for big non-institutional investors (bNII), it is 68 lots (2,380 shares), amounting to ₹10,06,740. IIFL Capital Services Ltd. is appointed as the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar for the issue.

Seshaasai Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1,13,47,588 shares (aggregating up to ₹480.00 Cr)

Offer for Sale (OFS): 78,74,015 shares of ₹10 (aggregating up to ₹333.07 Cr) |

| IPO Dates | 23 September 2025 to 25 September 2025 |

| Price Bands | ₹402 to ₹423 per share |

| Lot Size | 35 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 15,04,53,300 shares |

| Shareholding post -issue | 16,18,00,888 shares |

Seshaasai Technologies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 35 | ₹14,805 |

| Retail (Max) | 13 | 455 | ₹1,92,465 |

| S-HNI (Min) | 14 | 490 | ₹2,07,270 |

| S-HNI (Max) | 67 | 2,345 | ₹9,91,935 |

| B-HNI (Min) | 68 | 2,380 | ₹10,06,740 |

Seshaasai Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Seshaasai Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 18.55 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 36.36% |

| Net Asset Value (NAV) | 31.54 |

| Return on Equity | 39.00% |

| Return on Capital Employed (ROCE) | 33.48% |

| EBITDA Margin | 19.30% |

| PAT Margin | 10.78% |

| Debt to Equity Ratio | 0.52 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure for the expansion of existing manufacturing units | 1,953.28 |

| Repayment and / or prepayment, in part or in full, of certain outstanding loans | 3,000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

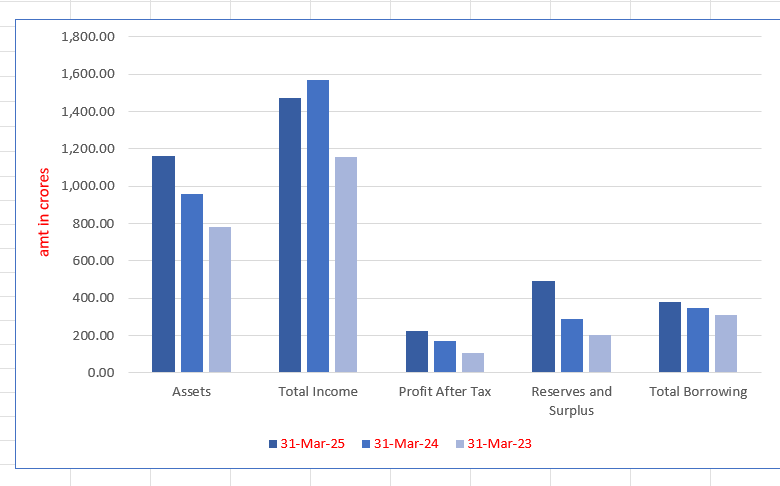

Seshaasai Technologies Limited Financials (in crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,160.39 | 958.41 | 782.54 |

| Total Income | 1,473.62 | 1,569.67 | 1,153.84 |

| Profit After Tax | 222.32 | 169.28 | 108.10 |

| Reserves and Surplus | 490.52 | 286.43 | 201.29 |

| Total Borrowing | 378.68 | 350.24 | 311.99 |

Financial Status of Seshaasai Technologies Limited

SWOT Analysis of Seshaasai Technologies IPO

Strength and Opportunities

- Recognised as a leading tech brand in the BFSI sector, enhancing credibility and trust.

- Established in 1993 with a nationwide presence across 12 strategic locations for optimal reach.

- Offers a comprehensive range of solutions, including smart payments, IoT services, and digital transformation.

- Actively contributes to India's digital evolution, positioning itself as an industry pioneer in innovation.

- Holds a 34.5% market share in credit and debit card issuance, showcasing leadership.

- Recognised for innovative products like AI-based spatial intelligence platforms, driving competitive advantage.

- Plans for IPO indicate potential for increased capital, visibility, and expansion opportunities globally.

- Awarded as Asia’s Greatest Brand in Customer Communication Management, enhancing market reputation.

- Expertise in anti-counterfeiting technologies meets increasing demand in e-commerce and digital payments.

- Focus on 'Make-in-India' initiatives aligns with national economic policies, boosting local support.

- Strategic partnerships enhance capabilities and strengthen the ecosystem, driving collaborative growth.

Risks and Threats

- Operating primarily in BFSI sector limits diversification into other industries, reducing flexibility.

- Rapid technological advancements require continuous investment in research and development to stay competitive.

- Dependence on proprietary software may pose challenges if not regularly updated or upgraded.

- Potential regulatory changes in the BFSI sector could significantly impact service offerings and profitability.

- Increasing competition from emerging fintech companies may erode market share and pricing power.

- Cybersecurity threats require robust measures to protect sensitive client data, increasing operational costs.

- Economic downturns could affect client budgets, leading to reduced demand and revenue.

- High reliance on BFSI sector makes the company vulnerable to sector-specific downturns or disruptions.

- Compliance with diverse international standards may create barriers in achieving seamless global expansion.

- Limited presence in emerging markets restricts potential growth and diversification opportunities globally.

- Rising operational costs could reduce profit margins and impact overall financial performance.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Seshaasai Technologies Limited

Seshaasai Technologies Limited IPO Strengths

- Established Leadership in Payment Solutions

Seshaasai Technologies holds a leading position in the highly regulated payment card manufacturing industry in India, with a market share of approximately 34.5% in fiscal 2024. This growth is attributed to the company’s expertise and strong relationships with key players in the banking, insurance, and financial sectors. Its ability to manage the entire payment lifecycle and adapt to industry needs ensures continuous demand for its products.

- Long-Standing Customer Relationships

Seshaasai Technologies has fostered deep, long-term relationships with major clients, with over 83% of its revenue coming from customers with whom it has worked for over five years. This customer retention, coupled with its ability to attract new clients, reflects the company’s exceptional ability to provide customised solutions across sectors like banking, insurance, and fintech.

- Diversified and Scalable Solutions Portfolio

With a broad range of offerings catering to sectors such as banking, insurance, and fintech, Seshaasai Technologies has built a diverse customer base. Its scalable and customisable solutions allow the company to cater to a wide array of needs, strengthening client relationships and driving consistent revenue across different industries.

- Comprehensive Portfolio of Customisable and Scalable Solutions

Seshaasai Technologies offers a wide range of customisable solutions tailored to meet the needs of various industries, particularly in BFSI. Their portfolio includes payment solutions, communication services, and fulfilment offerings, addressing the evolving demands of both BFSI and non-BFSI sectors. By collaborating with organisations like NPCI, they have introduced innovative products like RuPay wearables and NFC-enabled devices, solidifying their role in advancing the Indian financial ecosystem.

- Proprietary Technology Stack Enabling Bespoke Solutions

Seshaasai Technologies leverages its proprietary technology platforms, integrating AI, robotic automation, IoT, and various communication protocols to deliver bespoke solutions. Their RUBIC platform, for instance, is renowned for its ability to handle vast data volumes efficiently. This versatility allows them to cater to diverse industries beyond BFSI, offering tailored solutions that drive digital transformation and operational excellence for large-scale enterprises.

- Pan-India Advanced Manufacturing Capabilities

Seshaasai Technologies boasts one of the few approved manufacturing units in India for producing plastic, metal, and sustainable cards, as well as wearable payment devices and stickers. With 24 manufacturing units across seven locations, their capacity has grown significantly, ensuring scalability. They operate with stringent quality controls, using high-quality materials and processes, which allows them to produce regulatory-compliant products to meet their customers’ diverse requirements.

- Strong Financial Performance and Leadership Excellence

The company has demonstrated a strong and consistent financial performance, driven by technology-focused operations and low costs, which have resulted in higher operating margins. The efficient business model has contributed to significant revenue growth at a CAGR of 52.21%. The leadership of experienced promoters, Pragnyat Pravin Lalwani and Gautam Sampatraj Jain, coupled with a skilled senior management team, ensures the continuity of business strategies. The team is supported by a dedicated workforce, fostering long-term growth.

More About Seshaasai Technologies Limited

Innovative Solutions for BFSI and Beyond

Seshaasai Technologies Limited is a multi-location, technology-driven solutions provider, catering primarily to the banking, financial services, and insurance (BFSI) sector. With compliance and data security at the forefront, the company offers scalable, proprietary platform-based solutions critical for the operational needs of the BFSI industry. Additionally, Seshaasai extends its expertise to IoT solutions, serving diverse industries.

Key Achievements

- Market Leadership: Ranked among the top two payment card manufacturers in India with a market share of 34.5% in FY 2024, up from 23.7% in FY 2022.

- Cheque Manufacturing: One of India’s largest cheque leaf manufacturers, supporting BFSI needs at scale.

Leadership in Payment Solutions

Seshaasai is a dominant force in India’s payment card manufacturing industry, holding a 34.5% market share in Fiscal 2024 for credit and debit card issuance. The company provides a variety of payment instruments, including debit cards, credit cards, prepaid cards, and innovative products like metal and biometric cards. It has pioneered “RuPay On-the-Go” wearables and incorporated NFC technology into QR codes for enhanced digital payment experiences.

Communication and Fulfillment Excellence

The company also excels in secured omnichannel communication solutions tailored for BFSI and government agencies. Services include printing and delivery of policy documents, financial statements, tax identity cards, and citizen identity cards. These solutions integrate advanced inventory and order management systems, ensuring cost-effective and timely fulfilment for over 35,000 bank branches across India.

IoT Solutions and RFID Technology

Seshaasai’s IoT offerings encompass RFID-enabled tags, inlays, and automation hardware. These solutions are employed across industries like retail, logistics, and renewable energy for inventory management and authentication. Customised platforms and end-to-end IoT solutions enhance operational efficiencies for diverse customers.

Proprietary Technology Platforms

Seshaasai’s proprietary platforms, such as RUBIC, eTaTrak, and IOMS, leverage cutting-edge technologies to transform customer data into actionable outputs. These systems enable efficient communication, inventory management, and seamless integration with enterprise operations, demonstrating Seshaasai’s commitment to driving innovation and excellence.

Seshaasai Technologies Limited remains a pivotal player, delivering impactful solutions that shape industries and enhance customer experiences.

Financial Services Ecosystem

India’s financial services sector is witnessing rapid growth, shaped by digital adoption, banking expansion, and insurance penetration.

- ATM Penetration: Growth has stagnated at 3% CAGR since 2016 with 252,000 ATMs, reflecting low density (22 ATMs per 100,000 people in 2022).

- POS Terminals: Expanded from 3.7 million (2019) to 8.9 million (2024), supporting SMEs and rural merchants.

- Banking Expansion: CASA accounts grew from 1,724 million (2019) to 2,265 million (2023), boosted by digital inclusion.

- Insurance Growth: Life insurance premiums rose to ₹7,825 billion in 2023, with health insurance covering 550 million lives.

Payment Card Industry

- Transitioned from magnetic stripe to EMV chip cards, with NFC-enabled payments now common.

- Innovations like biometric authentication, tokenisation, and blockchain ensure secure transactions.

- Credit card receivables increased from ₹0.57 trillion (2017) to ₹2.6 trillion (2024).

Future Outlook

With rising fintech innovation, wearable payments, and IoT-driven eSIM adoption, India’s BFSI and payments ecosystem is positioned for sustained, technology-led growth.

How Will Seshaasai Technologies Limited Benefit?

- Holding 34.5% market share, Seshaasai drives card innovation with metal and biometric solutions.

- RuPay On-the-Go and NFC technology position Seshaasai strongly in India’s wearable payments growth.

- Omnichannel BFSI solutions ensure secure, timely communication and regulatory compliance across customer platforms.

- Leading cheque manufacturer modernises with CTS, ensuring security, efficiency, and fraud prevention in transactions.

- Customised IoT and RFID solutions improve inventory, authentication, and operational efficiency across multiple industries.

- RUBIC and IOMS provide scalable, data-driven insights supporting BFSI integration and communication excellence.

- Innovative RuPay instruments expand banking access, driving digital inclusion across urban and rural India.

- Expertise in security-driven cards strengthens Seshaasai’s role in India’s expanding fintech ecosystem.

- IoT-enabled systems and semiconductor localisation reduce costs, bolstering scalable, cost-effective multi-sector solutions.

- Eco-friendly card manufacturing aligns with global sustainability mandates, ensuring long-term payment industry leadership.

Peer Group Comparison

- There are no listed peers for this company as per the DRHP.

Key Strategies for Seshaasai Technologies Limited

- Consolidate Leadership Position in Payment Solutions

Seshaasai Technologies Limited aims to maintain its leadership in the payment solutions market. With a 34.5% market share in India’s credit and debit card issuance in 2024, the company plans to introduce innovative products like metal, sustainable, and biometric cards. Expanding its manufacturing capacity to meet growing demand, Seshaasai aims to offer cutting-edge payment solutions that address evolving consumer and enterprise needs.

- Expand Offerings in the IoT and RFID Space

Seshaasai Technologies Limited focuses on expanding its footprint in the IoT and RFID sectors. By increasing capacity for RFID manufacturing and enhancing chip bonding, the company aims to support sectors such as retail, logistics, and automotive. The company plans to leverage India’s “Make in India” initiative to produce local RFID components and capitalise on increasing demand for IoT solutions.

- Increase Wallet Share from Customers

Seshaasai Technologies Limited seeks to deepen relationships with existing customers by offering tailored solutions and expanding its product offerings. Through cross-selling and upselling, the company aims to increase wallet share and continue to serve customers more effectively. Leveraging its technology platforms and commitment to timely delivery, the company intends to strengthen long-term engagements and enhance customer satisfaction.

- Focus on Entering into International Markets

Seshaasai Technologies Limited plans to expand its solutions beyond India into global markets, including the SAARC region, Africa, and Eastern Europe. With certifications for metal and biometric cards, the company is positioned to meet global market demands. Through strategic partnerships and local collaborations, Seshaasai aims to enter these regions, enhance its product portfolio, and grow its customer base across various sectors.

- Focus on Inorganic Growth through Strategic Acquisitions

Seshaasai Technologies Limited is exploring inorganic growth opportunities through strategic acquisitions. By considering mergers and acquisitions, the company aims to strengthen its market position, expand its product portfolio, and achieve synergies. These acquisitions will help the company enhance its operational efficiency, market share, and expertise while fostering growth in key business areas and product categories.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Seshaasai Technologies Limited

What is the size and structure of Seshaasai Technologies Limited's IPO?

Seshaasai Technologies IPO is a book build issue of ₹813.07 crores. The issue is a combination of fresh issue of 1.13 crore shares aggregating to ₹480.00 crores and offer for sale of 0.79 crore shares aggregating to ₹333.07 crores.

How will Seshaasai Technologies utilise the proceeds from the IPO?

The company plans to use the proceeds for funding capital expenditure to expand existing manufacturing units, repaying or prepaying certain outstanding borrowings, and for general corporate purposes.

Who are the lead managers and registrar for the IPO?

The lead managers for the IPO are ICICI Securities Limited, SBI Capital Markets Limited, and BNP Paribas. The registrar to the issue is Link Intime India Private Limited.

When was the DRHP filed with SEBI?

Seshaasai Technologies filed its Draft Red Herring Prospectus (DRHP) with SEBI on December 27, 2024.

What is the current status of the IPO?

As of now, the IPO is in the filing stage, with the DRHP submitted to SEBI. The company is awaiting approval and will announce the offer details, including the price band and dates, once approved.

Who are the promoters of Seshaasai Technologies Limited?

The promoters of Seshaasai Technologies Limited are Pragnyat Pravin Lalwani and Gautam Sampatraj Jain.

What are the key objectives of the IPO?

The key objectives include funding capital expenditure for expanding manufacturing units, repaying outstanding borrowings, and general corporate purposes.

How can investors apply for the IPO?

Investors can apply for the IPO online using UPI or ASBA as a payment method. ASBA applications can be done through net banking, while UPI applications are offered by brokers.

What is the expected timeline for the IPO?

The timeline for the IPO, including the opening and closing dates, is 23 September 2025 and 25 September 2025, respectively