- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shadowfax Technologies IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Shadowfax Technologies IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Shadowfax Technologies Limited

Shadowfax Technologies Limited is a leading tech-enabled logistics solutions provider in India, specializing in e-commerce express parcel delivery and a comprehensive suite of value-added services. Its offerings span e-commerce and D2C delivery, hyperlocal and quick commerce, and specialized courier services. Powered by a massive network of over 205,000 gig-based delivery partners and 4,299+ touchpoints across India, the company serves over 14,758 pin codes. Shadowfax leverages a proprietary, agile technology stack to provide customizable, efficient, and scalable logistics solutions for a prestigious clientele that includes Flipkart, Meesho, Swiggy, Zepto, and Nykaa, establishing itself as a critical enabler of digital commerce.

Shadowfax Technologies Limited IPO Overview

Shadowfax Technologies Ltd. received SEBI approval for its Initial Public Offer (IPO) on 7 October 2025. With this approval, the company can move ahead with the next steps to launch the IPO, depending on market conditions and other required clearances. The approval granted by SEBI will remain valid for 12 months. The IPO will be a Book Build Issue, and the company plans to list its equity shares on both the NSE and BSE. ICICI Securities Ltd. has been appointed as the book-running lead manager, while Kfin Technologies Ltd. will act as the registrar for the issue. Key information such as IPO dates, price band and lot size is yet to be announced. Interested investors can refer to the Shadowfax Technologies IPO DRHP for more detailed disclosures.

The IPO will carry a face value of ₹10 per share, with the issue type categorised as a bookbuilding IPO. The total issue size is expected to aggregate up to ₹2,000 crore, although the exact number of shares and price band remain unspecified. The sale type has been marked as N/A, and details regarding the lot size are still awaited. Before the issue, the company’s shareholding stands at 47,67,14,621 shares. Once finalised, the IPO will be listed on the BSE and NSE, marking a significant step for Shadowfax Technologies Ltd.

Shadowfax Technologies Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | [●] shares (aggregating up to ₹2,000.00 Cr) |

| Fresh Issue | ₹ [●] |

| Offer for Sale (OFS) | ₹ 0 |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 47,67,14,621 shares |

| Shareholding post-issue | [●] |

Shadowfax Technologies IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shadowfax Technologies Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Shadowfax Technologies Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹ 0.13 |

| Price/Earnings (P/E) Ratio | [●] |

| Return on Net Worth (RoNW) | 0.97% |

| Net Asset Value (NAV) | ₹ 13.83 |

| Return on Equity (RoE) | 0.97% |

| Return on Capital Employed (RoCE) | 0.79% |

| EBITDA Margin | 1.96% |

| PAT Margin | 0.26% |

| Debt to Equity Ratio | 0.20 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements for network infrastructure | 4,234.31 |

| Funding of lease payments for new first mile, last mile, and sort centers | 1,386.43 |

| Funding of branding, marketing and communication costs | 885.74 |

| Unidentified inorganic acquisitions and general corporate purposes* | [●] |

*Note: To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC. The amount for general corporate purposes alone shall not exceed 25% of the Gross Proceeds.

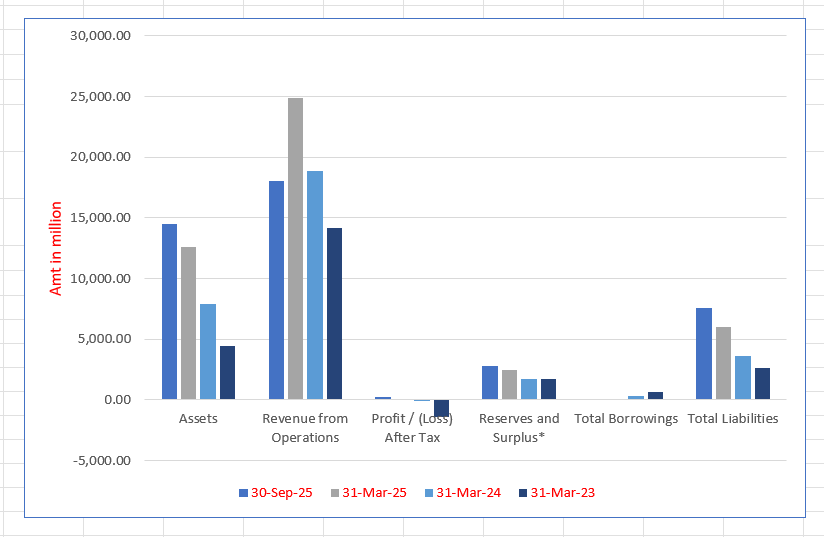

Shadowfax Technologies Limited Financials (in ₹ million)

| Particulars | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 14,531.59 | 12,592.55 | 7,861.37 | 4,427.28 |

| Revenue from Operations | 18,056.44 | 24,851.31 | 18,848.22 | 14,151.24 |

| Profit / (Loss) After Tax | 210.37 | 64.26 | (118.82) | (1,426.38) |

| Reserves and Surplus* | 2,812.59 | 2,481.55 | 1,724.66 | 1,712.04 |

| Total Borrowings | 5.03 | 64.59 | 315.03 | 607.29 |

| Total Liabilities | 7,596.28 | 5,988.28 | 3,643.61 | 2,664.13 |

Note: Reserves and Surplus is represented by “Other Equity” in the financial statements.

Financial Status of Shadowfax Technologies Limited

SWOT Analysis of Shadowfax Technologies IPO

Strength and Opportunities

- Largest last-mile gig-based delivery partner network in India.

- Agile and customizable multi-service logistics platform.

- Extensive, scalable, and capital-efficient nationwide network.

- Proprietary and agile full-stack technology capabilities.

- Proven business model with a path to profitability and healthy growth.

- Experienced and entrepreneurial founding team with a qualified management.

- Strong client relationships with leading digital commerce platforms.

- Significant growth opportunity from expanding e-commerce and quick commerce penetration.

- Potential to expand service portfolio into adjacent high-yield sectors like BFSI and cross-border.

- Opportunity to deepen wallet share with existing clients, especially high-yield D2C and SME brands.

Risks and Threats

- History of net losses until recent profitability.

- High dependency on the gig-economy workforce.

- Intense competition from established and emerging logistics players.

- Dependence on a concentrated base of key clients.

- Potential vulnerability to regulatory changes affecting gig workers.

- Operational risks associated with an asset-light, leased model.

- Susceptibility to macroeconomic fluctuations impacting e-commerce growth.

- Pressure on margins from intense industry competition and client pricing power.

- Execution risks in managing rapid growth and scaling operations.

- Risks associated with integrating future acquisitions.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Shadowfax Technologies Limited

Shadowfax Technologies Limited IPO Strengths

Comprehensive and Agile Service Portfolio

Shadowfax Technologies Limited is the only third-party logistics provider of scale in India offering an integrated suite of services, including end-to-end e-commerce delivery, last-mile for quick commerce, and various hyperlocal use cases. Its portfolio encompasses forward and reverse logistics, hand-in-hand exchanges, prime delivery, and critical item logistics. This agility allows it to serve the complex needs of major digital commerce clients, often across multiple service lines, thereby strengthening client relationships and increasing wallet share while positioning it as a leader in value-added logistics services.

Dominant Gig-Based Delivery Partner Infrastructure

The company has built India’s largest crowdsourced last-mile delivery fleet among 3PL e-commerce players. Its platform, powered by the proprietary ‘Frodo’ system, provides a dynamic, interoperable, and skilled workforce. This asset-light model ensures cost efficiency, scalability, and the ability to handle fluctuating demand. By offering flexible work, transparent payouts, insurance, and skill development, Shadowfax has become the preferred platform for delivery partners, which is a critical competitive advantage in fulfilling the vast and varied demands of the Indian digital commerce ecosystem.

Extensive and Scalable Nationwide Network

Shadowfax Technologies Limited operates a robust, hybrid mesh network of over 4,299 touchpoints, enabling it to service 14,758 pin codes across India. The network includes automated sort centers and a leased linehaul fleet of over 3,000 trucks daily. This infrastructure, combined with a capital-efficient, leased model, provides the backbone for efficient and scalable delivery. The company maintains high operational control through technology and automation, ensuring speed, reliability, and security while achieving the highest capital turnover ratio among its peers.

Proprietary and Integrated Technology Stack

The company’s operations are driven by a sophisticated, in-house technology platform. Key modules include a proprietary supply-demand allocation engine, the ‘Frodo’ delivery partner management system, the ‘SF Shield’ fraud detection engine, and the ‘SF Maps’ address intelligence system. This integrated tech stack enables real-time optimization, seamless customization for clients, efficient gig workforce management, enhanced security, and improved delivery accuracy. This technology-first approach is fundamental to managing scale, driving efficiencies, and maintaining a competitive edge.

Profitable Growth and Capital Efficiency

Shadowfax Technologies Limited has demonstrated a strong trajectory of revenue growth, achieving profitability after a period of investment. It has successfully expanded its Adjusted EBITDA margin from negative territory to a positive 2.86% for the six months ended September 2025. Concurrently, the company has maintained a sharp focus on capital efficiency, boasting the highest capital turnover ratio in its peer group. This combination of rapid growth, a path to profitability, and disciplined capital deployment underscores the strength and sustainability of its business model.

Experienced and Visionary Leadership

The company is guided by an entrepreneurial founding team, including the CEO and CTO, who have been instrumental in its vision and growth. They are supported by a seasoned management team with deep functional expertise across finance, product, operations, and human resources. This blend of entrepreneurial drive and professional execution capability has been pivotal in scaling the business, fostering a culture of innovation, and navigating the dynamic logistics landscape, as evidenced by the company’s ‘Great Place to Work’ certification.

More About Shadowfax Technologies Limited

Company Overview

Shadowfax Technologies Limited is a premier tech-enabled logistics and supply chain solutions provider in India, founded in 2015. It has emerged as a critical backbone for the country’s digital commerce ecosystem, offering a wide array of services tailored to the evolving needs of e-commerce, direct-to-consumer (D2C) brands, and quick commerce platforms.

Core Service Offerings

The company’s business is segmented into three primary service lines:

- Express Services: This includes standard and premium e-commerce parcel delivery, handling both forward and reverse logistics (pickups and returns), and specialized services like hand-in-hand exchanges.

- Hyperlocal & Quick Commerce: Catering to the demand for speed, this segment provides same-day and within-hours delivery for food, groceries, and other immediate needs.

- Other Logistics Services: This encompasses critical logistics for high-value items, strategic insourcing of unbranded services, and dark store operations.

Operational Network and Scale

Shadowfax has built an extensive and asset-light operational network that forms the core of its service delivery:

- Network Reach: As of September 30, 2025, its network spans 14,758 pin codes across India through 4,299 touchpoints, including first-mile, last-mile, and sortation centers.

- Infrastructure: The company operates from over 3.50 million sq. ft. of leased operational space, which includes 53 sort centers. It leverages automation in key facilities to enhance efficiency, accuracy, and throughput.

- Linehaul: A dedicated fleet of over 3,000 trucks daily ensures robust middle-mile connectivity.

Technology as a Differentiator

Technology is the central nervous system of Shadowfax’s operations. Its proprietary platform comprises several key modules:

- Demand-Supply Allocation Engine: Dynamically matches delivery orders with the best-suited gig delivery partners in real-time.

- Frodo: A comprehensive lifecycle management system for delivery partners, handling onboarding, training, payout gamification, and support.

- SF Shield: An advanced AI/ML-based fraud detection and prevention system that ensures shipment security through video surveillance, facial recognition, and product verification.

- SF Maps: An AI-powered address intelligence system that improves geo-tagging and route optimization, reducing failed deliveries.

Client Ecosystem

The company serves a veritable who’s who of the Indian digital economy, including Meesho, Flipkart, Myntra, Swiggy, Bigbasket, Zepto, Nykaa, Blinkit, and Zomato. Its ability to serve clients across multiple service lines deepens relationships and drives client retention.

Workforce

As of September 30, 2025, Shadowfax had a total of 4,472 permanent employees and 17,182 contract workers, supported by its massive network of over 205,864 Average Quarterly Unique Transacting Delivery Partners.

Industry Outlook

The Indian logistics industry is poised for robust growth, primarily fueled by the exponential expansion of digital commerce, the rapid adoption of quick commerce, and increasing consumer expectations for faster and more reliable deliveries.

Market Size and Growth

The Indian logistics market is one of the largest globally and is expected to grow at a significant CAGR, potentially reaching beyond $500 billion in the coming years. The Third-Party Logistics (3PL) segment, in which Shadowfax operates, is growing even faster as companies increasingly outsource their logistics needs for efficiency and cost-effectiveness.

Key Growth Drivers

- E-commerce Expansion: India’s e-commerce market is on a high-growth trajectory, expected to continue its double-digit growth. This directly translates into higher volumes for parcel delivery and reverse logistics services.

- Quick Commerce Penetration: The quick commerce segment is revolutionizing retail logistics, creating a massive demand for hyperlocal, minutes-to-hours delivery capabilities. This segment is expanding beyond metros into Tier-I and Tier-II cities.

- Rise of D2C Brands: The proliferation of Direct-to-Consumer brands represents a high-yield segment for logistics providers. These brands value customizable, agile, and tech-enabled logistics partners like Shadowfax.

- Government Initiatives: Policies like the National Logistics Policy aim to reduce logistics costs and improve efficiency, creating a favorable regulatory environment.

- Digital Payments and Infrastructure: Widespread adoption of digital payments and improving physical and digital infrastructure are enablers for seamless logistics operations.

Focus Areas for the Future

The industry is increasingly focusing on technology adoption (AI, ML, IoT), automation in warehouses and sortation, sustainability through electric vehicles, and providing integrated, end-to-end solutions. The ability to offer flexible, scalable, and cost-efficient services will be a key differentiator for logistics companies.

How Will Shadowfax Technologies Limited Benefit

- The massive and growing volume of shipments from the expanding e-commerce sector will directly drive higher order volumes for Shadowfax’s core express logistics services.

- The explosive growth of quick commerce will increase demand for its hyperlocal delivery platform, allowing it to leverage its existing gig partner network for higher utilization and revenue.

- The rising trend of D2C brands provides an opportunity to capture high-yield clients who value its customizable and agile service offerings, potentially improving overall margin profiles.

- The overarching industry growth will necessitate expansion into deeper geographies, aligning perfectly with Shadowfax’s strategy to increase its pin code reach and network density.

- The industry’s focus on cost efficiency plays to Shadowfax’s strengths, as its capital-efficient model and variable cost structure allow it to compete effectively on price while maintaining profitability.

- The drive for superior customer experience in e-commerce will increase the demand for its value-added services like reverse pickups, hand-in-hand exchanges, and same-day delivery, where it already holds a leadership position.

- The ongoing formalization and consolidation in the logistics industry will benefit organized, tech-enabled players like Shadowfax, potentially allowing it to gain market share from smaller, unorganized competitors.

- Future opportunities in adjacent service lines like BFSI logistics, cross-border deliveries, and B2B express, as identified in its strategy, are natural extensions driven by evolving market needs.

Peer Group Comparison

| Name of the company | Total Income (₹ in million) | Face Value (₹) | P/E | Basic EPS (₹) | Diluted EPS (₹) | RoNW (%) | NAV (₹) |

| Shadowfax Technologies Limited | 25,146.57 | 10.00 | N.A.* | 0.13 | 0.13 | 0.97 | 13.83 |

| Peer Group | |||||||

| Blue Dart Express Limited | 57,621.60 | 10.00 | 52.32 | 106.38 | 106.38 | 17.25 | 657.05 |

| Delhivery Limited | 93,720.09 | 1.00 | 218.18 | 2.19 | 2.14 | 1.75 | 124.77 |

Key Strategies for Shadowfax Technologies Limited

Market Share Expansion and Operating Leverage

Shadowfax Technologies Limited intends to consistently expand its market share by deepening relationships with existing clients and acquiring new ones, with a specific focus on high-yield D2C and SME brands. The company aims to leverage its operational agility and technology-driven infrastructure to drive revenue growth while improving margins through operating leverage and network-level cost efficiencies. This disciplined approach to scaling, supported by its variable-cost model, is designed to strengthen its competitive position and sustain long-term market leadership in the consolidating logistics landscape.

Diversification of Service Portfolio

The company plans to expand its service portfolio to stay at the forefront of India’s evolving logistics industry. This includes strengthening high-speed logistics through dark stores, extending its mobility offerings to adjacent urban transport use cases, and developing capabilities in BFSI and cross-border parcel deliveries. It also aims to enhance its express B2B parcel capabilities and handle large-sized shipments. This diversification strategy is aimed at increasing wallet share across clients, improving network utilization, and unlocking new growth vectors.

Network Strengthening and Expansion

Shadowfax is committed to deepening and expanding its nationwide network infrastructure. The strategy involves increasing the number of serviced pin codes, enhancing capacity at strategic locations, and investing in middle-mile capabilities to improve delivery speed. A key focus is on developing fully automated sortation centers with advanced technology to drive operational efficiencies, reduce manual error, and enable seamless scalability. These investments are expected to bring the network closer to end-consumers, optimizing both delivery times and costs.

Continuous Technology Investment

The company will continue to invest heavily in its proprietary technology platform to scale operations, improve efficiencies, and enhance the end-consumer experience. Future investments will focus on introducing new service offerings for complex sectors like BFSI, reducing last and middle-mile costs, strengthening network security via SF Shield, and improving customer experience metrics. A priority will be enhancing generative AI capabilities to optimize resource allocation, demand forecasting, and last-mile efficiency, maintaining its technology-driven competitive advantage.

Transition to Electric Vehicle Fleets

Shadowfax’s strategy centers on creating a sustainable and cost-efficient logistics solution by enabling a transition to electric vehicles (EVs). It plans to establish a three-way EV marketplace and open offline EV centers in high-demand areas to facilitate easy access for delivery partners. The company will expand its vehicle leasing initiatives for last-mile and middle-mile deliveries to reduce costs and dependency on conventional fuel. This initiative aims to lower operational costs, support partner retention, and align with long-term sustainability goals.

Growth through Strategic Acquisitions

The company will pursue inorganic growth through strategic acquisitions to enhance its service capabilities and strengthen existing offerings. It has a history of successful asset purchases, such as CriticaLog, which added critical shipment handling capabilities. Shadowfax will continue to evaluate opportunities across complementary industries to drive both revenue and margin growth. This strategy is intended to accelerate its growth trajectory, diversify service offerings, and solidify its market position in the dynamic logistics landscape.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shadowfax Technologies Limited IPO

How can I apply for Shadowfax Technologies Limited IPO?

You can apply via ASBA through your bank account or through online trading platforms like HDFC Sky using your UPI ID.

What is the lot size and price band for the Shadowfax Technologies IPO?

The lot size and price band are “To Be Announced” (TBA) and will be disclosed closer to the IPO launch date.

Is the Shadowfax IPO a fresh issue or an offer for sale?

The IPO is a combination of a fresh issue of shares worth up to ₹2,000 crore and no offer for sale (OFS) component.

Where will Shadowfax Technologies Limited shares be listed?

The equity shares will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

What is the key strength of Shadowfax Technologies?

A key strength is its extensive, tech-enabled platform supported by India’s largest gig-based delivery partner network for 3PL e-commerce logistics.