- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shah Investors Home IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Shah Investors Home Limited

Incorporated in 1994, Shah Investor’s Home Ltd. is a retail broking company offering a wide range of services, including equity and derivatives brokerage. It facilitates trading in equities, IPO investments, mutual funds, and other securities. The company primarily focuses on providing secondary market brokering services to retail clients, including resident and non-resident Indians, under the brand “Shah Investors.” As of March 31, 2025, it served over 100,000 demat accounts, with 37,810 active clients and 184 authorised partners across 11 branches in major Indian cities.

Shah Investors Home Limited IPO Overview

Shah Investor’s Home Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, proposing to raise funds through an Initial Public Offer (IPO). The IPO will be a Book-Build Issue consisting entirely of a fresh issue of up to 0.54 crore equity shares. The company’s equity shares are proposed to be listed on both the NSE and BSE. Beeline Broking Ltd. will act as the book-running lead manager, while MUFG Intime India Pvt. Ltd. will serve as the registrar of the issue. Details such as IPO dates, price band, and lot size are yet to be announced. Investors can refer to the Shah Investor’s Home IPO DRHP for complete information.

As per the preliminary details, the issue will have a face value of ₹10 per share and will aggregate up to 54,00,000 shares. The IPO will be conducted through the book-building process and will involve only fresh capital. Once listed, the shares will trade on both BSE and NSE.

The company filed its DRHP with SEBI on September 29, 2025. The promoters of Shah Investor’s Home Ltd. include Upendra Trikamlal Shah, Purnima Upendra Shah, Tanmay Upendra Shah, and Trupti Utpal Shah. The promoter holding before the issue stands at 84.34%, which will reduce post-issue after the IPO.

Shah Investor’s Home Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 0.54 crore equity shares |

| Fresh Issue | 0.54 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post-issue | TBA |

Shah Investors Home IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shah Investors Home Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Shah Investors Home Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹14.84 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 13.91% |

| Net Asset Value (NAV) | ₹106.70 |

| Return on Equity (RoE) | 14.68% |

| Return on Capital Employed (RoCE) | 20.35% |

| EBITDA Margin | 37.46% |

| PAT Margin | 24.76% |

| Debt to Equity Ratio | 0.03 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of the Company | 7000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

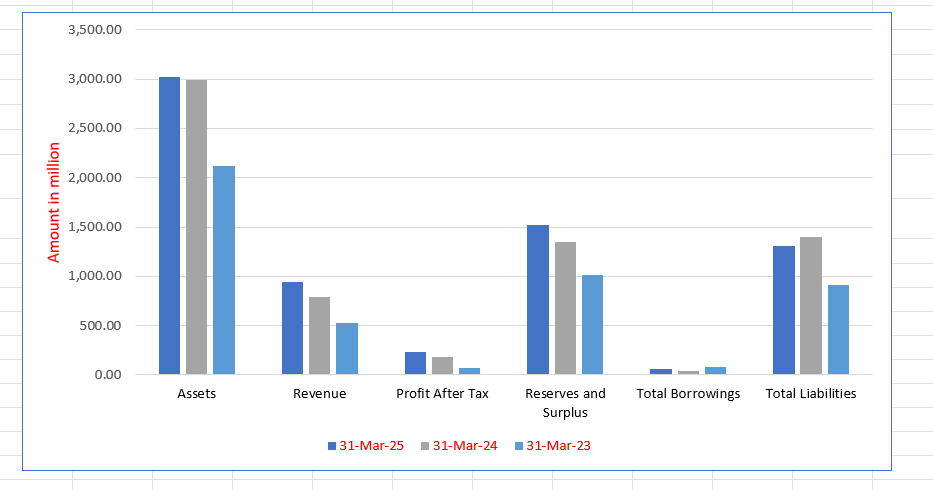

Shah Investor’s Home Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 3,025.65 | 2,987.61 | 2,118.69 |

| Revenue | 944.65 | 790.53 | 523.30 |

| Profit After Tax | 234.16 | 180.52 | 74.05 |

| Reserves and Surplus | 1,523.36 | 1,347.87 | 1,017.06 |

| Total Borrowings | 57.08 | 35.35 | 80.34 |

| Total Liabilities | 1,305.03 | 1,402.30 | 914.82 |

Financial Status of Shah Investors Home Limited

SWOT Analysis of Shah Investors Home IPO

Strength and Opportunities

- Long track record in retail broking since 1994 with an established reputation.

- Wide service range including equities, derivatives, IPO investing, and mutual funds distribution.

- Client base includes both resident and non-resident Indians, enhancing market reach.

- Technological adoption and a strong branch network facilitate accessibility.

- Opportunity to grow higher-margin advisory, portfolio management, or alternative investment services.

- Potential to expand through mobile apps, digital channels, and value-added services.

- Expansion into new geographic markets and catering to the growing NRI segment offer growth potential.

- Increasing financial literacy and investment participation in India create a larger market base.

- Ability to cross-sell multiple financial products enhances customer retention and lifetime value.

Risks and Threats

- Concentration in retail broking may limit diversification compared with full-service financial firms.

- Intense competition in the broking industry from discount brokers and fintech platforms may erode margins.

- Reliance on market volatility for revenue; downturns in equity markets reduce transaction volumes.

- Limited public data on scale compared with major brokers may reduce visibility among investors.

- Regulatory changes such as brokerage caps and margin rules pose ongoing threats to the business model.

- Vulnerability to cybersecurity risks or system disruptions due to online operations.

- Risk of regulatory or compliance issues may impact reputation and operations.

- Margin funding and stock-lending services carry credit and market-risk exposures during downturns.

- Rising operational costs from technology, talent, and compliance may affect profitability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Shah Investors Home Limited

Shah Investors Home Limited IPO Strengths

Extensive Regional Client Network

Shah Investor’s Home Limited (SIHL) boasts a sizeable clientele across Gujarat, supported by 11 branches and 184 Authorized Persons. This vast, decentralized network has served over 100,000 demat accounts. This strong regional presence facilitates deep market penetration, fosters strong client relationships, and allows the company to adapt to specific regional investment preferences.

Robust Financial Performance and Efficiency

SIHL maintains a strong financial track record and operating efficiency, highlighted by a 75.05% CAGR in profit after tax from fiscal 2023 to fiscal 2025, reaching ₹ 2,338.50 lakhs. Revenue also grew significantly at a 35.06% CAGR. The company exhibits an asset-light structure, with a notable decrease in the cost ratio from 81.11% to 66.76% over the same period.

Leveraging Technology for Client Satisfaction

The company remains at the forefront of technological adoption, with a transition to a virtual platform in 2007. SIHL launched its ‘SIHL Moneymaker’ trading app in 2023 and ‘SIHL Fundspro’ for mutual funds in 2024. This investment in digital platforms, coupled with an in-house ERP system, enhances client service, drives satisfaction, and supports future growth.

Integrated Model with Long-Term Client Base

SIHL operates an integrated brokerage model with a strong focus on long-term relationships, a strategy refined over three decades. An impressive 72.89% of its active clientele have been associated with the company for more than five years. This stable, enduring client base provides revenue stability and reinforces the company’s position as a trusted partner.

Experienced Promoters and Management

SIHL benefits from the extensive, combined experience of its Promoters and a highly seasoned senior management team. This veteran leadership has been crucial in guiding the company’s growth, ensuring continuous technological adoption, and strengthening its risk management, compliance, and governance frameworks. Their expertise provides a significant competitive advantage

More About Shah Investors Home Limited

Established in 1994, Shah Investor’s Home Limited is a leading retail broking company with more than three decades of experience in the Indian financial markets. The company provides a comprehensive suite of services including equity and derivatives broking, IPO investing, and mutual fund distribution. It operates primarily in the secondary market segment, catering to both resident and non-resident retail investors under the brand name “Shah Investors.”

Operational Network

As of March 31, 2025, Shah Investor’s Home Limited has over 100,000 demat accounts, including more than 37,800 active clients. The company maintains 11 operational branches across Mumbai, Ahmedabad, Vadodara, Junagadh, Gandhinagar, and Rajkot, supported by a network of 184 authorised persons. Its strong presence in Gujarat and Maharashtra helps it capture a diverse clientele of retail and high-net-worth investors.

Technological Evolution

The company has progressively adopted digital innovations. In 2007, it introduced a VMWare-based virtualised environment for trading and back-office processes. In 2023, it launched its proprietary app-based trading platform, “SIHL Moneymaker,” which, as of March 2025, had over 11,462 active users. Additionally, the in-house ERP system supports all branches and franchises, improving client interaction and operational efficiency.

Key Business Verticals

- Broking Services: Core business covering equity delivery, futures and options, and currency derivatives across NSE, BSE, and MCX.

- Margin Trading Facility: Provides leverage to investors to enhance their purchasing power, with a margin trading book of ₹964.22 lakhs in FY2025.

- Depository Services: Acts as a registered depository participant of NSDL, servicing 37,814 active accounts in FY2025.

- Distribution Services: Distributes mutual funds and third-party PMS schemes through AMFI and APMI registrations, via both online and offline channels.

Financial Performance

Shah Investor’s Home Limited reported consolidated revenue from operations of ₹9,427.39 lakhs in FY2025, rising from ₹5,168.30 lakhs in FY2023. Profit after tax increased from ₹763.17 lakhs to ₹2,338.50 lakhs during the same period, reflecting robust financial growth and operating efficiency.

Industry Outlook

The Indian security brokerage market was valued at around USD 3.15 billion in 2024 and is projected to reach approximately USD 5.51 billion by 2032, registering a CAGR of about 7.2% between 2025 and 2032. Another estimate places the market at USD 3.98 billion in 2024, expected to rise to USD 6.21 billion by 2030, indicating a CAGR of around 7.7%. Overall, analysts expect the industry to sustain a 7–8% CAGR through 2030, driven by robust retail participation and digitisation.

Key Growth Drivers

- Rapid increase in retail investor participation supported by rising financial literacy and market accessibility.

- Expansion of digital trading platforms, mobile apps, and low-cost brokerage models enabling mass adoption.

- Regulatory reforms by SEBI promoting transparency, dematerialisation, and integrated broking-depository models.

- Strong growth in derivatives, margin-funded trading, and mutual fund distribution driving revenue diversification.

- Penetration into Tier-II and Tier-III cities, along with increasing NRI participation and digital onboarding.

Segment Outlook: Broking, Depository & Distribution Services

- Broking Services: Equity delivery, futures, and options trading will remain core revenue drivers, accounting for nearly half of total market share.

- Depository Services: Expected to expand with increasing demat account openings and margin trading activities.

- Distribution Services: Rising demand for mutual funds, PMS, and IPO investments will support multi-service brokerage models.

How Will Shah Investor’s Home Limited Benefit

- Shah Investor’s Home Limited is well-positioned to leverage the industry’s 7–8% CAGR through its strong retail broking base and wide client network across key financial hubs.

- The company’s advanced trading platform, SIHL Moneymaker, aligns with the industry’s digital growth trend, enhancing user engagement and transaction efficiency.

- Increasing retail participation and demat account openings will directly benefit its core broking and depository services.

- Its diversified portfolio—covering equities, derivatives, mutual funds, and IPO investments—supports steady revenue expansion amid growing market participation.

- SEBI’s regulatory initiatives and technology-driven reforms will strengthen investor confidence, boosting trading volumes handled by Shah Investors.

- Expansion into Tier-II and Tier-III cities offers an opportunity to increase its customer base beyond major metros.

- Its strong brand reputation and operational scalability make it well-equipped to capitalise on evolving investor preferences and digital adoption.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Basic EPS (₹) | Diluted EPS (₹) | P/E Ratio | RoNW (%) | NAV per Equity Share (₹) | Revenue from Operations (₹ in Lakhs) |

| Shah Investor’s Home Limited | 10.00 | 14.84 | 14.84 | [●] | 13.91% | 106.70 | 9,427.39 |

| Peer Group | |||||||

| SMC Global Securities Limited | 2.00 | 13.92 | 13.92 | 7.49 | 11.97% | 116.25 | 1,77,574.15 |

| Share India Securities Limited | 10.00 | 15.58 | 14.90 | 10.60 | 14.04% | 534.79 | 1,44,856.84 |

| Arihant Capital Markets Limited | 1.00 | 5.64 | 5.37 | 12.15 | 15.27% | 36.93 | 24,731.70 |

Key Strategies for Shah Investors Home Limited

Expanding Brokerage Footprint and Presence

Shah Investor’s Home Limited intends to increase market share by strengthening its brokerage presence across India, particularly in states beyond Gujarat. SIHL will use marketing, new branches, and an expanded Authorised Person network, focusing on personalised services and promoting its mobile application in Tier 2 and Tier 3 cities to capture new clients.

Continuous Investment in Technology and Innovation

SIHL plans to offer more technology-based products, including expanding its API-based trading services to meet rising demand for algorithmic strategies. The company aims to deploy stronger technology systems and leverage AI and data management to enhance operational efficiency, improve cybersecurity, and increase customer satisfaction and loyalty.

Increasing Fee-Based Revenue Streams

The company seeks to grow its fee-based revenue by significantly expanding its wealth management and financial planning services. This includes increasing Assets Under Management (AUM), distributing mutual funds and Specialized Investment Fund (SIF) schemes, and exploring the insurance business to provide comprehensive financial solutions to its large active client base.

Enabling Access to Global Equities

Through its subsidiary, SIHL Global Investments (IFSC) Private Limited, the company is expanding its international business from GIFT City. This presence, which benefits from a favorable regulatory and tax environment, will allow SIHL to enable its clients to easily access global equities, ETFs, and thematic portfolios in a regulated manner

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shah Investor’s Home Limited IPO

How can I apply for Shah Investor’s Home Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Shah Investor’s Home Limited IPO?

Shah Investor’s Home Limited IPO is a book-built issue of up to 0.54 crore fresh equity shares.

When was the DRHP for Shah Investor’s Home Limited IPO filed?

The Draft Red Herring Prospectus (DRHP) was filed with SEBI on September 29, 2025.

On which exchanges will the shares be listed?

The equity shares of Shah Investor’s Home Limited will be listed on both NSE and BSE.

What will the funds raised through the IPO be used for?

The IPO proceeds will be used for working capital needs and general corporate purposes.

Who are the promoters and lead manager of the IPO?

Promoters include Upendra, Purnima, Tanmay, and Trupti Shah, with Beeline Broking Ltd. as the lead manager.