- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shankesh Jewellers IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Shankesh Jewellers IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

About Shankesh Jewellers Limited

Shankesh Jewellers Limited specialises in manufacturing and supplying customised handcrafted gold jewellery, focusing on 22-karat and 18-karat pieces. Its diverse portfolio includes bangles, necklaces, chokers, jhumkas, rings, bridal sets, and more across antique, semi-antique, temple, Calcutta, gheru polish, and coloured gold categories. Operating PAN-India, the company serves corporate and non-corporate clients, including reputed brands like Joyalukkas, Kalyan Jewellers, and P. N. Gadgil & Sons. Following an asset-light model, it engages skilled local karigars for production while managing design, sourcing, and delivery in-house. All jewellery is BIS-hallmarked. Shankesh Jewellers also provides custom job work services using client-supplied bullion. With over three decades of experience, the company has established strong relationships through design excellence, craftsmanship, and tailored solutions.

Shankesh Jewellers Limited IPO Overview

Shankesh Jewellers Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building issue of 4.00 crore equity shares, comprising a fresh issue of up to 3.00 crore shares and an offer for sale (OFS) of up to 1.00 crore shares. The equity shares are proposed to be listed on NSE and BSE, with Kfin Technologies Ltd. appointed as the registrar, while the book running lead manager is yet to be declared. Key details such as IPO dates, price bands, and lot size are not yet announced. Pre-IPO, the company had 11,75,49,420 shares, and post-IPO, the total shareholding will increase to 14,75,49,420 shares. Promoters Kantilal Kheemraj Jain, Mahavir Kantilal Jain, and Manoj Kantilal Jain currently hold 95.48% of the company’s shares.

Shankesh Jewellers Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 4 crore equity shares |

| Fresh Issue | 3 crore equity shares |

| Offer for Sale (OFS) | 1 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 11,75,49,420 shares |

| Shareholding post-issue | 14,75,49,420 shares |

Shankesh Jewellers IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shankesh Jewellers Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Shankesh Jewellers Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.43 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 40.07% |

| Net Asset Value (NAV) | ₹8.58 |

| Return on Equity (RoE) | 40.07% |

| Return on Capital Employed (RoCE) | 26.33% |

| EBITDA Margin | 4.66% |

| PAT Margin | 2.87% |

| Debt to Equity Ratio | 1.44 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or part, of certain borrowings | 1580 |

| Funding working capital requirements | 380 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

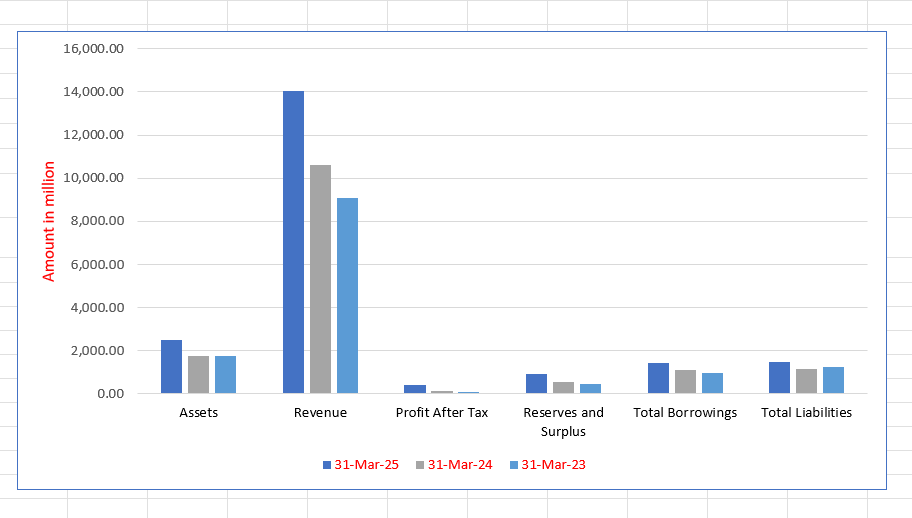

Shankesh Jewellers Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 2,495.58 | 1,770.72 | 1,743.40 |

| Revenue | 14,038.26 | 10,617.83 | 9,091.93 |

| Profit After Tax | 403.12 | 128.16 | 104.43 |

| Reserves and Surplus | 908.27 | 575.03 | 447.28 |

| Total Borrowings | 1,448.39 | 1,085.77 | 983.97 |

| Total Liabilities | 1,489.61 | 1,167.78 | 1,268.21 |

Financial Status of Shankesh Jewellers Limited

SWOT Analysis of Shankesh Jewellers IPO

Strength and Opportunities

- Established brand with over three decades of experience.

- Specializes in antique and handcrafted gold jewellery, catering to niche markets.

- Strong B2B clientele, including reputed jewellers like Joyalukkas and Kalyan Jewellers.

- Offers both ready stock and custom job work services, enhancing customer flexibility.

- BIS-hallmarked jewellery ensures compliance with industry standards.

- Asset-light business model reduces capital expenditure requirements.

- Strong presence in Zaveri Bazar, Mumbai, a prominent jewellery market.

- Active engagement in digital platforms for broader market reach.

- Plans for IPO to raise funds and enhance brand visibility.

Risks and Threats

- Heavy reliance on third-party job workers and karigars for production.

- Concentration of skilled artisans in Maharashtra exposes the company to regional risks.

- Limited formal agreements with karigars may lead to inconsistent quality control.

- High inventory levels increase exposure to theft and loss risks.

- Potential challenges in maintaining statutory and regulatory permits and licenses.

- Vulnerability to fluctuations in gold prices affecting margins and profitability.

- Competitive industry environment may pressure pricing and market share.

- Dependence on a few key customers for a significant portion of revenue.

- Potential legal and taxation proceedings could impact reputation and operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Shankesh Jewellers Limited

Shankesh Jewellers Limited IPO Strengths

Robust Historical Financial Performance

Shankesh Jewellers Limited has demonstrated a strong financial position with consistent growth in the last three Fiscals. The company’s revenue from operations has increased substantially, from ₹9,091.93 million in Fiscal 2023 to ₹14,038.26 million in Fiscal 2025. This growth, coupled with an increase in EBITDA and Net Profit After Tax, highlights the effectiveness of its capital allocation and robust working capital management, providing a solid foundation for funding future growth.

Long-Term Relationships with Skilled Local Job Workers

The company operates as a wholesale gold jewellery player and principal contractor, outsourcing the manufacturing process to a network of 66 experienced local job workers (“Karigars”), primarily in Mumbai. This model leverages specialized skills for custom, hand-crafted gold jewellery, ensuring precision and intricate designs. By maintaining long-term relationships with these artisans, Shankesh Jewellers Limited achieves superior craftsmanship and flexibility, allowing for efficient adaptation to evolving market trends while upholding quality.

Efficient Asset-Light Business Model

Shankesh Jewellers Limited employs an asset-light business model by leveraging the expertise of Karigars through job workers for the hand-crafting of jewellery. This strategic approach allows the company to manage fluctuations in demand efficiently and minimize capital expenditure. By reducing operational risks and costs like maintenance, this model allows for the efficient deployment of capital while maintaining flexibility in serving diverse industry verticals and ensuring better inventory management across the supply chain.

Wide Product Range in Hand-Crafted Gold Jewellery

The company offers a comprehensive and wide range of high-quality hand-crafted gold jewellery under one roof, providing a one-stop shopping solution for its clientele. Its extensive categories include Antique, Calcutta, Temple, and Yellow/Rhodium/Rose Gold Jewellery, with product lines such as Bangles, Bridal sets, Necklaces, and Rings. This breadth of offering—with the capability to create customized pieces—is a key competitive strength, enabling the company to cater to diverse tastes and occasions.

Strong Commitment to Quality and Customer Satisfaction

Shankesh Jewellers Limited is committed to excellence, prioritizing quality control and customer satisfaction. The company exclusively deals in gold jewellery certified by the Bureau of Indian Standards (BIS) Hallmark, ensuring purity and building consumer trust. As a customer-centric entity, it focuses on providing unique designs with the desired finish and quality, often based on specific client requirements. This dedication to high standards has established the company as a trusted partner to its clients.

Established Relationships with Corporate and Non-Corporate Clients

The company has successfully built and fostered strong, enduring relationships with a diverse client base, including major corporate jewellery brands like Joyalukkas India Limited and Kalyan Jewellers India Limited, as well as non-corporate clients. Its commitment to quality assurance and timely delivery ensures that its products consistently meet the high standards expected by its partners. These established relationships, which contribute significantly to the company’s revenue, are central to its continued growth and mutual success.

Experienced Promoters and Management Team

Shankesh Jewellers Limited attributes its sustained growth to its experienced Promoters and seasoned management team. The Promoters collectively bring decades of industry experience to the company, driving strategic planning and business development. Their deep industry knowledge and understanding of customer preferences are instrumental in shaping the company’s vision, enabling it to navigate market challenges and leverage its execution capabilities to drive sustained growth in the evolving jewellery market.

Established Marketing Setup and Strong Customer Base

The success of Shankesh Jewellers Limited is underpinned by its established marketing setup and strong, loyal customer base. The Sales & Marketing team, under the direct supervision of the Directors, focuses on maintaining and expanding client relationships through an excellent rapport. The company’s reputation for timely delivery, high design quality in 22 and 18 karat jewellery, and design confidentiality is crucial for client retention and for successfully attracting new customers.

More About Shankesh Jewellers Limited

Shankesh Jewellers Limited is a renowned player in the handcrafted gold jewellery industry, offering both bespoke customization and ready-to-wear products. The company’s clientele comprises prominent corporate entities, including Joyalukkas India Limited, Kalyan Jewellers India Limited, P. N. Gadgil & Sons Limited, Novel Jewels Limited (Aditya Birla Group), Bhima Jewellery Madurai, and several non-corporate clients such as Verma Jewellers and Sham Jewellers.

Business Model

The company operates primarily as a principal contractor, managing design, material sourcing, and finished jewellery production. Depending on the type of jewellery, production is outsourced to local karigars through job workers, ensuring end-to-end delivery aligned with client specifications. This asset-light model allows Shankesh Jewellers to focus on inventory management, design, and marketing, without significant investment in manufacturing infrastructure.

Product Portfolio

Shankesh Jewellers offers a wide range of 22-karat and 18-karat handcrafted gold jewellery, including:

- Bangles, bridal jewellery, chokers, jhumkas

- Long and short necklace sets, mangalsutras, rings, and combined sets

- Categories such as Antique, Semi-Antique, Calcutta, Temple, Gheru Polish, and Yellow/Rhodium/Rose Gold

All jewellery is BIS-hallmarked as per regulatory standards. The company also provides custom job work services, crafting pieces from client-supplied bullion and delivering finished products directly.

Legacy and Leadership

Founded by Mr. Kantilal Kheemraj Jain in 1992, the company evolved from a proprietary firm to Shankesh Jewellers Limited in 2025. It is currently managed by Mr. Kantilal Jain and his sons, Mr. Mahavir Kantilal Jain and Mr. Manoj Kantilal Jain, who continue to bring decades of industry experience and strategic leadership.

Operational Footprint

Shankesh Jewellers operates across India through a robust distribution network spanning 21 states and 4 union territories. In Fiscal 2025, the company served 457 customers, generating revenue of ₹14,038.26 million, reflecting a 32.21% year-on-year growth. Corporate clients accounted for 55.8% of revenue, with the remainder from non-corporate clients.

Skilled Workforce

The company collaborates with 87 job workers and over 66 specialized karigars, ensuring high-quality craftsmanship and stringent quality control. In-house designers develop new collections in line with market trends and customer preferences, enhancing product offerings and client satisfaction.

Through its asset-light model, legacy expertise, and diverse product range, Shankesh Jewellers Limited continues to strengthen its presence in India’s handcrafted gold jewellery market, serving both corporate and non-corporate clients efficiently.

Industry Outlook

The Indian handcrafted gold jewellery industry is experiencing significant growth, driven by cultural traditions, rising disposable incomes, and evolving consumer preferences. The market is projected to reach USD 122.34 billion by 2031, expanding at a CAGR of 5.09% from 2025 to 2031.

Market Dynamics

- Cultural Significance: Gold jewellery holds deep cultural importance in India, especially in weddings and festivals, leading to sustained demand.

- Consumer Preferences: There is a growing inclination towards lightweight and 18-carat gold jewellery, influenced by rising gold prices and changing lifestyles.

- Regional Concentration: The western and southern regions of India, including Mumbai, Surat, and Chennai, account for over 50% of the jewellery market share.

Product Trends

- Gold Jewellery: Continues to be the dominant segment, with necklaces being the largest revenue-generating product.

- Handcrafted Jewellery: The demand for handcrafted gold jewellery is increasing, as consumers seek unique and personalized designs.

- Customization Services: Companies offering customization services are gaining traction, catering to the desire for bespoke jewellery pieces.

Challenges

- Gold Price Volatility: Fluctuating gold prices can impact consumer purchasing decisions and affect sales.

- Economic Factors: Economic downturns can lead to reduced discretionary spending, affecting jewellery sales.

Conclusion

The Indian handcrafted gold jewellery market presents promising growth opportunities, with increasing demand for personalized and culturally significant products. Companies like Shankesh Jewellers Limited, which offer a diverse range of handcrafted gold jewellery and customization services, are well-positioned to capitalize on these trends and expand their market presence

How Will Shankesh Jewellers Limited Benefit

- Shankesh Jewellers Limited can leverage the growing demand for handcrafted gold jewellery across India to expand its market share.

- Rising preference for 18-karat and lightweight gold jewellery aligns with the company’s diverse product portfolio, enhancing sales potential.

- The company’s expertise in customization services positions it to capture consumers seeking personalized and unique jewellery designs.

- Its asset-light model allows efficient inventory management, design innovation, and timely delivery without heavy manufacturing investments.

- Strong relationships with over 66 specialized karigars ensure consistent craftsmanship quality and scalability to meet rising demand.

- Presence across 21 states and 4 union territories provides broad market access and revenue diversification.

- Association with reputed corporate and non-corporate clients strengthens brand credibility and repeat business opportunities.

- Ability to respond quickly to changing trends and customer preferences helps maintain competitiveness in a dynamic market.

- BIS-hallmarked products enhance consumer trust and regulatory compliance, supporting long-term growth.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Shankesh Jewellers Limited

Capturing Market Opportunities

Shankesh Jewellers Limited aims to capitalize on the rapidly growing Indian jewellery market, projected to reach ₹11,548 billion by CY29. By aligning its handcrafted and customizable gold jewellery offerings with increasing middle-class disposable incomes, urbanisation, and evolving consumer preferences, the company seeks to expand its market share and strengthen its presence.

Leveraging Client Relationships

The company plans to deepen ties with existing corporate and non-corporate clients while pursuing new partnerships. By understanding client-specific requirements and tailoring products accordingly, Shankesh Jewellers Limited intends to enhance customer loyalty, secure recurring orders, and reinforce its position as a preferred B2B partner for handcrafted gold jewellery.

Scaling Operations and Capacity

To meet rising demand, Shankesh Jewellers Limited intends to expand operational capacity, optimize supplier networks, and leverage its asset-light production model. Scaling operations will enable the company to efficiently manage higher volumes, maintain quality standards, and deliver customized jewellery products across its PAN India client base.

Strengthening Financial Flexibility

The company aims to augment its working capital and reduce reliance on debt by allocating part of its IPO proceeds for repayment of working capital obligations. Enhanced financial flexibility will allow Shankesh Jewellers Limited to procure raw materials, manage inventory efficiently, and respond promptly to market growth opportunities.

Investing in Marketing and Brand Building

Shankesh Jewellers Limited will continue participating in key B2B exhibitions and trade shows, including IIJS and GJS, to showcase its product portfolio and connect with clients. Additionally, targeted marketing campaigns across social media, industry magazines, and store visits aim to increase brand awareness and stimulate client engagement.

Enhancing Digital Engagement

Through its mobile application and online presence, the company provides clients with a seamless browsing experience of its jewellery collections. This digital initiative supports its marketing efforts, facilitates client interactions, and strengthens the company’s visibility in the competitive handcrafted gold jewellery market.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shankesh Jewellers Limited IPO

How can I apply for Shankesh Jewellers Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is Shankesh Jewellers Limited IPO?

Shankesh Jewellers Limited IPO is a book-building issue of 4 crore equity shares, including fresh issue and OFS.

When will the IPO be open, and where will shares be listed?

The IPO dates are yet to be announced; shares will be listed on NSE and BSE.

How will the IPO proceeds be utilised?

Proceeds will fund debt repayment (₹158 crore), working capital (₹38 crore), and general corporate purposes.

Who are the promoters of Shankesh Jewellers Limited?

Promoters include Kantilal Kheemraj Jain, Mahavir Kantilal Jain, and Manoj Kantilal Jain, holding 95.48% pre-IPO.

What is the IPO reservation for different investor categories?

Retail investors get at least 35%, QIBs up to 50%, and Non-Institutional Investors a minimum of 15%.