- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shanti Gold International IPO

₹14,175/75 shares

Minimum Investment

IPO Details

25 Jul 25

29 Jul 25

₹14,175

75

₹189 to ₹199

NSE, BSE

₹360.11 Cr

01 Aug 25

Shanti Gold International IPO Timeline

Bidding Start

25 Jul 25

Bidding Ends

29 Jul 25

Allotment Finalisation

30 Jul 25

Refund Initiation

31 Jul 25

Demat Transfer

31 Jul 25

Listing

01 Aug 25

Shanti Gold International Limited

Shanti Gold International Limited, founded in 2003 by Pankaj Kumar H. Jagawat and Manoj Kumar N. Jain, benefits from their extensive 20 years of experience in the jewellery industry. The company is a leading manufacturer of high-quality 22kt CZ casting gold jewellery, specializing in intricate designs and diverse product offerings. With a strong production capacity, it provides an extensive range of bangles, rings, necklaces, and jewellery sets. Catering to various price points, its collection includes jewellery for weddings, festive occasions, and daily wear.

Shanti Gold International Limited IPO Overview

Shanti Gold IPO is a book-building issue of 1.81 crore shares, entirely a fresh issue of the same number. The IPO dates and price band are yet to be announced, and the allotment is expected to be finalised soon. Choice Capital Advisors Pvt Ltd is the book-running lead manager for the issue, while Bigshare Services Pvt Ltd has been appointed as the registrar. Investors can refer to the Shanti Gold IPO Draft Red Herring Prospectus (DRHP) for detailed information. The total issue size is 1,80,96,000 shares. The pre-issue shareholding stands at 5,40,00,000 shares. The DRHP was filed with SEBI on January 20, 2025, and January 22, 2025. Shanti Gold is promoted by Pankajkumar H Jagawat, Manojkumar N Jain, and Shashank BhawarlalJagawat, with a pre-issue promoter holding of 99.98%. The post-issue shareholding will be updated after finalisation.

Shanti Gold International Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 1.8 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 5,40,00,000 shares |

| Shareholding post -issue | TBA |

Shanti Gold International IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shanti Gold International Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.98 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 32.28% |

| Net Asset Value (NAV) | 17.90 |

| Return on Equity | 32.28% |

| Return on Capital Employed (ROCE) | 17.97% |

| EBITDA Margin | 7.51% |

| PAT Margin | 3.78% |

| Debt to Equity Ratio | 2.18 |

Shanti Gold International Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements towards setting up of the Proposed Jaipur facility | 458.32 |

| Funding incremental working capital requirements of our Company | 1900 |

| Repayment and/or pre-payment, in full or part, of certain borrowings availed by our Company | 200 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

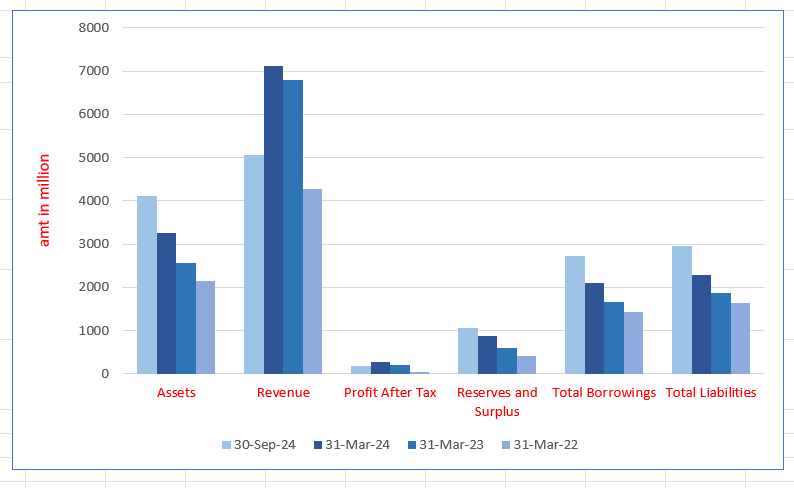

Shanti Gold International Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 4112.56 | 3254.01 | 2568.83 | 2144.10 |

| Revenue | 5059 | 7114.34 | 6794.04 | 4283.41 |

| Profit After Tax | 182.48 | 268.68 | 198.19 | 33.01 |

| Reserves and Surplus | 1058.43 | 876.69 | 608.05 | 410.13 |

| Total Borrowings | 2729.10 | 2106.78 | 1653.35 | 1439.72 |

| Total Liabilities | 2964.13 | 2287.31 | 1870.78 | 1644.97 |

Financial Status of Shanti Gold International Limited

SWOT Analysis of Shanti Gold International IPO

Strength and Opportunities

- Experienced promoters with over 20 years in the jewellery industry.

- Strong relationships with marquee customers like Joyalukkas and Lalithaa Jewellery Mart.

- State-of-the-art manufacturing facility with 2,700 kg annual capacity.

- Comprehensive control over design and production processes.

- Rich heritage and cultural importance in the Indian jewellery market.

- Expansion in e-commerce platforms offers broader market reach.

- Growing international demand for Indian jewellery presents export potential.

- Rising consumer interest in eco-friendly and lab-grown jewellery.

- Untapped markets in tier-2 and tier-3 cities with increasing incomes.

- Increasing preference for lightweight, daily-wear gold jewellery boosts market demand.

Risks and Threats

- Working capital-intensive operations due to sizeable receivables and inventory.

- Exposure to gold and diamond price volatility affecting profitability.

- Susceptibility to regulatory changes impacting market stability.

- Intense competition from organized and unorganized players.

- Dependence on gold imports, making the business vulnerable to price fluctuations.

- Economic slowdowns may reduce consumer spending on jewellery.

- Increasing raw material costs can shrink profit margins.

- Regulatory changes, such as gold import restrictions, can disrupt operations.

- Substitution by artificial or imitation jewellery may divert customers.

- Fluctuating currency exchange rates may impact international sales and profitability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Shanti Gold International Limited

More About Shanti Gold International Limited

Shanti Gold International Limited is a leading manufacturer of high-quality 22kt CZ casting gold jewellery, recognized for its installed production capacity. The company specializes in designing and producing:

- Bangles

- Rings

- Necklaces

- Complete jewellery sets

These designs cater to various price points, ranging from wedding jewellery to festive and daily-wear collections.

Manufacturing Capabilities

Shanti Gold operates a fully integrated in-house manufacturing facility to ensure quality control across:

- Design

- Manufacturing

- Packaging

A significant portion of the stone-setting process is manually handled by skilled artisans. The manufacturing facility, located in Andheri East, Mumbai, spans 13,448.86 square feet with an installed production capacity of 2,700 kg per annum.

Customer Network and Market Presence

Shanti Gold serves an extensive clientele, utilizing CAD technology to develop over 400 new designs per month. As of November 15, 2024, the company employed 80 CAD designers.

Customer Base and Revenue Growth

- Served 332 customers in the six-month period ending September 30, 2024.

- Customer base grew from 271 (Fiscal 2022) to 379 (Fiscal 2023).

- Achieved a CAGR of 28.88%.

Key Clients

Shanti Gold has established strong relationships with renowned jewellery brands, including:

- Joyalukkas India Limited

- Lalithaa Jewellery Mart Limited

- Alukkas Enterprises Private Limited

- Vysyaraju Jewellers Private Limited

- Shree Kalptaru Jewellers (I) Private Limited

The company serves 13 states and one union territory in India, along with four international markets.

Market Reach and Expansion Plans

- Established presence in Mumbai, Bangalore, Chennai, Hyderabad, and branches in Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, Gujarat, and Madhya Pradesh.

- Plans to expand into Jaipur with a new manufacturing facility.

- South India is a key market due to its deep cultural affinity for gold jewellery.

Revenue Distribution by Region

South India (Major Market Share)

- Tamil Nadu: ₹2,786.39 million (Fiscal 2024) (39.17% of revenue)

- Andhra Pradesh: ₹966.45 million (Fiscal 2024) (13.58% of revenue)

- Karnataka: ₹1,046.61 million (Fiscal 2024) (14.71% of revenue)

- Telangana: ₹778.77 million (Fiscal 2024) (10.95% of revenue)

- Kerala: ₹105.22 million (Fiscal 2024) (1.48% of revenue)

Rest of India

- ₹1,128.86 million (Fiscal 2024) (15.87% of revenue)

International Markets

- UAE: ₹208.79 million (Fiscal 2024)

- Singapore: ₹81.98 million (Fiscal 2024)

- Qatar: ₹11.27 million (Fiscal 2024)

- USA: Nil (Fiscal 2024)

Leadership and Vision

- Promoters & Directors: Pankajkumar H. Jagawat and Manojkumar N. Jain.

- Commitment to craftsmanship, innovation, and growth in the jewellery industry.

- Expansion efforts focus on capturing market opportunities in the growing jewellery sector.

Recognitions and Accreditations

Shanti Gold International Limited has received several accolades for its brand, including:

- Recognition by the Gem and Jewellery Export Promotion Council for the year 2023-24.

- Preferred Manufacturer of India (PMI 5) Award by the Gem and Jewellery Domestic Council in 2019-20.

- All gold jewellery products are hallmarked by the Bureau of Indian Standards (BIS).

Industry Outlook

In CY24, the Indian jewellery market is projected to grow by 13.1% year-on-year, reaching ₹4,653 billion. Additionally, the market is expected to expand at a compounded annual growth rate (CAGR) of 9.7% between CY23 and CY29, reaching ₹7,162 billion.

The increasing demand for gold jewellery in India is primarily driven by the expanding middle class and rising disposable incomes. As more individuals experience financial growth, they are increasingly able to afford luxury items like gold jewellery.

For many in this segment, gold jewellery serves as a status symbol, representing an enhanced lifestyle and a valuable investment. This trend is particularly strong in urban areas, where economic growth has boosted financial independence and purchasing power.

How Will Shanti Gold International Limited Benefit

- Market Growth Alignment: With the Indian jewellery market expected to grow at a 9.7% CAGR, Shanti Gold International Limited is well-positioned to capitalize on rising demand by expanding its product offerings and market reach.

- Expanding Middle-Class Demand: The increasing disposable income of India’s middle class enhances demand for gold jewellery. Shanti Gold, with its diverse product range, can cater to this growing customer segment effectively.

- Strong Manufacturing Capabilities: Shanti Gold’s in-house manufacturing facility ensures high-quality production. With a 2,700 kg annual capacity and skilled artisans, the company maintains precision in design, stone setting, and craftsmanship.

- Widespread Market Presence: Operating across 13 states and four international markets, Shanti Gold leverages its established presence to expand further, tapping into new opportunities in Jaipur and beyond.

- Robust Customer Network: With a rapidly growing customer base and strong ties to leading jewellery brands, Shanti Gold benefits from sustained business relationships and consistent revenue growth.

- Strategic Expansion in South India: South India accounts for a major share of Shanti Gold’s revenue. Strengthening distribution and manufacturing in this region enhances accessibility and market dominance.

Peer Group Comparison

| Company Name | Face Value (₹) | Revenue (₹ million) | Earnings per Share

(₹) |

NAV (₹) | Price / Earnings Ratio | RoNW (%) |

| Shanti Gold International Limited | 10 | 7,114.34 | 4.98 | 17.90 | [●] | 32.28 |

| Peer Group | ||||||

| Utssav CZ Gold Limited | 10 | 3,401.96 | 7.65 | 20.96 | 37 | 44.62 |

| RBZ Jewellers Limited | 10 | 3,274.29 | 5.39 | 51.87 | 39 | 14.38 |

| Sky Gold Limited | 10 | 17,454.84 | 35.18 | 212.15 | 168 | 23.66 |

Key Insights

- Face Value: All companies have a uniform face value of ₹10 per share. This standardization makes direct comparisons easier and ensures fairness in valuation across the industry.

- Revenue: Sky Gold Limited leads with ₹17,454.84 million, followed by Shanti Gold at ₹7,114.34 million. Shanti Gold’s revenue is significantly higher than Utssav CZ Gold and RBZ Jewellers, showing steady market traction.

- Earnings Per Share: Sky Gold has the highest EPS at ₹35.18, reflecting strong profitability. Utssav CZ Gold (₹7.65) and RBZ Jewellers (₹5.39) surpass Shanti Gold’s ₹4.98, indicating scope for improving earnings efficiency.

- Net Asset Value: Sky Gold has the highest NAV at ₹212.15, showing strong asset backing. RBZ Jewellers follows at ₹51.87, while Shanti Gold’s NAV of ₹17.90 suggests potential for strengthening financial reserves.

- Price / Earnings Ratio: Sky Gold has the highest P/E ratio at 168, indicating strong investor confidence. Utssav CZ Gold (37) and RBZ Jewellers (39) remain competitive, while Shanti Gold’s figure is undisclosed, requiring further assessment.

- Return on Net Worth (RoNW %): Utssav CZ Gold leads with 44.62% RoNW, showing superior profitability. Shanti Gold (32.28%) performs better than RBZ Jewellers (14.38%) but lags behind Sky Gold (23.66%) in terms of investor returns.

Shanti Gold International Limited IPO Strengths

- Extensive Jewellery Collection Designed by Experts

The company specialises in designing and producing 22 Kt CZ gold jewellery, offering a diverse range of intricately crafted pieces, including bangles, rings, and necklaces. With 80 CAD designers creating over 400 designs monthly, it continuously innovates to meet client preferences across markets.

- Integrated In-House Manufacturing for Quality Control

Operating a fully integrated manufacturing setup, the company ensures complete quality control from design to packaging. Its Andheri facility, spanning 13,448.86 square feet, has an annual capacity of 2,700 kg, allowing precise, high-quality jewellery production while reducing reliance on external vendors.

- Experienced Leadership Driving Business Growth

With over 20 years of industry experience, the company’s promoters leverage their expertise and connections to expand operations. Their leadership has strengthened relationships with key stakeholders, positioning the company for sustained growth while navigating market challenges effectively.

- Stable Financial Performance and Growth

The company’s financial stability is reflected in its consistent revenue growth and profitability. Key metrics, including EBITDA margins and return on net worth, highlight its strong financial performance over the past fiscal years, ensuring resilience and long-term sustainability.

- Established Relationships with Corporate and Jewellery Businesses

Strong, long-term relationships with corporate clients and jewellery businesses across 13 Indian states and four international markets enable the company to cater to diverse consumer needs. These strategic partnerships have contributed to its growing market presence and reputation within the industry.

Key Strategies for Shanti Gold International Limited

- Capturing Market Opportunities in the Jewellery Industry

In CY23, India’s gold jewellery market was valued at ₹4,115 billion, with a 31.5% CAGR from CY20 to CY23. Despite a 2% volume decline, gold prices increased by 7%. The market is projected to reach ₹7,162 billion by CY29.

- Manufacturing Expansion and Jaipur Facility

The company operates with an annual manufacturing capacity of 2,700 kg, producing 775.54 kg by September 2024. A new Jaipur facility, adding 1,200 kg capacity, is planned with advanced machinery. Necessary approvals are being secured to ensure regulatory compliance and smooth operations.

- Introduction of Machine-Made Gold Jewellery

A new line of machine-made plain gold jewellery is being introduced at the Jaipur facility, catering to 85% of India’s bridal jewellery demand. Marketing efforts are underway, securing three Letters of Intent (LOIs) from potential buyers to expand product offerings.

- Leveraging Market Growth and Client Expansion

The company aims to capitalize on industry growth by strengthening supplier networks and client relationships. Expansion into corporate clientele is a strategic focus, aligning product offerings with market trends while participating in exhibitions to enhance partnerships and customer engagement.

- Expanding Presence in North India

North India’s gold jewellery trends favour lightweight, modern designs. The company’s revenue from Punjab, Haryana, and Rajasthan demonstrates its foothold, with plans to scale operations in these states and further strengthen its regional market position.

- Strengthening Global Market Presence

The global jewellery market, valued at USD 235–245 billion in CY23, is expected to reach USD 257 billion by 2028. Expansion into the USA and UAE through trade exhibitions will enhance brand visibility, fostering partnerships with international distributors and retailers.

- Enhancing Working Capital for Business Growth

Domestic gold demand rose to 289 tonnes in H1CY24 from 281 tonnes in H1CY23. To scale operations and meet increasing demand, the company plans to enhance working capital for raw material procurement, ensuring sustainable business growth and market competitiveness.

Financials Status

Revenue

0Total Assets

0Profit

0How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQ's On IPO

What is the size of the Shanti Gold International IPO?

The IPO comprises a fresh issue of 1.8 crore equity shares, aiming to raise approximately ₹1,500 crore.

When is the expected opening date for the Shanti Gold International IPO?

The IPO is anticipated to open in the second week of March 2025, though exact dates are yet to be confirmed.

What are the primary objectives of the Shanti Gold International IPO?

The funds will be utilized for setting up a new manufacturing facility in Jaipur, meeting working capital needs, repaying certain debts, and general corporate purposes.

Who is the lead manager for the Shanti Gold International IPO?

Choice Capital Advisors Private Limited is serving as the Book Running Lead Manager for this IPO.

How can investors apply for the Shanti Gold International IPO?

Investors can apply online using UPI or ASBA payment methods through their bank’s net banking services or authorized brokers.