- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shivalaya Construction IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Shivalaya Construction IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Shivalaya Construction Limited

Incorporated in 1997, Shivalaya Construction Limited is a leading EPC company specialising in roads, highways, and bridges, with 41 projects executed across 19 states and union territories as of July 31, 2025. The company has built over 2,700 lane kilometers of roads, including elevated roads, flyovers, bridges, and railway overbridges, with projects ranging from 14 to 210 lane kilometers. Its ongoing pipeline includes 1,500 lane kilometers across 14 projects, comprising five EPC and nine HAM projects, supported by a fleet of 2,516 machines and construction equipment, and an order book of ₹36,269.90 million.

Shivalaya Construction Limited IPO Overview

Shivalaya Construction Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 5, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building Issue comprising a fresh issue of ₹450.00 crore and an Offer for Sale (OFS) of up to 2.49 crore equity shares. The equity shares are proposed to be listed on NSE and BSE. While the book running lead manager has not been declared yet, MUFG Intime India Pvt. Ltd. is appointed as the registrar of the issue. Key details such as IPO dates, price bands, and lot size are yet to be announced. The face value of each share is ₹2, with the issue type being a fresh capital-cum-OFS. Pre-IPO shareholding stands at 100% with promoters Shripal Aggarwal, Pradeep Nandal, Sumitra Nandal, Sahil Aggarwal, and Sumit Nandal.

Shivalaya Construction Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | |

| Fresh Issue | ₹450 crore |

| Offer for Sale (OFS) | 2.49 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 47,16,62,505 shares |

| Shareholding post-issue | TBA |

Shivalaya Construction IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shivalaya Construction Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Shivalaya Construction Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹7.29 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 18.17% |

| Net Asset Value (NAV) | ₹45.57 |

| Return on Equity (RoE) | 18.17% |

| Return on Capital Employed (RoCE) | 18.59% |

| EBITDA Margin | 24.84% |

| PAT Margin | 11.52% |

| Debt to Equity Ratio | 1.10 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Pre-payment or re-payment, in full or in part, of all or a portion of certain outstanding borrowings availed by the Company | 3400 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Based on this format-

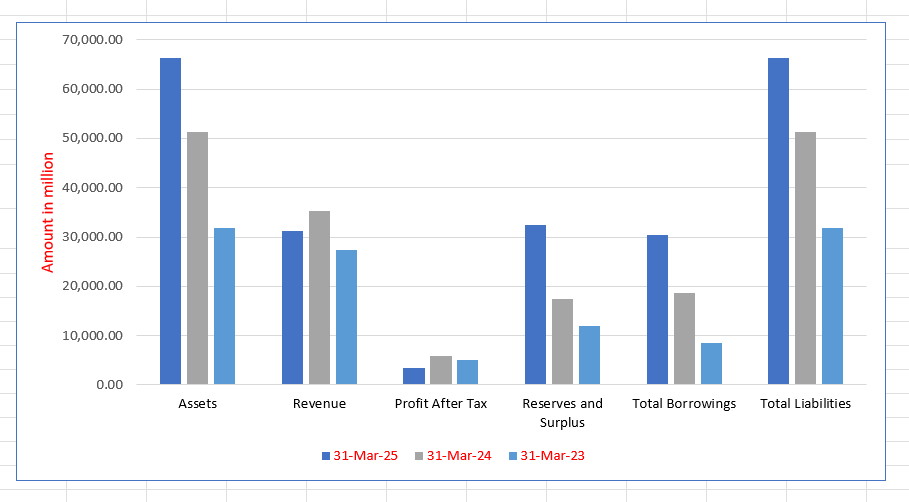

Shivalaya Construction Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 66,307.32 | 51,253.53 | 31,830.56 |

| Revenue | 31,245.26 | 35,375.69 | 27,315.42 |

| Profit After Tax | 3,438.22 | 5,889.75 | 5,031.74 |

| Reserves and Surplus | 32,503.50 | 17,381.84 | 12,010.60 |

| Total Borrowings | 30,481.51 | 18,611.64 | 8,577.79 |

| Total Liabilities | 66,307.32 | 51,253.53 | 31,830.56 |

Financial Status of Shivalaya Construction Limited

SWOT Analysis of Shivalaya Construction IPO

Strength and Opportunities

- Established track record in infrastructure development

- Extensive experience in road, highway, and bridge construction

- Completed 41 projects across 19 states and union territories

- Strong order book of ₹36,269.90 million as of July 2025

- Operational fleet of 2,516 machines and vehicles

- Proven capability in executing large-scale EPC and HAM projects

- Focus on reducing debt through IPO proceeds

- Potential for growth in underdeveloped regions

- Opportunity to leverage IPO funds for expansion and debt reduction

Risks and Threats

- High debt levels, with borrowings of ₹3,048 crore as of March 2025

- Dependence on government contracts, subject to policy changes

- Potential delays in project execution due to regulatory approvals

- Vulnerability to fluctuations in raw material prices

- Exposure to risks associated with labor shortages and strikes

- Limited geographic diversification outside India

- Competition from other established infrastructure companies

- Environmental and sustainability compliance challenges

- Risks related to geopolitical instability affecting project sites

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

Shivalaya Construction Limited

Shivalaya Construction Limited IPO Strengths

Integrated EPC Player with Pan-India Presence

Shivalaya Construction Limited is an integrated EPC player with over 25 years of experience in roads and highways, including specialized structures. They leverage technology for systematic project design, supporting a pan-India presence across 19 states. This deep technical expertise allows the company to undertake complex, varied projects efficiently.

Vertical Integration for Competitive Advantage

The company’s operations are vertically integrated, owning and operating crusher plants for aggregate supply and in-house ready-mix concrete batching plants. This significantly reduces reliance on third-party suppliers, ensures consistent quality, and allows Shivalaya Construction to maintain greater control over key project inputs, improving efficiency and profitability.

Strong Execution and Proven Track Record

Shivalaya Construction Limited possesses strong execution capabilities demonstrated by a track record of handling complex and challenging projects, often ahead of schedule, for which they’ve received bonuses. The firm achieves the majority of project execution through in-house resources, supported by direct management involvement, which ensures quick decision-making and optimal resource allocation.

Robust In-House Equipment Bank

The company maintains an extensive in-house equipment bank, owning 2,516 machines, vehicles, and construction equipment as of July 31, 2025. This large, well-maintained fleet ensures ready availability and flexible deployment, reducing reliance on external rentals. The equipment bank minimizes downtime, aids in efficient project execution, and contributes to better cost management.

Diversified Order Book with Revenue Visibility

Shivalaya Construction’s strong and diversified Order Book provides long-term revenue growth visibility. A significant portion of the order book is with the Nodal Authority, ensuring stable and reliable counterparties. Geographic and business vertical diversification reduces risk, while strategic project clustering helps optimize resources and achieve economies of scale.

Experienced Promoters and Management Team

The company is led by highly experienced Promoters, including Shripal Aggarwal and Pradeep Nandal, with a combined experience of over five decades. This leadership, along with an experienced management team, provides deep industry knowledge and a hands-on approach to project oversight, which is instrumental in successful execution and continued growth.

More About Shivalaya Construction Limited

Shivalaya Construction Limited is an integrated infrastructure engineering, procurement, and construction (EPC) player, primarily focused on roads, highways, and bridges across India. As of July 31, 2025, the company has successfully executed 41 projects across 19 states and union territories, leveraging more than 25 years of experience in the construction, development, and maintenance of road infrastructure, including specialized structures like elevated roads, flyovers, bridges, and railway over bridges.

Project Scale and Experience

The company’s portfolio highlights its capacity for large-scale operations:

- Constructed Over: 2,700 lane kms of roads and highways as of July 31, 2025.

- Project Size Range: Projects executed have ranged from 14 lane kms to 210 lane kms.

- Ongoing Projects: The company currently has over 1,500 lane kms of Ongoing Projects.

Business Model and Project Portfolio

Shivalaya Construction Limited undertakes projects through two primary models: Engineering, Procurement, and Construction (EPC) and Hybrid Annuity Model (HAM).

- EPC Business: Services include the construction of highways, bridges, buildings, and other civil infrastructure such as water works.

- HAM Business: Focuses on the development of roads and highways under the hybrid annuity model.

As of July 31, 2025, the company’s executed projects include 31 road EPC projects, four HAM projects, and six other EPC projects (including government buildings). It has 14 Ongoing Projects (five EPC and nine HAM) spread across states/union territories like Jammu and Kashmir, Haryana, Uttar Pradesh, Maharashtra, Kerala, Karnataka, Jharkhand, and Meghalaya.

Commitment to Challenging Projects

The company maintains a strong focus on quality, safety, and timely completion, utilizing technology and a skilled workforce to handle projects of diverse complexity.

- Execution Track Record: The company has a proven track record of executing challenging projects. For instance, it successfully executed an EPC project in hilly terrain involving slope and rock fall protection due to heavy rainfall.

- Specialized Structures: It is currently executing projects in high-traffic, high-density areas, and constructing specialized structures such as tunnels, major bridges spanning backwaters, and elevated roads.

Industry Outlook

India’s road construction sector is poised for significant growth, driven by substantial government investments and a focus on enhancing connectivity across the nation. The market was valued at approximately USD 142.40 billion in 2024 and is projected to reach USD 341.31 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 10.20% during the forecast period

Growth Drivers

- Government Initiatives: The Indian government has allocated substantial funds to infrastructure development, with the Ministry of Road Transport and Highways receiving a budget of INR 2.72 lakh crore (USD 32.68 billion) for the fiscal year 2024–25

- Urbanization and Industrial Expansion: Rapid urbanization and industrial growth are increasing the demand for efficient transportation networks to support economic activities.

- Rural and Border Connectivity: Focus on improving road access in rural areas and strategic border regions is enhancing mobility and supporting economic development in underserved regions.

Market Segmentation

- National Highways: Continued expansion and upgrading of national highways are central to the government’s infrastructure agenda.

- Expressways and Regional Corridors: Development of expressways and regional corridors is improving connectivity and reducing travel time.

- Rural Roads: Initiatives like the Pradhan Mantri Gram Sadak Yojana (PMGSY) are enhancing road access in rural areas, fostering inclusive growth.

Future Outlook

The Indian road infrastructure sector is expected to maintain a robust growth trajectory, supported by continued government investments, technological advancements, and a focus on sustainable development. The emphasis on multimodal transportation networks and strategic connectivity projects will further bolster the sector’s expansion in the coming years.

How Will Shivalaya Construction Limited Benefit

- Shivalaya Construction Limited is well-positioned to benefit from the rapid expansion of national highways and expressways across India.

- Government funding of INR 2.72 lakh crore for FY 2024–25 increases the pipeline of EPC and HAM projects, providing growth opportunities.

- Ongoing rural road initiatives like PMGSY allow the company to diversify its project portfolio and strengthen presence in underserved regions.

- Increasing industrial and urban development boosts demand for high-capacity roads, flyovers, and bridges, aligning with the company’s expertise.

- Focus on multimodal connectivity projects supports large-scale project execution, enhancing revenue visibility and operational efficiency.

- Experience in challenging terrains and specialized structures positions Shivalaya for complex, high-margin contracts.

- Technological adoption and skilled workforce enable timely completion, improving project credibility and client trust.

- Strategic geographic spread across multiple states reduces dependency on any single region and mitigates project risk.

- Strong financial health allows participation in large public-private partnerships and HAM projects, capitalizing on government incentives.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per the DRHP.

Key Strategies for Shivalaya Construction Limited

Focus on Large and Complex Road Projects

Shivalaya Construction Limited will continue to bid for complex, large-scale Road Projects with high contract values, leveraging its proven execution skills. By adopting advanced construction techniques, like pre-tensioned I-beams, the company enhances its engineering excellence to tackle challenging projects, including those in eco-sensitive zones, ensuring long-term growth.

Strategic Geographic and Segment Expansion

The firm plans to expand its presence across new states, reducing geographical risk and diversifying its portfolio. This strategy focuses on growing both the EPC and HAM segments by selectively targeting projects with limited competition and high margins. It recently secured Letters of Award for projects in three new states: Andhra Pradesh, Bihar, and Haryana.

Diversify into New Infrastructure Sectors

Shivalaya Construction intends to leverage its core EPC competencies to expand into high-growth business lines such as power transmission, solar energy, and railways. This includes developing grid-connected storage solutions and bidding on railway infrastructure projects like track laying and electrification, creating synergies with existing operations while mitigating over-diversification risk.

Expand Public-Private-Partnership Projects

The company will continue to seek and evaluate opportunities under the Hybrid Annuity Model (HAM), which offers a favorable risk-reward balance with stable annuity-based income. Shivalaya Construction may also opportunistically bid for Toll-Operate-Transfer (TOT) projects to diversify its revenue mix and utilize its asset management and operational expertise.

Enhance Capabilities through Technology

The firm aims to enhance its execution capabilities by leveraging technology and automation, from structured design processes using third-party software to the adoption of innovative machinery like straddle carriers for efficient bridge construction. This focus on advanced tools and automation optimizes workflows, ensures precision, and reduces project turn-around time.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shivalaya Construction Limited IPO

How can I apply for Shivalaya Construction Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of Shivalaya Construction Limited’s IPO?

The IPO comprises a fresh issue of ₹450 crores and an Offer for Sale of up to 2.49 crore shares.

Where will Shivalaya Construction shares be listed?

The equity shares are proposed to be listed on both NSE and BSE.

Who are the promoters of Shivalaya Construction Limited?

Shripal Aggarwal, Pradeep Nandal, Sumitra Nandal, Sahil Aggarwal, and Sumit Nandal are the company promoters.

How will the IPO proceeds be utilised?

Proceeds will be used to prepay or repay borrowings and for general corporate purposes.

What is the face value and issue type of the IPO?

The face value per share is ₹2, and the IPO is a Book Building Issue