- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Short Call & Short Put

By HDFC SKY | Updated at: Sep 15, 2025 08:57 PM IST

Summary

In the series of understanding the derivatives market, we have covered buying Call and Put option, which is nothing but in market terminology a plain vanilla strategy. In this chapter, we will move to the next level of derivatives trading strategy, which is the Selling Call Option and Selling Put Option or Short Call and Short Put Strategy – sometimes referred to as the short call short put strategy.

This being a highly risky and cost-sensitive activity, it is often used by traders who have acquired enough knowledge about this strategy to cover their risk in underlying assets or even to hedge against long call or long put positions.

Let us understand these two strategies, i.e. selling Call Option and Put Option, one by one in detail. They work effectively once the market’s trend is ascertained and position initiated accordingly to make a profit. However, the earning potentials are restricted to the difference between option premium. That’s because the trader is betting on the premium to fall in either case. Let’s find out how.

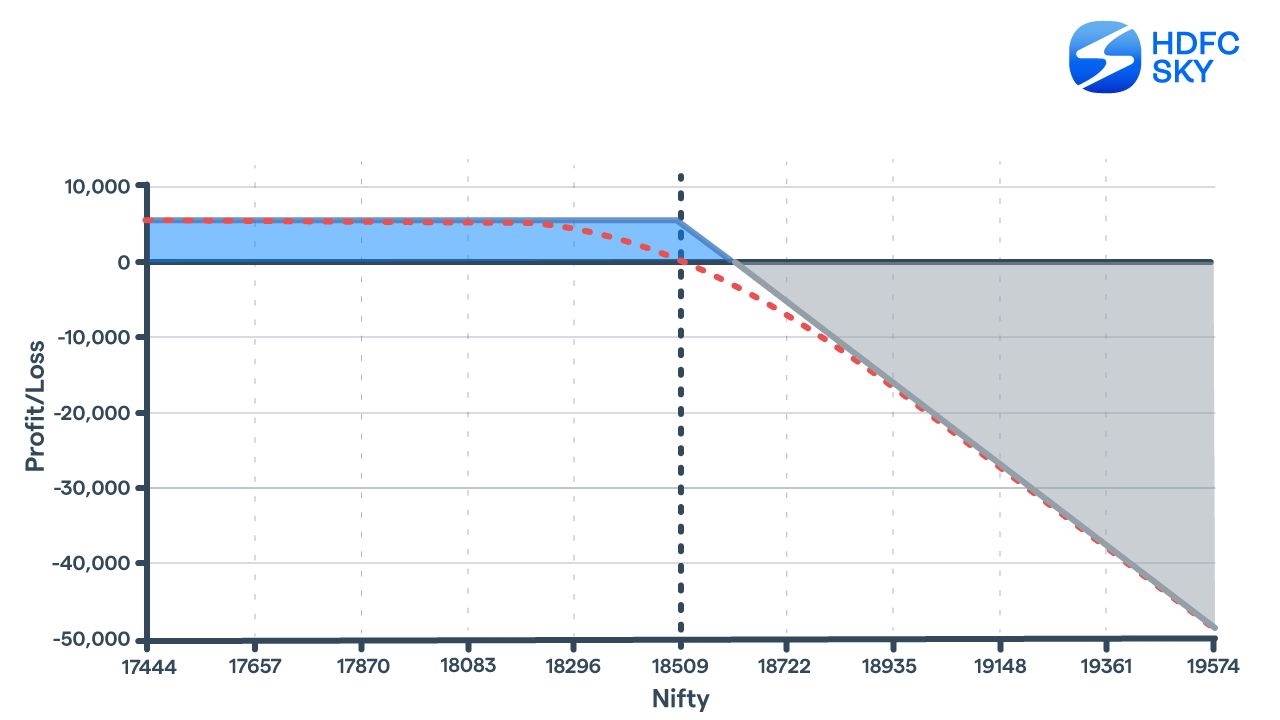

Short Call

When to initiate:

There are situations when the trader expects a sideways market, or at the least does not expect the price of a particular security to go up. The trader also does not expect the stock price to go down materially, which deters him from buying a put option. In such a situation selling a call option is a way to trade, often as part of a short put short call approach.

Why initiate:

The trader expects the price to move sideways or does not expect it to go up. Also, if a trader is bearish on a stock.

What are the payoffs?

Selling a call option means the seller gets to keep the premium received. In return, he gives the call option buyer the right but not the obligation to buy the specified security at the strike price at the pre-determined (expiry) date. If the underlying security trades below or at the strike price, then the call option buyer does not exercise the call option. The seller, in such a situation, pockets the premium received. His gains are limited to that extent. If the price of the underlying security trades above the strike price, then the seller’s loss can be unlimited. The loss equals to the market price minus the strike price minus the premium received.

When a call option is sold, the trader has to pay a margin. The amount of margin depends on the strike price of the underlying, volatility and time to expiry, among other factors.

How does the strategy work?

After selling a call option, the seller can buy it back at any time in the market and square off the trade if he wants to book his profit or loss. The premium oscillates as the underlying stock or index’s price changes. If the price keeps trending up and the volatility increases, then the premium also goes up, other things remaining the same. If the price of the underlying rises, then the premium also goes up. The seller of the call option, in such cases, makes a loss. As the call option nears the expiry, the premium goes down, other things remaining the same. This time decay eats into the premium. Put simply, the trader is better off if the stock price does not go up.

Traders generally sell an out of the money option if they expect the price to not go up. However, the premium to be received is less in out of the money options. For far out the money call options, the premium charged is even smaller. If the trader is keen to pocket more premium, then he has to sell an option with a strike price closer to the current market price. But in that case, the delta of the option is high (the probability of the stock price going down to that price is high) and it runs a relatively higher risk of the price going against him before expiry compared to a far out of the money option.

Example:

Nifty Closes at 18,512.75 on November 25, 2022.

Nifty 01DEC2022 CE 18500 quotes at Rs 110.2

The call option seller will pocket the premium if the Nifty closes on the day of expiry (01Dec2022) below 18,500 – 110.2 = 18,389.8, assuming zero* brokerage and transaction cost.

If the Nifty closes at 18,800, then the loss for the call option seller is 18,800 – 18,500 – 110.2 = Rs 189.8 multiplied by the contract size, i.e., 50 (for Nifty option) = Rs 9,490.

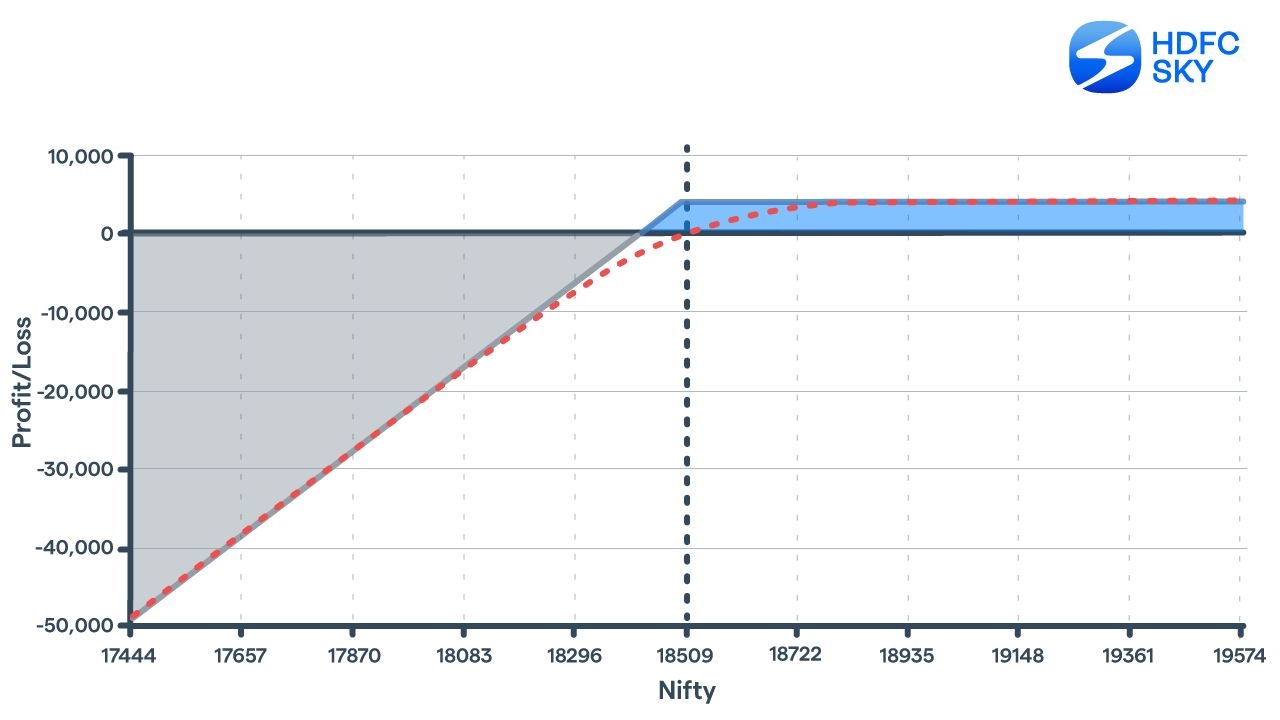

Short Put

When to initiate:

Sometimes traders expect the price of a security to trade sideways or, at the least, do not expect the price of a particular security to go down. The trader also does not expect the stock price to go up. In such a situation, he cannot buy a call option. In such a situation selling a put option is considered by savvy traders as a part of short put and short call strategy, often described as a short call short put strategy.

Why initiate:

The trader expects the price to move sideways or does not expect it to go down. Traders may not be sure of the stock price going up.

What are the payoffs?

Selling a put option allows the seller to keep the premium received. In return, he gives the put option buyer the right but not the obligation to sell the specified security at the strike price at the pre-determined (expiry) date. If the underlying security trades higher or at the strike price, then the put option buyer does not exercise the put option. The seller, in such a situation, pockets the premium received. His gains are limited to that extent. If the price of the underlying security trades below the strike price, then the seller’s loss can be technically unlimited (though in the real world, the price of the underlying may not go below zero). The loss equals to the strike price minus market price minus the premium received.

When a put option is sold, the trader has to pay a margin. The amount of margin depends on the strike price of the underlying, volatility and time to expiry among other things.

How does the strategy work?

After selling a put option the seller can buy it back any time in the market and square off the trade if he wants to book his profit or loss. The premium oscillates as the underlying stock or index’s price changes. If the price keeps trending down and the volatility increases then the premium also goes up, other things remaining the same. If the price of the underlying falls, then the premium also goes up. The seller of the put option in such cases makes a loss. As the put option nears the expiry, the premium goes down, other things remaining the same. This time decay eats into the premium. Put simply, the trader is better off if the stock price does not fall.

Traders generally sell an out of the money put option if they expect the price to not fall. However, the premium to be received is less in out of the money options. For far out the money put options, the premium charged is even smaller. If the trader is keen to pocket more premium, then he has to sell an option with a strike price closer to the current market price. But in that case, the delta of the option is high, and it runs a relatively higher risk of the price going against him before expiry compared to a far out of the money option.

Nifty Closes at 18,512.75 on November 25, 2022.

Nifty 01DEC2022 PE 18500 quotes at Rs 77.9

The put option seller will make money if the Nifty closes on the day of expiry (01DEC2022) above 18,500 – 77.9 = 18,422.1, assuming zero* brokerage and transaction cost.

If the Nifty closes at 18,500, then the loss for the put option seller is 18,500 – 18,300 – 77.9 = Rs 122.1 multiplied by the contract size, i.e., 50 (for Nifty option) = Rs 6,105.

Conclusion:

While using the short call or short put strategy, the seller of the option should keep in mind the chance that the market is going against his view. The premium to be received in case the view goes right and the margin required to sell the option decides the rate of return on the trade.