- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shree Ram Twistex IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Shree Ram Twistex IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Shree Ram Twistex Limited

Shree Ram Twistex manufactures a wide range of cotton yarns, including Compact Ring Spun and Carded varieties, both Combed and Carded, used in knitting and weaving for denim, shirting, terry towels, sheeting, sweaters, socks, home textiles, bottom wear, and industrial fabrics. It also produces value-added yarns such as Eli Twist, Compact Slub, and Lycra-Blended Yarns. Operating on a B2B model, the company supplies textile manufacturers, garment exporters, bulk buyers, and processors across Indian states and abroad. Its Gondal, Gujarat facility houses 27,744 spindles and warehouses with 9,855 MT capacity

Shree Ram Twistex Limited IPO Overview

Shree Ram Twistex Ltd. has filed its Draft Red Herring Prospectus (DRHP) with SEBI on June 27, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Build Issue comprising a fresh issue of up to 1.06 crore equity shares, with the shares proposed to be listed on both NSE and BSE. Interactive Financial Services Ltd. is acting as the book running lead manager, while Bigshare Services Pvt. Ltd. is the registrar. Important details such as IPO dates, price bands, and lot size are yet to be disclosed. The issue has a face value of ₹10 per share, and post-issue shareholding will increase from 2.93 crore shares to 3.99 crore shares. Promoters include Bhaveshbhai Bhikhumbhai Ramani, Jay Atulbhai Tilala, and Nidhi Bhaveshbhai Kothari, with promoter shareholding expected to change from 47.07% pre-issue.

Shree Ram Twistex Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.06 crore equity sahares |

| Fresh Issue | 1.06 crore equity shares |

| Offer for Sale (OFS) | NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 2,93,75,000 shares |

| Shareholding post -issue | 3,99,75,000 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shree Ram Twistex Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

Shree Ram Twistex Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.23 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 10.25% |

| Net Asset Value (NAV) | ₹21.77 |

| Return on Equity (RoE) | 10.25% |

| Return on Capital Employed (RoCE) | 12.50% |

| EBITDA Margin | 8.72% |

| PAT Margin | 2.83% |

| Debt to Equity Ratio | 1.00 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding for setting up of 6.1 MW Solar Power Plant for captive use | 784.55 |

| Funding for setting up of 4.2 MW Wind Power Plant for captive use | 390 |

| Repayment and/or pre-payment, in full or part, of certain borrowings availed by our Company | 148.9 |

| Funding the working capital requirements of our Company | 440.0 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

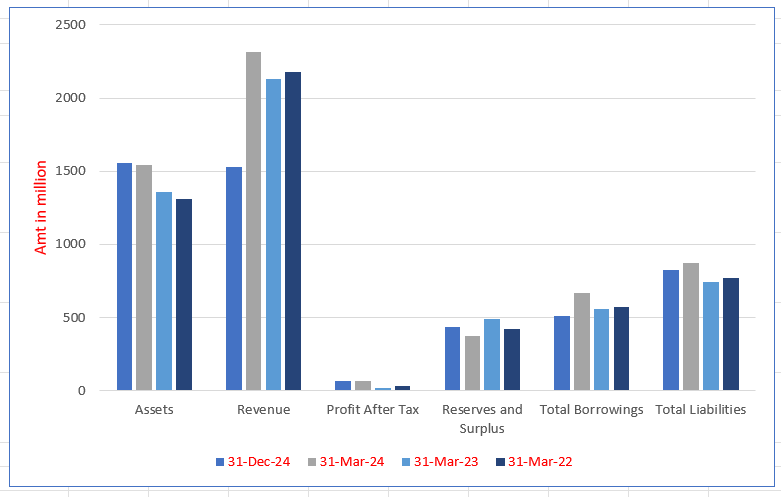

Shree Ram Twistex Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 1558.71 | 1543.05 | 1357.15 | 1307.79 |

| Revenue | 1525.99 | 2315.91 | 2131.03 | 2179.72 |

| Profit After Tax | 69.64 | 65.53 | 20.51 | 36.38 |

| Reserves and Surplus | 438.06 | 374.24 | 493.61 | 421.23 |

| Total Borrowings | 514.01 | 670.45 | 557.01 | 569.62 |

| Total Liabilities | 826.90 | 875.06 | 746.04 | 769.06 |

Financial Status of Shree Ram Twistex Limited

SWOT Analysis of Shree Ram Twistex IPO

Strength and Opportunities

- Strong specialization in high-quality 100% cotton ring-spun, combed, carded yarns tailored for knitting and weaving.

- Advanced manufacturing in Rajkot with 17 compact ring-spinning machines (27,744 spindles) enhancing production capacity.

- DRHP filing and move toward IPO signal growth ambition and access to capital markets.

- Rising investor visibility and potential for brand strengthening via listing.

- Opportunity to use IPO proceeds for power projects and working capital expansion.

- Potential to diversify product range or expand into renewable energy solutions as per planned projects.

- Strong manufacturing base and quality focus can attract premium buyers in textiles industry.

- Geographic concentration in Gujarat enables operational efficiencies and regional supply chain integration

- IPO momentum may boost credibility and enable scaling of value-added capabilities like TFO twisting and solar power.

Risks and Threats

- High dependency on a limited number of suppliers for cotton bales, exposing it to raw material supply volatility.

- Stringent quality requirements from institutional buyers pose reputational risks if standards slip.

- Reliance on brokers and agents for sales may cause market reach limitations or inconsistent performance.

- Difficulty in forecasting demand and inventory mismatches could impair operations and cash flows

- Major portion of revenue derived from specific yarn types—carded, combed, ELI—making product portfolio exposure narrow

- Customer payment delays may heighten working capital demands and cash flow stress.

- Competitive pressures from domestic/international yarn makers and rise of synthetic textiles pose market threats

- Geographic concentration also creates vulnerability to local disruptions such as natural disasters or regional downturns

- Exchange controls and regulatory limits on foreign capital borrowing may constrain financing flexibility.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Shree Ram Twistex Limited

Shree Ram Twistex Limited IPO Strengths

Integrated Infrastructure and Advanced Technology

Shree Ram Twistex Limited operates a fully integrated spinning facility with advanced technologies, including compact ring spinning and TFO twisting. Equipped with modern European machinery, automated monitoring, and climate-controlled systems, the Company ensures efficiency, consistency, and superior yarn quality. Its diversified, customizable product portfolio strengthens competitiveness across domestic and international textile markets.

Strong Customer Relationships

Shree Ram Twistex Limited has cultivated long-standing relationships with key institutional customers, bulk purchasers, and merchant exporters. Supported by a network of brokers and agents, the Company ensures strong market reach, repeat business, and customer-centric services. Its focus on customised solutions and consistent quality has reinforced reputation, loyalty, and sustained growth over years.

Strategic Location and Storage Capabilities

Shree Ram Twistex Limited’s manufacturing facility, located in Gondal, Gujarat, benefits from excellent connectivity to highways, rail, and ports. With ample land for expansion and modern storage systems, the Company ensures streamlined procurement, efficient inventory management, and timely deliveries. This infrastructure supports scalability, optimises logistics, and strengthens responsiveness to domestic and global customer requirements.

Consistent Financial Growth

Shree Ram Twistex Limited has demonstrated consistent growth in revenues and profitability, supported by operational efficiency and market demand. Its revenues rose from ₹6,278.65 lakhs in Fiscal 2017 to ₹23,159.12 lakhs in Fiscal 2024. A resilient business model, effective cost management, and strategic execution have enabled stability and expansion despite industry challenges and economic disruptions.

Experienced Promoters and Skilled Management

Shree Ram Twistex Limited is guided by experienced promoters and a strong leadership team with deep expertise in the textile sector. Their collaborative approach drives innovation, operational efficiency, and customer-centric strategies. Supported by qualified managerial staff and a skilled workforce, the Company continues to strengthen market presence, scale operations, and pursue future growth opportunities.

More About Shree Ram Twistex Limited

Shree Ram Twistex Limited is engaged in the manufacturing of high-quality cotton yarns. The company produces Compact Ring Spun and Carded Yarns, both combed and carded, along with specialised value-added yarns such as Eli Twist (combed and carded), Compact Slub Yarns, and Lycra-Blended Yarns. These yarns cater to both knitting and weaving applications across diverse end-use segments including denim, terry towels, shirting, sheeting, sweaters, socks, bottom wear, home textiles, and industrial fabrics.

Business Model and Market Presence

The company operates exclusively in the business-to-business (B2B) segment, supplying yarns to:

- Textile manufacturers

- Garment exporters

- Bulk purchasers

- Fabric processors

This focused B2B approach allows Shree Ram Twistex Limited to streamline production, maintain consistent quality, and meet large-scale requirements efficiently. Long-term customer relationships and customised yarn solutions, tailored to technical parameters such as count, twist, and strength, further strengthen its market position.

Manufacturing Facility

The company’s manufacturing operations are centred in Gondal, Rajkot, Gujarat, with a built-up area of nearly 29,947 sq. m. Key features include:

- 17 compact ring-spinning machines with a spindle count of 27,744.

- Production capacity of cotton yarn ranging from Ne 8 to Ne 40 (carded and combed varieties).

- Specialised Eli Twist (Siro) yarns, Compact Slub Yarns for textured fabrics, and Lycra-blended yarns for stretchable garments.

- By-products such as cotton waste, viscose-cotton mix yarn, FP bales, and open-end yarn also contribute to revenue.

Sales and Distribution

Shree Ram Twistex Limited serves both domestic and international markets.

- Domestic sales are executed through direct institutional sales and brokers across Gujarat, Rajasthan, West Bengal, Maharashtra, Tamil Nadu, Madhya Pradesh, Punjab, and Dadra & Nagar Haveli.

- Exports are routed through merchant exporters, who possess expertise in global compliance and trade practices, ensuring smooth overseas delivery.

Sustainability and Growth

With nearly a decade of operational experience, the company integrates advanced technology and sustainability into its processes. A 1.2 MW rooftop solar plant, commissioned in July 2024, already contributes to reducing operational costs and lowering the carbon footprint. Plans for a 6.1 MW solar project and a 4.2 MW wind project underline its commitment to renewable energy and long-term efficiency.

Industry Outlook

India’s textile and apparel market is poised for robust expansion, projected to grow at a 10% CAGR, reaching US $350 billion by 2030—with exports anticipated to hit US $100 billion.

The textile manufacturing segment specifically is expected to scale from US $128.28 billion in 2024 to US $190.57 billion by 2033, at a 4.15% CAGR.

Cotton Yarn Segment Growth

The global cotton yarn market is forecast to grow from US $86.11 billion in 2024 to US $117.79 billion by 2032, at a 4.0% CAGR, with Asia Pacific—the hub including India—holding over 80% market share.

A more optimistic estimate projects the global cotton yarn market value doubling from US $72.57 billion in 2024 to US $149.61 billion by 2034, achieving a 7.5% CAGR; notably, carded yarn currently dominates 40–45% of the segment, and the apparel segment drives the highest demand.

Growth Drivers & Industry Catalysts

- Rising domestic consumption and government stimuli such as the PLI scheme, P.M. MITRA parks, and FDI reforms are fueling expansion.

- Sustainability shifts—notably investments in zero-liquid-discharge tech, clean energy, and eco-friendly fabrics—are accelerating demand for premium cotton yarns.

- Strategic import reliance on high-quality cotton continues: due to domestic shortfalls, India’s ELS cotton imports (notably from the U.S.) are surging, aided by favorable duties and reliability in supply.

How Will Shree Ram Twistex Limited Benefit

- Positioned to benefit from India’s textile industry CAGR of 10% and projected US $350 billion size by 2030, driving greater yarn demand.

- Strong presence in carded and combed yarns aligns with the dominant 40–45% share of carded yarn in the global market.

- Value-added offerings like Eli Twist, Slub, and Lycra-blended yarns cater to the rising apparel demand, the fastest-growing end-use segment.

- Expansion in domestic consumption and government support through PLI and MITRA parks enhances opportunities for bulk B2B supply.

- Sustainability investments, including solar and wind energy, match global buyers’ preference for eco-friendly and low-carbon yarn sourcing.

- Strategic production flexibility (Ne 8 to Ne 40) ensures adaptability to varied customer requirements across denim, shirting, home textiles, and industrial fabrics.

- Export via merchant exporters positions the company to capture growth in Asia Pacific, which dominates 80% of cotton yarn demand.

Peer Group Comparison

| Companies | EPS | PE Ratio | RONW (%) | NAV (Per Share) | Face Value | Revenue (in lakhs) |

| Shree Ram Twistex Limited | 2.37 | [●] | 10.25 | 21.77 | 10.00 | 23,159.12 |

| Peer Group | ||||||

| Ambika Cotton Mills Limited | 110.00 | 13.70 | 7.52 | 1,463.33 | 10.00 | 82,345.99 |

| Damodar Industries Limited | 2.24 | 15.74 | 4.45 | 50.39 | 5.00 | 71,538.26 |

| Rajapalayam Mills Limited | 31.00 | 29.68 | 6.04 | 508.40 | 10.00 | 85,855.86 |

Key Strategies for Shree Ram Twistex Limited

Setting up Ground-Mounted Solar Power Plant and Windmill for Captive Use

Shree Ram Twistex Limited is expanding its renewable energy portfolio by installing a 6.1 MW solar plant and a 4.2 MW wind project. Designed for captive use, these projects will stabilize energy costs, strengthen operational resilience, and align business expansion with long-term environmental stewardship.

Working Capital Optimization

Shree Ram Twistex Limited aims to strengthen liquidity through better demand forecasting, stricter receivable management, and supplier negotiations. By optimizing inventory turnover, leveraging pledge loans, and expanding financial limits, the company ensures smoother cash flow, supports operational continuity, and sustains scalability in a growing manufacturing business.

Maintain and Expand Long-Term Relationships with Customers and Brokers

Shree Ram Twistex Limited prioritizes building enduring customer and broker relationships based on trust and consistent service. By closely understanding client requirements, offering timely solutions, and maintaining reliability, the company strengthens loyalty, drives repeat business, and creates a foundation for long-term expansion across diverse markets.

Operational Efficiency and Manufacturing Excellence

Shree Ram Twistex Limited focuses on enhancing productivity through modern spinning infrastructure, in-house quality control systems, and process optimization. By reducing waste, improving cost efficiency, and investing in automation, the company ensures high-quality output, strengthens competitiveness, and maintains agility in responding to evolving domestic and international market demands.

Focus on Rationalizing Indebtedness

Shree Ram Twistex Limited plans to reduce borrowings by repaying part of the SIDBI loan used for renewable energy projects. This strategy lowers interest expenses, improves the debt-to-equity ratio, and enhances financial flexibility, enabling reinvestment in core operations while reinforcing commitment to sustainability and responsible capital management.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shree Ram Twistex Limited IPO

How can I apply for Shree Ram Twistex Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When is the Shree Ram Twistex Limited IPO opening for subscription?

The IPO open and close dates are yet to be announced, as the company recently filed its DRHP.

What is the total issue size of the Shree Ram Twistex Limited IPO?

The IPO comprises a fresh issue of 1.06 crore equity shares, with no offer for sale component.

On which stock exchanges will the Shree Ram Twistex Limited shares be listed?

The equity shares of Shree Ram Twistex Limited are proposed to be listed on both NSE and BSE.

What is the face value of shares in the Shree Ram Twistex Limited IPO?

Each equity share under the Shree Ram Twistex Limited IPO carries a face value of ₹10 per share.

What is the reservation breakup for the Shree Ram Twistex Limited IPO?

At least 75% is reserved for QIBs, up to 15% for NIIs, and 10% for retail investors.