- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shreeji Shipping Global IPO

₹13,920/58 shares

Minimum Investment

IPO Details

19 Aug 25

21 Aug 25

₹13,920

58

₹240 to ₹252

NSE, BSE

₹410.71 Cr

26 Aug 25

Shreeji Shipping Global IPO Timeline

Bidding Start

19 Aug 25

Bidding Ends

21 Aug 25

Allotment Finalisation

22 Aug 25

Refund Initiation

25 Aug 25

Demat Transfer

25 Aug 25

Listing

26 Aug 25

Shreeji Shipping Global Limited

Shreeji Shipping Global Limited is a logistics and shipping company specialising in dry-bulk cargo operations, primarily across non-major ports along India’s west coast and Sri Lanka. It has served over 20 ports, including Kandla, Navlakhi, and Puttalam. The company offers cargo handling, stevedoring, lightering, and transportation services, along with fleet chartering and equipment rentals. As of March 31, 2025, it operates 80+ vessels and 370+ earthmoving machines. Its clientele spans Oil and Gas, Energy, FMCG, and Metals sectors, supported by end-to-end port-to-premise logistics solutions.

Shreeji Shipping Global Limited IPO Overview

Shreeji Shipping Global IPO is a book-built public issue consisting of 1.63 crore equity shares, entirely comprising a fresh issue. The IPO will open for subscription on August 19, 2025, and close on August 21, 2025. The allotment of shares is expected to be finalised on Friday, August 22, 2025. Post allotment, the shares are proposed to be listed on both the BSE and NSE, with a tentative listing date scheduled for Tuesday, August 26, 2025. The price band for the issue has not yet been disclosed. Beeline Capital Advisors Pvt Ltd is acting as the book-running lead manager for the IPO, while Bigshare Services Pvt Ltd is appointed as the registrar to the issue.

Shreeji Shipping Global Limited IPO Details

| Particulars | Details |

| IPO Date | 19 August 2025 to 21 August 2025 |

| Listing Date | 26 August 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹240 to ₹252 per share |

| Lot Size | 58 shares |

| Total Issue Size | 410.71 crore |

| Fresh Issue | 1,62,98,000 shares aggregating to 410.71 crore |

| Offer for Sale (OFS) | NA |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 14,66,20,254 shares |

| Share Holding Post Issue | 16,29,18,254 shares |

Shreeji Shipping Global IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not more than 50% of the Net Issue |

| Retail | Not less than 35% of the Net Issue |

| NII (HNI) | Not less than 15% of the Net Issue |

Shreeji Shipping Global IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 58 | ₹14,616 |

| Retail (Max) | 13 | 754 | ₹1,90,008 |

| S-HNI (Min) | 14 | 812 | ₹2,04,624 |

| S-HNI (Max) | 68 | 3,944 | ₹9,93,888 |

| B-HNI (Min) | 69 | 4,002 | ₹10,08,504 |

Shreeji Shipping Global IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue | 90% |

Shreeji Shipping Global IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) (Pre-/post-IPO) | ₹9.63/8.67 |

| Price/Earnings (P/E) (Pre-/post-IPO) | 26.16/29.07 |

| Return on Net Worth | 42.91% |

| Net Asset Value (NAV) | ₹23.41 |

| Return on Equity | 42.91% |

| Return on Capital Employed | 28.09% |

| EBITDA Margin | 33.03% |

| PAT Margin | 23.24% |

| Debt to Equity Ratio | 0.75 |

Objectives of the Proceeds

- Acquire Supramax category dry bulk carriers – ₹251.18 Cr

- Pre-pay/repay selected outstanding borrowings – ₹23.00 Cr

- Utilise balance for general corporate purposes

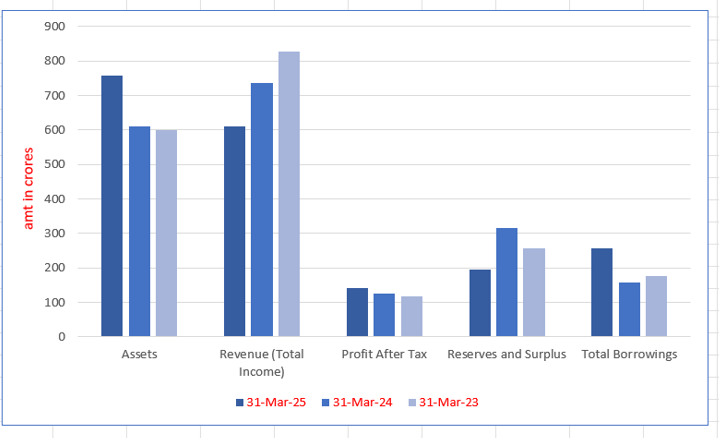

Key Financials (in ₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 758.58 | 610.65 | 600.92 |

| Revenue (Total Income) | 610.45 | 736.17 | 827.33 |

| Profit After Tax | 141.24 | 124.51 | 118.89 |

| Reserves and Surplus | 196.55 | 315.08 | 255.71 |

| Total Borrowings | 256.47 | 158.88 | 175.45 |

SWOT Analysis of Shreeji Shipping Global IPO

Strength and Opportunities

- Strong presence in dry-bulk logistics and coastal shipping sector.

- Proven fleet and equipment operational capabilities.

- Long-term relationships with key institutional clients.

- Experienced promoters and committed team.

- Well-established cargo handling and fleet chartering operations.

Risks and Threats

- Exposure to commodity price fluctuations and operational risks.

- Revenue decline noted in recent financial year.

- High dependency on non-major ports and selective routes.

- Capital-intensive business with high maintenance costs.

- Vulnerability to changes in trade regulations and shipping laws.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Shreeji Shipping Global Limited IPO

Shreeji Shipping Global IPO Strengths

- Recognised for its strong presence in integrated shipping and logistics across India

- Maintains enduring relationships with institutional clients in major industry sectors

- Offers well-established cargo handling services specifically for dry bulk cargo

- Operates with a self-owned, capable fleet supporting seamless logistics execution

- Demonstrates consistent financial growth with a proven performance track record

- Led by seasoned promoters and a dedicated, experienced management team

Peer Group Comparison

- As per the DRHP, there are no comparable listed peer of the company and therefore information related to peer is not provided

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shreeji Shipping Global IPO

How can I apply for Shreeji Shipping Global IPO?

You can apply via HDFC Sky using UPI-based ASBA for IPO participation.

What is the listing date for Shreeji Shipping Global IPO?

The tentative listing date is scheduled for Tuesday, 26 August 2025.

Is the IPO a fresh issue or does it include an offer for sale?

The IPO is entirely a fresh issue of 1.63 crore shares.

What sectors does Shreeji Shipping Global serve?

The company serves clients in Oil & Gas, Energy, FMCG, and Metal industries.