- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shri Kanha Stainless IPO

₹1,44,000/1,600 shares

Minimum Investment

IPO Details

03 Dec 25

05 Dec 25

₹1,44,000

1,600

₹90 to ₹90

NSE

₹46.28 Cr

10 Dec 25

Shri Kanha Stainless IPO Timeline

Bidding Ends

03 Dec 25

Bidding Ends

05 Dec 25

Allotment Finalisation

08 Dec 25

Refund Initiation

09 Dec 25

Demat Transfer

09 Dec 25

Listing

10 Dec 25

Shri Kanha Stainless Limited

Incorporated in 2015, Shri Kanha Stainless Limited is a manufacturer of precision stainless steel cold rolled strips. The company produces a wide variety of thin and ultra-thin strips used in industries like textiles, automotive, and chemicals for applications such as flexible tubes and watches. With a manufacturing capacity of 14,000 MTPA, its facility is strategically located in Sikar, Rajasthan. The company holds key quality certifications including ISO 9001:2015 and relevant ISI standards, supporting its established market presence.

Shri Kanha Stainless Limited IPO Overview

The Shri Kanha Stainless Limited IPO is a fixed price issue of ₹46.28 crores, comprising a fresh issue of 51,42,400 shares. The IPO opens for subscription on December 3, 2025, and closes on December 5, 2025. The allotment is tentatively scheduled for December 8, 2025, with listing on NSE SME expected by December 10, 2025. The lot size is 1,600 shares, making the minimum investment ₹2,88,000 for retail investors. Kreo Capital Pvt. Ltd. is the book running lead manager, and MAS Services Ltd. is the registrar for the issue.

Shri Kanha Stainless Limited IPO Details

| Particulars | Details |

| IPO Date | 3 December 2025 to 5 December 2025 |

| Listing Date | 10 December 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹90 per share |

| Lot Size | 1,600 Shares |

| Total Issue Size | 51,42,400 shares (aggregating up to ₹46.28 Cr) |

| Fresh Issue | 51,42,400 shares (aggregating up to ₹46.28 Cr) |

| Offer for Sale | NA |

| Issue Type | Fixed Price IPO |

| Listing At | NSE SME |

| Share Holding Pre Issue | 1,04,40,000 shares |

| Share Holding Post Issue | 1,55,82,400 shares |

| Market Maker Portion | 2,59,200 shares |

Shri Kanha Stainless Limited IPO Reservation

| Investor Category | Shares Offered |

| Market Maker | 2,59,200 shares (5.04%) |

| NII (HNI) | 24,41,600 shares (47.48%) |

| Retail | 24,41,600 shares (47.48%) |

Shri Kanha Stainless Limited IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 2 | 3,200 | ₹2,88,000 |

| Retail (Max) | 2 | 3,200 | ₹2,88,000 |

| HNI (Min) | 3 | 4,800 | ₹4,32,000 |

Shri Kanha Stainless Limited IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 100.00% |

| Post-Issue | 67.00% |

Shri Kanha Stainless Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.55 |

| Price/Earnings (P/E) Ratio | 16.23 |

| Return on Net Worth (RoNW) | 47.61% |

| Net Asset Value (NAV) | ₹11.65 |

| Debt to Equity Ratio | 4.19 |

| PAT Margin | 3.97% |

| EBITDA Margin | 9.18% |

Objectives of the Proceeds

- Upgrade manufacturing facility by installing a new rolling machine. (₹12.00 Cr)

- Repayment and pre-payment of certain secured and unsecured borrowings. (₹18.00 Cr)

- Funding the working capital requirements of the company. (₹5.48 Cr)

- Meet general corporate purposes. (₹5.00 Cr)

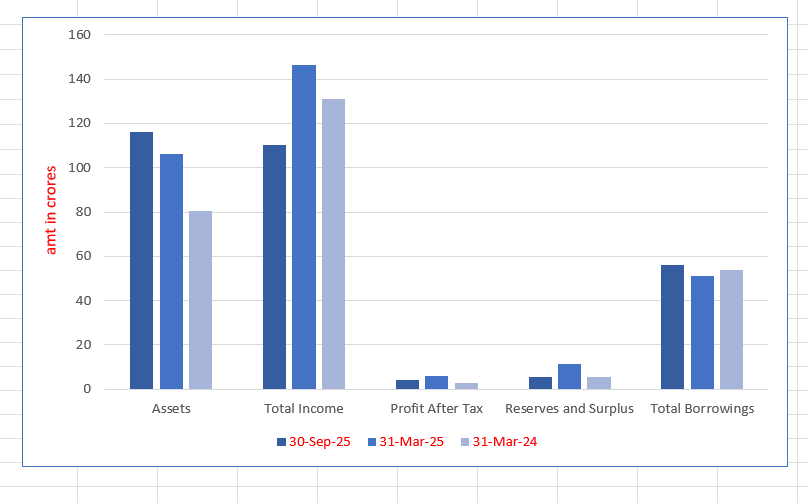

Key Financials (in ₹ crore)

| Particulars | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 |

| Assets | 116.34 | 106.13 | 80.25 |

| Total Income | 110.30 | 146.39 | 131.00 |

| Profit After Tax | 4.26 | 5.79 | 2.60 |

| Reserves and Surplus | 5.59 | 11.29 | 5.50 |

| Total Borrowings | 56.02 | 50.98 | 53.94 |

SWOT Analysis of Shri Kanha Stainless IPO

Strength and Opportunities

- Reputed manufacturer with quality certifications.

- Ability to produce ultra-thin strips.

- Strategically located manufacturing unit.

- Growing order book indicating demand.

- Expansion and modernization potential.

Risks and Threats

- High debt-to-equity ratio.

- Dependency on specific industrial demand.

- Intense competition in the steel industry.

- Raw material price volatility.

- Economic cycles affecting end-user sectors.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Shri Kanha Stainless Limited IPO

IPO Strengths

- Promoters have experience in the stainless steel industry.

- Reputed private sector manufacturer of cold-rolled stainless sections.

- Strategic manufacturing unit location to cater to major markets.

- Capability to manufacture low-thickness strips up to 0.08 mm.

- Diverse product portfolio used across multiple industries.

- Strong quality assurance with ISO and relevant ISI certifications.

- Effective cost control management systems.

- Healthy and growing order book position.

Peer Group Comparison

| Company Name | P/E (x) | EPS | RoNW (%) | NAV |

| Shri Kanha Stainless Limited | 16.23 | 5.55 | 47.61 | 11.65 |

| Peer Group | ||||

| Hisar Metal Industries Limited | 35.09 | 5.89 | 9.00 | 116 |

| Quality Foils (India) Limited | 15.30 | 4.97 | 4.00 | 106 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shri Kanha Stainless Limited IPO

How can I apply for Shri Kanha Stainless Limited IPO?

You can apply via HDFCSky using your UPI ID through the ASBA process.

What is the lot size for the retail investors?

The lot size is 1,600 shares, requiring a minimum investment of ₹2,88,000.

When will the Shri Kanha Stainless IPO allotment be finalized?

The share allotment is tentatively scheduled for Tuesday, December 8, 2025.

Where will Shri Kanha Stainless shares be listed?

The company’s shares will be listed on the NSE SME platform.