- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shringar House of Mangalsutra IPO

₹13,950/90 shares

Minimum Investment

IPO Details

10 Sep 25

12 Sep 25

₹13,950

90

₹155 to ₹165

NSE, BSE

₹400.95 Cr

17 Sep 25

Shringar House of Mangalsutra IPO Timeline

Bidding Start

10 Sep 25

Bidding Ends

12 Sep 25

Allotment Finalisation

15 Sep 25

Refund Initiation

16 Sep 25

Demat Transfer

16 Sep 25

Listing

17 Sep 25

Shringar House of Mangalsutra Limited

Shringar – House of Mangalsutra, a leading manufacturer of mangalsutras, has been a trusted partner for jewellery retailers across India and internationally for nearly six decades. Known for its commitment to exceptional craftsmanship, innovative designs, and uncompromising quality, the company takes pride in its partnerships. Specialising in designing and manufacturing a wide range of mangalsutras, Shringar offers products studded with various stones like American diamonds, cubic zirconia, and pearls. The company contributed to around 6% of India’s organized mangalsutra market in 2023.

Shringar House of Mangalsutra Limited IPO Overview

Shringar House of Mangalsutra IPO is a book-built issue worth ₹400.95 crores, comprising entirely a fresh issue of 2.43 crore shares. The IPO opens for subscription on 10 September 2025 and closes on 12 September 2025, with allotment expected to be finalized on 15 September 2025. The shares are scheduled to list on BSE and NSE, with a tentative listing date of 17 September 2025. The IPO price band is set between ₹155.00 and ₹165.00 per share, with a lot size of 90 shares. For retail investors, the minimum investment required is ₹14,850, based on the upper price band. For S-HNI investors, the lot size is 14 lots (1,260 shares), amounting to ₹2,07,900, while for B-HNI investors, it is 68 lots (6,120 shares), amounting to ₹10,09,800. Choice Capital Advisors Pvt. Ltd. is acting as the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar for the issue.

Shringar House of Mangalsutra Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 2.43 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | 10 Sept 2025 to 12 Sept 2025 |

| Price Bands | ₹155 to ₹165 per share |

| Lot Size | 90 Shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 7,21,32,080 shares |

| Shareholding post -issue | 9,64,32,080 shares |

Important Dates

| Activity | Date |

| IPO Open Date | 10 September 2025 |

| IPO Close Date | 12 September 2025 |

| Tentative Allotment | 15 September 2025 |

| Initiation of Refunds | 16 September 2025 |

| Credit of Shares to Demat | 16 September 2025 |

| Tentative Listing Date | 17 September 2025 |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 90 | ₹14,850 |

| Retail (Max) | 13 | 1,170 | ₹1,93,050 |

| S-HNI (Min) | 14 | 1,260 | ₹2,07,900 |

| S-HNI (Max) | 67 | 6,030 | ₹9,94,950 |

| B-HNI (Min) | 68 | 6,120 | ₹10,09,800 |

Shringar House of Mangalsutra Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Shringar House of Mangalsutra Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.39 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.65% |

| Net Asset Value (NAV) | 19.29 |

| Return on Equity | 25.65$ |

| Return on Capital Employed (ROCE) | 21.52% |

| EBITDA Margin | 4.61% |

| PAT Margin | 2.82% |

| Debt to Equity Ratio | 0.80 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of our Company | 2500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

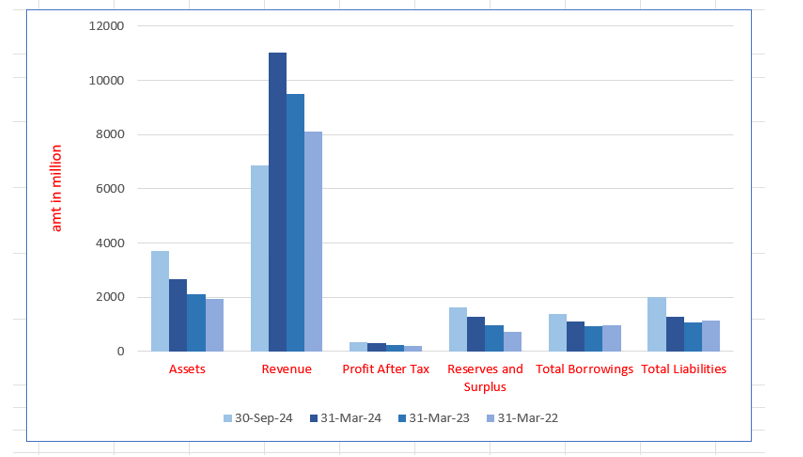

Shringar House of Mangalsutra Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 3714.80 | 2650.03 | 2115.46 | 1954.72 |

| Revenue | 6871.35 | 11,015.23 | 9502.17 | 8101.87 |

| Profit After Tax | 330.34 | 311.05 | 233.58 | 202.65 |

| Reserves and Surplus | 1609.14 | 1278.90 | 967.66 | 734 |

| Total Borrowings | 1379.12 | 1100.91 | 931.87 | 977.99 |

| Total Liabilities | 2016.09 | 1281.56 | 1058.23 | 1131.15 |

Financial Status of Shringar House of Mangalsutra Limited

SWOT Analysis of Shringar House of Mangalsutra IPO

Strength and Opportunities

- Established legacy with nearly six decades of experience in the mangalsutra manufacturing industry.

- Diverse product range including mangalsutras studded with stones like American diamonds, cubic zirconia, pearls, and semi-precious stones.

- High-quality standards and commitment to exceptional craftsmanship.

- Strong retail partnerships with top jewellery brands across India and internationally.

- Cultural significance of mangalsutras in Indian tradition, enhancing brand value.

- Growing middle-class affluence and increasing disposable incomes leading to more opportunities for growth in jewellery.

- Expansion in digital transformation, with the potential to tap into the growing e-commerce market.

- Rising demand for branded jewellery, along with a shift from unorganized to organized sectors, creating more opportunities.

- Expansion into Tier 2 and 3 cities, capitalizing on the growing affluence and demand in smaller cities and towns.

- Increasing emphasis on sustainable and eco-friendly practices, requiring significant investment to meet consumer expectations.

Risks and Threats

- Limited diversification, with a primary focus on mangalsutras, restricting market reach.

- Heavy reliance on traditional markets, potentially at risk due to changing consumer preferences.

- Intense competition from the unorganized sector offering lower prices due to minimal overheads.

- Economic downturns may lead to reduced consumer spending on luxury items like gold jewellery.

- Adverse regulatory changes in taxation, import duties, or government policies may impact profitability.

- Price volatility of gold driven by global economic factors can impact consumer buying behavior and market stability.

- Vulnerability to supply chain disruptions due to dependence on specific raw material suppliers.

- Brand recognition challenges in a competitive jewellery market.

- Lag in adopting technological advancements, which may affect operational efficiency and product innovation.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Shringar House of Mangalsutra Limited IPO

Shringar House of Mangalsutra Limited IPO Strengths

- Established Client Base and Long-Standing Relationship with Clients

Shringar House of Mangalsutra Limited has built long-term relationships with key clients over 15 years of operational experience. The company serves a diverse clientele, including corporate clients, wholesale jewellers, and retailers across India, including 24 states and 4 union territories. It has expanded internationally to countries like the UK, UAE, USA, New Zealand, and Fiji. These strong associations have contributed significantly to the company’s growth, with revenue visibility, industry goodwill, and quality assurance offering competitive advantages for future expansion.

- Design Innovation and Diversified Product Portfolio

Shringar House of Mangalsutra Limited offers a wide range of Mangalsutra designs, including antique, bridal, traditional, and contemporary styles, catering to diverse preferences. With over 15 collections and 10,000 active SKUs, the company focuses on customization and innovation, supported by an in-house design team and skilled Karigars.

- Integrated Manufacturing Facility

Shringar House of Mangalsutra Limited operates an 8,300 sq ft manufacturing facility with a capacity of 2,500 kg per annum. The facility is equipped with advanced technologies like CNC para machines, laser solder machines, and 3D printers, ensuring precision. A team of 182 in-house Karigars complements this technology, ensuring high-quality, intricately designed Mangalsutras.

- Quality Assurance and Quality Control of Mangalsutras

Shringar ensures high-quality Mangalsutras, each marked with a unique HUID number. Their quality control process includes XRF machines and steel pin detectors at every manufacturing stage, guaranteeing authenticity and durability. With over 100 Karigars and contractual agreements with 66, they maintain a three-stage quality assurance procedure to ensure consistent quality and purity.

- Continuously Improving Financial Performance

The Company has demonstrated consistent growth, with its revenue reaching ₹11,015.23 million in Fiscal 2024, an increase from ₹9,502.17 million in Fiscal 2023 and ₹8,101.87 million in Fiscal 2022. This represents year-on-year growth of 15.92% in 2024 and 17.28% in 2023. The net profit after tax also rose to ₹330.34 million in the six months ending September 30, 2024, compared to ₹311.05 million in Fiscal 2024, reflecting an increase in PAT margin from 2.50% in Fiscal 2022 to 4.81% in Fiscal 2024. This growth can be attributed to the Company’s efficient business model and strong financial position

- Experienced Promoters and Professional Management Team

The Company’s Promoters have a rich legacy in the jewellery industry, with over 40 years of experience. Led by Chetan Thadeshwar, along with Viraj and Balraj Thadeshwar, they have successfully expanded operations and built a strong presence in both domestic and international markets, guided by a client-centric approach.

More About Shringar House of Mangalsutra Limited

Shringar House of Mangalsutra Limited is a prominent name in the Indian jewellery industry, specialising in the design, manufacture, and marketing of Mangalsutras. The company is recognised for its wide range of Mangalsutras studded with diverse stones such as American diamonds, cubic zirconia, pearls, and semi-precious stones, crafted in 18k and 22k purity of gold.

- Legacy: Shringar House of Mangalsutra is deeply rooted in India’s cultural tradition of Mangalsutras, which hold symbolic significance in marital commitments.

- Market Presence: The company has carved a strong position in both domestic and international markets, contributing approximately 6% to the organised Mangalsutra market in India as of CY23.

Product Offerings

- Extensive Portfolio: Shringar House offers over 15 collections and more than 10,000 SKUs catering to various occasions, including weddings, festivals, and daily wear.

- Designs: The Mangalsutras come in a variety of styles, from traditional to contemporary, and even Indo-western.

- Diverse Stones: Incorporating stones like American diamonds, cubic zirconia, and pearls.

Customer Network

- Domestic Reach: The company sells its products to corporate clients, wholesale jewellers, and retailers across 24 states and 4 union territories in India.

- International Expansion: Shringar House has extended its reach to countries such as the UK, UAE, New Zealand, the USA, and Fiji.

- Notable Clients: The company serves prestigious clients like Malabar Gold, Titan Company, and Joyalukkas India.

Manufacturing Setup

- Facility: Shringar House operates from a state-of-the-art manufacturing facility located in Mumbai, spanning 8,300 sq. ft.

- In-house Team: The company employs 12 full-time designers and 182 in-house Karigars, blending traditional techniques with innovative methods to craft unique and intricate designs.

This combination of expertise, traditional craftsmanship, and modern techniques positions Shringar House of Mangalsutra as a leading brand in the industry.

Industry Outlook

Growth of the Indian Gold Mangalsutra Market

The Indian Gold Mangalsutra market has witnessed significant growth, reaching a market value of Rs. 93 billion in CY23, with a year-on-year growth of approximately 16%. The market is projected to grow by 7.9% in CY24, expected to reach Rs. 101 billion.

Long-Term Market Outlook

- CAGR Growth: The Indian Gold Mangalsutra market is anticipated to grow at a CAGR of 5.9% over the next decade, reaching Rs. 160 billion by CY32.

Driving Factors

- Wedding Sector Boom: The increasing number of weddings in India is fueling demand for jewellery, as weddings traditionally involve significant jewellery purchases.

- High Demand for Bridal Jewellery: Gold and diamond jewellery hold immense cultural and sentimental value, with an increasing preference for elaborate sets, engagement rings, and wedding bands.

Projected Wedding Growth

- The number of weddings in India is forecast to grow from 124.3 lakh in CY24 to 180.8 lakh by 2032, a CAGR of 4.8%.

Organized vs Unorganized Wholesale Gold Jewellery Market

- Organized Market Growth: The organized gold jewellery sector, though smaller, is expanding rapidly, driven by prominent brands like Kalyan Jewellers, Malabar Gold & Diamonds, and Titan’s Tanishq.

- Share of Market: In CY23, organized manufacturers accounted for 10.9% of the wholesale gold jewellery market, valued at Rs. 281 billion.

- Future Outlook: The market is expected to grow to Rs. 489 billion by CY29, with a CAGR of 9.0% from CY24 to CY29.

How Will Shringar House of Mangalsutra Limited Benefit

- Strong Market Position: With a 6% share of the organized Mangalsutra market in India, Shringar House stands poised to benefit from the growing demand for gold jewellery, especially in the wedding sector.

- Cultural Legacy: As a brand deeply rooted in India’s tradition of Mangalsutras, Shringar House can capitalise on the increasing cultural importance of bridal jewellery, ensuring sustained customer loyalty.

- Expanding Domestic and International Reach: With a presence in 24 states and international markets, including the UK, UAE, and USA, the company is well-positioned to tap into growing global demand for bridal jewellery.

- Diverse Product Portfolio: Shringar House offers an extensive range of Mangalsutras, including over 10,000 SKUs, catering to diverse preferences, from traditional to contemporary designs, appealing to a broad customer base.

- Innovative Manufacturing Setup: The state-of-the-art facility in Mumbai, combined with a skilled team of designers and karigars, enables the brand to deliver high-quality, intricate jewellery that meets evolving market demands.

Shringar House of Mangalsutra Limited IPO Overview

Shringar House of Mangalsutra Ltd, a Mumbai-based jewellery company, has filed draft papers with SEBI for its IPO. The offering includes 2.43 crore fresh equity shares, with no Offer for Sale (OFS). A portion of the IPO will be reserved for eligible employees, who will also receive a discount. Post-IPO, the shares will be listed on the NSE and BSE. Choice Capital Advisors is the book-running lead manager, and MUFG Intime India is the registrar. The IPO will follow a book-building process with allocations for QIBs, NIIs, and retail investors.

Shringar House of Mangalsutra Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: 2.43 crore equity shares

Offer for Sale (OFS): NA |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

Shringar House of Mangalsutra IPO Important Dates

| IPO Activity | Date |

| IPO Open Date | TBA |

| IPO Close Date | TBA |

| Basis of Allotment Date | TBA |

| Refunds Initiation | TBA |

| Credit of Shares to Demat | TBA |

| IPO Listing Date | TBA |

Shringar House of Mangalsutra IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shringar House of Mangalsutra Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 4.39 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 25.65% |

| Net Asset Value (NAV) | 19.29 |

| Return on Equity | 25.65$ |

| Return on Capital Employed (ROCE) | 21.52% |

| EBITDA Margin | 4.61% |

| PAT Margin | 2.82% |

| Debt to Equity Ratio | 0.80 |

Peer Group Comparison

| Name of the Company | Revenue

(₹ in million) |

Face Value (₹) | P/E (Basic) (₹) | EPS (Basic) (₹) | RoNW (%) | NAV (₹) |

| Shringar House of Mangalsutra Limited | 11,015.23 | 10 | [●] | 4.39 | 25.65 | 19.29 |

| Peer Groups | ||||||

| Utssav CZ Gold Ltd | 3,401.96 | 10 | 28.79 | 7.65 | 44.62 | 20.96 |

| RBZ Jewellers Ltd | 3,274.29 | 10 | 34.42 | 5.39 | 14.38 | 51.87 |

| Sky Gold Ltd | 17,454.84 | 10 | 120.00 | 35.18 | 23.66 | 212.15 |

Key Insights

- Revenue: Shringar House of Mangalsutra Limited generates ₹11,015.23 million in revenue, which positions it as a strong player in the industry. However, it falls behind Sky Gold Ltd (₹17,454.84 million) in total revenue, reflecting its smaller scale relative to peers.

- Face Value: All companies have a face value of ₹10 per equity share, ensuring uniformity in the capital structure across the industry. This does not reflect their individual market valuation but is important for calculating share capital and determining the financial stability.

- P/E Ratio: Shringar House of Mangalsutra Limited has an undisclosed P/E ratio ([●]), suggesting either insufficient or unavailable market data. In comparison, Utssav CZ Gold Ltd has a P/E of 28.79, signaling higher market expectations. Sky Gold Ltd leads with a very high P/E of 120.00.

- EPS (Basic): Shringar House reports a basic EPS of ₹4.39, indicating a stable profit. Utssav CZ Gold Ltd has the highest EPS at ₹7.65, suggesting better profitability per share. Sky Gold Ltd follows with a strong EPS of ₹35.18.

- Return on Net Worth (RoNW): Shringar House of Mangalsutra Limited has a solid RoNW of 25.65%, indicating efficient capital utilization. In comparison, Utssav CZ Gold Ltd leads with 44.62%, showing its higher profitability relative to equity. Sky Gold Ltd has a RoNW of 23.66%.

- NAV: Shringar House’s NAV per share stands at ₹19.29, reflecting its net asset value relative to shares. Sky Gold Ltd significantly outperforms with ₹212.15, showcasing a much higher asset base per share. RBZ Jewellers Ltd follows with ₹51.87.

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding working capital requirements of our Company | 2500 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

Shringar House of Mangalsutra Limited Financials (in million)

| Particulars | 30 Sept 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 3714.80 | 2650.03 | 2115.46 | 1954.72 |

| Revenue | 6871.35 | 11,015.23 | 9502.17 | 8101.87 |

| Profit After Tax | 330.34 | 311.05 | 233.58 | 202.65 |

| Reserves and Surplus | 1609.14 | 1278.90 | 967.66 | 734 |

| Total Borrowings | 1379.12 | 1100.91 | 931.87 | 977.99 |

| Total Liabilities | 2016.09 | 1281.56 | 1058.23 | 1131.15 |

Key Strategies for Shringar House of Mangalsutra Limited

- Expanding Geographic Reach Through a Robust Supply Chain Network

Shringar House of Mangalsutra Limited operates a B2B model, supplying products across 24 Indian states and internationally to markets like the UK, USA, UAE, New Zealand, and Fiji. It aims to expand its reach through third-party facilitators in untapped regions.

- Strengthening Relationships with Existing Clients and Supporting Their Expansion

Shringar House of Mangalsutra Limited aims to deepen its relationships with existing clients by fostering recurring sales and increasing sales volumes. With the organized sector growing rapidly in India’s gold jewellery market, the company plans to scale operations to meet rising demand and support clients’ expansion.

- Continue to Invest in Marketing and Brand Building Initiatives

Shringar House of Mangalsutra Limited actively promotes its collection through participation in key B2B exhibitions, trade shows, and marketing campaigns. We aim to further enhance brand visibility by collaborating with celebrities, advertising, and focusing on customer engagement to increase interest and sales.

- Continuing Focus on Reducing Operating Costs and Improving Operational Efficiency

We aim to enhance profitability by optimizing costs, leveraging backward integration, and increasing capacity utilization. By automating our manufacturing processes, we have reduced errors and inefficiencies, and we plan to further improve production capabilities and design expansion to reduce costs and increase output.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shringar House of Mangalsutra's IPO

What is the purpose of Shringar House of Mangalsutra's IPO?

The company aims to raise ₹250 crore to support working capital requirements and general corporate purposes.

How many equity shares are being offered in the IPO?

The IPO comprises a fresh issue of 2.43 crore equity shares, with no offer-for-sale component.

What is the price band for the IPO?

Shringar House of Mangalsutra IPO price band is set at ₹155.00 to ₹165.00 per share

When is the IPO expected to open and close?

Shringar House of Mangalsutra IPO opens for subscription on Sep 10, 2025 and closes on Sep 12, 2025.

Where will the equity shares be listed post-IPO?

Post-IPO, the equity shares are proposed to be listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).