- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Shriram Food Industry IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Shriram Food Industry IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Shriram Food Industry Limited

Incorporated in 2014, the company operates a B2B model, primarily exporting rice to international markets. Part of the Greta Group, it is active in steel, scrap metal recycling, power generation, mineral exploration, and food processing. It offers varieties such as Parboiled Rice, White Rice, 100% Broken Rice, and by-products like rejection rice and rice bran. The company either sources fully processed rice from third-party processors or processes paddy/raw rice in-house to meet quality and packaging requirements. In Fiscal 2025, it exported over 2,50,253 metric tons of rice across Asia, Africa, Russia, and the Middle East, supplying flexible packaging formats to more than 33 countries.

Shriram Food Industry Limited IPO Overview

Shriram Food Industry Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on September 11, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Build Issue of 2.64 crore equity shares, comprising a fresh issue of up to 2.12 crore shares and an offer for sale (OFS) of up to 0.52 crore shares. The equity shares are proposed to be listed on NSE and BSE, with Choice Capital Advisors Pvt. Ltd. as the book running lead manager and MUFG Intime India Pvt. Ltd. as the registrar. Key details, including IPO dates, price bands, and lot size, are yet to be announced. The total issue size of 2.64 crore shares will increase the company’s shareholding from 8.40 crore pre-issue to 10.52 crore post-issue. Promoters include Anup Ramavtar Goyal, Nitesh Chaudhari, Aman Anup Goyal, Orient Dealtrade Pvt. Ltd., and Greta Industries Pte Ltd., holding 100% pre-issue.

Shriram Food Industry Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 2,64,00,000 shares (aggregating up to ₹[.] Cr) |

| Fresh Issue | 2,12,00,000 shares (aggregating up to ₹[.] Cr) |

| Offer for Sale (OFS) | 52,00,000 shares of ₹10 (aggregating up to ₹[.] Cr) |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 8,40,00,070 shares |

| Shareholding post-issue | 10,52,00,070 shares |

Shriram Food Industry IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Shriram Food Industry Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Shriram Food Industry Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.09 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 34.39% |

| Net Asset Value (NAV) | ₹17.34 |

| Return on Equity (RoE) | 34.39% |

| Return on Capital Employed (RoCE) | 28.14% |

| EBITDA Margin | 5.41% |

| PAT Margin | 3.15% |

| Debt to Equity Ratio | 1.53 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment and/or pre-payment, in full or part, of certain borrowings availed by our Company from banks or financial institutions | 7000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

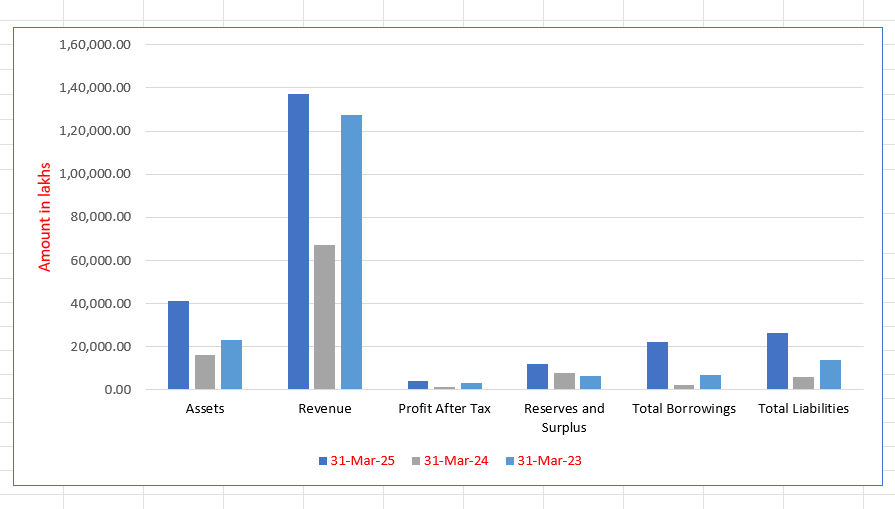

Shriram Food Industry Limited Financials (in lakhs)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 41,087.84 | 16,155.46 | 22,990.81 |

| Revenue | 137,071.24 | 67,406.66 | 127,390.40 |

| Profit After Tax | 4,276.11 | 1,447.87 | 3,391.31 |

| Reserves and Surplus | 12,169.08 | 7,895.65 | 6,505.86 |

| Total Borrowings | 22,236.39 | 2,402.89 | 7,116.38 |

| Total Liabilities | 26,518.76 | 5,859.81 | 14,084.95 |

Financial Status of Shriram Food Industry Limited

SWOT Analysis of Shriram Food Industry IPO

Strength and Opportunities

- Strong legacy as a three-generation rice manufacturer and exporter.

- Diversified product mix: parboiled, white, broken rice and by-products like bran.

- Established international reach with exports to over 33 countries.

- Flexible packaging capabilities (metallic, BOPP, jumbo, PP woven).

- Ability to procure and process rice in-house to customise quality.

- Strong promoter experience and infusion of funds in operations.

- Growth potential from rising global demand for non-basmati rice.

- Opportunity to expand into new markets and value-added rice products.

- Potential to integrate backward into paddy sourcing and forward into branded retail.

Risks and Threats

- High exposure to volatile raw material (paddy) prices and supply risks.

- Heavy reliance on export markets may expose the company to foreign demand fluctuations.

- Regulatory risk from government export bans or tariffs on agricultural products.

- Geographical concentration risk in certain export markets.

- Operational cost pressures due to logistics, energy, and maintaining quality standards.

- Working capital intensity and high inventory needs (seasonal stocks).

- Currency fluctuations affecting export margins.

- Intense competition in the global rice trade impacting margins.

- Climate risk (erratic rainfall) impacting agricultural raw material availability.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Shriram Food Industry Limited

Shriram Food Industry Limited IPO Strengths

Global Presence via Diversified Group Affiliation

Shriram Food Industry Limited, incorporated in 2014, specializes in the B2B export of rice and is a key entity within the well-diversified Greta Group of Companies. This global business house operates across over eight countries and sectors like steel and power, with a consolidated Fiscal 2024 topline exceeding ₹7,200.00 crores. The company leverages this association to establish its footprint in the agri-commodity sector.

Integrated Trading and Manufacturing Model

The company operates an integrated business model that strategically combines scalable export trading with in-house milling and processing. This hybrid approach, supported by a facility with an installed capacity of 1,63,200 MT per annum, balances flexibility, product consistency, and cost efficiency. It enhances agility, ensures adherence to specific quality standards, and strengthens control over the entire value chain.

Specialized Third-Party Labeling Services

Shriram Food Industry Limited excels in an export-focused strategy by providing comprehensive third-party labeling services for international customers. The company handles procurement, processing, and packaging, allowing overseas buyers to market the rice under their own brands. This offering is supported by customized packaging solutions—including jumbo bags and various BOPP formats—and helps diversify the customer base while expanding export volumes.

Strong Customer Relationships and High Retention

The company has cultivated long-term partnerships across international markets, reflected in a high customer retention rate. During Fiscal 2025, 46.08% of revenue came from customers associated with the company for the last three Fiscals, demonstrating strong stickiness. Operational flexibility, consistent quality, and the ability to offer customized solutions—such as third-party labeling—are central to its success in fostering repeat business.

Efficient and Scalable Supply Chain Infrastructure

The company maintains an efficient and scalable supply chain through a hybrid procurement model. It sources rice via a network of over 200 experienced brokers and agents across India’s major agricultural markets, ensuring year-round supply continuity. This broad sourcing base, coupled with logistics expertise in handling bulk exports and strict compliance protocols, enables timely and cost-effective product distribution across global geographies.

Demonstrated Track Record of Healthy Growth

Shriram Food Industry Limited has exhibited a healthy growth trajectory in revenue and profitability. Revenue from operations increased significantly to ₹1,35,944.79 lakhs in Fiscal 2025. Despite temporary market-related dips, the company rebounded strongly. This track record, reinforced by its ability to manage market dynamics, showcases its financial resilience and capacity to achieve substantial growth in the competitive global rice industry.

More About Shriram Food Industry Limited

Shriram Food Industry Limited, incorporated in 2014, operates primarily on a business-to-business (B2B) model with a focus on rice exports. As a member of the Greta Group of Companies—a global business house with a presence in over eight countries—the company benefits from the group’s expertise across steel, power, scrap recycling, food processing, and other sectors. For Fiscal 2024, the Greta Group achieved consolidated revenues exceeding ₹7,200 crores, strengthening Shriram Food’s global credibility.

Product Portfolio

The company offers a diverse range of rice varieties, including:

- Parboiled Rice

- White Rice

- 100% Broken Rice

- By-products such as rejection rice and rice bran

Its ability to provide customised packaging solutions—ranging from BOPP bags to jumbo sacks—enhances global market adaptability.

Business Model

Shriram Food Industry Limited follows a hybrid approach:

- Procuring fully processed rice from third-party processors for direct export

- Procuring raw rice and processing it at its own integrated milling facility in Nagpur

This model ensures flexibility in meeting specific customer requirements regarding grain size, quality, and packaging.

Market Presence

The company derives the majority of its revenue from international markets, exporting to over 33 countries across Asia, Africa, Russia, and the Middle East. Recognised as a Three Star Export House by the Government of India, it has consistently delivered bulk exports under third-party labels.

Operations and Infrastructure

- Processing capacity of 76,800 MT per year

- Storage capacity of 50,000 MT with 23 climate-sensitive silos

- Advanced machinery sourced from international providers like Buhler and Kinetic

- Rooftop solar installation (999 KW), underscoring sustainability commitments

Procurement Strategy

With a network of 200+ brokers and agents across major agricultural mandis, the company ensures timely sourcing, price discovery, and high-quality raw material procurement.

Leadership

Under the leadership of Chairman and Managing Director, Anup Ramavtar Goyal, and CEO, Aman Anup Goyal, the company emphasises product quality, technology integration, and market responsiveness, supported by a capable senior management team.

Industry Outlook

The Indian rice market was valued at around USD 10.12 billion in 2024 and is expected to grow to USD 12.21 billion by 2033, at a CAGR of ~2.1 %. More broadly, the domestic rice market is projected to touch USD 54.09 billion in 2025, with steady growth of around 2.40 % annually through 2030.

In the rice milling and processing machinery segment, India is anticipated to expand at ~3.7 % CAGR between 2024 and 2032. Globally, the rice industry is forecast to grow from USD 339.8 billion in 2025 to USD 432.1 billion by 2033, reflecting a CAGR of ~2.8 %.

Growth Drivers & Key Trends

- Export scale: India remains the world’s leading rice exporter, with shipments projected at nearly 24 million tonnes in 2025–26.

- Premium varieties: Rising demand for basmati and specialty rice is driving export opportunities.

- Value chain upgrades: Growing consumption of packaged rice, better packaging, and demand for by-products add resilience.

- Government support: Incentives, export facilitation, and food processing schemes aid industry expansion.

- Technology adoption: Mechanized sorting, grading, and traceability tools enhance productivity.

- Sustainability focus: Climate-resilient farming and efficient water use are emerging priorities.

Challenges & Risks

- Policy shifts: Export curbs and tariffs can disrupt market flows.

- Volatility in raw material: Weather and yield uncertainties impact paddy supply and costs.

- Currency fluctuations: Exchange rate swings influence export profitability.

- Global competition: Producers like Thailand and Vietnam challenge India’s market share.

- Oversupply risks: Large harvests may put pressure on global rice prices.

Outlook for Processed Products

Processed rice and its by-products present stronger growth potential:

- Value-added rice such as broken rice and specialty grades are expected to outpace commodity rice in growth.

- By-products like rice bran, rejection rice, and husk are gaining traction in food, feed, and oil industries.

- Packaged rice in both domestic and export markets is projected to grow rapidly, with the Indian packaged rice market expected to cross USD 19.66 billion by 2031, at a CAGR of ~5.9 %.

Overall, the sector is set for steady volume growth, but the bigger opportunity lies in premiumisation, processing efficiency, and branded packaged offerings.

How Will Shriram Food Industry Limited Benefit

- Strong global demand for Indian rice will support Shriram Food Industry Limited’s export-led business model, particularly across Asia, Africa, Russia, and the Middle East.

- Rising demand for parboiled, white, and broken rice aligns directly with the company’s core product portfolio.

- Growth in packaged rice markets complements its customised packaging solutions, enabling expansion under third-party labels.

- Increasing acceptance of rice by-products creates additional revenue streams for offerings like rejection rice and rice bran.

- Government incentives and export facilitation measures enhance competitiveness in global tenders and institutional sales.

- Adoption of advanced milling and grading technologies at its Nagpur facility strengthens efficiency and product consistency.

- Sustainability initiatives, including solar-powered operations, position the company favourably among eco-conscious international buyers.

- Expanding global market size and India’s leadership in exports allow the company to scale its presence across more countries

Peer Group Comparison

| Name of the Company | Revenue (₹ in lakhs) | Face Value (₹) | P/E | EPS (Basic) (₹) | EPS (Diluted) (₹) | RoNW (%) | NAV (₹) |

| Shriram Food Industry Limited | 1,35,944.79 | 10 | [●] | 5.09 | 5.09 | 34.39% | 17.34 |

| Peer Group | |||||||

| Sarveshwar Foods Limited | 1,13,622.90 | 127.6 | 0.27 | 0.27 | 0.27 | 9.66% | 3.11 |

| Chaman Lal Setia Exports Limited | 1,49,525.58 | 213.82 | 20.69 | 20.69 | 20.69 | 14.22% | 147.46 |

| GRM Overseas Limited | 1,34,819.28 | 236.12 | 10.10 | 10.10 | 10.10 | 16.02% | 70.94 |

Key Strategies for Shriram Food Industry Limited

Expanding Global and Domestic Presence

Shriram Food Industry Limited seeks to strengthen its position by expanding internationally while deepening its domestic market reach. Leveraging integrated procurement, milling, and processing capabilities, alongside strategic facilities in Nagpur and Kandla, the company aims to optimise logistics, diversify markets, build strong partnerships, and enhance long-term profitability.

Augmenting Capacity with a New Processing Facility

Shriram Food Industry Limited is establishing a modern processing facility in Kachchh, Gujarat, strategically located near Kandla Port. This facility will reduce reliance on third-party processors, enhance quality control, lower logistics costs, and support expansion into basmati rice, thereby boosting scalability, profitability, and resilience in global operations.

Strengthening Cost Optimisation

Shriram Food Industry Limited continues to prioritise cost optimisation across procurement, logistics, and operations. Through data-driven evaluations, bulk sourcing, and freight consolidation, the company aims to improve margins, reduce inefficiencies, and sustain competitiveness, enabling stronger financial performance and long-term growth across both domestic and export businesses.

Enhancing Financial Flexibility through Deleveraging

Shriram Food Industry Limited is focused on deleveraging by repaying and pre-paying existing borrowings, thereby lowering debt servicing costs and improving its debt-to-equity ratio. This strategy enhances capital structure flexibility, frees internal resources for business expansion, and positions the company to pursue future growth opportunities efficiently.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Shriram Food Industry Limited IPO

How can I apply for Shriram Food Industry Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Shriram Food Industry IPO?

The IPO consists of 2.64 crore equity shares, including a fresh issue and an offer for sale.

Where will the shares of Shriram Food Industry IPO be listed?

The equity shares are proposed to be listed on both the NSE and the BSE exchanges.

What is the objective of Shriram Food Industry IPO?

The IPO aims to repay borrowings and fund general corporate purposes to support growth and expansion.

Who are the promoters of Shriram Food Industry Limited?

Promoters include Anup Ramavtar Goyal, Nitesh Chaudhari, Aman Anup Goyal, Orient Dealtrade Pvt Ltd and Greta Industries.

What percentage of IPO shares is reserved for retail investors?

Not less than 35% of the net offer is reserved specifically for retail individual investors.