- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sify Infinit Spaces IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sify Infinit Spaces IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sify Infinit Spaces Limited

Sify Infinit Spaces Limited is a leading provider of hyperconnected, high-performance digital infrastructure solutions in India. Operating 14 data centres across six key cities, the company boasts a significant built IT power capacity of 188.04 MW. Its strategically located facilities serve a prestigious clientele, including top global hyperscaler and major enterprises, particularly in the BFSI sector. The company offers a comprehensive suite of services, including colocation, build-to-suit, and interconnection, supported by advanced, AI-ready infrastructure and a strong commitment to sustainability through high renewable energy usage.

Sify Infinit Spaces Limited IPO Overview

Sify Infinit Spaces Ltd. has filed a Draft Red Herring Prospectus (DRHP) with SEBI on October 16, 2025, to raise funds through an Initial Public Offering (IPO). The IPO is a book-building issue of ₹3,700.00 crores, comprising a fresh issue of shares worth ₹2,500.00 crores and an offer for sale (OFS) of ₹1,200.00 crores. The equity shares are proposed to be listed on both the NSE and BSE. JM Financial Ltd. is acting as the book running lead manager, while Kfin Technologies Ltd. is the registrar of the issue. Key details such as IPO dates, price bands, and lot size are yet to be announced.

The face value of each share is ₹10. The total issue size will aggregate up to ₹3,700.00 crores, with the fresh issue contributing up to ₹2,500.00 crores and the OFS up to ₹1,200.00 crores. The IPO will follow the book-building process and is expected to be listed on the BSE and NSE. Prior to the IPO, the company has 51,01,31,127 shares in circulation.

The promoters of Sify Infinit Spaces Ltd. include Sify Technologies Ltd., Vegesna Ananta Koti Raju, Vegesna Bala Saraswathi, Ramanand Core Investment Company Private Limited, and Raju Vegesna Infotech & Industries Pvt. Ltd. The promoters currently hold 100% of the company’s shares, and their post-IPO holding will be updated after the issue.

Sify Infinit Spaces Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹3,700.00 Crores |

| Fresh Issue | ₹2,500.00 Crores |

| Offer for Sale (OFS) | ₹1,200.00 Crores |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 51,01,31,127 shares |

| Shareholding post-issue | TBA |

Sify Infinit Spaces IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sify Infinit Spaces Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sify Infinit Spaces Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹2.45 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 7.68% |

| Net Asset Value (NAV) | ₹28.82 |

| Return on Equity (RoE) | 7.68% |

| Return on Capital Employed (RoCE) | 7.92% |

| EBITDA Margin | 44.40% |

| PAT Margin | 8.85% |

| Debt to Equity Ratio | 1.37 |

Objectives of the IPO Proceeds

The Net Proceeds from the Fresh Issue are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Part funding of capital expenditure requirements towards completion of tower B of Chennai 02 Data Centre | 4,650.00 |

| Part funding of capital expenditure requirements for setting up of towers 11 and 12 of Rabale Data Centre | 8,600.00 |

| Repayment / prepayment, in full or in part, of certain borrowings availed by our Company | 6,000.00 |

| General corporate purposes* | [●] |

*Note: To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

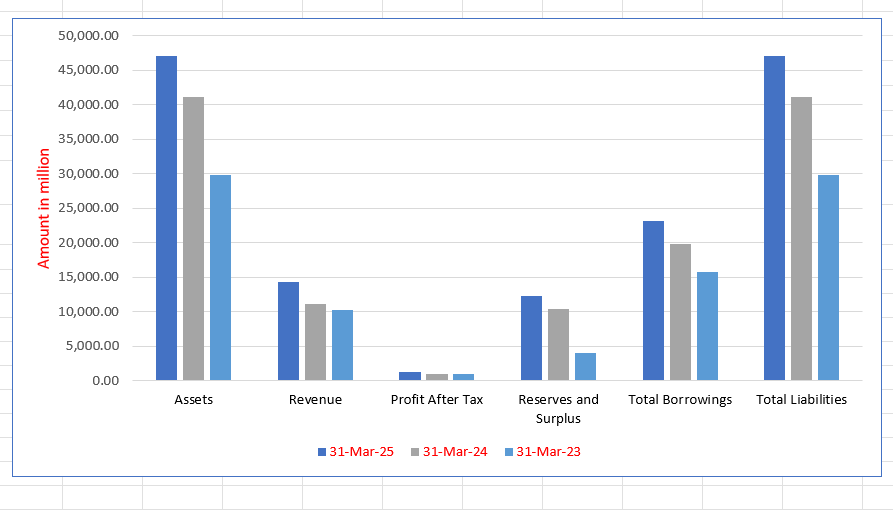

Sify Infinit Spaces Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 47,047.07 | 41,152.89 | 29,874.23 |

| Revenue | 14,283.65 | 11,141.70 | 10,213.40 |

| Profit After Tax | 1,263.60 | 932.48 | 966.86 |

| Reserves and Surplus | 12,306.95 | 10,423.19 | 4,110.74 |

| Total Borrowings | 23,181.49 | 19,882.60 | 15,811.60 |

| Total Liabilities | 47,047.07 | 41,152.89 | 29,874.23 |

Note: Total Borrowings includes lease liabilities. Figures are from the Restated Consolidated Financial Statements.

Financial Status of Sify Infinit Spaces IPO

SWOT Analysis of Sify Infinit Spaces IPO

Strength and Opportunities

- Pan-India leadership in digital infrastructure with significant built capacity.

- Strategic presence in India's fastest-growing data centre clusters and key coastal cities.

- Advanced, AI-ready facilities certified by NVIDIA for cutting-edge cooling technologies.

- A diversified and prestigious client base including top global hyperscalers and Indian BFSI leaders.

- Long-term, sticky client relationships with contracts featuring built-in rental escalations.

- Deep industry expertise and operational excellence inherited from the Sify Group over the decades.

- Robust financial profile with strong revenue growth, high EBITDA margins, and predictable cash flows.

- Converged offering within the Sify Group, enabling cross-selling of ICT services.

- Strong commitment to sustainability with high renewable energy integration and top-tier certifications.

- Massive market opportunity driven by data explosion, digitalization, and AI adoption in India.

Risks and Threats

- High reliance on a concentrated base of hyperscale clients for a majority of revenue.

- Substantial debt levels leading to high finance costs and a leveraged balance sheet.

- Intense competition from both global data centre giants and new domestic entrants.

- Significant execution risks associated with the rapid expansion of data centre capacity.

- Dependence on a continuous and reliable power supply, with potential cost volatility.

- Regulatory changes in data sovereignty and compliance could impact operational models.

- Capital expenditure requirements are immense for building and maintaining state-of-the-art facilities.

- Vulnerability to cyber-attacks and security breaches despite robust security frameworks.

- Economic downturns could reduce demand for IT services and data centre capacity from enterprises.

- Technological obsolescence risk necessitates continuous investment in upgrading infrastructure.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sify Infinit Spaces Limited

Sify Infinit Spaces Limited IPO Strengths

Pan-India Leading Digital Infrastructure Provider

Sify Infinit Spaces Limited is one of the top three data centre colocation providers in India. It operates a pan-India network of 14 facilities across six major cities with a total built IT power capacity of 188.04 MW. Its strategic presence in high-demand clusters like Mumbai and Chennai positions it to capitalize on the growing needs of hyperscale and enterprise clients effectively.

Strategic and Hyperconnected Data Centre Locations

The company’s data centres are strategically located in key commercial hubs and in proximity to international undersea cable landing points. This ensures low-latency access and strong global connectivity for its clients. Locations in cities like Mumbai and Chennai are among India’s fastest-growing data centre clusters, providing a significant competitive advantage.

Advanced and High-Performance Infrastructure

Sify Infinit Spaces Limited deploys advanced cooling technologies, including air, liquid, and immersion cooling systems. Three of its latest facilities are NVIDIA-certified as AI-ready. Its carrier-neutral data centres feature multiple fiber paths and internet exchange points, ensuring high reliability, 99.99%+ uptime, and support for high-density AI workloads up to 130 kW per rack.

Deep Industry Expertise and Operational Excellence

The company leverages over three decades of domain knowledge from the Sify Group. It possesses in-house expertise in engineering, site selection, power management, and project management. This enables Sify Infinit Spaces Limited to achieve high build speeds, cost efficiencies, and deliver high-performance digital infrastructure, swiftly transitioning new capacity into revenue.

Long-Term Relationships with a Distinguished Client Base

Sify Infinit Spaces Limited boasts a diversified client base of over 500 clients, including top global hyperscalers and leading Indian enterprises. Its relationships are long-term and sticky, with a significant portion of revenue coming from contracts of at least seven years. This provides predictable annuity revenue and high visibility for future cash flows.

Strategic Converged Offering within Sify Group

The company benefits from a unified go-to-market strategy with its promoter, Sify Technologies Limited, and group company, Sify Digital Services Limited. This converged platform allows for cross-selling of data centre, network, cloud, and IT solutions. Clients benefit from an integrated ICT offering, enhancing the value proposition and client stickiness.

Commitment to Power Efficiency and Sustainability

Sify Infinit Spaces Limited is committed to sustainable operations, with a notably high usage of renewable energy in its power mix. It holds long-term Power Purchase Agreements for renewable power and maintains top-tier certifications like IGBC Platinum. This focus on sustainability makes it a partner of choice for environmentally conscious hyperscalers and enterprises.

Robust Financial Profile with Strong Growth

The company demonstrates a robust financial performance with consistent revenue growth and a strong EBITDA margin of over 44%. Its contractual arrangements with clients provide cash flow visibility and stability. The combination of scale, growth, profitability, and predictable returns underpins its solid financial foundation.

More About Sify Infinit Spaces Limited

Sify Infinit Spaces Limited, a part of the renowned Sify Group, has established itself as a cornerstone of India’s digital economy. It is one of the country’s leading providers of data centre colocation services, operating a robust network of 14 facilities across six strategic cities: Mumbai, Chennai, Noida, Hyderabad, Bengaluru, and Kolkata. As of June 30, 2025, the company commands a total built IT power capacity of 188.04 MW.

Comprehensive Service Portfolio

The company offers a full spectrum of digital infrastructure services tailored to meet the evolving needs of its clients:

- Colocation Services: Providing secure, scalable, and reliable space for clients to host their IT infrastructure.

- Build-to-Suit: Developing custom-designed data centre facilities to meet the specific requirements of large clients, particularly hyperscalers.

- Interconnection Services: Enabling low-latency, high-performance connectivity between different clients and cloud providers within its data centres.

- Value-Added Digital Services: Offering a range of services including security, cloud management, and other digital solutions.

AI-Ready and Certified Infrastructure

Staying ahead of technological curves, Sify Infinit Spaces Limited has developed future-ready infrastructure. Three of its newest facilities are certified by NVIDIA for AI workloads, supporting both air and liquid cooling. This positions the company at the forefront of the AI revolution in India. Furthermore, its facilities boast the highest industry certifications, including TIA-942 Rated 4 for fault-tolerant infrastructure and the Indian Green Building Council’s Platinum rating for sustainability, alongside compliance with PCI DSS, SOC I/II, and ISO 27001 standards.

The Sify Group Advantage

The company operates as a converged platform within the Sify Group. This strategic synergy allows it to offer clients a one-stop solution for all their Information and Communications Technology (ICT) needs. Through its promoter, Sify Technologies Limited (STL), it provides extensive network and connectivity services, while Sify Digital Services Limited (SDSL) offers advanced digital transformation solutions. This integrated approach, reinforced by the “One Sify Marketplace” online platform, facilitates efficient cross-selling and enhances client retention and value.

Industry Outlook

The Indian data centre industry is poised for an unprecedented growth trajectory, driven by a massive digital transformation wave. According to industry reports, the data centre demand in India, which stood at approximately 1.3 GW in Fiscal 2025, is projected to surge to between 4.7 GW and 5.7 GW by Fiscal 2030. This represents a staggering Compound Annual Growth Rate (CAGR) of 30.1% to 35.1% over the period.

Key Growth Drivers

- Data Localization Regulations: Mandates requiring data to be stored within India’s borders are creating significant demand for domestic data centre capacity.

- Rapid Digitalization: Increased internet penetration, smartphone adoption, and the shift to cloud-based solutions across enterprises and consumers are fuelling data consumption.

- 5G Rollout: The expansion of 5G networks will catalyse new applications in IoT, augmented reality, and real-time analytics, necessitating edge data centres and core infrastructure.

- Adoption of Artificial Intelligence (AI): AI and generative AI workloads require high-power density and advanced cooling solutions. The share of AI-related workloads is expected to rise from less than 1% in Fiscal 2025 to 15-20% by Fiscal 2030, creating demand for 0.7 GW to 1.1 GW of AI-optimized data centre capacity.

- Hyperscale Expansion: Global cloud service providers are aggressively expanding their footprint in India to capture the growing market, contributing to over 65% of the demand.

Outlook for Colocation and AI-Ready Infrastructure

Within this booming industry, the demand for sophisticated colocation services, particularly for AI-ready infrastructure, is accelerating. Hyperscale demand is expected to grow at a CAGR of 34.5% to 41.7%. Furthermore, the need for edge data centres is also rising to support low-latency applications like gaming, video streaming, and IoT. Companies that offer hyperconnected, sustainable, and advanced infrastructure, like Sify Infinit Spaces Limited, are uniquely positioned to be the primary beneficiaries of this multi-year growth cycle.

How Will Sify Infinit Spaces Limited Benefit

- Benefit from the massive capacity gap, with industry demand projected to grow 4-5 times by 2030, allowing it to fill its existing and planned data centres.

- Capitalize on the hyperscale demand boom, which is its core client segment, by offering scalable capacity in strategic locations.

- Leverage its first-mover advantage in AI-ready infrastructure to capture high-value contracts as AI workloads become mainstream, commanding premium pricing.

- Utilize its deep expertise and in-house capabilities to expand capacity swiftly and cost-effectively, staying ahead of competitors.

- Monetize the growing need for edge computing by developing edge data centres in cities like Lucknow and Chandigarh to serve new demand pockets.

- Strengthen its value proposition to enterprise clients, especially in BFSI, who are mandated to use TIA-942 Rated 4 certified facilities, a certification it already holds.

- Enhance its sustainability-led marketing to attract global hyperscalers and enterprises who are increasingly prioritizing green partners for their ESG goals.

- Use the integrated Sify Group platform to cross-sell services to a wider client base, increasing wallet share and building deeper client relationships.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (₹ million) | Basic EPS (₹) | NAV (₹ per share) | P/E Ratio | RONW (%) |

| Sify Infinit Spaces Limited | 10 | 14,283.65 | 2.45 | 28.82 | [●]^ | 7.68% |

| Peer Group | ||||||

| Equinix, Inc. | 0.08 | 731,953.66 | 714.55 | 11,995.45 | 100.90 | 6.22% |

| Digital Realty Trust, Inc. | 0.85 | 464,789.57 | 145.59 | 546.93 | 115.46 | 2.96% |

| NEXTDC Limited | N.A. | 23,504.86 | -5.28 | 366.88 | NM* | -1.55% |

Key Strategies for Sify Infinit Spaces Limited

Expanding Power Capacity and Expertise

Sify Infinit Spaces Limited is committed to aggressively expanding its digital infrastructure to meet the projected surge in data centre demand in India. The company plans to develop 11 new data centre facilities across strategic locations like Mumbai, Noida, and Chennai. This strategy involves incorporating advanced technological features, including subsea cable connectivity and earthquake-resistant designs, to maintain its competitive edge and capture long-term client relationships in a market driven by data localization norms.

Upscaling AI-Ready Capabilities

The company is strategically scaling up its AI-ready data centre capacity to address the specific demands of high-power-density AI workloads. By deploying advanced liquid cooling systems and modular designs in its NVIDIA-certified facilities, Sify Infinit Spaces Limited aims to attract high-value clients in the AI domain. This focus positions the company to capitalize on the anticipated growth of AI-related data centre demand, which is expected to constitute a significant share of the market by 2030.

Focus on Renewable Investments and Sustainability

Sify Infinit Spaces Limited will continue its strong commitment to sustainability by increasing investments in renewable energy sources. The strategy includes entering into long-term Power Purchase Agreements and investing in additional renewable energy capacity to power its operations. This aligns with global ESG priorities and enhances its appeal to environmentally conscious hyperscalers and enterprises, while also securing a stable and sustainable power supply for its future growth.

Upscaling Relationships and Expanding Client Base

The company plans to deepen relationships with existing hyperscale clients while expanding its enterprise client base, focusing on sectors like deep tech and manufacturing. Leveraging the Sify Group’s unified go-to-market strategy, it aims to cross-sell data centre services to the existing clients of its group companies. This dual approach is designed to maximize revenue from high-value, long-term partnerships and drive sustainable growth.

Strengthen Access to Interconnection Services

Sify Infinit Spaces Limited intends to enhance and up-sell its interconnection services, capitalizing on the network effect between its hyperscale and enterprise clients. By providing more low-latency connection points within its data centres, the company will strengthen the self-reinforcing cycle of demand, making its ecosystem more valuable and stickier for all clients, thereby increasing its revenue per client.

Widening Edge Data Centre Presence

Recognizing the growing demand for low-latency processing from IoT and real-time applications, the company is expanding its edge data centre footprint. With facilities under development in Lucknow and Chandigarh, Sify Infinit Spaces Limited aims to provide mainstream data centre capabilities at the edge, catering to the evolving needs of hyperscalers and supporting the next wave of digital consumption.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sify Infinit Spaces Limited IPO

How can I apply for Sify Infinit Spaces Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the lot size and price band for the Sify Infinit Spaces Limited IPO?

The lot size and price band for the Sify Infinit Spaces Limited IPO are yet to be announced and will be updated once finalized.

What is the total issue size of the Sify Infinit Spaces Limited IPO?

The IPO is a combination of a fresh issue and an offer for sale, aggregating to a total issue size of ₹3,700 crores.

Where will the equity shares be listed?

The equity shares of Sify Infinit Spaces Limited are proposed to be listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

What is the main objective of raising funds through this IPO?

The net proceeds will primarily fund capital expenditure for new data centres and repay certain borrowings, as detailed in the DRHP.