- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sillverton Industries IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sillverton Industries IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sillverton Industries Limited

Sillverton Industries Limited, incorporated in 1995, is engaged in the manufacturing and marketing of eco-friendly specialty paper through integrated operations, catering to varied industries. Its product portfolio includes writing and printing paper, kraft paper, cupstock paper, and other specialised grades, with over 265 varieties manufactured and supplied between April 2021 and December 2024. The company’s offerings serve retail, corporate, educational, packaging, FMCG, food and beverage, pharmaceutical, and government sectors. With a facility at Muzaffarnagar, Uttar Pradesh, spread across 251,502 sq. metres, Sillverton operates pan-India through 227 distributors and 191 dealers across 22 states

Sillverton Industries Limited IPO Overview

Sillverton Industries Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on July 2, 2025, to raise funds through an Initial Public Offer (IPO). The IPO, structured as a Book Build Issue, includes a fresh issue of ₹300 crore and an Offer for Sale (OFS) of up to 3.22 crore equity shares. The equity shares are proposed for listing on NSE and BSE. Bigshare Services Pvt. Ltd. is the registrar, while the book-running lead manager is yet to be appointed. IPO dates, price bands, and lot size remain unannounced. Investors can refer to the DRHP for further details.

Sillverton Industries Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Fresh Issue | ₹300 crore |

| Offer for Sale (OFS) | 3.22 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹5 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | TBA |

| Shareholding post -issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sillverton Industries Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sillverton Industries Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹3.61 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 26.74% |

| Net Asset Value (NAV) | ₹13.50 |

| Return on Equity (RoE) | 26.74% |

| Return on Capital Employed (RoCE) | 26.93% |

| EBITDA Margin | 13.65% |

| PAT Margin | 10.08% |

| Debt to Equity Ratio | 0.56 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding capital expenditure requirements towards investment in sustainability initiatives within the existing Manufacturing Facility by way of installation of (a) 14MW waste-to-energy captive power plant (“Captive Power Plant”) and (b) Compressed Bio Gas (“CBG”) plant. | 1293.91 |

| Funding capital expenditure requirements of the Company at the existing Manufacturing Facility by way of (a) enhancement of rewinder and sheeter capacity; and (b) construction of in-house warehouses | 252.49 |

| Repayment and/or pre-payment, in part or full, of certain borrowings availed by the Company | 720 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

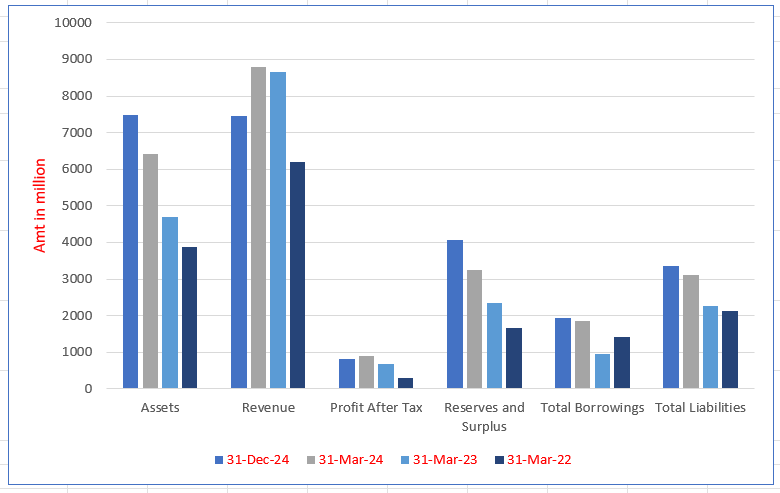

Sillverton Industries Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 7492.65 | 6424.16 | 4694.00 | 3872.38 |

| Revenue | 7451.56 | 8795.85 | 8659.98 | 6186.54 |

| Profit After Tax | 824.40 | 886.20 | 681.98 | 304.27 |

| Reserves and Surplus | 4061.97 | 3236.95 | 2349.75 | 1665.32 |

| Total Borrowings | 1938.63 | 1862.11 | 963.73 | 1416.68 |

| Total Liabilities | 3353.98 | 3110.51 | 2267.55 | 2130.36 |

Financial Status of Sillverton Industries Limited

SWOT Analysis of Sillverton Industries IPO

Strength and Opportunities

- Diverse, innovative packaging portfolio across food-grade, liquid, pharmaceutical, flexible, premium card, cooling pad, and bulky book papers.

- Established legacy of over 30 years with strong brand presence in packaging solutions.

- Strong focus on sustainability with eco-friendly and recyclable paper products.

- Planned IPO to fund expansion, reduce debt, and enhance sustainability infrastructure.

- Expansion into coated grades for label, food packaging, and coating base segments, unmatched by any other Indian mill

- Targeting ₹1,000 crore top-line growth by FY 2026–27, showing strong growth ambition

- Investor transparency with DRHP, annual reports, and governance details

- Strategic location in Muzaffarnagar, Uttar Pradesh for North Indian production and distribution

- Wide-ranging product traceability, customization, and delivery focus across industries

Risks and Threats

- Heavy debt load of ₹591 crore versus satisfied charges of ₹338 crore poses financial risk.

- Unlisted company status may limit liquidity and broader investor access.

- Volatility in raw materials and commodity prices could impact margins.

- Execution risk for new cogeneration and biogas facilities may delay returns.

- Competitive threat from larger, diversified packaging players with global scale

- Economic slowdown or reduced demand in FMCG, pharma, and food industries could slow growth

- Dependence on regulatory approvals for IPO and infrastructure projects poses uncertainty

- Debt servicing may strain cash flows if growth targets are not met

- Sustainability investments may raise short-term costs before long-term payoff

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sillverton Industries Limited

Sillverton Industries Limited IPO Strengths

Diversified and Continuously Expanding Product Portfolio

Sillverton Industries Limited offers a comprehensive range of paper-based products including writing and printing, kraft, cupstock, and specialised grade papers, available in multiple grammages. With over 265 active varieties and expansion into packaged drinking water, the company effectively caters to diverse industries while reducing reliance on any single sector for business stability.

Strong and Widespread Distribution Network

Sillverton Industries Limited has built a robust dealer network of 191 partners, ensuring access to multiple industries across India. Longstanding relationships with reputed dealers support steady demand and repeat orders. The company’s focus on customer engagement, competitive pricing, and dealer incentives has strengthened its distribution reach and created a significant entry barrier for competitors.

Strategically Located Integrated Facilities

Sillverton Industries Limited operates an integrated manufacturing facility in Muzaffarnagar, Uttar Pradesh, strategically positioned near high-consumption markets of North India. With ISO-certified operations, automation technologies, and ample land for expansion, the facility offers scalability, efficiency, and quality. Plans to enhance capacity by 90,000 MTPA further strengthen its ability to meet evolving market requirements.

Commitment to Sustainability and Recycling

Sillverton Industries Limited emphasises sustainability by using waste paper as raw material and investing in renewable energy solutions. Its waste-to-energy boiler, biogas plant, and proposed additional captive power facilities reduce operational costs and environmental impact. These eco-friendly practices align with India’s regulatory push towards biodegradable packaging, positioning the company as a responsible industry leader.

Experienced Promoters with Proven Capabilities

Sillverton Industries Limited benefits from experienced promoters and senior management with expertise in manufacturing, procurement, operations, and business development. Led by industry veterans with deep domain knowledge, the company leverages its leadership team’s strategic insights and networks to drive growth, explore new markets, and strengthen its position in the competitive paper and packaging sector.

Financially Stable Business Model

Sillverton Industries Limited has consistently demonstrated financial growth, supported by operational efficiency and strategic expansion. With strong RoE of 26.74% in FY24 and PAT growing at a CAGR of 70.66% from FY22 to FY24, the company has built a resilient business model that balances profitability, scalability, and long-term sustainability in the evolving industry.

More About Sillverton Industries Limited

Sillverton Industries Limited is engaged in the manufacturing and marketing of eco-friendly speciality paper. With integrated operations, the Company caters to a wide spectrum of end-use industries, offering a diversified portfolio that reduces reliance on any single segment.

Product Portfolio

The Company manufactures and markets a broad range of paper-based products, including:

- Writing and Printing Paper

- Kraft Paper

- Cupstock Paper

- Specialised Grade Papers

These products are widely applied across:

- Retail, corporate, educational and government sectors

- Packaging, FMCG, and secondary packaging

- Food & beverage packaging and quick service restaurant solutions

- Labels, stationery, and pharmaceutical packaging

Between April 1, 2021, and December 31, 2024, the Company produced and supplied over 265 active paper varieties, reflecting the adaptability of its product range.

Market Position & Growth

India’s packaging industry grew from ₹1,567 billion in FY21 to ₹2,421 billion in FY24, registering a CAGR of 15.6%. The sector is projected to reach ₹3,600–3,800 billion by FY29, driven by demand across FMCG, pharma, and e-commerce (Source: CRISIL Report).

Sillverton has capitalised on this growth by leveraging its three-decade-long market presence. According to CRISIL, the Company recorded the second-highest PAT growth from FY22 to FY24, achieving a CAGR of 70.66%, with PAT rising from ₹304.27 million in FY22 to ₹886.20 million in FY24.

Strategic Diversification

Over the years, the Company has transformed from a traditional paper manufacturer into a multi-paper packaging solutions provider through strategic capital expenditure. Key developments include:

- Recognition as a ‘Mega Unit’ under Uttar Pradesh’s Industrial Investment and Employment Promotion Policy, 2017, owing to an investment of ₹1,697.50 million in expansion and modernisation.

- Installation of a 16 MW coal-fired boiler and a waste-to-energy captive power plant for self-sufficiency in energy.

- Setting up a packaged drinking water bottling plant with a capacity of 570 kilolitres per day (40,000 bottles/hour) in collaboration with Energy Beverages Private Limited for contract manufacturing.

Revenue Performance

The Company’s revenue from operations grew by 42.18%, rising from ₹6,186.54 million in FY22 to ₹8,795.85 million in FY24. Product diversification and new applications within existing portfolios have also contributed to higher realisations

Industry Outlook

Indian Paper & Packaging Industry Outlook

Industry Overview

The Indian paper and packaging industry has emerged as one of the fastest-growing sectors, driven by increasing demand from FMCG, e-commerce, pharmaceuticals, education, and food & beverage industries. The country ranks among the top paper producers globally, with consumption steadily rising due to economic expansion and lifestyle changes.

Market Size & Growth

- The packaging industry in India expanded from ₹1,567 billion in FY21 to ₹2,421 billion in FY24, marking a CAGR of 15.6%.

- It is projected to reach ₹3,600–3,800 billion by FY29, supported by growth in retail, exports, and digital commerce.

- India’s overall paper demand is expected to grow at a CAGR of 6–7% till 2030, with writing & printing paper, kraft paper, and speciality paper categories playing a key role.

Segment-wise Outlook

- Writing & Printing Paper: Although digitisation has reduced demand in developed markets, India continues to see steady usage in education, government, and corporate sectors. This category is expected to grow at 4–5% CAGR.

- Kraft Paper: Driven by e-commerce and FMCG packaging, kraft paper demand is forecasted to grow at 8–9% CAGR over the next five years.

- Cupstock Paper: Rising food delivery services, QSR chains, and eco-friendly packaging push this segment, expected to grow at 10–12% CAGR.

- Speciality Papers: Used in pharmaceuticals, labelling, décor, and security applications, speciality paper is witnessing high-margin growth with a CAGR of 9–10%.

Growth Drivers

- E-commerce Boom: Surge in online retail driving packaging-grade paper consumption.

- FMCG & Pharma Growth: Increasing packaged goods and regulated pharmaceutical packaging.

- Sustainability Push: Ban on single-use plastics boosting demand for eco-friendly paper-based packaging.

- Government Initiatives: Incentives under industrial policies and support for domestic manufacturing.

- Rural & Urban Demand: Expanding literacy and rising disposable income fuelling writing & printing paper usage.

Key Figures

- India produces over 25 million tonnes of paper annually.

- The country’s per capita consumption of paper is about 15–16 kg, significantly below the global average of 57 kg, indicating vast untapped potential

How Will Sillverton Industries Limited Benefit

- Rising demand for kraft paper from e-commerce, FMCG, and sustainable packaging will directly boost Sillverton’s volumes, as kraft remains one of its core offerings.

- Expansion of cupstock and food-grade specialty papers aligns with India’s booming QSR, food delivery, and plastic substitution drive, opening high-margin opportunities.

- Writing & printing paper continues to grow in India at 4–5% CAGR, supported by education and institutional demand, ensuring steady base revenues.

- The surge in specialty paper applications—labels, décor, pharma, and security—positions Sillverton to capture premium niches with higher realizations.

- Government policies banning single-use plastics and encouraging eco-friendly packaging will accelerate the shift towards paper-based alternatives, strengthening long-term demand.

- With India’s per capita paper consumption still well below global averages, Sillverton is poised to benefit from structural growth and increasing domestic penetration.

Peer Group Comparison

| Name of the Company | Face Value (₹) | Revenue (in ₹ million) | EPS (₹) | NAV (₹) | Price / Earnings Ratio | Return on Net Worth (%) |

| Sillverton | 5 | 8,795.85 | 3.61 | 113.50 | [●] | 26.74 |

| Peer Groups | ||||||

| JK Paper Limited | 10 | 66,592.30 | 66.22 | 299.26 | 6.00 | 22.35 |

| Kuantam Papers Limited | 1 | 12,112.97 | 21.07 | 128.79 | 5.39 | 16.36 |

| Seshasayee Paper And Boards Limited | 2 | 18,018.30 | 44.96 | 303.05 | 6.74 | 14.17 |

| West Coast Paper Mills Limited | 2 | 44,476.82 | 104.77 | 490.80 | 4.80 | 24.25 |

| N R Agarwal Industries Limited | 10 | 12,931.29 | 73.72 | 446.73 | 4.64 | 16.50 |

Key Strategies for Sillverton Industries Limited

Capturing Market Opportunities through Product Diversification and Capacity Expansion

Sillverton Industries Limited seeks to capture rising opportunities in India’s fast-growing paper packaging industry by diversifying its speciality product portfolio and expanding production capacity by 90,000 MT annually. With new investments in machinery and warehousing, the Company aims to deliver high-quality, customised, and sustainable packaging solutions.

Expanding Global Footprint and Client Base

Sillverton Industries Limited intends to strengthen its global presence by expanding exports across markets such as Australia, Europe, and the UAE. By leveraging its speciality portfolio, growing international demand, and export-related incentives, the Company aims to diversify revenue streams and mitigate regional economic risks.

Advancing ESG Practices and Sustainable Energy Investments

Sillverton Industries Limited continues to invest in ESG initiatives by adopting advanced wastewater treatment technologies and enhancing renewable energy use. With waste-to-energy and proposed CBG plants, the Company aims to reduce its carbon footprint, optimise costs, ensure energy security, and create sustainable revenue streams.

Leveraging Policy Incentives for Growth and Competitiveness

Sillverton Industries Limited strategically aligns with Uttar Pradesh’s Industrial Investment and Employment Promotion Policy, gaining ‘Mega Unit’ classification benefits. By capitalising on subsidies, tax reimbursements, and EPR credits, the Company strengthens cost efficiency, expands production capacity, and reinforces leadership in eco-conscious, resource-efficient, and profitable paper packaging solutions.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sillverton Industries Limited IPO

How can I apply for Sillverton Industries Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the issue size of the IPO?

The IPO includes a fresh issue of ₹300 crore and an offer-for-sale of 3.22 crore shares.

Who is managing and overseeing the IPO process?

Pantomath Capital Advisors Private Limited is the book-running lead manager for this IPO.

What are the key purposes for which IPO proceeds will be used?

Funds will cover sustainability projects (waste-to-energy, CBG plants), capacity enhancement, warehousing, debt repayment, and corporate uses.

Which company is handling the IPO allotment and related services?

Bigshare Services Private Limited is the registrar managing allotment status and related IPO services.

What is the IPO structure? Is it a fresh issue and/or offer-for-sale?

It’s a combination of a fresh issue (₹300 crore) and an offer-for-sale by promoters (3.22 crore shares)