- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Silver Consumers Electricals IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Silver Consumers Electricals Limited

Incorporated in 2021, Silver Consumer Electricals Limited manufactures electrical consumer durables and agricultural equipment, including pumps, motors, solar pumps, controllers, fans, lighting products, and other appliances. The company operates a single, vertically integrated manufacturing facility in Rajkot, Gujarat, spanning 138,821 square meters. It follows a dual business model, selling products under its brands “Silver” and “Bediya” and supplying to OEMs across India. As of March 31, 2025, its R&D team had 111 personnel working on product development and innovation, supported by 977 machines. The company employed 3,450, 2,866, and 1,088 full-time staff in Fiscals 2025, 2024, and 2023, respectively.

Silver Consumers Electricals Limited IPO Overview

Silver Consumer Electricals Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on August 7, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is structured as a book-building issue aggregating ₹1,400.00 crores, comprising a fresh issue of shares worth ₹1,000.00 crores and an Offer for Sale (OFS) of ₹400.00 crores. The company plans to list its equity shares on both NSE and BSE. While MUFG Intime India Pvt. Ltd. has been appointed as the registrar, the book running lead manager is yet to be declared. Key details, including IPO dates, price bands, and lot size, are awaited. For more information, refer to the Silver Consumer Electricals IPO DRHP.

Silver Consumers Electricals Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | ₹1400 crore |

| Fresh Issue | ₹1000 crore |

| Offer for Sale (OFS) | ₹400 crore |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 28,28,84,390 shares |

| Shareholding post-issue | TBA |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Silver Consumers Electricals Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Silver Consumers Electricals Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹1.88 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 7.35% |

| Net Asset Value (NAV) | ₹23.80 |

| Return on Equity (RoE) | 10.15% |

| Return on Capital Employed (RoCE) | 11.69% |

| EBITDA Margin | 10.02% |

| PAT Margin | 2.96% |

| Debt to Equity Ratio | 1.19 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/ prepayment, in full or part, of all or certain outstanding borrowings availed by the company and its subsidiaries | 9000 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

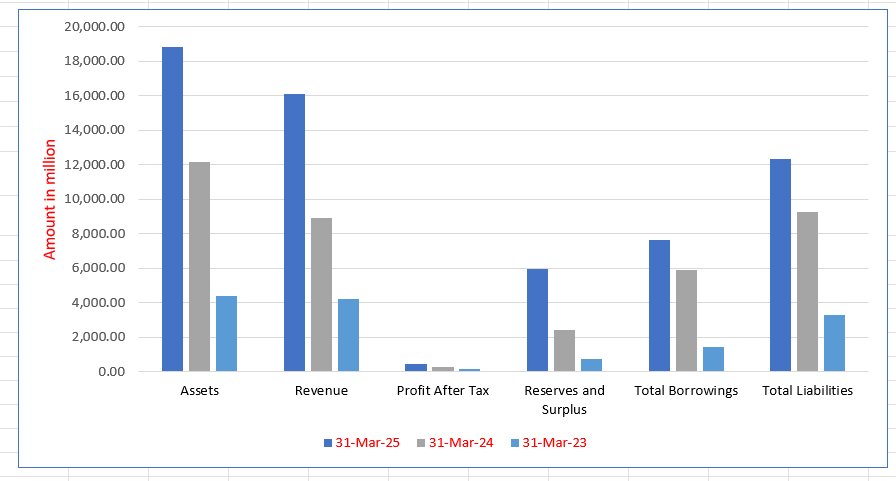

Silver Consumers Electricals Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 18,822.54 | 12,148.78 | 4,416.49 |

| Revenue | 16,121.27 | 8,936.60 | 4,209.74 |

| Profit After Tax | 476.94 | 282.39 | 197.13 |

| Reserves and Surplus | 5,944.88 | 2,435.23 | 726.04 |

| Total Borrowings | 7,618.76 | 5,896.09 | 1,430.54 |

| Total Liabilities | 12,332.08 | 9,243.14 | 3,290.45 |

Financial Status of Silver Consumers Electricals Limited

SWOT Analysis of Silver Consumers Electricals IPO

Strength and Opportunities

- Established in 1981 with a strong legacy in manufacturing electrical consumer durables.

- Owns India's largest single-location manufacturing facility for electrical and agricultural equipment.

- Diverse product portfolio including pumps, motors, solar solutions, fans, lighting, and agricultural equipment.

- Significant installed capacities with advanced infrastructure and robotic automation.

- Strong leadership under Chairman & MD Vinit Bediya, driving rapid organizational growth.

- Commitment to corporate social responsibility, focusing on community development and environmental sustainability.

- Strategic brand partnerships, such as with Hardik Pandya, enhancing brand visibility.

- Impressive financial growth with a 95.17% CAGR between FY2023 and FY2025.

- Expansion into new business streams like ceiling fans, agricultural equipment, and consumer lighting.

Risks and Threats

- Relatively recent transformation from a private limited to a public limited company in 2025.

- High capital expenditure requirements for continuous infrastructure expansion.

- Potential challenges in managing a broad product range across multiple sectors.

- Dependency on external investors for funding, as evidenced by private placement rounds.

- Risks associated with rapid growth, including potential strain on operational efficiency.

- Exposure to market volatility and economic downturns affecting consumer demand.

- Intense competition in the electrical consumer durables and agricultural equipment sectors.

- Challenges in maintaining consistent product quality across a large-scale operation.

- Potential regulatory hurdles and compliance requirements in new product categories.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Silver Consumers Electricals Limited

Silver Consumers Electricals Limited IPO Strengths

Rapid Growth and Proven Execution

Silver Consumers Electricals Limited is India’s fastest-growing manufacturer of consumer durables and agricultural equipment. The company’s revenue from operations saw a remarkable 95.17% CAGR from Fiscal 2023 to Fiscal 2025. This rapid growth, driven by an ability to quickly launch products, demonstrates a proven track record of efficient execution and market responsiveness.

Strong Engineering and Vertical Integration

The company operates India’s largest single-location, vertically integrated plant in Rajkot, Gujarat. This facility, equipped with advanced automation and robotic processes, has leading installed capacities for pumps, fans, and lighting. Its backward integration capabilities and scalable production lines ensure manufacturing efficiency and superior product quality, minimizing external dependencies.

Diversified Business Model

Silver Consumers Electricals employs a diversified dual business model, serving customers through both its own “Silver” and “Bediya” brands and strong OEM partnerships. This approach, combined with an extensive product portfolio of over 3,000 SKUs, mitigates operational risks and reduces dependency on single revenue streams, ensuring stable and sustained growth across market conditions.

Advanced R&D Capabilities

The company maintains a strong commitment to innovation through its five dedicated R&D units. Its R&D team, comprising over 111 personnel, leverages advanced simulation, 3D printing, and automation to develop new product features, optimize manufacturing processes, and ensure product reliability. This focus enables the company to meet evolving customer needs and support OEM partnerships.

Expansive Distribution Network

Silver Consumers Electricals has an extensive “Feet on Street” distribution network across India. As of March 31, 2025, this network included 102 distributors and 5,616 dealers, a substantial increase from previous years. The dedicated sales force actively engages with customers, ensuring timely product availability, personalized service, and enhanced market penetration, thereby maintaining a competitive edge.

Experienced Leadership and Governance

The company benefits from an experienced leadership team, led by Chairman and Managing Director Vinit Dharamshibhai Bediya. Under his guidance, the company has seen significant expansion in its manufacturing capabilities and product portfolio. The management is committed to high standards of corporate governance, transparency, and accountability, fostering a stable and progressive work environment.

Overview of Silver Consumers Electricals Limited

Silver Consumers Electricals Limited is a prominent and rapidly expanding manufacturer of consumer durables and agricultural equipment in India. The company specializes in a wide range of electrical products, including pumps, motors, solar equipment, fans, and lighting. According to a 1Lattice Report, Silver Consumers Electricals was the fastest-growing manufacturer in its sector in India from fiscal year 2023 to fiscal year 2025, with a compound annual growth rate (CAGR) of 95.17% in revenue from operations.

Manufacturing and Production Capabilities

The company’s operational hub is located in Rajkot, Gujarat, where it operates India’s largest single-location, vertically integrated plant. This expansive facility, covering 138,821 square meters, is equipped with advanced infrastructure, robotic automation, and customized machinery to ensure efficient and high-quality production.

Key manufacturing capacities as of March 31, 2025, include:

- Pumps and Motors: 2,400,000 units

- Fans: 7,200,000 units

- Lighting Products: 21,900,000 units

- Agricultural Equipment: 72,000 units

Silver Consumers Electricals is recognized as one of the largest companies in terms of manufacturing capacity in the residential and solar pumps segments. The backward-integrated nature of its plant minimizes external dependencies and supports large-scale business operations.

Business Model and Product Offerings

Silver Consumers Electricals operates a dual business model, focusing on both its own brands and partnerships with Original Equipment Manufacturers (OEMs). The company’s products are sold under its own “Silver” and “Bediya” brands, while it also designs, manufactures, and supplies products to leading OEMs in India. This strategy helps to de-risk its business and optimize operations through larger production volumes.

The company’s core capabilities in complex engineering and backward-integrated manufacturing allow it to deliver high-quality, cost-effective products. This “concept to commercial” approach encompasses every stage of production, from initial design collaboration to final delivery. The company’s diverse portfolio includes over 3,000 stock-keeping units (SKUs) across various product categories.

Customer Base and Distribution

Silver Consumers Electricals serves an extensive and diverse customer base across residential, agricultural, industrial, and commercial sectors. As of March 31, 2025, the company had served over five million end-use customers with its branded products. In its OEM business, the company has established long-standing relationships with renowned partners, including Crompton Greaves Consumer Electricals Limited and Finolex Cables Limited.

The company maintains a wide-reaching distribution network to ensure efficient product availability nationwide. As of March 31, 2025, this network included 102 distributors and 5,616 dealers, supported by a dedicated “Feet on Street” sales team.

Industry Outlook

The Indian consumer electricals and pumps industry is experiencing significant growth, driven by urbanization, agricultural modernization, and infrastructure development.

Market Size & Growth

- Consumer Electricals: Valued at approximately USD 89.12 billion in 2024, the market is projected to grow at a CAGR of 9.60%, reaching USD 222.88 billion by 2034.

- Pumps Market: Valued at USD 7.00 billion in 2024, expected to reach USD 8.70 billion by 2033, growing at a CAGR of 2.20%.

Growth Drivers

- Urbanization: Increasing demand for home appliances and electrical products.

- Agricultural Modernization: Rising need for efficient irrigation solutions.

- Infrastructure Development: Boost in construction activities requiring electrical equipment.

- Government Initiatives: Support for solar energy adoption and rural electrification.

Key Figures

- Consumer Electricals: USD 89.12 billion (2024)

- Pumps Market: USD 7.00 billion (2024)

- Projected Growth (2034): USD 222.88 billion for consumer electricals, USD 8.70 billion for pumps.

How Will Silver Consumers Electricals Limited Benefit

- Silver Consumers Electricals can leverage the rising demand for home appliances and electrical products due to rapid urbanization, expanding its consumer base.

- Increasing need for efficient irrigation solutions positions the company’s pumps and agricultural equipment for higher adoption in rural and semi-urban markets.

- Ongoing infrastructure development boosts demand for fans, lighting, and motors, allowing the company to supply large-scale residential and commercial projects.

- Government initiatives supporting solar energy and rural electrification align with the company’s solar equipment portfolio, creating new revenue opportunities.

- Its large-scale, backward-integrated manufacturing plant ensures the ability to meet growing market demand efficiently and cost-effectively.

- A diversified product portfolio of over 3,000 SKUs allows Silver Consumers to cater to multiple market segments simultaneously.

- Strong OEM partnerships with Crompton Greaves and Finolex enable consistent order flow and reduced business risks.

- Extensive distribution network of 102 distributors and 5,616 dealers ensures wide market penetration and improved product availability nationwide.

- Advanced production capabilities and robotic automation enhance product quality, reinforcing brand trust in competitive markets.

Peer Group Comparison

| Name of Company | Face value (₹) | Revenue

(in ₹ million) |

EPS (₹) | P/E | NAV

(₹) |

RONW (%) |

| Silver Consumers Electricals | 2.00 | 15,863.83 | 1.88 | NA | 23.80 | 7.35 |

| Peer group | ||||||

| Havells India Limited | 1.00 | 217,780.60 | 23.49 | 64.28 | 132.92 | 17.64 |

| PG Electroplast Limited | 1.00 | 48,695.32 | 10.74 | 74.80 | 99.90 | 10.18 |

| Crompton Greaves Consumer Electricals Limited | 2.00 | 78,635.50 | 8.64 | 37.85 | 59.76 | 14.66 |

| Kirloskar Brothers Limited | 2.00 | 44,922.43 | 52.29 | 35.50 | 264.45 | 19.94 |

| KSB Limited | 2.00 | 25,330.86 | 14.22 | 58.27 | 85.34 | 16.66 |

| Shakti Pumps (India) Limited | 10.00 | 25,162.40 | 33.97 | 24.32 | 96.59 | 35.17 |

| Oswal Pumps Limited | 1.00 | 14,303.07 | 28.21 | 26.70 | 46.48 | 60.69 |

| Bajaj Electricals Limited | 2.00 | 48,284.34 | 11.57 | 53.29 | 150.61 | 7.68 |

| Orient Electric Limited | 1.00 | 30,936.80 | 3.90 | 54.78 | 32.54 | 11.99 |

| VST Tillers Tractors Limited | 10.00 | 9,945.50 | 107.60 | 42.79 | 1,159.62 | 9.28 |

| Wonder Electricals Limited | 1.00 | 8,945.01 | 1.24 | 130.08 | 7.52 | 16.46 |

Key Strategies for Silver Consumers Electricals Limited

Expand Product Verticals and Enhance Process Efficiencies

Silver Consumers Electricals Limited focuses on expanding into high-potential product verticals such as solar panels, TPW fans, LED chips, coolers, and geysers. Leveraging technical capabilities and backward integration, the company ensures quality, scalability, and value addition across its brand and OEM business, strengthening market presence.

Expand Domestic and International Operations

The company aims to grow both domestically and internationally by replicating successful business verticals abroad. By optimizing existing infrastructure and production capacity, Silver Consumers Electricals Limited targets unorganized markets, broadens its customer base, and strengthens relationships in export markets, ensuring sustainable growth and global market penetration.

Pursue Cost Leadership Through Resource Optimisation

Silver Consumers Electricals Limited seeks to achieve cost efficiency via large-scale manufacturing, backward integration, and flexible production lines. By optimizing working capital, capital expenditure, and economies of scale, the company delivers high-quality products at competitive prices, maintaining sustainable cost leadership and reinforcing industry competitiveness.

Build a Strong Consumer Brand and Pursue Inorganic Growth

The company plans strategic acquisitions to expand product categories, enhance manufacturing capabilities, and strengthen technological expertise. Simultaneously, brand-building initiatives using advertising, social media, and influencer engagement aim to establish a strong consumer brand with global recognition, driving market share growth and operational synergies.

Expand Distribution Channels

Silver Consumers Electricals Limited is expanding its distributor network and modern trade presence, including e-commerce channels, to increase product accessibility. Initiatives like the Saarthi loyalty program incentivize retailers, enhance engagement, and ensure wider reach, enabling the company to serve diverse customer segments effectively and strengthen market penetration.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Silver Consumers Electricals Limited IPO

How can I apply for Silver Consumers Electricals Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the total size of the IPO?

The IPO is valued at ₹1,400 crore, comprising a fresh issue of ₹1,000 crore and an OFS of ₹400 crore.

What is the purpose of the IPO proceeds?

Proceeds will be used for repayment/prepayment of borrowings and general corporate purposes of the company.

On which stock exchanges will the IPO be listed?

The equity shares are proposed to be listed on the NSE and BSE mainboards.

What are the company’s financial highlights for FY March 2025?

Revenue was ₹1,612.13 million and profit after tax was ₹47.69 million for FY March 2025.

Who are the key participants in the IPO process?

MUFG Intime India Pvt. Ltd. is the registrar, while book running lead managers are yet to be declared.