- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

SIP vs STP vs SWP in Mutual Funds: Which Is Better?

By HDFC SKY | Published at: May 28, 2025 05:17 PM IST

Several strategies exist for systematically investing, transferring, or withdrawing funds when investing in mutual funds. Three popular methods are SIP (Systematic Investment Plan), STP (Systematic Transfer Plan), and SWP (Systematic Withdrawal Plan), each designed to meet different investment objectives.

However, many investors find it challenging to grasp the distinctions between SIP and SWP or to understand how STP compares to SIP. In this blog, we will explore what SIP, STP, and SWP are, discuss their advantages, and guide you on how to select the best option for your financial objectives.

What is a SIP (Systematic Investment Plan)?

SIP, or Systematic Investment Plan, is a structured approach to investing in which an individual contributes a set amount to a mutual fund at regular intervals, such as monthly, quarterly, or annually. This method allows people to gradually build wealth by making consistent investments, regardless of the market performance.

Benefits of SIP

- Rupee Cost Averaging: SIP allows investors to purchase more units when prices are low and fewer units when prices are high, helping to average out the overall cost

- Power of Compounding: As time goes on, reinvesting returns can greatly enhance wealth accumulation.

- Lower Market Timing Risk: SIP removes the pressure of trying to time the market since investments are made gradually over time.

- Flexibility: Investors have the flexibility to increase, decrease, pause, or stop their SIPs whenever they choose.

- Accessible to All: You can begin investing in SIPs with just ₹500 a month, making it accessible for everyone, regardless of their income level.

What is SWP (Systematic Withdrawal Plan)?

SWP is the opposite of SIP. Rather than investing a set amount, investors regularly withdraw a specific amount at intervals such as monthly, quarterly, or annually. This approach is often utilised by retirees seeking a consistent income stream.

Benefits of SWP

- Steady Income Stream: Perfect for those seeking a steady income after retirement.

- Tax Efficiency: Withdrawals are taxed solely on capital gains, which makes this option more tax-efficient than fixed deposits.

- Market Participation: Even after withdrawals, the remaining amount keeps increasing.

- Customisable Withdrawals: Investors have the flexibility to choose the amount they want to withdraw and the frequency of those withdrawals.

- Better Alternative to Fixed Deposits: SWP provides the opportunity for potentially greater returns than what you would typically find with traditional fixed-income investments.

What is STP (Systematic Transfer Plan)?

STP is a convenient method for transferring funds between different mutual fund schemes at set intervals. Many investors utilise STP to gradually shift their money from a low-risk debt fund to a higher-return equity fund.

Benefits of STP

- Gradual Exposure to Equity: Assists investors in minimising risk when transitioning from debt to equity.

- Better Returns: Investors can earn interest in a debt fund before making an equity transfer.

- Rupee Cost Averaging: Like SIP, STP diversifies investments across various market cycles.

- Customisable Transfer Amount: Investors have the flexibility to choose the amount they wish to transfer and the frequency of those transfers.

- Tax Management: Aids in lowering the capital gains tax burden when compared to one-time transfers.

A Comparative Analysis of SIP, STP, and SWP

| Feature | SIP (Systematic Investment Plan) | STP (Systematic Transfer Plan) | SWP (Systematic Withdrawal Plan) |

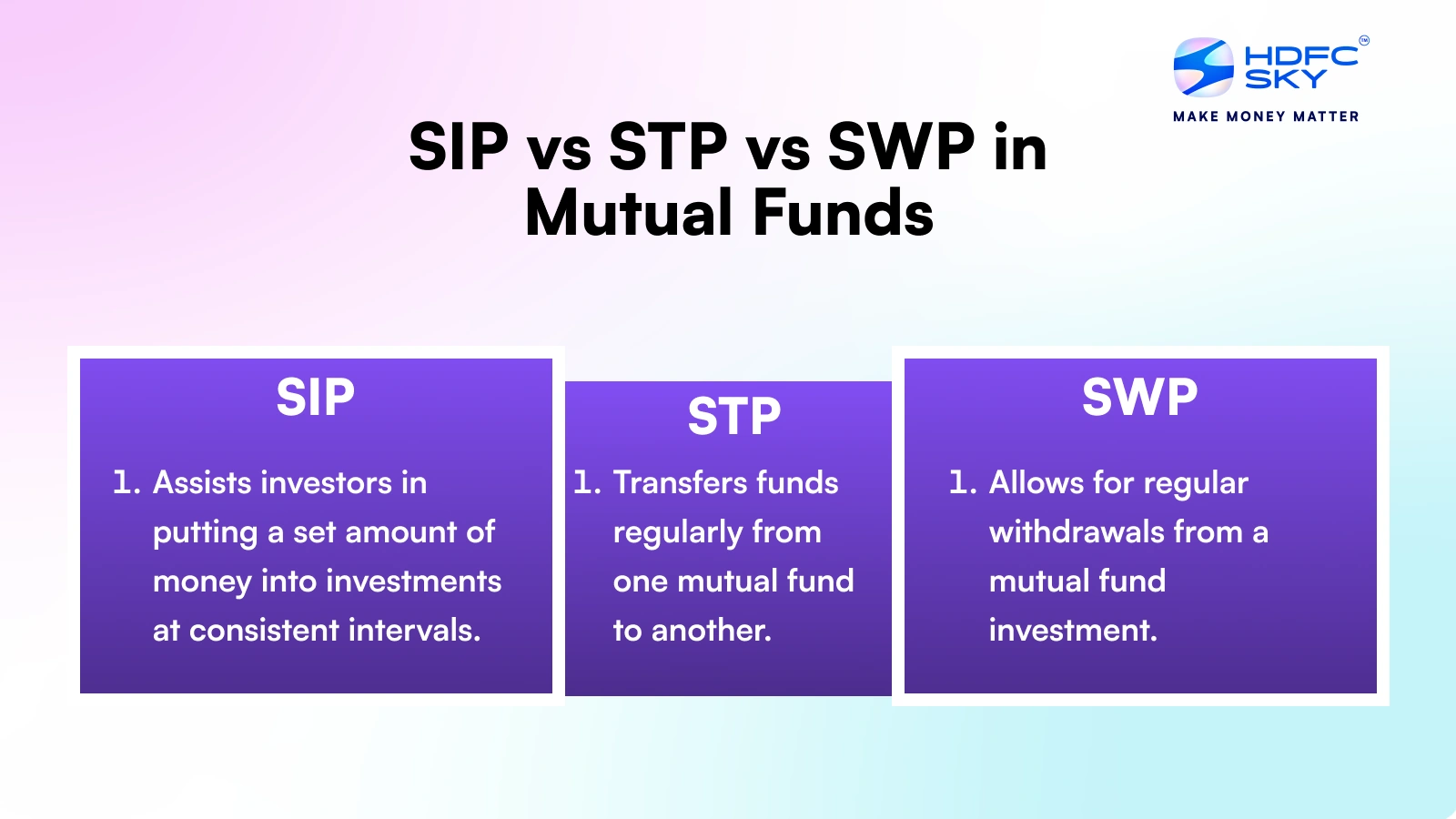

| Purpose | Assists investors in putting a set amount of money into investments at consistent intervals. | Transfers funds regularly from one mutual fund to another. | Allows for regular withdrawals from a mutual fund investment. |

| Investment Type | Small, regular investments | Transfers between mutual funds | Systematic withdrawal of funds |

| Best For | Investors aiming for long-term wealth creation. | Investors are looking to shift their funds from debt to equity or vice versa. | Retirees or investors looking for a reliable income stream from their investments. |

| Market Conditions | Great for an unpredictable market | Facilitate a smooth transition between different fund types | Maintain cash flow throughout retirement |

| Risk Factor | Moderate to high-risk. Market risk can be effectively managed through a strategy known as rupee cost averaging. | Moderate risk exists as funds are transferred gradually. | There is a low to moderate risk, which depends on the specific fund you choose. |

| Flexibility | Highly flexible – can be stopped or paused at any time. | Can be tailored to fit individual risk profiles and investment objectives. | Enables managed withdrawals while maintaining market exposure. |

| Taxation | Capital gains tax applies when you redeem your investments. | Every transfer is treated as a redemption and is subject to taxation accordingly. | Withdrawals could be subject to capital gains tax. |

Which One is Right for You: SIP, STP, or SWP?

Deciding between SIP, STP, and SWP depends on your financial objectives. For instance:

- If you’re looking to invest small amounts and grow your wealth over time, consider a Systematic Investment Plan (SIP).

- If you have a larger sum and want to enter the equity market gradually, a Systematic Transfer Plan (STP) is the way to go.

- A systematic withdrawal plan (SWP) is perfect for those who need a steady cash flow from their investments.

To create a well-rounded financial strategy, investors can utilise a combination of SIP, STP, and SWP. For instance:

- Consider using a Systematic Investment Plan (SIP) to invest consistently in an equity fund.

- After some time, you can utilise a Systematic Transfer Plan (STP) to move your profits into a more secure debt fund.

- Ultimately, you can implement a Systematic Withdrawal Plan (SWP) to access your funds as needed for retirement or other expenses.

Conclusion

SIP, STP, and SWP are three key strategies in mutual fund investing, each with its unique purpose. SIP is designed to help you build wealth over time, STP is useful for managing risk during investment transitions, and SWP provides a consistent income stream.

Your selection should align with your investment timeline, risk appetite, and financial objectives. A thoughtfully crafted mix of SIP, STP, and SWP can enhance returns while reducing risk, paving the way for a successful financial journey.

Related Articles

FAQs on SIP vs STP vs SWP in Mutual Funds

Can I use SIP, SWP, and STP together in my investment strategy?

Absolutely! You can use all three methods together. For instance, you might begin with a Systematic Investment Plan (SIP), then transfer funds through a Systematic Transfer Plan (STP), and finally, when necessary, withdraw using a Systematic Withdrawal Plan (SWP).

Which is better for long-term investment: SIP, SWP, or STP?

A Systematic Investment Plan (SIP) is an excellent choice for building long-term wealth. It encourages disciplined investing, takes advantage of rupee cost averaging, and maximises the benefits of compounding.

How can a SWP provide regular income?

A Systematic Withdrawal Plan (SWP) enables investors to take out a set amount of money at regular intervals. This can be particularly beneficial for retirees who require a consistent cash flow while still allowing their remaining investments to grow.