- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

SIS Cash Services IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

SIS Cash Services IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

SIS Cash Services Limited

SIS Group Enterprises began in 1974 as a small two-member company and has grown into a market leader in Security, Facility Management, and Cash Logistics across the Asia-Pacific. Through a technology-driven approach, the group has enhanced operational efficiency and customer experience using platforms like iOPS, ARK, SalesMaxx, and MySIS. SIS now operates India’s largest command centre, overseeing 5,00,000 sites, and leads the e-surveillance space. With a presence in all 28 Indian states, 8 Union Territories, and countries like Australia, New Zealand, and Singapore, SIS continues to expand strategically.

SIS Cash Services Limited IPO Overview

SIS Prosegur IPO is structured as a book-building issue, comprising a fresh issue worth ₹100 crore and an offer for sale of 37,15,150 equity shares. While the IPO dates, price band, and lot size are yet to be officially announced, the allotment and listing are expected to take place on the BSE and NSE. The face value of each share is ₹10.

Dam Capital Advisors Ltd (formerly IDFC Securities Ltd) is the book-running lead manager, with Link Intime India Private Ltd acting as the registrar. As per the Draft Red Herring Prospectus (DRHP), the total pre-issue shareholding stands at 1,98,13,664 shares, with a 98% promoter holding. The IPO is backed by SIS Limited, Singpai Pte. Ltd., LUXPAÏ CIT S.À R.L., Prosegur Global CIT Row, S.L.U., and Prosegur Cash, S.A., who are the key promoters. The DRHP was filed with SEBI on March 31, 2025, and later submitted on April 8, 2025.

SIS Cash Services Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹100 crores

Offer for Sale (OFS): 0.37 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 1,98,13,664 shares |

| Shareholding post -issue | TBA |

SIS Cash Services IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

SIS Cash Services Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Offer |

| NII (HNI) Shares Offered | Not more than 15% of the Offer |

SIS Cash Services Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | 25.32 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 38.71% |

| Net Asset Value (NAV) | 77.99 |

| Return on Equity | 38.71% |

| Return on Capital Employed (ROCE) | 27.59% |

| EBITDA Margin | 16.88% |

| PAT Margin | 7.91% |

| Debt to Equity Ratio | 0.79 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding of capital expenditure requirements for the purchase of cash vehicles and fabrication of the secured vehicle | 375.89 |

| Pre-payment or scheduled re-payment of a portion of certain outstanding borrowings availed by the company | 298.07 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

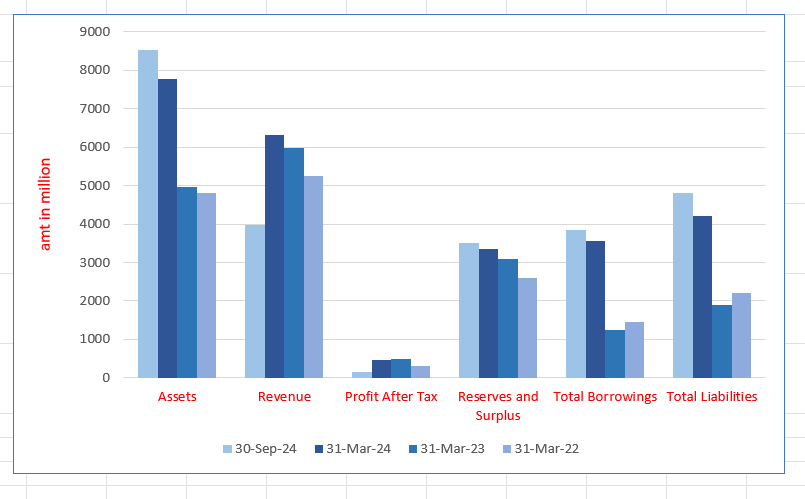

SIS Cash Services Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 7108.23 | 6489.19 | 5999.38 | 5185.81 |

| Revenue | 5298.58 | 6338.25 | 5430.34 | 3925.87 |

| Profit After Tax | 387.41 | 501.59 | 188.54 | 47.52 |

| Reserves and Surplus | 1735.74 | 1347.07 | 848.11 | 654.33 |

| Total Borrowings | 1916.02 | 2059.34 | 2385.64 | 2201.42 |

| Total Liabilities | 5174.35 | 4943.98 | 4953.13 | 4333.34 |

Financial Status of SIS Cash Services Limited

SWOT Analysis of SIS Cash Services IPO

Strength and Opportunities

- Established as the second-largest cash logistics provider in India.

- Backed by strong infrastructural, operational, and financial support from the parent company, SIS India.

- Technical support from Prosegur, a leading global cash management services provider.

- Strong brand recognition through SIS Prosegur and SISCO brands.

- Diverse service offerings including cash-in-transit, ATM replenishment, and precious cargo management.

- Positive credit ratings indicating financial stability.

- Expansion into international markets, enhancing growth prospects.

- Adoption of technology to improve efficiency and service delivery.

- Opportunities arising from the increasing demand for secure cash handling solutions in emerging markets.

Risks and Threats

- Vulnerability to regulatory changes affecting cash handling and logistics.

- High working capital requirements impacting liquidity.

- Exposure to operational risks such as theft, fraud, and physical damage during cash transportation.

- Dependence on the banking sector, which is subject to regulatory approvals and changes.

- Competitive pressure from other cash logistics companies like CMS Info Systems and Radiant Cash Management.

- Potential impact of digital payment growth reducing demand for cash logistics services.

- Operational challenges due to the need for specialized security measures and trained personnel.

- Fluctuations in fuel prices and transportation costs affecting operational expenses.

- Potential cybersecurity threats impacting digital aspects of cash management services.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About SIS Cash Services Limited

Strategic Support from Prosegur Compañía de Seguridad, S.A. and Its Subsidiaries, and SIS Limited and Its Subsidiaries

SIS Cash Services Limited benefits from the strategic support of SIS and Prosegur, whose combined expertise strengthens operational excellence and innovation. Through JV Agreements, both partners offer co-branding, technology sharing, and regulatory assistance. Their global-local synergy drives new cash solutions, enhances market reach, and elevates service standards in India.

India’s Leading Cash Logistics and Retail Cash Management Services Provider

SIS Cash Services Limited is India’s largest cash-in-transit company by fleet size and among the top retail cash management providers. With over 25,000 retail touchpoints and a vast network of secured vehicles, it offers secure, efficient, and scalable cash handling solutions, meeting diverse client needs across industries and geographies.

Strong Client Relationships Power SIS Cash Services’ Leadership in Bank Outsourcing Solutions

SIS Cash Services Limited has cultivated over a decade-long relationship with key public and private banks, including HDFC Bank, since 2012. With eight of its top 10 clients linked for more than 10 years, the company has grown alongside them, leveraging these ties to cross-sell customised services and emerge as a trusted bank outsourcing partner.

Integrated Platform Powered by Advanced Technology and Global Standards

SIS Cash Services Limited delivers a unified platform built on advanced technology aligned with international standards. Leveraging Prosegur’s global expertise, the company integrates AI-driven forecasting, ERP systems, real-time monitoring, mobile applications, and advanced security features. With centralised control via the National Operations Centre, SIS ensures traceable, efficient, and secure cash operations—enabling clients to focus on core activities without heavy infrastructure investments.

India’s Fastest Growing Cash Logistics Company with Industry-Leading Financial Metrics

SIS Cash Services Limited emerged as India’s fastest growing cash logistics company from Fiscal 2022 to 2024, with revenue rising at a 27.06% CAGR. Backed by the highest ROE (38.71%), EBITDA CAGR (40.72%), and PAT CAGR (224.89%) in the industry, SIS also achieved leading operating cash flow efficiency and ranked second in both revenue and profit among peers.

Experienced Leadership and Robust Risk Management Fuel Operational Excellence

SIS Cash Services Limited benefits from an experienced leadership team with deep expertise in operations, finance, and global best practices. Backed by a comprehensive risk and compliance framework, including ISO-certified systems, independent audits, and advanced technology, the company has consistently minimised losses. These strategic efforts reflect in reduced insurance premiums and superior operational reliability across India’s cash logistics sector.

More About SIS Cash Services Limited

SIS Cash Services Limited has been a leading provider of cash logistics solutions in India for over 13 years. As per the CRISIL Report, it ranks as the second-largest player in the Indian cash logistics industry by revenue for Fiscal 2024, holding an estimated market share of 17-18%. The company is also the fastest-growing in its sector, with a revenue CAGR of 27.06% and profit after tax CAGR of 224.89% between Fiscal 2022 and Fiscal 2024.

Notably, SIS Cash Services is the largest in terms of the number of secured vehicles (cash vans) deployed for cash-in-transit services as of March 31, 2024. The total value of cash processed through its business lines in Fiscal 2024 was ₹2,230,635.47 million.

Business Structure and Trademarks

The company operates under the trademark SIS Prosegur, while its wholly-owned subsidiary, SIS Prosegur Holdings Private Limited, trades as SISCO. Together, they provide a comprehensive range of cash logistics services including:

- Cash in Transit Services

- Retail Cash Management (Doorstep Banking)

- ATM Cash Replenishment and First-Level Maintenance

- Cash Assistant-Cash Peon Services (collectively called Traditional Cash Logistics Services)

- New Solutions: Value-added and synergetic solutions for cash and valuables

Traditional Cash Logistics Services

SIS Cash Services offers integrated cash logistics with extensive coverage across all Indian states, servicing both public and private banks. Key services include:

- Cash in Transit: Secure transportation of cash between bank branches and currency chests using a large fleet of RBI and MHA-compliant secured vehicles. Services are available as permanent daily or on-demand “on-call” basis.

- Retail Cash Management: Streamlining cash handling for businesses through services like cash delivery, collection, counting, vaulting, and reconciliation.

- ATM Services: Cash replenishment and maintenance for ATMs and self-service terminals.

- Cash Assistant Services: Outsourcing cash sorting and processing at bank currency chests, improving productivity and reducing operational costs.

Growth and Diversification

Since its incorporation in 2011, SIS Cash Services has expanded by introducing New Solutions to complement traditional offerings. These solutions integrate existing services with added value components, driving future growth with a CAGR of 33.64% in revenue between Fiscal 2022 and Fiscal 2024.

The company also caters to retailers, government entities, and e-commerce firms, providing customized cash management and secure transportation for bullion, jewellery, and other valuables. This diversified business model ensures SIS Cash Services maintains a strong presence and adaptability within the evolving cash logistics industry.

Industry Outlook

The Indian cash logistics industry is a crucial component of the country’s financial ecosystem, supporting cash circulation across banks, ATMs, retail businesses, and government sectors. With rising banking penetration and growing ATM networks, the sector is witnessing robust growth.

Growth Prospects & Future CAGR

The industry is projected to expand at a CAGR of around 20-25% over the next five years. This growth is propelled by increasing demand for secure cash handling solutions, especially in tier 2 and tier 3 cities, and the sustained use of cash despite digital payment trends.

Key Growth Drivers

- Rising banking and financial inclusion: More access to banking services in rural and semi-urban areas demands efficient cash logistics.

- Regulatory compliance: RBI and Ministry of Home Affairs mandates on secure cash transit foster organized growth.

- Expansion of ATM networks: Growing ATM deployment requires reliable cash replenishment and maintenance.

- Retail and e-commerce growth: Cash-on-delivery remains a significant payment mode, driving retail cash management services.

- Diversification into valuables logistics: Increasing need for safe transportation of bullion, jewellery, and valuables adds new revenue streams.

SIS Cash Services’ Product Focus

SIS Cash Services Limited, the second-largest player with a 17-18% market share (FY24), operates a large fleet of RBI- and MHA-compliant cash vans, processing over ₹2,23 lakh crore annually. Its offerings include:

- Cash in Transit Services — secure transport between banks and currency chests

- Retail Cash Management — doorstep banking, cash delivery, collection, and reconciliation

- ATM Cash Replenishment and Maintenance

- Cash Assistant Services — outsourced cash processing to improve bank efficiencies

- New Solutions — value-added services for cash and valuables logistics

With a revenue CAGR of 27.06% (FY22-24), SIS is well-positioned to leverage industry growth and diversify further.

How Will SIS Cash Services Limited Benefit

- SIS Cash Services will capitalize on the growing demand for secure cash handling in tier 2 and tier 3 cities, expanding its customer base.

- Its large fleet of RBI- and MHA-compliant vehicles positions the company to efficiently meet regulatory requirements, enhancing trust among banks and financial institutions.

- The company’s diversified service portfolio, including retail cash management and ATM replenishment, allows it to capture multiple revenue streams amid expanding banking and ATM networks.

- SIS’s value-added New Solutions for valuables logistics enable entry into niche segments like bullion and jewellery transportation, supporting higher-margin growth.

- With increasing financial inclusion and e-commerce growth, SIS can leverage rising cash-on-delivery transactions, boosting demand for its retail cash management services.

- The company’s strong revenue CAGR (27.06%) and profit growth (224.89%) reflect operational efficiency and scalability, which will help sustain competitive advantage.

- Continuous innovation and geographic expansion will further consolidate SIS’s position as a market leader, supporting long-term growth and resilience.

Peer Group Comparison

| Name of Company | Revenue

(₹ million) |

Face Value (₹ per share) | EPS Basic (₹) | NAV per Share (₹) | P/E Ratio | RoNW (%) |

| SIS Cash Services Limited | 6,338.25 | 10 | 25.32 | 77.99 | TBD | 38.71% |

| Peer Groups | ||||||

| AGS Transact Technologies Ltd | 14,706.34 | 10 | (6.64) | 38.15 | (1.82) | (16.07) |

| CMS Info Systems Ltd | 22,646.77 | 10 | 22.22 | 119.61 | 20.33 | 19.78 |

| Radiant Cash Management Services Ltd | 3,863.16 | 1 | 4.17 | 23.71 | 12.63 | 18.41 |

Key Strategies for SIS Cash Services Limited

Expanding Operations through Rising Cash Circulation

SIS Cash Services Limited aims to expand operations by leveraging India’s growing cash circulation and banking infrastructure. With rising cash dependency, outsourcing trends, and organised retail expansion, the company is strategically positioned to meet the increasing demand for reliable, efficient, and innovative cash logistics solutions.

Diversifying Revenue via Banking Outsourcing and New Solutions

SIS Cash Services Limited is enhancing market presence by offering innovative banking outsourcing and bundled New Solutions. These integrated, value-added services reduce dependency on single revenue streams, target organised retail, and offer end-to-end support for valuables logistics—positioning the company for sustainable, diversified growth.

Strengthening Market Position through Strategic Partnerships

SIS Cash Services Limited focuses on forming strategic partnerships with banks, retail chains, and government bodies. These alliances improve service reach, operational efficiency, and trust, enabling the company to deliver customised cash management and logistics solutions aligned with evolving market demands and client expectations.

Enhancing Operational Efficiency via Technology Integration

The company invests in advanced technology to optimise cash handling and logistics. Automation, real-time tracking, and data analytics enhance accuracy and security, reduce operational costs, and enable SIS Cash Services Limited to provide seamless, transparent, and reliable services to clients across sectors.

Expanding Geographical Footprint Across India

SIS Cash Services Limited aims to grow its presence nationwide, targeting tier II and III cities with untapped potential. Expanding geographically helps the company access new customer segments, leverage regional market growth, and establish itself as a leading cash logistics service provider throughout India.

Focusing on Compliance and Risk Management

Maintaining strict regulatory compliance and robust risk management frameworks is a priority for SIS Cash Services Limited. This ensures safe, secure, and ethical operations, builds client confidence, and mitigates financial and operational risks in the cash logistics business, fostering long-term sustainable growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On SIS Cash Services Limited IPO

How can I apply for SIS Cash Services Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

When is the SIS Cash Services IPO scheduled?

The IPO is expected to open in mid-2025; exact dates will be announced by the company.

What is the price band for the SIS Cash Services IPO?

The price band is yet to be announced

How many shares are being offered in the SIS IPO?

The company plans to offer around 0.37 crore shares through OFS

What is the objective of the SIS Cash Services IPO?

Funds will be used for debt repayment, business expansion, and general corporate purposes.