- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Sky Alloys & Power IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Sky Alloys & Power IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Sky Alloys & Power Limited IPO

Founded in 2009, Sky Alloys and Power Limited is a steel manufacturing company producing Sponge Iron, Mild Steel (MS) Billets, Ferro-Alloy products like Silico Manganese, and TMT Bars. It operates an integrated manufacturing facility in Temtema village, Raigarh district, Chhattisgarh. The company began operations with its first Direct Reduced Iron (DRI) plant in Raigarh. Its product range caters to both intermediate and end-use markets, with B2B sales for Sponge Iron and MS Billets, and dealer-based distribution for its flagship “SKY TMT” bars.

Sky Alloys & Power Limited IPO Overview

Sky Alloys & Power Ltd. filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025, proposing to raise funds through an Initial Public Offer (IPO). The IPO will be a Book Build Issue comprising a total of 1.79 crore equity shares, which includes a fresh issue of up to 1.61 crore equity shares and an offer for sale (OFS) of up to 0.18 crore equity shares. The company’s equity shares are proposed to be listed on both the NSE and BSE. While the book-running lead manager is yet to be announced, MUFG Intime India Pvt. Ltd. has been appointed as the registrar for the issue. Key details such as the IPO opening and closing dates, price band, and lot size are yet to be disclosed.

As per the DRHP, the issue carries a face value of ₹10 per share, with a total issue size of 1,78,91,000 shares aggregating up to ₹[.] crore. This includes a fresh issue of 1,60,84,000 shares and an OFS of 18,07,000 shares of ₹10 each. The IPO is classified as a Bookbuilding Issue, and the company plans to list its shares on both BSE and NSE. The pre-issue shareholding stands at 4,83,73,451 shares, which will increase to 6,44,57,451 shares post-issue. The company’s promoters are Ravi Singhal, Sandeep Agrawal, and Nisha Singhal, who collectively held 72.33% of the company’s shares before the issue. The post-issue promoter holding details are yet to be announced.

Sky Alloys & Power Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 1.79 crore equity shares |

| Fresh Issue | 1.61 crore equity shares |

| Offer for Sale (OFS) | 0.18 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 4,83,73,451 shares |

| Shareholding post-issue | 6,44,57,451 shares |

Sky Alloys & Power IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Sky Alloys & Power Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Sky Alloys & Power Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹8.49 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 27.83% |

| Net Asset Value (NAV) | ₹34.75 |

| Return on Equity (RoE) | 27.83% |

| Return on Capital Employed (RoCE) | 19.01% |

| EBITDA Margin | 13.46% |

| PAT Margin | 6.48% |

| Debt to Equity Ratio | 1.24 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Funding part of the capital expenditure requirements towards setting-up of Solar Power Project. | 900 |

| Repayment and/or pre-payment, of borrowings | 1200 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

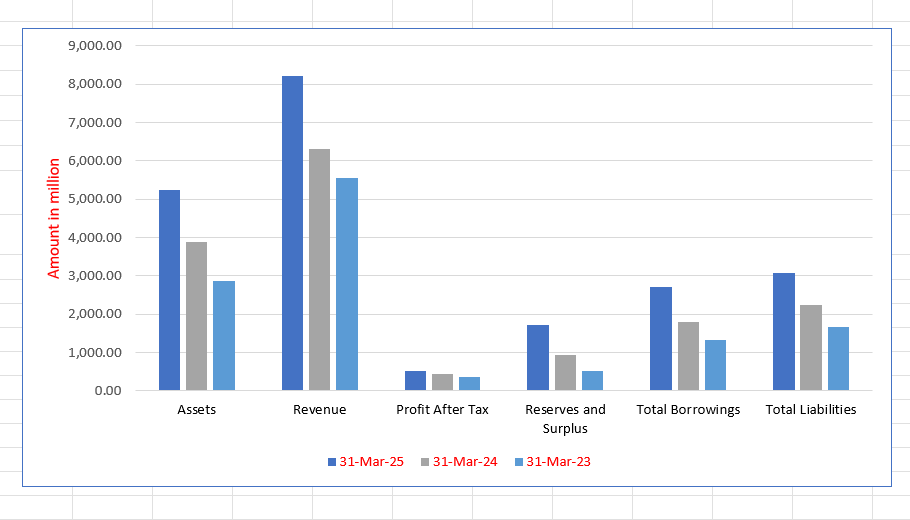

Sky Alloys & Power Limited Financials (in million)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,240.76 | 3,880.78 | 2,857.52 |

| Revenue | 8,210.92 | 6,312.31 | 5,554.67 |

| Profit After Tax | 530.46 | 449.67 | 375.64 |

| Reserves and Surplus | 1,705.94 | 948.79 | 508.35 |

| Total Borrowings | 2,697.10 | 1,785.77 | 1,321.05 |

| Total Liabilities | 3,069.71 | 2,239.36 | 1,656.55 |

Financial Status of Sky Alloys & Power Limited

SWOT Analysis of Sky Alloys & Power IPO

Strength and Opportunities

- Strong promoter experience in the steel industry.

- Semi-integrated operations covering sponge iron, billets, and TMT bars.

- Captive power generation reduces energy costs and improves profit margins.

- Forward integration into value-added products like TMT bars strengthens market reach.

- Ongoing capacity expansion enhances scale and operational efficiency.

- Diversified customer base limits dependency on a few clients.

- Strong financial performance with improving margins and leverage profile.

- Expanding retail presence through dealer and agent networks for TMT bars.

- Strategic location in Chhattisgarh ensures proximity to raw materials and end-users.

Risks and Threats

- High dependency on the cyclicality of the steel and commodities market.

- Intense competition and limited product differentiation in the steel sector.

- Execution risks related to large capacity expansion projects.

- Raw material and fuel cost volatility affecting profitability.

- Regulatory and environmental compliance risks due to high emissions.

- Dependence on infrastructure and real-estate sectors for demand.

- Vulnerability to changes in mining, power, or steel industry policies.

- Competition from larger integrated steel producers in similar product lines.

- Exposure to macroeconomic slowdowns and global steel trade fluctuations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Sky Alloys & Power Limited

Sky Alloys & Power Limited IPO Strengths

Strategic Operations Hub in Chhattisgarh

The company’s manufacturing unit is strategically located in Raigarh, Chhattisgarh, which is the heart of India’s steel industry, particularly for the Sponge Iron (DRI) and Induction Furnace (IF) production route. This key position provides Sky Alloys & Power Limited with significant operational synergies, cost efficiencies, and logistical benefits, which are critical for the competitive production of its flagship “SKY TMT” brand.

Experienced and Stable Management

Sky Alloys & Power Limited benefits from experienced promoters and a senior management team with extensive exposure and acumen across the entire steel value chain. Their collective expertise covers raw material procurement, supplier/distribution management, business development, finance, and operations. This seasoned leadership provides a competitive advantage in managing operations, tapping new growth avenues, and ensuring the company’s stability and success.

Diversified Product Portfolio

The company maintains a diversified product mix primarily consisting of sponge iron, mild steel billets, ferro-alloy products, and TMT Bars (sold under the ‘SKY TMT’ brand). This range of offerings effectively de-risks its revenue streams by reducing dependency on any single product. The varied portfolio ensures resilience and allows Sky Alloys & Power Limited to capitalize on multiple segments of the steel market.

More About Sky Alloys & Power Limited

Sky Alloys & Power Limited is a leading steel manufacturing company based in Raigarh, Chhattisgarh. Established with a strong industrial foundation, the company produces a wide range of steel products, including Sponge Iron, Mild Steel (MS) Billets, Ferro-Alloys such as Silico Manganese, and TMT Bars. The company began its operations with the installation of its first Direct Reduced Iron (DRI) plant in Raigarh, marking its entry into India’s competitive steel manufacturing sector.

Expansion and Recognition

In line with its growth strategy, Sky Alloys & Power Limited undertook a major capacity expansion in Fiscal 2022, approved by the Directorate of Industries, Government of Chhattisgarh. Recognised as a “Mega Manufacturing Enterprise”, the company benefits from incentives under the Chhattisgarh State Industrial Policy 2019–24.

Post-expansion capacities include:

- Sponge Iron: Increased from 60,000 to 1,20,000 MT

- MS Billets: Increased from 66,666 to 1,00,000 MT

- Ferro-Alloys: Increased from 15,000 to 30,000 MT

The company also enhanced its captive power generation capacity to 16 MW, using Waste Heat Recovery and Atmospheric Fluidized Bed Combustion Boilers. This expansion created 168 new jobs, growing total employment from 141 in FY 2021 to 309 in FY 2022.

Brand Development: SKY TMT

Sky Alloys introduced its flagship brand “SKY TMT”, registered in March 2024. A state-of-the-art rolling mill with a capacity of 95,000 TPA, established at a cost of ₹911.5 million, supports in-house TMT bar production.

Milestones include:

- March 8, 2024: Trademark registration of “SKY TMT”.

- September 5, 2024: Approval from the State Housing Authority for supply in development works.

- June 19, 2025: Approval from the Public Works Department for infrastructure projects.

- June 30, 2025: Agreement with a major Indian conglomerate for state-wide TMT distribution.

Financial Performance Highlights

For FY 2025, Sky Alloys & Power Limited reported Revenue from Operations of ₹8,192.40 million and Profit After Tax (PAT) of ₹530.46 million, with an EBITDA margin of 13.46%. The company maintained a Debt-to-Equity ratio of 1.24x and ROE of 27.83%, reflecting operational strength, efficiency, and financial stability.

Industry Outlook

The Indian steel industry is poised for strong expansion, supported by robust domestic demand, government-led infrastructure development, and capacity augmentation. India is currently the world’s second-largest producer of crude steel with a capacity of nearly 200 million tonnes and aims to reach around 300 million tonnes by 2030–31. Domestic steel demand is expected to rise by approximately 8–10% in 2025, surpassing global averages.

Key growth drivers include:

- Government investments in infrastructure such as roads, railways, ports, and housing.

- Expanding automobile, construction, and capital goods sectors.

- Automation, energy-efficient technologies, and the shift towards value-added steel products.

Outlook for Relevant Product Segments

Sky Alloys & Power Limited operates in multiple steel product categories, including Sponge Iron, Mild Steel (MS) Billets, Ferro-Alloys (Silico Manganese), and TMT Bars.

- Sponge Iron & MS Billets: India continues to lead global DRI production, accounting for nearly half of the world’s output. The increasing demand for billets for long steel products enhances the growth potential for these segments.

- Ferro-Alloys: The domestic ferro-alloys industry is projected to grow at a CAGR of 7–8% over the next five years, driven by rising steel production.

- TMT Bars: Long steel products such as TMT bars are witnessing strong demand growth, propelled by housing projects and nationwide infrastructure expansion.

Key Figures & Future Prospects

- Finished steel demand in India reached about 150 million tonnes in FY25.

- Per capita steel consumption remains low at around 80 kg, compared to the global average of 222 kg, indicating significant growth potential.

- The ferro-alloys industry, with a production capacity of 7.5 million tonnes and output near 6 million tonnes, still has room for expansion.

How Will Sky Alloys & Power Limited Benefit

- Rising infrastructure and housing projects across India will boost demand for TMT bars, directly strengthening Sky Alloys’ sales of its flagship “SKY TMT” brand.

- The government’s focus on domestic steel capacity expansion aligns with the company’s increased production of sponge iron, billets, and ferro-alloys.

- Being located in Chhattisgarh, a steel hub with rich mineral resources, provides the company with cost-efficient access to raw materials and logistics advantages.

- The company’s integrated operations, from sponge iron to finished TMT bars, allow better cost control and improved profit margins.

- Growth in ferro-alloy demand at a projected 7–8% CAGR supports expansion of Sky Alloys’ silico manganese production.

- With India’s per capita steel consumption expected to rise steadily, long-term demand for Sky Alloys’ products will remain strong.

- The company’s captive power generation capacity helps reduce production costs and maintain competitiveness amid rising energy prices.

Peer Group Comparison

| Name of the Company | Total Income (₹ in Millions) | Face Value (₹) | P/E | EPS (Basic & Diluted) | Return on Net Worth (%) | NAV per share (₹) | PAT (₹ in Millions) |

| Sky Alloys & Power Ltd | 8,210.92 | 10 | [●] | 8.49 | 27.83% | 34.75 | 530.46 |

| Peer Group | |||||||

| Godawari Power & Ispat Ltd | 54,717.10 | 1 | 19.64 | 13.24 | 16.47% | 80.55 | 8,129.80 |

| Sarda Energy & Minerals Ltd | 48,152.50 | 1 | 29.34 | 19.36 | 10.98% | 181.39 | 7,021.90 |

| Gallant Ispat Ltd | 43,083.44 | 10 | 39.98 | 16.61 | 14.10% | 117.81 | 4,007.42 |

| Prakash Industries Ltd | 40,398.20 | 10 | 8.46 | 19.85 | 10.71% | 185.43 | 3,554.50 |

Key Strategies for Sky Alloys & Power Limited

Value-Added Capacity Expansion

Sky Alloys & Power Limited focuses on continuous capacity expansion, highlighted by the recent completion of its integrated facility in Raigarh. This scaling strategy doubles intermediate product capacity and enables forward integration into high-margin, value-added TMT bars to meet market demand and enhance overall profitability.

Operational Cost Optimization

The company actively pursues cost optimization and efficiency gains by upgrading its captive turbine to 20MW and planning a large-scale 50 MWp Captive Solar Power Project. This strategic investment will secure long-term power supply, mitigate volatile tariffs, and is expected to achieve significant power cost savings per unit.

Focused Brand Solidification

A core strategy is solidifying the “SKY TMT” brand as a symbol of quality through strategic brand building. This involves securing key approvals from high-value government infrastructure bodies and forging strategic alliances. These actions pre-qualify products for large-scale public projects, ensuring robust market penetration and growth.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Sky Alloys & Power Limited IPO

How can I apply for Sky Alloys & Power Limited IPO?

You can apply via HDFCSky or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the Sky Alloys & Power Limited IPO?

It is a Book-Build Issue comprising 1.79 crore equity shares, including a fresh issue and offer for sale.

When was the IPO filed with SEBI?

Sky Alloys & Power Limited filed its Draft Red Herring Prospectus (DRHP) with SEBI on September 29, 2025.

How many shares are offered under the fresh issue and OFS?

The fresh issue consists of 1.61 crore shares, while the OFS includes 0.18 crore shares.

Where will Sky Alloys & Power Limited shares be listed?

The equity shares are proposed to be listed on both BSE and NSE stock exchanges.

What are the key objectives of the IPO?

The IPO proceeds will fund a solar power project, repay borrowings, and meet general corporate purposes