- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Skyways Air Services IPO

To be Announced

Minimum Investment

IPO Details

TBA

TBA

TBA

TBA

TBA

NSE, BSE

TBA

TBA

Skyways Air Services IPO Timeline

Bidding Start

TBA

Bidding Ends

TBA

Allotment Finalisation

TBA

Refund Initiation

TBA

Demat Transfer

TBA

Listing

TBA

Skyways Air Services Limited

Skyways Air Services Limited (SASL) is a prominent Indian air freight forwarding and logistics company, offering air and ocean freight, trucking, warehousing, customs broking, and express cargo services. The company provides value-added solutions including logistics planning, cargo handling, inventory management, documentation, and end-to-end distribution. Supported by a robust IT platform and global alliances such as WCA, AOP, CLN, MGLN, GFA, and TWIG, SASL maintains strong international connectivity. Partnerships with airlines like Saudi Cargo, Air India Cargo, Turkish Airlines, and Lufthansa enhance service coverage, while cold storage and integrated multi-modal solutions cater to temperature-sensitive and diverse cargo needs.

Skyways Air Services Limited IPO Overview

Skyways Air Services Ltd. filed a Draft Red Herring Prospectus (DRHP) with SEBI on July 2, 2025, to raise funds through an Initial Public Offer (IPO). The IPO is a Book Building Issue of 4.63 crore equity shares, comprising a fresh issue of up to 3.29 crore shares and an Offer for Sale (OFS) of up to 1.33 crore shares. The company plans to list its equity shares on both NSE and BSE. While the book running lead manager is yet to be appointed, Bigshare Services Pvt. Ltd. has been designated as the registrar of the issue. Key details such as IPO dates, price bands, and lot size are yet to be announced.

The IPO involves a face value of ₹10 per share, with the total issue size aggregating to 4,62,51,000 shares. The fresh issue accounts for 3,29,17,700 shares, while the OFS includes 1,33,33,300 shares. The issue is structured as a Book Building IPO, and the company’s pre-issue shareholding stands at 11,24,25,918 shares, expected to increase to 14,53,43,618 shares post-issue.

Skyways Air ServicesLimited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | 4.63 crore equity shares |

| Fresh Issue | 3.2 crore equity shares |

| Offer for Sale (OFS) | 1.33 crore equity shares |

| IPO Dates | TBA |

| Price Bands | TBA |

| Lot Size | TBA |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 11,24,25,918 shares |

| Shareholding post -issue | 14,53,43,618 shares |

IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | TBA | TBA | TBA |

| Retail (Max) | TBA | TBA | TBA |

| S-HNI (Min) | TBA | TBA | TBA |

| S-HNI (Max) | TBA | TBA | TBA |

| B-HNI (Min) | TBA | TBA | TBA |

Skyways Air Services Limited IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

Skyways Air Services Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | ₹5.99 |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | 20.26% |

| Net Asset Value (NAV) | ₹29.56 |

| Return on Equity (RoE) | 22.37% |

| Return on Capital Employed (RoCE) | 15.57% |

| EBITDA Margin | 3.75% |

| PAT Margin | 2.68% |

| Debt to Equity Ratio | 1.92 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Particulars | Amount (in ₹ million) |

| Repayment/pre-payment, in full or in part, of certain outstanding borrowings availed by the Company and our Subsidiary “Forin Container Line Private Limited | 21,67.87 |

| Funding incremental working capital requirements of the Company. | 1300 |

| General corporate purposes* | [●] |

Note: *To be determined upon finalisation of the Offer Price and updated in the Prospectus prior to filing with the RoC

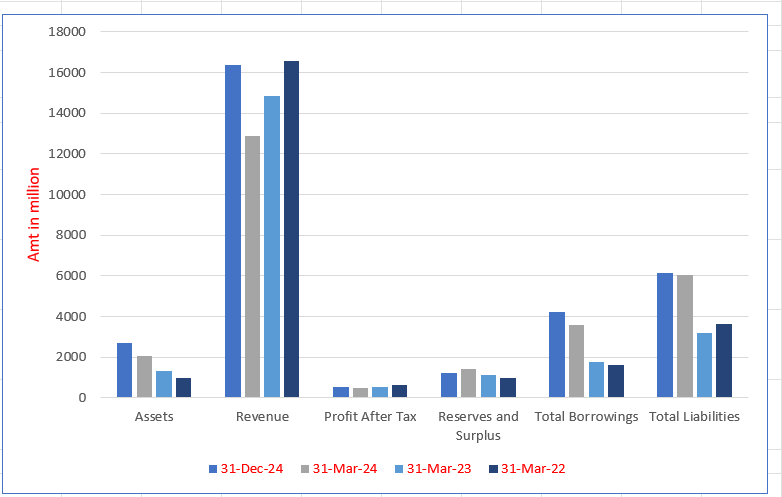

Skyways Air Services Limited Financials (in million)

| Particulars | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 2675.04 | 2072.99 | 1331.28 | 962.93 |

| Revenue | 16372.21 | 12891.10 | 14841.23 | 16585.63 |

| Profit After Tax | 518.88 | 483.81 | 529.76 | 634.00 |

| Reserves and Surplus | 1207.21 | 1438.21 | 1147.49 | 960.57 |

| Total Borrowings | 4222.22 | 3573.35 | 1750.24 | 1634.03 |

| Total Liabilities | 6160.51 | 6042.98 | 3180.53 | 3638.43 |

Financial Status of Skyways Air Services Limited

SWOT Analysis of Skyways Air Services IPO

Strength and Opportunities

- Leading position in India's air freight sector, ranked No. 1 by World ACD for three consecutive years (2022–2024).

- Extensive service portfolio including air freight, ocean freight, trucking, warehousing, customs broking, and express cargo delivery.

- Strong digital infrastructure supporting logistics operations and customer interactions.

- Established global network through alliances with organizations like WCA, AOP, CLN, MGLN, GFA, and TWIG.

- Strategic partnerships with major international airlines such as Saudi Cargo, Air India Cargo, Turkish Airlines, and Lufthansa.

- Over 7,600 clients across diverse industries, indicating a broad customer base.

- Long-standing industry presence since 1984, contributing to brand recognition and trust.

- Recognition through awards like the ACE Northern Airfreight Forwarder of the Year and Multimodal Logistics Awards.

- Commitment to sustainability and compliance with international standards, as evidenced by certifications and affiliations.

Risks and Threats

- High dependence on air freight, which can be affected by global economic fluctuations and fuel price volatility.

- Increased working capital intensity, potentially impacting liquidity.

- Exposure to geopolitical tensions and trade policy changes affecting international logistics.

- Competition from both established logistics companies and emerging digital-first logistics startups.

- Regulatory challenges and compliance requirements in multiple jurisdictions.

- Potential risks associated with the management of a large and diverse client base.

- Vulnerability to disruptions in global supply chains and logistics networks.

- Challenges in maintaining consistent service quality across a vast operational network.

- Potential environmental regulations and sustainability pressures impacting operations.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Skyways Air Services Limited

Skyways Air Services Limited IPO Strengths

Experienced Promoters

Skyways Air Services Limited is guided by promoters Mr. Yashpal Sharma and Mr. Tarun Sharma, with over two decades of combined logistics expertise. Their deep understanding of trade, regulations, and cargo operations enables strategic decision-making, risk management, and foresight into global trends, providing SASL with a sustainable competitive advantage and long-term growth in the dynamic logistics sector.

Comprehensive Range of Logistics Solutions

SASL offers an integrated suite of services, including air, ocean, express cargo, parcel delivery, customs clearance, warehousing, and advanced supply chain software. This diversified, customer-centric approach streamlines operations for clients, reduces dependency on multiple vendors, enhances retention, and strengthens SASL’s position as a trusted, full-spectrum logistics partner with operational excellence certified under ISO 9001:2015.

Broad Network of Partners

Through long-term collaborations with international and regional airlines and affiliations with global logistics networks like WCA, AOP, CLN, and GFA, SASL leverages a vast partner ecosystem. This extensive reach enables scalable, cost-effective logistics solutions worldwide, ensuring efficient operations without heavy fixed infrastructure costs, expanding SASL’s international footprint, and enhancing its ability to serve diverse client requirements.

Strong Collaboration with Customers

SASL serves clients across diverse industries, including textiles, pharmaceuticals, FMCG, electronics, automotive, healthcare, and retail. Its integrated logistics model addresses sector-specific supply chain needs, consolidates smaller freight volumes for operational efficiency, secures competitive rates, and reinforces SASL’s reputation as a preferred partner for businesses of varying size and complexity.

Technology and Infrastructure Driving Operational Effectiveness

SASL integrates advanced IT platforms, including SLS 100X, Power BI, and digital employee tools, to optimize supply chain operations. Features such as real-time container tracking, automated data processing, direct airline integrations, and AI-powered analytics improve transparency, efficiency, workforce engagement, and decision-making, providing operational excellence, competitive advantage, and a superior logistics experience for clients.

Long-Standing Client Relationships

SASL maintains enduring partnerships with key clients such as Weldforce, FedEx Trade Networks, and Phoenix Logistics. By anticipating evolving logistics needs and delivering innovative, reliable, cost-efficient solutions, SASL secures repeat business, fosters loyalty, gains sector-specific insights, and expands its footprint, reinforcing its position as a trusted logistics partner capable of delivering consistent, high-quality services.

More About Skyways Air Services Limited

Established in 1984, Skyways Air Services Limited (SASL) has emerged as a leading player in India’s air freight forwarding and logistics sector. Consistently ranked No. 1 by WorldACD for air waybill (AWB) generation in 2022, 2023, and 2024, the company handles the highest volume of air cargo consignments from India to global destinations. SASL offers a comprehensive suite of services including air and ocean freight forwarding, trucking, warehousing, customs broking, technology-driven express cargo, and parcel delivery, along with a wide range of value-added services to meet diverse domestic and international client requirements.

Services and Value-Added Solutions

SASL began operations as a Custom House Agent and has expanded into a full-service logistics provider. Its value-added services include:

- Logistics planning and management through an IT-enabled operational model

- Customized logistics solutions for diverse cargo requirements

- Cargo handling operations ensuring timely and secure shipment processing

- Warehousing, inventory management, and last-mile distribution support

- Documentation and customs clearance ensuring compliance across borders

- Global connectivity via strategic international alliances and network subsidiaries

Strategic Partnerships and Global Networks

The company maintains performance-based agreements with leading international airlines such as Saudi Cargo, Air India Cargo, Turkish Airlines, and Lufthansa, enhancing global reach and service reliability. Additionally, SASL participates in prominent logistics networks including the World Cargo Alliance (WCA), Air & Ocean Partners (AOP), Combined Logistics Networks (CLN), Multi Group Logistics Network (MGLN), Global Freight Alliance (GFA), and Transport Worldwide International Group (TWIG), providing access to extensive international business opportunities.

Multi-Modal and Integrated Logistics

Over the decades, SASL has evolved into a multi-modal logistics provider. Its portfolio now spans ocean freight, trucking, warehousing, express cargo, and parcel delivery, complemented by specialized cold chain solutions for temperature-sensitive cargo. Subsidiary and associate companies support niche services and technology platforms, strengthening the company’s end-to-end logistics capabilities.

Technology and Operational Excellence

SASL leverages advanced technology to optimize freight operations, reduce costs, and enhance customer satisfaction. Key platforms include:

- SLS HIKE – End-to-end logistics management with real-time tracking and automated workflows

- SLS 100X – Dynamic booking engine for competitive air freight rates

The company also maintains automated accounting systems for efficient invoicing and reporting. SASL has earned ISO 9001, ISO 14001, and OHSAS 45001 certifications, reflecting its commitment to quality, environmental responsibility, and occupational safety.

Leadership

SASL is led by promoters Mr. Yashpal Sharma, Chairman & Managing Director, with over 30 years of industry experience, and Mr. Tarun Sharma, Whole-Time Director, with expertise in ocean freight and global logistics expansion. Their vision and leadership continue to drive innovation, growth, and operational excellence across the Skyways Group.

Industry Outlook

India’s logistics industry is experiencing significant growth, driven by robust economic expansion, increased trade activities, and advancements in infrastructure. The sector encompasses various services, including air and ocean freight forwarding, trucking, warehousing, customs broking, and value-added services.

Key Market Figures:

- Market Size: The Indian logistics market was valued at approximately USD 228.4 billion in 2024 and is projected to reach USD 357.3 billion by 2030, growing at a CAGR of 7.7%.

- Freight Forwarding Segment: The freight forwarding market in India was valued at around USD 128.4 billion in 2024 and is expected to grow at a CAGR of 9.4% from 2025 to 2034.

- Air Cargo Market: The air cargo market in India is projected to exhibit a CAGR of 11.50% during 2025-2033, reaching a volume of 9.56 million tons by 2033.

Growth Drivers

- E-commerce Expansion: The rapid growth of e-commerce has increased demand for efficient logistics solutions, particularly in express delivery and last-mile services.

- Infrastructure Development: Government initiatives such as the development of multimodal logistics hubs and expressways are enhancing connectivity and reducing transit times.

- Technological Advancements: The adoption of technologies like automation, AI, and IoT is improving operational efficiency and transparency in the logistics sector.

- Global Trade Dynamics: India’s strategic position in global trade routes and the “China Plus One” strategy are boosting exports and, consequently, logistics activities.

Segment-Specific Insights

Air Freight Forwarding:

- Market Outlook: The air freight segment is poised for substantial growth, with projections indicating a rise from 3.7 million tonnes to between 5 and 5.8 million tonnes by 2029, reflecting a CAGR of 6-9%.

- Opportunities: Increased demand for high-value and time-sensitive goods presents opportunities for companies specializing in air freight services.

Ocean Freight Forwarding:

- Market Dynamics: The ocean freight segment remains a cornerstone of India’s logistics, with ongoing investments in port infrastructure and containerization.

- Challenges: Addressing inefficiencies in Part Truck Load (PTL) shipping and enhancing transparency are key areas for improvement.

Warehousing and Distribution:

- Growth Potential: The warehousing sector is witnessing rapid growth, driven by the rise in organized retail and the need for efficient inventory management.

- Regional Focus: Expansion of warehousing facilities into Tier 2 and Tier 3 cities is essential to meet the growing demand.

How Will Skyways Air Services Limited Benefit

- Increased demand for air and ocean freight forwarding will expand SASL’s shipment volumes and revenue.

- Growth in e-commerce and express delivery will boost utilization of SASL’s technology-driven parcel and cargo services.

- Expansion of warehousing and logistics infrastructure in Tier 2 and Tier 3 cities will enhance SASL’s storage and distribution capabilities.

- Adoption of automation, AI, and IoT across the logistics sector aligns with SASL’s IT-enabled platforms, improving operational efficiency.

- Rising international trade and global connectivity trends will strengthen SASL’s cross-border freight forwarding business.

- Multi-modal logistics demand will benefit SASL’s integrated air, ocean, trucking, and cold chain solutions.

- Performance-based airline agreements will support increased service coverage and reliability amid growing air cargo volumes.

- Participation in global logistics networks will open new international business opportunities.

- Enhanced customer expectations for transparency and speed will drive adoption of SASL’s SLS HIKE and SLS 100X platforms.

- Industry growth will reinforce SASL’s leadership and competitive positioning in India’s logistics market.

Peer Group Comparison

- There are no comparable listed companies in India that engage in a business similar to that of the company. Accordingly, it is not possible to provide an industry comparison as per DRHP.

Key Strategies for Skyways Air Services Limited

Expand and Strengthen Business Operations

Skyways Air Services Limited focuses on growing its core logistics operations by improving cost efficiency, streamlining supply chain management, and optimizing workforce productivity. Leveraging proprietary platforms and backward-forward integration, SASL enhances operational excellence, reduces dependency on external providers, and delivers seamless, value-driven services to clients.

Develop Infrastructure

SASL invests in infrastructure to expand capacity, strengthen global and regional networks, and enhance operational efficiency. Strategically located warehouses, advanced cargo handling systems, and automation ensure timely, reliable services. These initiatives support scalable growth, address diverse cargo requirements, and position the company for emerging market and e-commerce opportunities.

Strengthen Customer Connections

The company focuses on deepening relationships with existing clients by providing customized supply chain solutions. Leveraging insights from diverse industries, SASL standardizes high-quality protocols, enhances delivery speeds, and expands services, enabling broader market penetration and fostering client loyalty while addressing evolving operational and industry-specific requirements.

Enhance Technological Capabilities

SASL continuously advances its software and hardware infrastructure, developing proprietary platforms like SLS Hike and SLS 100X. Upcoming SLS 100X 2.0 will further improve functionality, enabling real-time carrier integration, dynamic rate comparisons, end-to-end tracking, and self-service capabilities, enhancing operational efficiency, transparency, and customer experience.

Venture into High-Growth Global Markets

SASL strategically targets emerging international markets with strong trade potential, establishing regional hubs and partnerships with local providers, airlines, and customs authorities. Tailored freight solutions, last-mile delivery, and advanced digital tools enable efficient market entry, regulatory compliance, and sustainable growth in regions including Southeast Asia, the Middle East, and North America

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Skyways Air Services

How can I apply for Skyways Air Services Limited IPO?

You can apply via HDFCSky, or other brokers using UPI-based ASBA (Application Supported by Blocked Amount).

What is the size of the Skyways Air Services IPO?

The IPO comprises a fresh issue of 3.29 crore equity shares and an offer-for-sale of 1.33 crore shares by existing shareholders.

How will the funds from the IPO be utilized?

Proceeds will be used to repay ₹216.79 crore of debt, ₹130 crore for working capital, and the remainder for general corporate purposes.

Who are the promoters selling shares in the IPO?

Promoters Yashpal Sharma and Tarun Sharma will sell 95.8 lakh shares, with Himanshu Chhabra and Rohit Sehgal selling 18.66 lakh and 18.86 lakh shares, respectively.

Which exchanges will list the Skyways Air Services shares?

The equity shares are proposed to be listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

When is the IPO expected to open and list?

The opening and listing dates, along with the price band and lot size, are yet to be announced.