- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Smartworks Coworking Spaces IPO

₹13/36 shares

Minimum Investment

IPO Details

10 Jul 25

14 Jul 25

₹13

36

₹387 to ₹407

NSE, BSE

₹582.56 Cr

17 Jul 25

Smartworks Coworking Spaces IPO Timeline

Bidding Start

10 Jul 25

Bidding Ends

14 Jul 25

Allotment Finalisation

15 Jul 25

Refund Initiation

16 Jul 25

Demat Transfer

16 Jul 25

Listing

17 Jul 25

Smartworks Coworking Spaces Limited

Smartworks provides premium, tech-enabled office spaces through a managed campus platform tailored for mid-to-large enterprises. Their offerings include fully serviced, well-designed workspaces and aspirational amenities that enhance employee satisfaction and productivity. With a diverse client base—ranging from Indian corporates to global MNCs and startups—Smartworks focuses on value-driven pricing and a superior experience over traditional offices. The company operates 8 million sq. ft. across 41 centres in 13 Indian cities, and has expanded internationally with 2 centres in Singapore.

Smartworks Coworking Spaces Limited IPO Overview

Smartworks Coworking Spaces is launching its IPO through a book-building process, aiming to raise ₹582.56 crores. The issue comprises a fresh issuance of 1.09 crore equity shares aggregating to ₹445.00 crores and an offer for sale of 0.34 crore shares worth ₹137.56 crores. The IPO will open for public subscription on July 10, 2025, and will close on July 14, 2025. The allotment of shares is expected to be finalised on Tuesday, July 15, 2025, with a tentative listing date scheduled for Thursday, July 17, 2025, on both the BSE and NSE.

The price band for the IPO is set between ₹387 to ₹407 per share, with a lot size of 36 shares. Retail investors will need to invest a minimum of ₹13,932 for a single lot. For small non-institutional investors (sNIIs), the minimum application size is 14 lots, equating to 504 shares and an investment of ₹2,05,128. For big non-institutional investors (bNIIs), the required lot size is 69 lots, translating to 2,484 shares. Additionally, the IPO includes a reservation of up to 1,01,351 shares for employees, offered at a discounted rate of ₹37 per share.

JM Financial Limited is acting as the book-running lead manager for the IPO, while MUFG Intime India Private Limited (Link Intime) is appointed as the registrar to the issue.

Smartworks Coworking Spaces Limited Upcoming IPO Details

| Category | Details |

| Issue Type | Book Built Issue IPO |

| Total Issue Size | Fresh Issue: ₹445 crores (1,09,33,660 shares) |

| Offer for Sale: 33,79,740 shares of ₹10 | |

| IPO Dates | 10 July 2025 to 4 July 2025 |

| Price Bands | ₹387 to ₹407 per share |

| Lot Size | 36 shares |

| Face Value | ₹10 per share |

| Listing Exchange | BSE, NSE |

| Shareholding pre-issue | 10,31,89,592 shares |

| Shareholding post -issue | 11,41,23,252 shares |

Smartworks Coworking Spaces IPO Lots

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 36 | ₹14,652 |

| Retail (Max) | 13 | 468 | ₹1,90,476 |

| S-HNI (Min) | 14 | 504 | ₹2,05,128 |

| S-HNI (Max) | 68 | 2448 | ₹9,96,336 |

| B-HNI (Min) | 69 | 2484 | ₹10,10,988 |

Smartworks Coworking Spaces Limited IPO Valuation Overview

| KPI | Value |

| Earnings Per Share (EPS) | (5.18) |

| Price/Earnings (P/E) Ratio | TBD |

| Return on Net Worth (RoNW) | (99.90%) |

| Net Asset Value (NAV) | 5.19 |

| Return on Equity | (1.23%) |

| Return on Capital Employed (ROCE) | 28.12% |

| EBITDA Margin | 63.47% |

| PAT Margin | – |

| Debt to Equity Ratio | 6.87 |

Objectives of the IPO Proceeds

The Net Proceeds are intended to be utilised as per the details provided in the table below:

| Sr. No. | Particulars | Amount (in ₹ million) |

| 1. | Repayment/ prepayment/ redemption, in full or in part, of certain borrowings availed by our Company | 1400.00 |

| 2. | Capital expenditure for fit-outs in the new centres and for security deposits of the new centres | 2823.00 |

| 3. | General corporate purposes* | [●] |

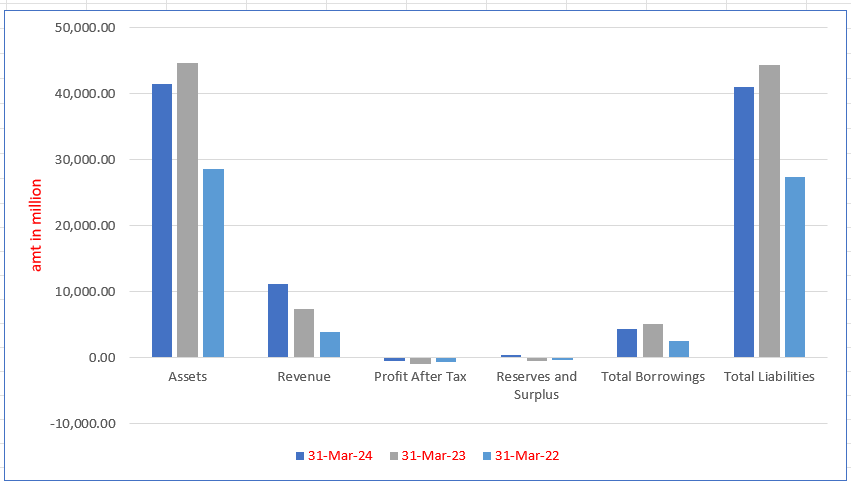

Smartworks Coworking Spaces Limited Financials(in million)

| Particulars | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 41,470.84 | 44,735.03 | 28,595.73 |

| Revenue | 11,131.10 | 7440.70 | 3942.04 |

| Profit After Tax | (499.57) | (1010.46) | (699.05) |

| Reserves and Surplus | 368.94 | (462.25) | (290.06) |

| Total Borrowings | 4273.50 | 5153.89 | 2476.03 |

| Total Liabilities | 40,970.77 | 44,420.37 | 27,454.83 |

Financial Status of Smartworks Coworking Spaces Limited

SWOT Analysis of Smartworks Coworking Spaces IPO

Strength and Opportunities

- Smartworks operates 41 centres across 13 cities, offering 8 million square feet of coworking space, leading in India’s market.

- Customised managed workspaces cater to mid-to-large enterprises, boosting productivity and meeting employee needs.

- Strategic funding from Keppel Land and Ananta Capital enhances growth, supporting expansion into newer markets, including Singapore and globally.

- Revenue grew to ₹744 crore in FY23, highlighting Smartworks’ ability to scale operations and meet rising enterprise demand.

- Transitioning to a public limited company enhances corporate transparency and opens new avenues for capital through an IPO.

- Rising demand for hybrid, flexible workspaces post-pandemic presents growth opportunities, appealing to enterprises valuing cost efficiency and adaptability.

- Smartworks’ technology-driven office spaces and innovations like automation enhance client experiences.

- A strong leadership team with experienced investors guides Smartworks to leverage market opportunities.

- The coworking industry’s rapid growth in India positions Smartworks for sustained expansion.

Risks and Threats

- Increasing competition from global players like WeWork and local firms like Awfis intensifies market dynamics.

- High operational costs, including leasing, maintenance, and staffing, challenge financial sustainability.

- Dependency on real estate leasing ties business success to fluctuations in property markets.

- Losses increased by 44% to ₹101 crore in FY23, signalling operational inefficiencies and profitability concerns.

- Global economic uncertainties, including recession and inflation, may weaken corporate spending on coworking spaces.

- Regulatory complexities increase with Smartworks’ public status, potentially straining resources.

- Revenue dependence on enterprise clients exposes Smartworks to risks if a major client terminates their contract.

- Market saturation in key metros like Bengaluru, Mumbai, and Delhi NCR limits growth potential.

- Volatility in investor sentiment could affect funding opportunities after its IPO, impacting Smartworks growth.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

All About Smartworks Coworking Spaces Limited IPO

Smartworks Coworking Spaces Limited IPO Strengths

Market Leadership and Steady Growth

Smartworks is the largest managed campus operator in India, with 8.00 million square feet across 41 centres in 13 cities. The company has achieved impressive growth, with a 41.69% CAGR in space and a 69.86% CAGR in revenue from 2022 to 2024.

Ability to Lease and Transform Large Properties

Smartworks leases entire large properties in 13 cities, transforming them into branded campuses. With 90.01% of managed space in Tier 1 cities, the company dominates the flexible workspace market, managing significant campuses like Vaishnavi Tech Park in Bengaluru, spanning 0.7 million square feet.

Focus on Enterprise Clients and High Seat Requirements

Smartworks targets mid-to-large enterprises, securing deals with over 4,800 seats. Between 2022 and 2024, large client deals grew substantially, with multi-city clients contributing 30.65% of rental revenue, highlighting the company’s ability to meet large-scale workspace needs and maintain high seat retention.

Execution Capabilities Supported by Cost Efficiency and Technology

Smartworks executes projects with cost-efficient operations and advanced technology. Standardised designs, modular fit-outs, and economies of scale ensure sustainable solutions. Tools like BuildX speed up project completion, while automated systems manage energy and facilities, maintaining quality workspaces at lower costs than industry benchmarks.

Capital Efficiency and Strategic Financial Model

Smartworks excels in capital efficiency, with a short 30-32 month payback period for mature centres, compared to the industry average of 53-54 months. By using long-term contracts and client deposits to fund fit-outs, the company reduces upfront costs and maintains efficient cash flow management.

Risk Mitigation Strategy and Diversified Client Portfolio

Smartworks mitigates risks through a robust pricing strategy that ensures rental revenues exceed lease obligations. Its diversified client portfolio minimizes concentration risks, with no client occupying more than 30% of a centre’s capacity. The company demonstrated resilience during the COVID-19 pandemic by maintaining lease stability.

Strong Leadership and Management Team

Led by co-founders Neetish Sarda and Harsh Binani, Smartworks benefits from a visionary leadership team and stable management. With expertise in large-scale operations, strategy, and finance, the team ensures cohesive decision-making, long-term strategies, and seamless execution, contributing to sustained growth in the workspace industry.

More About Smartworks Coworking Spaces Limited

Smartworks is India’s leading managed office and campus platform, with the largest stock among peers as of March 31, 2024. With 8 million sq. ft. under management across India and Singapore, it caters to mid-to-large enterprises, offering modern, tech-enabled offices with daily needs and aspirational amenities.

Widespread Footprint and Expansion

Smartworks operates 41 centres in 13 Indian cities and two in Singapore, serving 618+ clients. With a 90.13% committed occupancy rate, the company continues to expand in Pune and Gurugram. Notable campuses include Bengaluru’s Vaishnavi Tech Park (0.7 million sq. ft.) and Pune’s M-Agile and AP-81.

Capitalising on Market Opportunities

India’s office stock is projected to reach 1,079.3 million sq. ft. by 2027. Smartworks partners with non-institutional landlords (73.8% of the market), converting large properties into fully serviced campuses. The demand for flexible spaces in Tier 1 cities is expected to reach 59% by 2026. Smartworks has already achieved a 44.68% CAGR (2020–2023) in these cities.

Operating Model and Value-Added Services

Smartworks leases large bare-shell spaces, transforming them into plug-and-play campuses with configurable seating for teams of 50 to 4,800+. Its modular fit-outs, tech-enabled delivery model, and 45–60-day execution cycle ensure cost-efficiency. Initiatives like FaaS (Fit-Out-As-A-Service) and partnerships with Chaipoint, Nutritap, and Park+ enhance services and margins.

Client Base and Strategic Alliances

With clients like Google IT Services, Bridgestone, and MakeMyTrip, Smartworks offers fully managed offices in prime areas. Long-term lease agreements with landlords (10–15 years) ensure financial stability and streamlined operations. Integration of proprietary tech and smart systems further enriches user experience and promotes profitability.

Industry Outlook

India’s office market has grown remarkably, reaching 841.2 million sq. ft. of commercial stock by March 2024. Of this, 78% (658 million sq. ft.) is non-SEZ, and 22% (183 million sq. ft.) is SEZ. The stock has increased 18-fold since 2003, with notable benchmarks like 309.7 million sq. ft. in 2010 and 595.1 million sq. ft. in 2018.

Key Growth Drivers

A large talent base, including 2.5 million STEM graduates in FY2023, fuels tech sector demand. Global Capability Centres (GCCs) are expanding rapidly, with over 1,900 expected by FY2025 and 17.96% annual leasing growth (2022–2023). Domestic firms, boosted by economic recovery, made up 49% of leasing in Q1 2024.

Startups and Emerging Sectors

India hosts over 117,000 startups (as of December 2023) and 114 unicorns, driving office demand, especially in tech, BFSI, and real estate.

Trends and Future Outlook

Post-pandemic leasing is up 9% year-on-year. Grade A office stock, now 715.9 million sq. ft., dominates. By 2027, flexible workspaces may grow to 116 million sq. ft., reflecting hybrid work trends and rising demand for tech-enabled managed campuses.

How Will Smartworks Coworking Spaces Limited Benefit?

- Hybrid work trends are boosting demand for flexible, agile office spaces nationwide.

- Startups need scalable, cost-effective workspaces; Smartworks meets this growing demand.

- Expanding Global Capability Centres seek tech-enabled, flexible spaces Smartworks already offers.

- Urban growth in Tier 1 cities fuels demand for Grade A coworking spaces.

- Rising income and corporate investment drive interest in well-equipped, modern offices.

- Growth in smaller cities opens opportunities for Smartworks’ flexible space expansion.

- Tech-driven office experiences increase demand for Smartworks’ smart workspace solutions.

Peer Group Comparison

| Name of the Company | Revenue from Operations (in ₹ million) | Face Value per Equity Share (₹) | P/E (x) | EPS (Basic) (₹ per share) | EPS (Diluted) (₹ per share) | RoNW (%) | Net Asset Value “NAV” (in ₹ million) | Net Asset Value “NAV” (₹ per share) |

| Smartworks Coworking Spaces Limited | 10,393.64 | 10 | NA | (5.18) | (5.18) | (99.90) | 500.07 | 5.19 |

| Awfis Space Solutions Ltd | 8,488.19 | 10 | NA | (2.79) | (2.79) | (7.00) | 2,514.31 | NA |

Key Strategies for Smartworks Coworking Spaces Limited

Strengthening Market Leadership in Managed Workspaces

Smartworks aims to reinforce its leadership in the managed workspace sector by expanding its portfolio in key and emerging cities. As the largest operator in India, it benefits from a growing demand for modern, amenity-rich campuses. The company focuses on building long-term relationships with multi-city clients to drive consistent growth.

Enhancing Capital Efficiency through Flexible Business Models

Smartworks improves capital efficiency by implementing variable rental and management contract models. These strategies reduce occupancy risks by offsetting capital expenditure with client deposits and landlord contributions. The company aims to expand into new markets and improve unit economics while maintaining a strong focus on sustainable growth.

Scaling Margin-Accretive Revenue Streams

Smartworks seeks to scale margin-accretive revenue streams by leveraging its extensive client base and strategic partnerships. The company plans to expand value-added services like gyms and retail stores, as well as fit-out-as-a-service (FaaS) offerings. Diversifying services will help grow revenue, enhance client satisfaction, and drive business growth.

Driving Innovation with Proprietary Technology

Smartworks is committed to driving innovation through proprietary technology to improve operational efficiency. By integrating AI and IoT solutions, it enhances asset and workforce management. The company also plans to deploy its SaaS products across non-managed properties, offering landlords streamlined operations while generating new revenue and cutting costs.

Prioritising Sustainability and Social Responsibility

Smartworks prioritises sustainability with a focus on environmental, social, and governance (ESG) initiatives. Key efforts include a solar capacity project, water conservation, and waste reduction. The company tracks consumption data to meet client green targets, planning further adoption of clean energy and impactful social programs to positively impact communities and the environment.

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Smartworks IPO

What is the purpose of the Smartworks IPO?

The funds raised from the IPO will likely be used for business expansion, reducing debt, upgrading facilities, or meeting general corporate expenses.

What is the issue size of the Smartworks IPO?

Smartworks IPO totals ₹582.56 crores, combining fresh issue and offer for sale components. Fresh issue includes 1.09 crore shares worth ₹445.00 crores for future growth and expansion. Offer for sale involves 0.34 crore shares, aggregating to ₹137.56 crores by existing shareholders.

How can I apply for the Smartworks IPO?

You can apply through your stockbroker’s trading platform, net banking ASBA (Application Supported by Blocked Amount) service, or via online IPO applications like Zerodha, Upstox, or Paytm Money.

What is the minimum investment required for the IPO?

The minimum investment will be ₹14,652 and the lot size is 36 shares

When will the Smartworks IPO open for subscription?

The subscription opening and closing dates are 10 July 2025 and 14 July 2025, respectively.

What is the listing date of the IPO?

The listing date is around 17 July 2025

How can I check the allotment status of the Smartworks IPO?

You can check the allotment status on the registrar’s website (details will be provided in the DRHP) or through your broker’s platform.

What is the expected listing date of the IPO?

The listing date will be announced after the allocation process is completed

How can I check the allotment status of the Smartworks IPO?

You can check the allotment status on the registrar’s website (details will be provided in the DRHP) or through your broker’s platform.