- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Solarworld Energy Solutions IPO

₹13,986/42 shares

Minimum Investment

IPO Details

23 Sep 25

25 Sep 25

₹13,986

42

₹333 to ₹351

NSE, BSE

₹490 Cr

30 Sep 25

Solarworld Energy Solutions IPO Timeline

Bidding Start

23 Sep 25

Bidding Ends

25 Sep 25

Allotment Finalisation

26 Sep 25

Refund Initiation

29 Sep 25

Demat Transfer

29 Sep 25

Listing

30 Sep 25

Solarworld Energy Solutions Limited

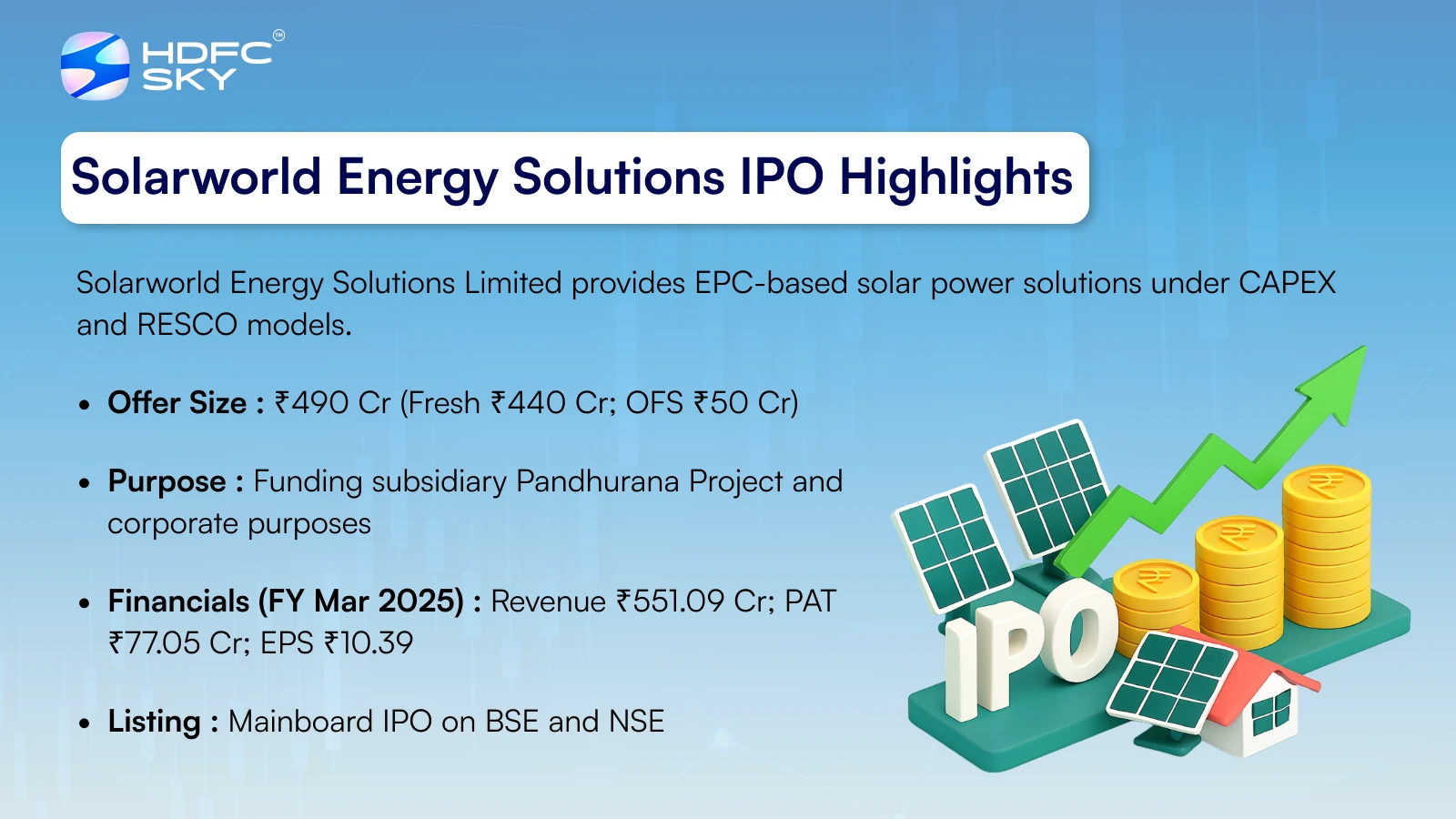

Incorporated in 2013, SolarWorld Energy Solutions Limited provides comprehensive solar energy solutions, specialising in engineering, procurement, and construction (EPC) services. It operates through two models: the CAPEX model, offering end-to-end project solutions with customer-owned assets, and the RESCO model, allowing businesses to adopt solar power without upfront investment, reducing carbon footprint. In May 2024, the company partnered with ZNSHINE PV-Tech Co. Ltd. to establish a solar panel manufacturing facility. Its client base includes SJVN Green Energy, Haldiram Snacks, Ethnic Food Manufacturing, and Samiksha Solarworld.

Solarworld Energy Solutions Limited IPO Overview

Solarworld Energy Solutions IPO is a book-built issue worth ₹490 crore, comprising a fresh issue of 1.25 crore shares totaling ₹440 crore and an offer for sale of 0.14 crore shares worth ₹50 crore. The IPO opens for subscription on 23 September 2025 and closes on 25 September 2025, with allotment expected on 26 September 2025. Shares are tentatively scheduled to list on BSE and NSE on 30 September 2025. The price band is ₹333 to ₹351 per share, with a lot size of 42 shares. Retail investors require a minimum investment of ₹14,742, sNII 14 lots (₹2,06,388), and bNII 68 lots (₹10,02,456). Nuvama Wealth Management Ltd. is the lead manager and MUFG Intime India Pvt. Ltd. is the registrar.

Solarworld Energy Solutions Limited IPO Details

| Particulars | Details |

| IPO Date | 23 September 2025 to 25 September 2025 |

| Listing Date | 30 September 2025 (tentative) |

| Face Value | ₹5 per share |

| Issue Price Band | ₹333 to ₹351 per share |

| Lot Size | 42 shares |

| Total Issue Size | 1,39,60,113 shares (₹490 Cr) |

| Fresh Issue | 1,25,35,612 shares (₹440 Cr) |

| Offer for Sale | 14,24,501 shares (₹50 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 7,41,37,042 shares |

| Share Holding Post Issue | 8,66,72,654 shares |

Solarworld Energy Solutions IPO Reservation

| Investor Category | Shares Offered |

| QIB | Not less than 75% of the Offer |

| Retail | Not more than 10% of the Issue |

| NII (HNI) | Not more than 15% of the Issue |

Solarworld Energy Solutions IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 42 | ₹14,742 |

| Retail (Max) | 13 | 546 | ₹1,91,646 |

| S-HNI (Min) | 14 | 588 | ₹2,06,388 |

| S-HNI (Max) | 67 | 2,814 | ₹9,87,714 |

| B-HNI (Min) | 68 | 2,856 | ₹10,02,456 |

Solarworld Energy Solutions IPO Promoter Holding

| Shareholding Status | Percentage |

| Pre-Issue | 78.70% |

| Post-Issue | [To be updated] |

Solarworld Energy Solutions IPO Valuation Overview

| KPI | Value |

| EPS (Pre IPO) | ₹10.39 |

| EPS (Post IPO) | ₹8.89 |

| P/E Ratio (Pre IPO) | 33.77 |

| P/E Ratio (Post IPO) | 39.48 |

| ROE | 40.27% |

| ROCE | 54.53% |

| Debt/Equity | 0.37 |

| RoNW | 40.27% |

| PAT Margin | 14.14% |

| EBITDA Margin | 19.60% |

Objectives of the Proceeds

- Investment in subsidiary KSPL for Pandhurana Project part-financing: ₹575.30 Cr

- General corporate purposes to support business operations and expansion

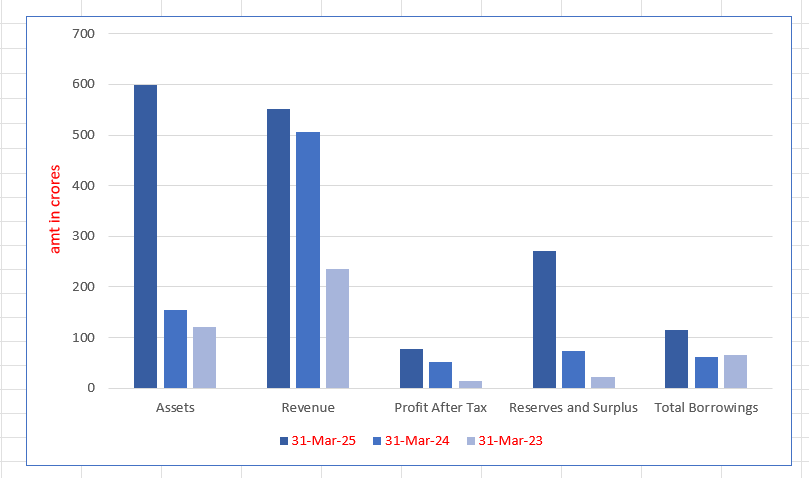

Key Financials (₹ Crore)

| Particulars | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 598.02 | 155.02 | 120.43 |

| Revenue | 551.09 | 505.50 | 235.05 |

| Profit After Tax | 77.05 | 51.69 | 14.84 |

| Reserves and Surplus | 272.00 | 73.28 | 21.59 |

| Total Borrowings | 114.55 | 61.10 | 64.67 |

SWOT Analysis of Solarworld Energy Solutions IPO

Strength and Opportunities

- Established track record in end-to-end solar EPC solutions with strong execution.

- Asset-light business model enables strong financial performance and scalability.

- Long-term relationships with reputed clients ensure repeat business and order visibility.

- Experienced management and skilled personnel with deep industry expertise drive operational efficiency.

Risks and Threats

- Highly competitive solar EPC market may pressure margins and growth.

- Dependence on government policies and incentives could impact project viability.

- Volatility in solar panel prices may affect project costs and profitability.

- Expansion into new geographies may face regulatory and operational hurdles.

Explore IPO Opportunities

Explore our comprehensive IPO pages to stay updated on the latest trends and insights.

About Solarworld Energy Solutions Limited

Solarworld Energy Solutions IPO Strengths

- Strong execution capabilities for end-to-end solar EPC solutions across multiple industries.

- Asset-light business model drives revenue growth and robust financial performance.

- Reliable customer relationships ensure repeat projects and steady order inflow.

- Experienced management team with industry expertise drives operational efficiency.

- Strategic partnerships, like with ZNSHINE PV-Tech, support technological and manufacturing growth.

Peer Group Comparison (As on March 31, 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

| Solarworld Energy Solutions | 10.68 | 10.68 | 41.69 | — | 40.27 | — |

| Peer Group | ||||||

| Sterling and Wilson Renewable Energy | 3.49 | 3.49 | 42.59 | 76.48 | 8.78 | 6.33 |

| Kpi Green Energy | 16.23 | 16.09 | 133.57 | 30.57 | 18.77 | 3.69 |

| Waaree Renewable Technologies | 22.00 | 21.95 | 43.64 | 47.32 | 65.29 | 24.14 |

| Oriana Power | 79.52 | 79.52 | 254.75 | 29.01 | 47.59 | 9.08 |

How to apply IPO with HDFC SKY?

Follow these simple steps to apply for an IPO through HDFC SKY. Secure your investments and explore new opportunities with ease by accessing the IPOs available on the platform.

1Login to your HDFC SKY Account

2Select Issue

3Enter Number of Lots and your Price.

4Enter UPI ID

5Complete Transaction on Your UPI App

FAQs On Solarworld Energy Solutions IPO

How can I apply for Solarworld Energy Solutions IPO?

You can apply via HDFCSky using UPI-based ASBA for seamless online subscription.

What is the minimum investment required for Solarworld Energy IPO?

Retail investors can invest a minimum of ₹14,742 for one lot of 42 shares.

When will Solarworld Energy IPO shares get listed?

The IPO is expected to list on BSE and NSE on 30 September 2025.

What is the price band for Solarworld Energy Solutions IPO

The price band is fixed at ₹333 to ₹351 per share for all investors.