- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Difference Between Sovereign Gold Bond and Gold ETF

By Ankur Chandra | Updated at: Jul 28, 2025 01:28 PM IST

Summary

- Ownership Structure:

- Sovereign Gold Bonds (SGBs) represent government-backed digital ownership of gold with fixed interest.

- Gold ETFs are exchange-traded funds backed by physical gold stored with custodians.

- Returns:

- SGBs offer 2.5% annual interest plus gold price appreciation.

- Gold ETFs provide returns based only on gold price movement, with no extra interest.

- Liquidity & Tenure:

- SGBs have an 8-year lock-in with premature exit options after 5 years.

- Gold ETFs are highly liquid and can be traded on stock exchanges anytime.

- Taxation:

- SGBs offer capital gains tax exemption on redemption after maturity.

- Gold ETFs attract capital gains tax based on the holding period.

- Costs:

- SGBs have no expense ratio and are issued at a discount for online purchases.

- Gold ETFs include expense ratios and brokerage fees.

- Suitability:

- SGBs suit long-term investors seeking assured returns + tax benefits.

- Gold ETFs are ideal for short-term traders or those preferring high liquidity.

- Risk Profile:

- Both are low-risk, but SGBs carry sovereign guarantees, whereas ETF returns depend on market operations.

Gold has always been a favoured investment, especially in India, and it is often seen as a hedge against inflation and economic uncertainty. But with various ways to invest in gold, the question arises: which is better for you, Sovereign Gold Bonds (SGBs) or Gold ETFs?

While SGBs and Gold ETFs offer exposure to gold prices, they have distinct characteristics that cater to different investment needs and preferences. Understanding these differences is crucial for aligning your investment choice with your financial goals and risk appetite.

This detailed comparison of Sovereign Gold Bond vs Gold ETF will help you gain knowledge to make informed investment decisions. So, let’s get started.

What is a Sovereign Gold Bond?

So, what is a Sovereign Gold Bond? A Sovereign Gold Bond (SGB) is a government security denominated in grams of gold issued by the Reserve Bank of India (RBI) on behalf of the Government of India. Instead of holding physical gold, you have a government security that tracks the price of gold. This eliminates worries about storage, purity, and theft, making SGBs attractive to many investors. Additionally, SGBs offer a fixed interest rate, providing a regular income stream.

What Is a Gold ETF?

A Gold ETF is an Exchange-Traded Fund (ETF) that invests in physical gold. Each unit represents a specific quantity of gold held by the fund. Gold ETFs offer a convenient way to invest in gold without worrying about storage or purity. They are traded on stock exchanges, providing high liquidity and allowing investors to buy and sell units quickly throughout the trading day.

Sovereign Gold Bond vs Gold ETF

So, what is gold ETF vs SGB? Here is a breakdown of the key differences between Sovereign Gold Bond vs Gold ETF. This can also answer your questions stated above:

| Feature | Sovereign Gold Bond | Gold ETF |

| Issuer | Reserve Bank of India (RBI), on behalf of the Government of India | Mutual Fund Companies |

| Form | Government security | Exchange Traded Fund |

| Underlying Asset | Gold | Gold |

| Interest | Pays a fixed interest rate (currently 2.5% per annum) | No interest paid |

| Maturity | 8 years with an option for early redemption after 5 years | No maturity date |

| Liquidity | Traded on stock exchanges, but liquidity can be lower than Gold ETFs | Highly liquid, traded on stock exchanges throughout the trading day |

| Expenses | No expense ratio | It has a low expense ratio charged by the fund house |

| Taxation | Interest is taxable; capital gains at maturity are tax-exempt | Capital gains are taxed based on the holding period (short-term or long-term) |

Pros and Cons of Sovereign Gold Bonds

Like every investment product, SGBs too have their own set of pros and cons:

Pros:

- Fixed Interest: Unlike Gold ETFs, which offer no fixed income, Sovereign Gold Bonds provide a fixed interest rate of 2.5% per annum, payable semi-annually. This provides a steady income stream and potential capital gains from rising gold prices, a crucial difference between Sovereign Gold Bonds and gold ETFs.

- Tax Efficiency: One of the significant benefits of Sovereign Gold Bond is its tax efficiency.

- Sovereign Guarantee: SGBs are backed by the sovereign guarantee of the Government of India, ensuring the safety and security of your investment. Compared to other gold investment avenues, this makes them a relatively low-risk investment option.

- No Storage Costs: With SGBs, you don’t need to worry about the costs and hassles associated with storing physical gold. This is a significant advantage compared to holding physical gold, where you need to consider security, insurance, and storage costs.

Cons:

- Lock-in Period: SGBs have an eight-year lock-in period, although early redemption is allowed after five years. This might be a drawback for investors seeking higher liquidity. The lock-in period is a key difference between a Gold Bond and a Gold ETF.

- Limited Liquidity: You might wonder, ‘Can Sovereign Gold Bonds be traded on stock exchanges?’ The answer is yes, but their liquidity can be lower than that of Gold ETFs. This means it might be slightly more complicated to buy or sell SGBs quickly compared to the high liquidity offered by Gold ETFs.

- Interest Rate Risk: The fixed interest rate offered on SGBs might not always be competitive with other investment options, especially in a rising interest rate environment. This is something to consider when evaluating the overall returns of Gold ETF and Sovereign Gold Bond.

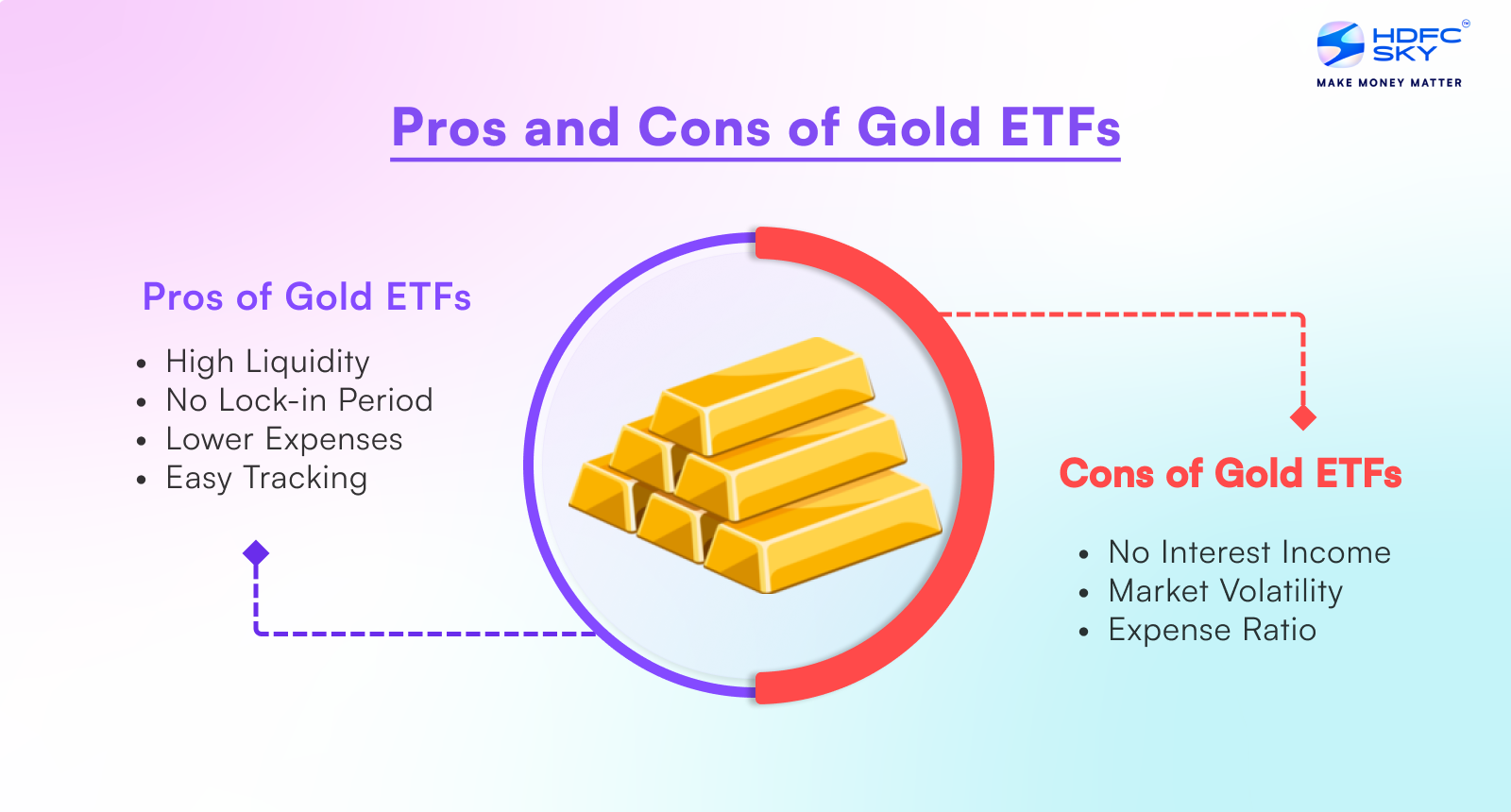

Pros and Cons of Gold ETFs

Pros:

- High Liquidity: One of the most significant advantages of Gold ETFs is their high liquidity. Unlike Sovereign Gold Bonds, which have a lock-in period, you can easily buy and sell Gold ETF units throughout the trading day. This makes them ideal for investors who might need quick access to their funds or prefer the flexibility of trading in the share market.

- No Lock-in Period: With Gold ETFs, you can buy and sell units anytime. This provides flexibility and lets you quickly adjust your portfolio based on changing market conditions. This is a key difference between Gold Bond and Gold ETF, where SGBs have a lock-in period.

- Lower Expenses: Expense ratios for Gold ETFs are generally lower than those for actively managed mutual funds. This means you get to keep more of your returns, making Gold ETFs a cost-effective way to invest in gold. However, comparing expense ratios across different Gold ETFs is essential to find the most competitive option.

- Easy Tracking: Gold ETFs are designed to track physical gold’s price closely. This makes it easy to monitor your investment and understand its performance relative to the underlying gold price. You can easily access Gold ETF price information on stock exchange websites or through your brokerage account.

Cons:

- No Interest Income: Unlike Sovereign Gold Bonds, which offer a fixed interest rate, Gold ETFs do not pay any interest. This means you will solely rely on the appreciation of gold prices for returns, which is an important consideration when comparing Gold ETF vs SGB.

- Market Volatility: Gold prices, and therefore Gold ETF prices, can fluctuate based on market conditions. This volatility can potentially lead to losses, especially for short-term investors. Before investing in gold ETFs, it is crucial to understand your risk tolerance and investment horizon.

- Expense Ratio: While Gold ETFs generally have lower expense ratios than actively managed funds, there is still a small expense ratio charged by the fund house. This can eat your returns over time, especially if you’re a long-term investor. It is important to factor in these expenses when evaluating the overall returns of Gold ETF and Sovereign Gold Bond.

There is much more to learn about “what is gold bond vs gold ETF” and “what is gold ETF vs sovereign gold bond”.

Conclusion

Choosing between Sovereign Gold Bond vs Gold ETF depends on your investment goals, risk appetite, and investment horizon. SGBs can be better for long-term investors seeking a safe, tax-efficient investment with a fixed-income component. Similarly, gold ETFs can be better for investors seeking high liquidity and flexibility who are comfortable with market volatility and do not require a fixed income stream. Consider your investment needs and preferences carefully before making a decision.

Related Articles

FAQs on Sovereign Gold Bond vs Gold ETF

Can sovereign gold bonds be traded?

Yes, Sovereign Gold Bonds (SGBs) can be traded on stock exchanges once they are listed. This allows investors to sell their bonds before maturity. However, liquidity might be lower than that of Gold ETFs, which are more actively traded.

Is gold ETF a good investment?

Gold ETFs are a good investment for those looking for a convenient way to invest in gold without the need for storage. They offer high liquidity and lower expenses than physical gold, but are subject to market price fluctuations and don’t generate interest.

Can I convert gold ETF to physical gold?

No, Gold ETFs generally cannot be converted directly into physical gold. To own physical gold, you would need to sell your ETF units and use the proceeds to purchase gold in its physical form, like coins or bars.

Are sovereign gold bonds a good investment?

Sovereign Gold Bonds (SGBs) are a solid choice for long-term investors seeking stable returns and exposure to gold, with the added benefit of fixed interest payments. However, they come with a lock-in period and interest rate risks, so they may not be suitable for everyone.

Can sovereign gold bonds be transferred?

Yes, Sovereign Gold Bonds (SGBs) can be transferred to another person. This is done through your Demat account by submitting a transfer request to your Depository Participant (DP). It’s an easy way to pass on or sell the bonds to others.

What is the difference between sovereign gold bond and gold ETF?

The primary difference lies in the structure and benefits. SGBs are government securities with a fixed interest rate and tax-free maturity proceeds, while Gold ETFs are market-traded funds without interest, and their proceeds are subject to capital gains tax based on holding period.