- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Table of Content

Special live trading session on 18th May!

By Roshan | Updated at: Apr 9, 2025 04:27 PM IST

Open Free Demat Account

SEBI & Exchanges want to ensure that market intermediaries such as Exchanges, Clearing Houses, and Depository Organizations can smoothly switch to a backup plan – the Disaster Recovery (DR) site in case of an unexpected disaster.

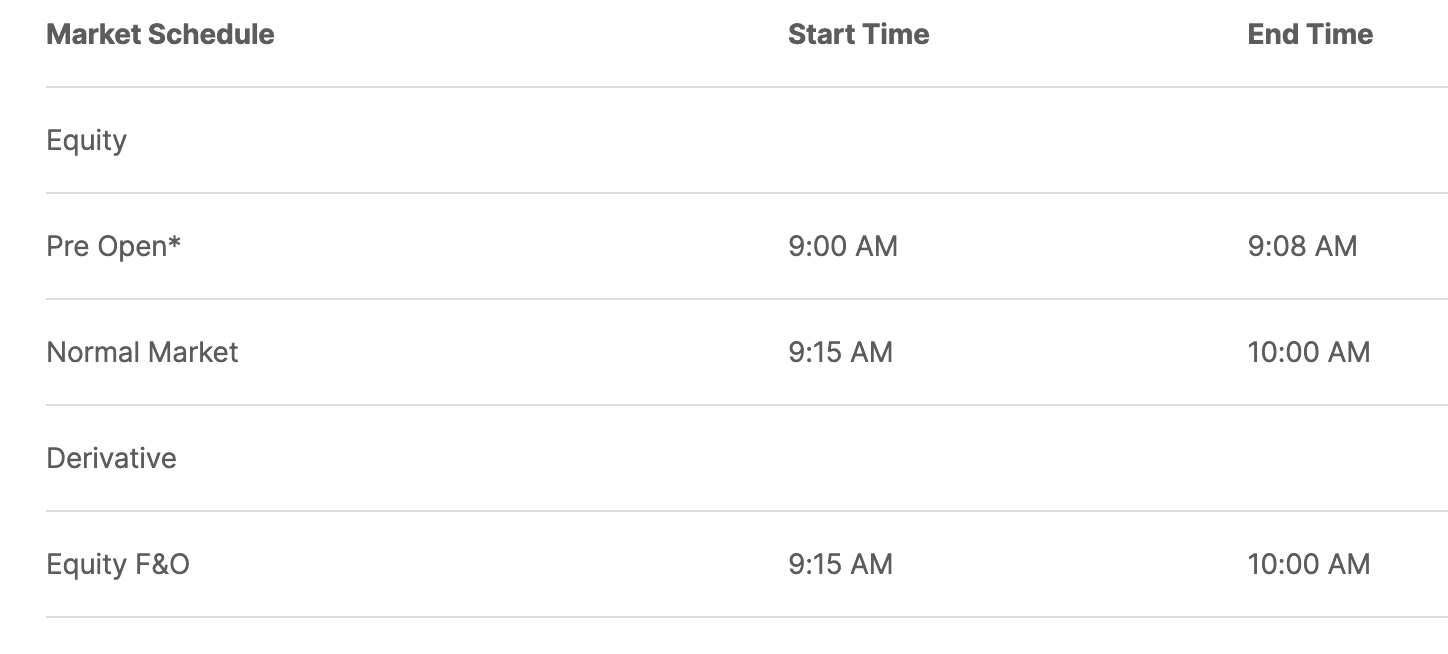

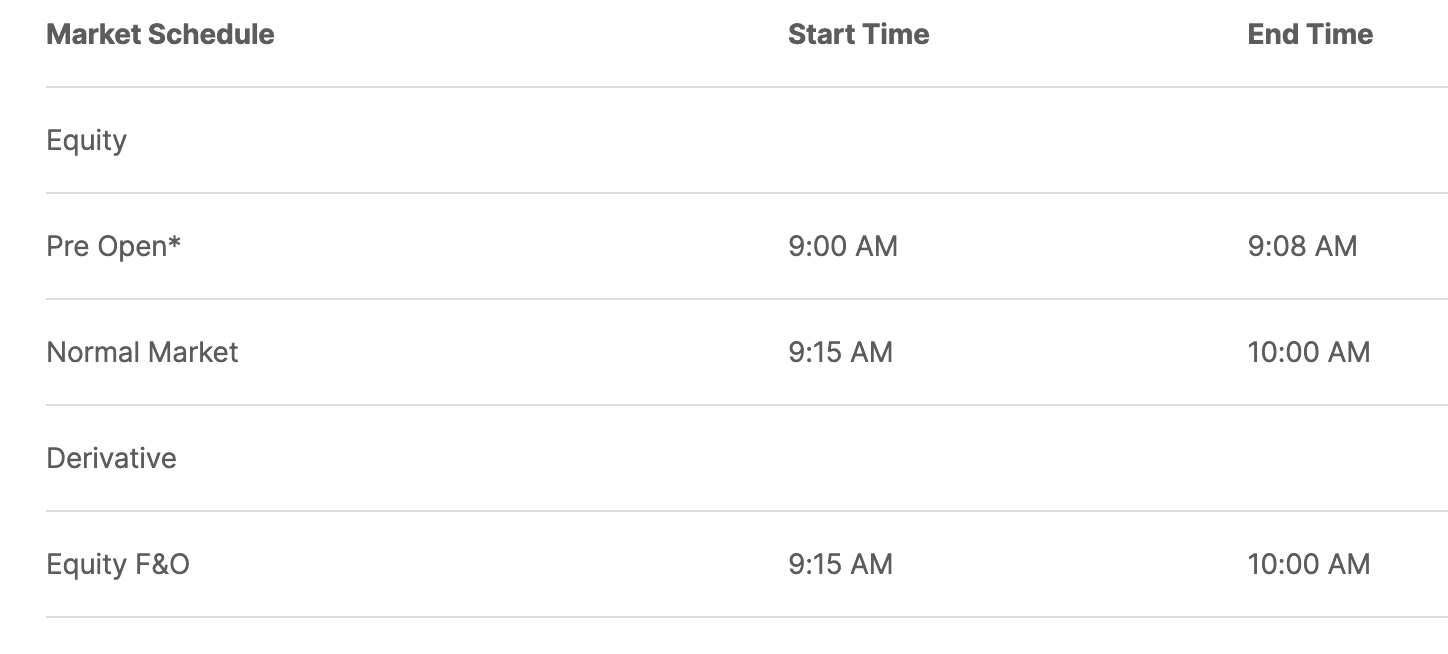

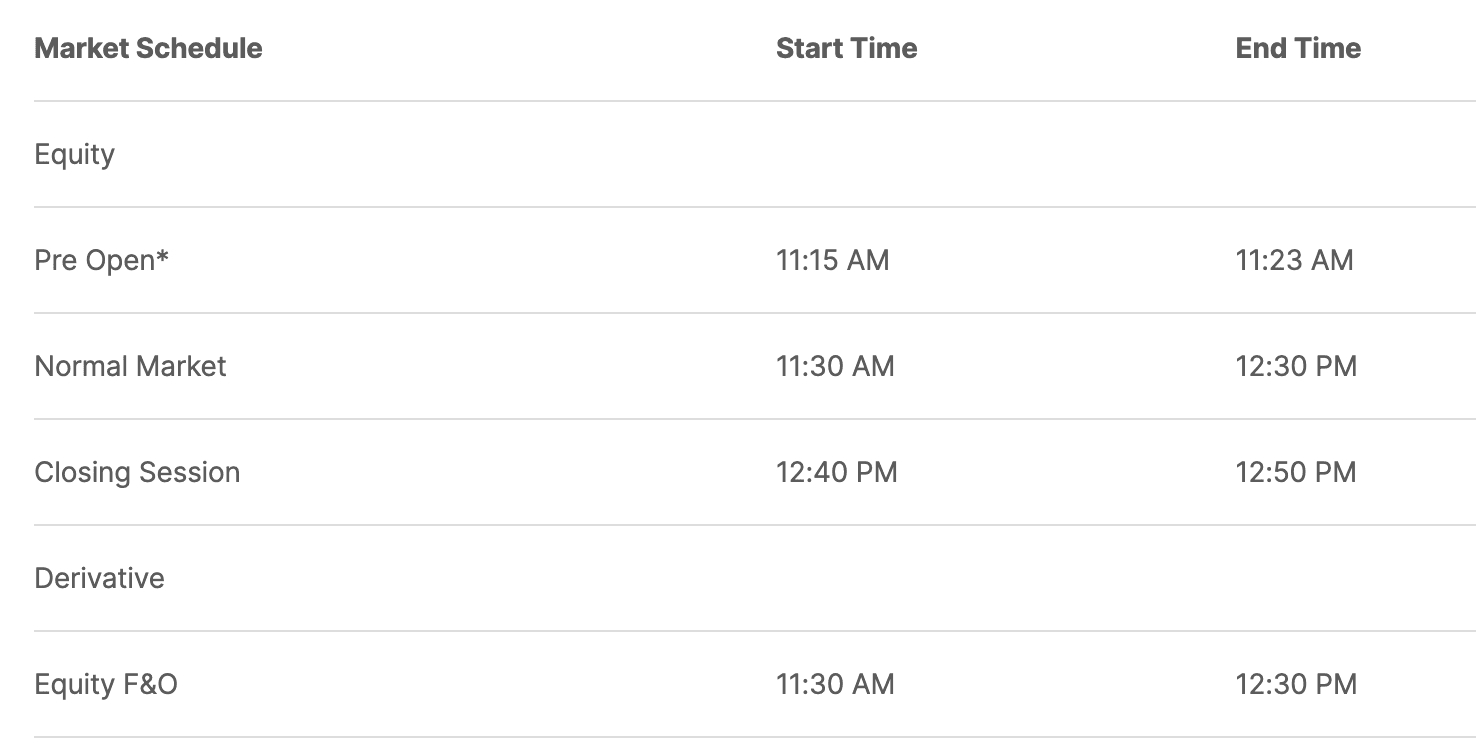

The market timings are as follows:

Live Trading from Primary Site (Trading Session 1):

*Fresh orders won’t be allowed in the last 5 minutes, all pending orders will be cancelled ( there will be no carry over of pending orders )

Trading from DR Site (Trading Session 2):

Note:

- SIP orders will not be executed during the Special trading session. The scheduled SIP orders will be placed on the next trading day, 21st May

- AMO Orders will not be available between 17th May 4 PM to 18th May 4 PM

- Only delivery trades would be allowed (No Intraday)

- Any profits booked / sales proceed from trades on 17th May will not be included in the

available funds during the special trading session as 18th May is a settlement holiday, they will be available for use on 21st May - Holdings bought ( Delivery ) on 17th May, will be available in your Portfolio on

Tuesday ( 21st May ), as 18th, 19th, 20th May are settlement holidays - BTST Transactions, hence won’t be allowed on 18th May

- MTF Pledge , Margin Pledge will be available during the above mentioned market hours

- MCX, NSE – Currency won’t be available on 18th May

- Fund Addition done before 18th May 1 PM, will be available in your Available Funds before the start of next trading session

- GTT Orders will not be triggered

- All withdrawal requests, placed between 17th May till 20th May, will be processed on 21st May.

- 20th May, is a trading/settlement holiday on the account of General Elections in Mumbai.

Additional Info :

- Securities (including stocks having F&O Contracts) will have upper and lower circuit limits set at 5%

- Stocks with existing 2% limits will maintain that limit

- All futures contracts will operate within a 5% range

- Typically, stocks in the F&O segment and futures contracts enjoy flexible price bands in a regular trading session. This means that if the circuit limit is reached, it is usually relaxed to facilitate continuous trading. However, this standard practice won’t apply during this special session.

About Author

Roshan

Open Free Demat Account

Popular Post from Trading Strategies

What is Wealth Effect?

Last Updated: May 25, 2025

Changes in Expiry Day for Index Derivatives on BSE & NSE

Last Updated: Dec 20, 2024

Explore More Categories